Summary:

- Apple’s net cash position has dipped below $50 billion.

- The net cash position can support less than six quarters when we include cash flows from operation.

- The buybacks have been a strong tailwind for Apple stock over the last few years which has allowed the stock price and EPS to increase significantly faster than net income.

- Apple also needs to conserve cash for services like TV+ which would require massive investment over the next few years.

- As the tailwind of buybacks subsides, we could see a correction in the stock price in the next few quarters.

Nikada/iStock Unreleased via Getty Images

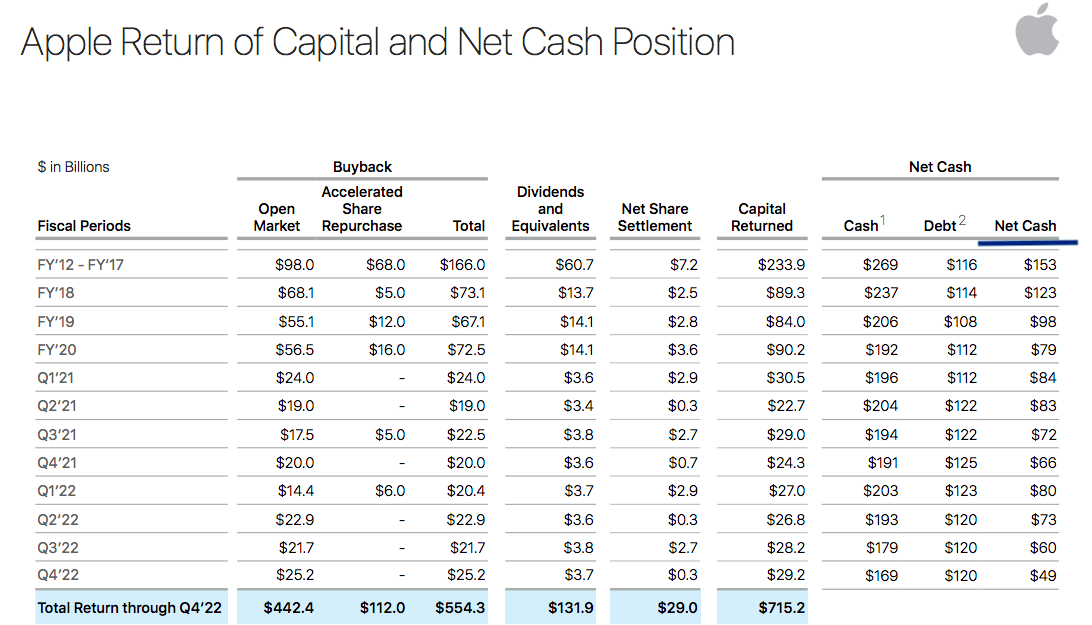

Apple (NASDAQ:AAPL) has been rewarding shareholders with dividends and buybacks over the last decade. It has spent a whopping $715 billion on dividends and buybacks since the program began in 2012. Currently, the company is investing close to $110 billion annually in buybacks and dividends. This is a staggering pace that has had a negative impact on the net cash position of the company. Apple has $49 billion in net cash, down from $123 billion in FY2018. It is highly likely that Apple will curb the buyback pace over the next few quarters in order to retain some net cash buffer.

Apple is investing in services that require massive investment in the initial phase. One of the most important is TV+ where it is competing against Netflix (NFLX), Disney (DIS), Amazon (AMZN) and other peers who are investing tens of billions of dollars every year in content. In order to build a respectable service, Apple would need to ramp up investment in TV+ which will further erode cash flow and reduce the ability to maintain a higher buyback pace. A rapid decline in buybacks over the next few quarters will be a headwind for Apple stock.

Decline in net cash position

Apple’s management had already announced its intention to reach “cash neutral” position through buybacks. The company is currently sitting on $49 billion in net cash and is spending close to $110 billion on buybacks and dividends every year. The free cash flows have been quite strong due to a boost from the pandemic and 5G iPhones. But it is unlikely that the company can maintain this pace of shareholder returns over the long run.

