Summary:

- In the middle of a cyclical downturn, it’s always darkest before dawn, and we might have reached the optimum pessimism levels for Intel.

- The cost reduction efforts to prove effective over the long run support the company in achieving its master plan to regain its leadership or at least catch up with the competition.

- Moreover, the stock has shown strong support levels slightly above its book value per share of $24.50, signaling a bottom.

- I’m staying invested in INTC, with a possible exit in the next cyclical uptrend around 2025-2026.

jiefeng jiang

Investment Thesis

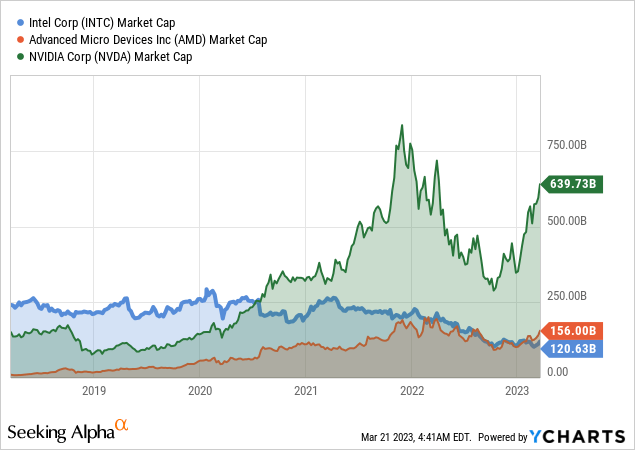

On the Nasdaq 100 Stock Index, Intel Corporation (NASDAQ:INTC) has the highest percentage of sell ratings, and its stock remains on a downward trajectory. Moreover, the outlook has deteriorated, and even analysts brave enough to maintain a buy rating are now getting cautious.

Intel has been on a rollercoaster; even patient investors have started losing faith in the company. Indeed, there is too much going on with Intel — inventory piling up, slowing demand, product delays, dividend cuts, capital commitments, chip wars, China restrictions, and so on. However, in the middle of a cyclical downturn, it’s always darkest before dawn, and we might have reached the optimum pessimism levels.

Post Q4 Earnings Outlook

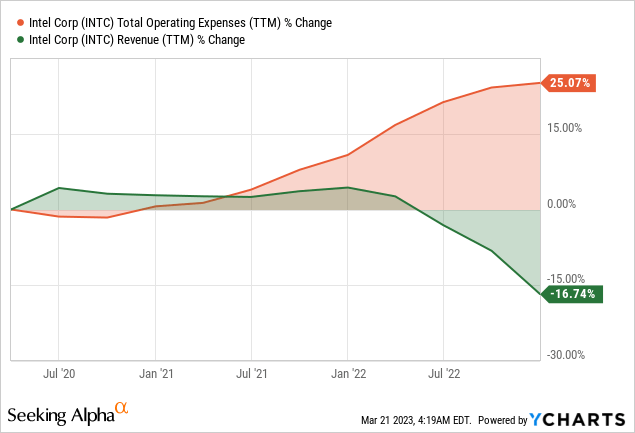

Intel’s results in the fourth quarter missed its guidance. The slump in the PC market on which it still depends heavily was worse than expected, causing a large net loss. In addition, the firm refrained from providing any full-year 2023 guidance, pointing to a rough macro environment, high cost of borrowing, rising tensions in Europe, and COVID headwinds in Asia.

Intel expects an even more dramatic sales decline compared to last quarter. Excess inventories still exist in many chip segments and must be cleared. The deterioration of financial results complicates the firm’s turnaround efforts, weakening possibilities for investments and capital expenditures. The leadership’s bold turnaround ambitions have not changed, however. Management plans to optimize its costs and capital spending even more and sees a possibility for improvement in the second half.

Cost Reduction Initiatives Are On Track

Given the weak compute environment as we move through 2023, the management team is taking prudent action on areas that it can control by identifying structural cost reductions that should drive $3 billion in savings to COGS/Opex in 2023 and $8-$10 billion in savings by the end of 2025. Thus, the company’s target of $3 billion in cost cuts should alleviate some pressure on gross margin and free cash flow.

In addition, the management team has announced an aggressive accounting change in its depreciation expense methodology (extended life of equipment from 5 to 8 years) that will reduce overall expenses by $4.2 billion for 2023 ($2.6 billion in gross profit, $0.4 billion in R&D, and $1.2B in inventory) and help absorb the sharp earnings drop. As an investor, I generally don’t like to see such creative accounting practices; even though it might be light and in line with GAAP policies, it is not a good sign. However, considering the global outlook, US-China Chip Wars, and cyclical downturn, there is some tolerance for now.

