Summary:

- Intel finally made the overdue decision to cut its dividend last week.

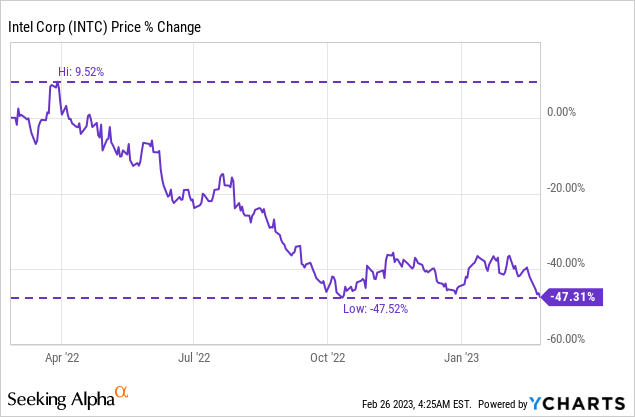

- New negative sentiment has been created and shares are trading near 1-year lows.

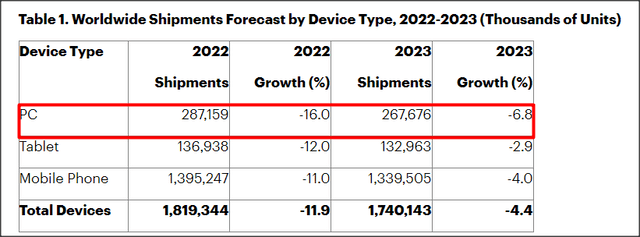

- Gartner’s forecast for FY 2023 device shipments implies another down-year for the PC market.

- I expect Intel to re-test its 1-year low.

JasonDoiy

Shares of Intel (NASDAQ:INTC) are once again trading near 1-year lows after the chip maker reported last week that it was gutting its dividend. The dividend cut follows last month’s earnings release which showed that Intel’s Client Computing Group, which is responsible for the majority of the company’s revenues, suffers mightily from shrinking consumer demand for computers, laptops and tablets. Although Intel recovered quickly from the earnings sell-off last month, the dividend cut has created new negative sentiment overhang for the chip maker. Gartner’s forecast for a second consecutive year of falling device shipments in FY 2023 suggests that negative sentiment could drive shares of Intel to new lows.

Intel is finally cutting its dividend

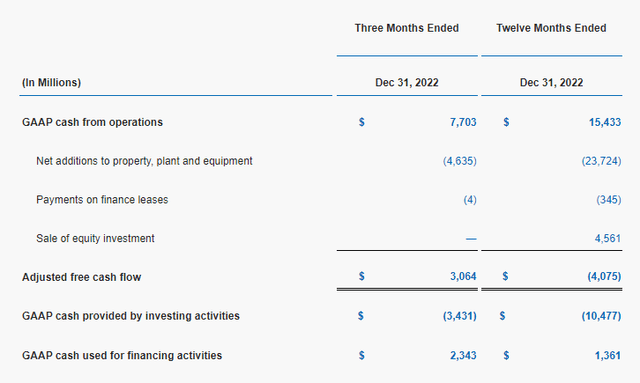

That Intel was facing a dividend cut was an open secret. In my work “Intel: Q4 Earnings Will Be A Moment Of Truth“, published on January 22, 2023, I warned of an accelerating PC shipment down-turn that was putting Intel’s free cash flow and dividend at risk. Intel’s free cash flow saw a sharp down-turn in FY 2022 and it was widely negative even before the release of Q4’22 earnings. The down-turn in the PC market, which really gained steam in the second half of FY 2022, resulted in Intel’s revenues dropping 20% year over year to $63.1B and free cash flow falling to $4.1B. Since dividends get paid out of free cash flow and Intel’s FCF turned negative due to mis-timed CapEx (Intel invested in new capacity just at a time when the market disappeared), a dividend cut was highly likely to occur.

Intel finally acknowledged this reality last week and announced that it was cutting its dividend by 66%. Going forward, investors are going to receive a quarterly dividend payment of $0.125 per-share which calculates to a total annual dividend pay-out of $0.50 per-share. Due to the change in capital allocation policy, Intel’s dividend yield dropped from 5.8% to 2.0%. The decline in the payout is making Intel significantly less attractive for dividend investors.

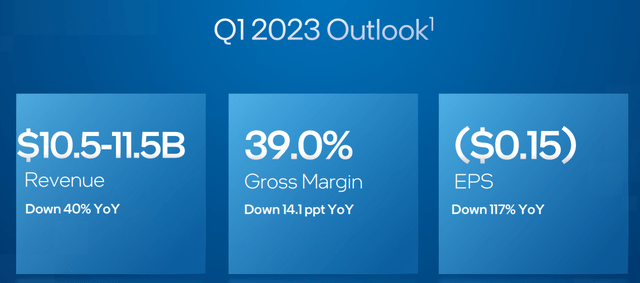

Intel, however, did confirm its outlook for the first-quarter. The chip maker continues to expect $10.5-11.5B in revenues and negative EPS of $0.15.