Intel’s turnaround on the top line may be pushed out to next year as cost controls become a greater focus amid demand weakness in its Client and Datacenter segments. Still, market-share loss in data center servers remains a risk to its medium and long-term growth expectations. Moreover, partnerships with fabless chipmakers for its foundry segment and subsidies from governments in the US and Europe will be vital to keeping Intel’s CapEx below 35%.

Even if it takes more than a dividend reduction to turn the company’s financial challenges around, the dividend cut will allow the firm to allocate $4 billion annually toward other priorities, including multi-billion foundry construction projects in Arizona, Ohio, and Germany. Unfavorably, Intel initially expected to spend €17 billion on the project in Germany; the firm now anticipates spending €30 billion. Finally, Intel delayed the start of construction at the plant, which it had previously agreed to build in Magdeburg with $7.2 billion in government assistance at the end of last year, but now the company is looking for additional funding.

Therefore, I expect the cost reduction efforts to prove effective over the long run supporting the company in achieving its master plan to regain its leadership or at least catch up with the competition.

Looking forward – Stick To The Big Picture

Looking at 2023, the team now expects PC unit shipment TAM to track near the low end of its prior outlook of 270-295 million units (or down 8-10%), given the demand weakness. In addition to the lower PC TAM outlook, the team under-shipped PC demand by 10% in 2022, with the pace of undershipments accelerating meaningfully higher in Q1 as customers work down their inventories. Intel’s management expects a 2H recovery led by China and enterprise, which should recover faster than cloud/hyperscaler.

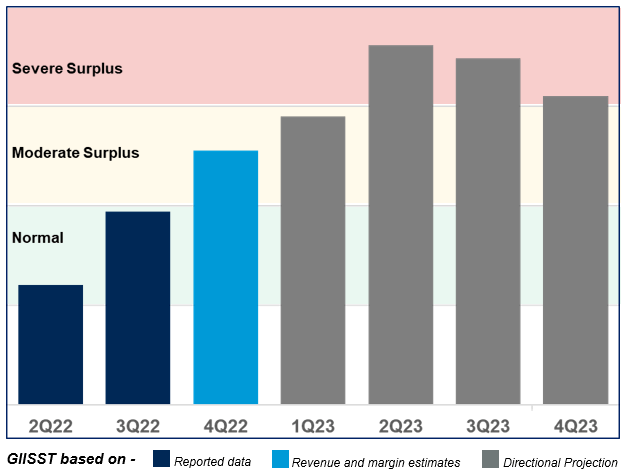

According to Gartner, despite the manufacturers’ slow output, the memory market will have severe overstock for most of 2023 due to weak end-equipment demand. In addition, a surplus of analog components is also expected due to manufacturers’ increased 300mm production capacity and a decline in demand.

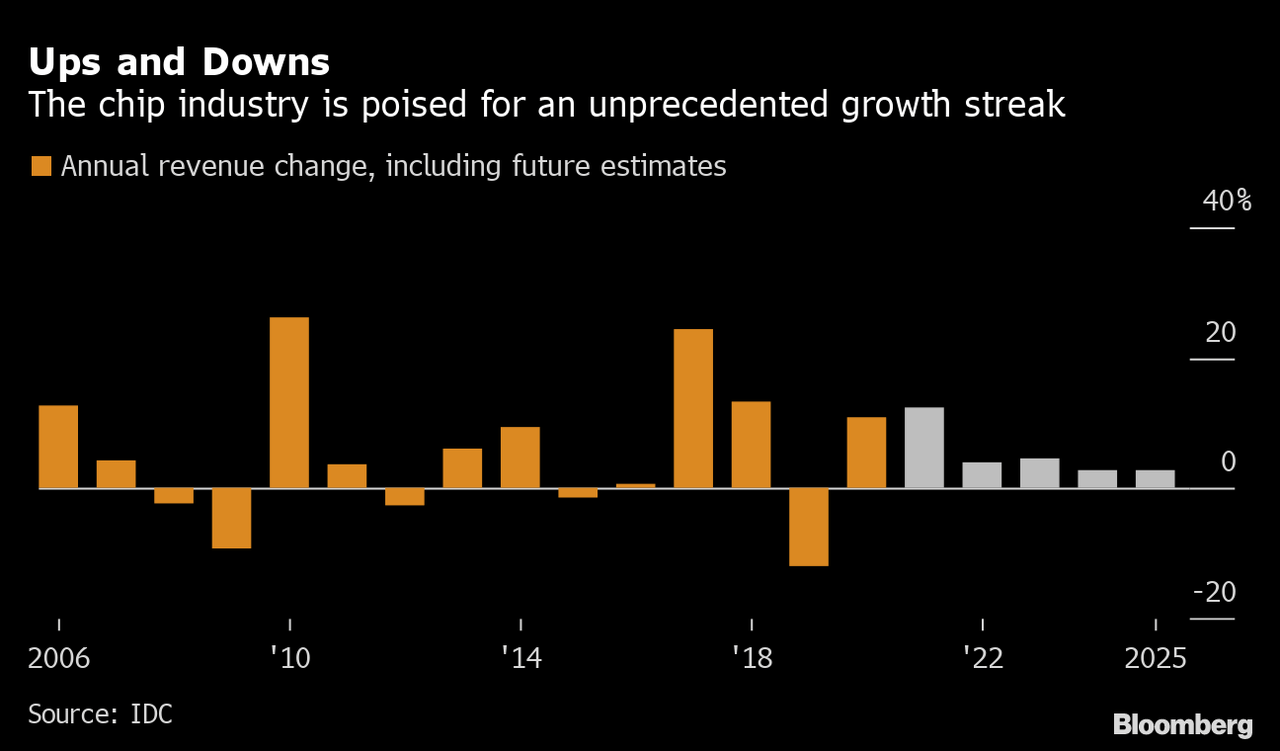

In 2023, there is a good likelihood that non-consumer markets, such as networking, servers, and storage, will follow a similar trajectory. Moreover, the inventory index is anticipated to rise through the second quarter of 2023 before declining as demand increases again. Finally, global semiconductor sales are expected to drop 6.5% to $562.7 billion in 2023; in 2024, the market is expected to rebound, expanding by 16.3% to generate $654.3 billion in sales.

www.gartner.com

While IT spending is still stable due to the need for cloud services, the semiconductor downcycle will continue in the first half of the year due to weakening end-demand for goods like smartphones and PCs and high supply chain inventory levels. On the other hand, the demand for 5G, high-performance computing, artificial intelligence, and the structural demand for sophisticated processors appears to hold up well.

Lastly, a lot depends on the company’s ambitious goal to catch up in process-node technology, which is the ultimate catalyst for the stock. Yet, how quickly end markets recover and how long destocking takes will influence the demand for mature nodes. In addition, reopening China might boost consumer confidence and resolve labor, supply chain, and logistics issues. Despite certain foundries’ announcements of CapEx reductions or delays, aggressive capacity increases continue, creating a short-term surplus.

Intel’s capital-spending plan to expand its foundry-manufacturing capacity, coupled with a sharp drop in revenue, will likely turn free-cash-flow expectations negative over the next 12-24 months yet provide a path toward long-term growth and a stronger business position. In addition, ample financial flexibility may enable investment spending of up to $75 billion over the next three years.

According to Bloomberg, it is less probable that semiconductor companies will experience a crash due to global scarcity of chips and supply-chain issues. However, most business leaders have warned that the shortfall won’t end until the second half of this year and that some items will continue to have delays due to the lack of parts well into 2023. Therefore, the industry remains cyclical, and based on its historical patterns, I expect elevated demand in 2025-2026.

www.bloomberg.com

Manufacturing & Technology Initiatives

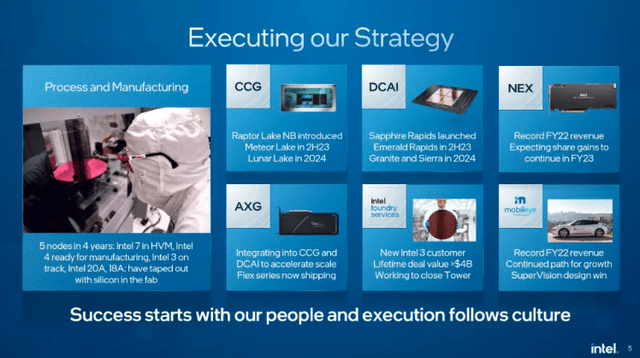

Management believes delivering five nodes in four years is on track. On the server side, the team is seeing robust demand for its Sapphire Rapids (ramping up one million units in the middle of the year), and Emerald Rapids is looking very healthy for later this year. In addition, Intel 3-based Granite Rapids/Sierra Forest server platforms show excellent health and are on track. Finally, on the PC side, the team is ready for manufacturing and is expected to ramp up Meteor Lakes in the 2H of the year.

Lunar is on target to be production-ready by 2024 and has already taped out its first silicon wafer. On Intel 20A and Intel 18A, the first nodes to use RibbonFET and PowerVia have been taped off, with silicon running in the fab. Given the weak compute environment as we move through 2023, I believe the team is taking prudent actions by identifying areas of structural cost reductions that should drive $3 billion in savings to COGS/ Opex in 2023 and $8-$10 billion in savings by the end of 2025 (a large part from IFS).

Intel

Takeaway

I don’t expect INTC to recover anytime soon, but long-term investors can accumulate shares at yearly lows for higher long-term gains. Moreover, the stock has shown strong support levels slightly above its book value per share of $24.50, signaling a bottom. Therefore, I’m staying invested in INTC, with a possible exit in the next cyclical uptrend in 2025-2026.

Disclosure: I/we have a beneficial long position in the shares of INTC, TSM, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.