Intel reiterated that its dividend cut is part of a multi-tiered restructuring approach that calls for the rightsizing of the organization and $3B in cost savings in FY 2023. As part of its restructuring, Intel announced the gutting of hundreds of jobs and instituted salary cuts for its executives. Intel’s cost savings are expected to scale to $8-10B by FY 2025 which should help Intel recover over time.

Bleak outlook for Intel’s operating environment in FY 2023

Despite the dividend cut, investors shouldn’t expect much with respect to Intel’s operating performance this year. Consulting company Gartner recently projected that the PC market is set for continual weakness in FY 2023 and is facing its second consecutive year of falling device shipments. PC shipments are projected to fall 6.8% while total device shipments including tablets and mobile phones are expected to see a 4.4% drop on a year over year basis. In FY 2022, global device shipments dropped 11.9% year over year to 1.8B units. Gartner also said that it expects a normalization of inventory levels in the second half of FY 2022. Morgan Stanley also recently lowered its forecast for PC shipments.

If Gartner’s projections turn out to be accurate, the PC market could bottom out in the second half of FY 2022, but the short term outlook remains light. Weak consumer demand for computers, notebooks and tablets should therefore be expected to continue to put pressure on Intel’s top line and stock valuation, at least in the first two fiscal quarters.

Intel’s valuation

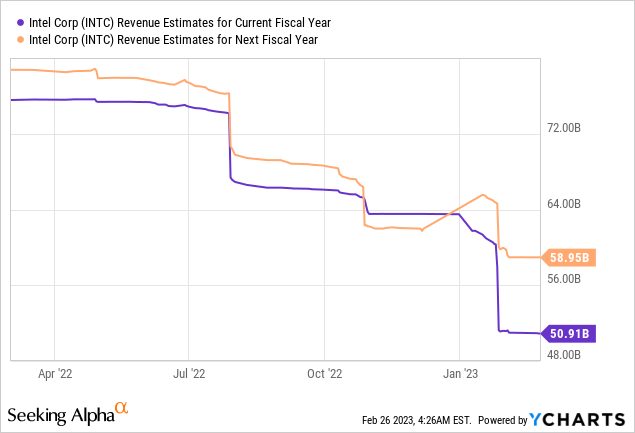

Although Intel has seen a 47% downside revaluation over the last 12 months, I don’t believe shares have bottomed yet… even after the company cut its dividend by 66%. Intel’s revenue estimates have dropped sharply and investors must brace for more pain if Gartner’s projections turn out to be true and consumer demand doesn’t rebound.

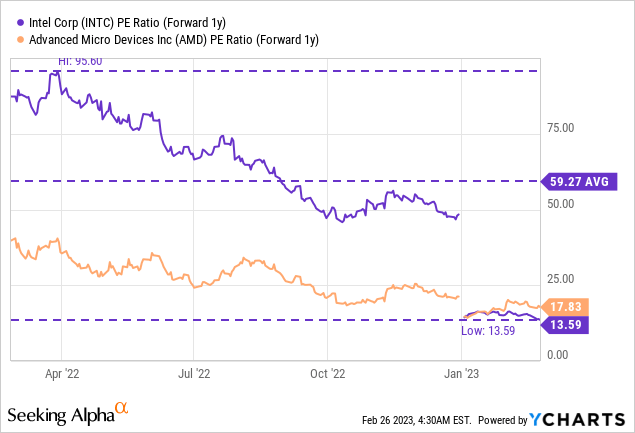

Intel is currently valued at a P/E ratio of 13.6 X which compares against a P/E ratio of 17.8 X for main rival AMD (AMD). Intel is, however, more dependent on consumer demand — and therefore more exposed to the health of the PC market — than AMD. AMD has made heavy investments in its Data Center capabilities in recent years and even acquired new companies such as Xilinx and Pensando in order to grow its market share in the server market.

Intel is currently trading near its 1-year low of $24.59 and the stock could very well re-test this level in the coming days and weeks.

Risks with Intel

The obvious and immediate risk is that slowing consumer demand will result in further revenue declines for Intel’s important Client Computing Group which accounted for 49.9% of revenues in FY 2022. There is also a risk that Intel will have to drive a harder restructuring if the company continues to suffer from a continual PC market slump. A successive slowdown in PC shipments in Q1’23 and Q2’23 could drive shares of Intel to new lows and potentially highlight the need for a more aggressive restructuring.

Final thoughts

The writing was already on the wall and many writers have warned that a dividend cut was inevitable considering that the down-turn in the PC market accelerated in the fourth-quarter and that Intel was not earning its dividend with free cash flow. However, I don’t believe that the dividend cut is enough to make Intel’s shares an attractive buy for investors just yet. Gartner’s projection for FY 2023 device shipments shows that the PC market is set to further contract which will continue to put pressure on Intel’s top and bottom line. Considering that the operating environment is expected to remain very challenging for at least the next six months, I believe Intel is going to re-test its latest lows.

Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.