Company data

Figure 1: Net cash position of Apple over the last few years. Source: Company data

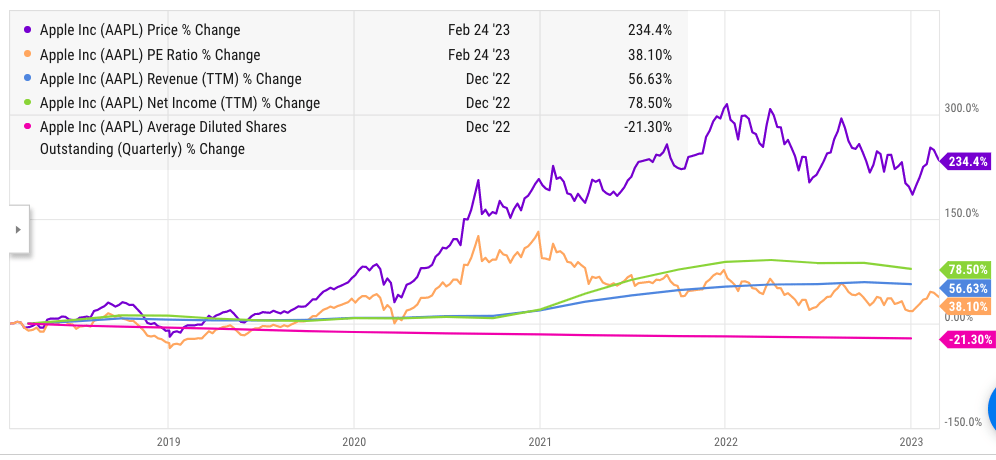

There has been a positive impact of buybacks on EPS as the outstanding stock declined by 40% in the last few years. The rapid increase in EPS has also helped in improving the valuation multiple which has boosted the stock price.

Buybacks and EPS

Apple has invested over half a trillion dollars in buybacks in the last few years. This has reduced the outstanding stock count from 26 billion to 16 billion which is equal to a decline of 40%. On a standalone basis, the buybacks have increased the EPS by 66% in the last ten years or 5.2% annually. The tailwind due to buybacks has certainly helped Apple weather several storms in the last few years.

YCharts

Figure 2: Trend in Apple’s stock price, net income, revenue and outstanding stock. Source: YCharts

Apple’s stock price growth has been higher than net income growth due to an increase in the valuation multiple and a decline in outstanding shares.

Future of buybacks

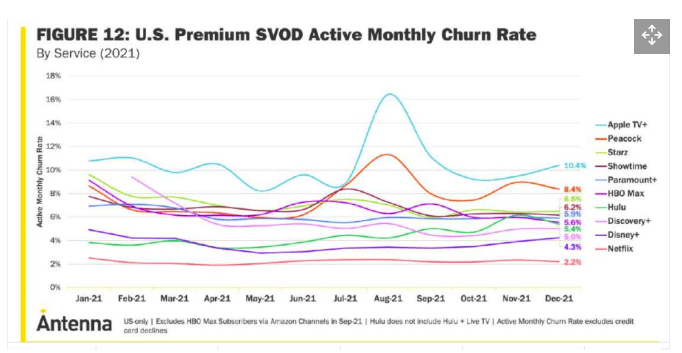

The decline in net cash position will force the management to rein in buybacks. However, we could see a bigger impact on buybacks due to higher cash demand from Apple’s new services. Apple is trying to ramp up its content play and wants to compete with the top companies in the video streaming business. Netflix, Amazon, Disney, and other video streaming players have massive budgets. Netflix and Amazon spent close to $17 billion on streaming in 2022. Disney is also spending massively and there are a number of other big players in this industry.

If Apple wants to gain subscribers and retain them, it would need to ramp up the content budget. Ideally, Apple would need an annual content budget of at least $15 billion over the next few years to build a strong content library. This would be equal to 20% of its net income. On the other hand, the revenue from subscriptions to TV+ would be lower in the initial phase as many customers binge-watch the limited content on TV+ and cancel subscriptions.

Antenna

Figure 3: Churn rate of TV+ is a lot higher than other players. Source: Antenna. Nexttv

Apple’s investment in TV+ would hurt free cash flows for the company. Lower net cash position and smaller free cash flow will inevitably lead to a pullback in buyback pace from the management.

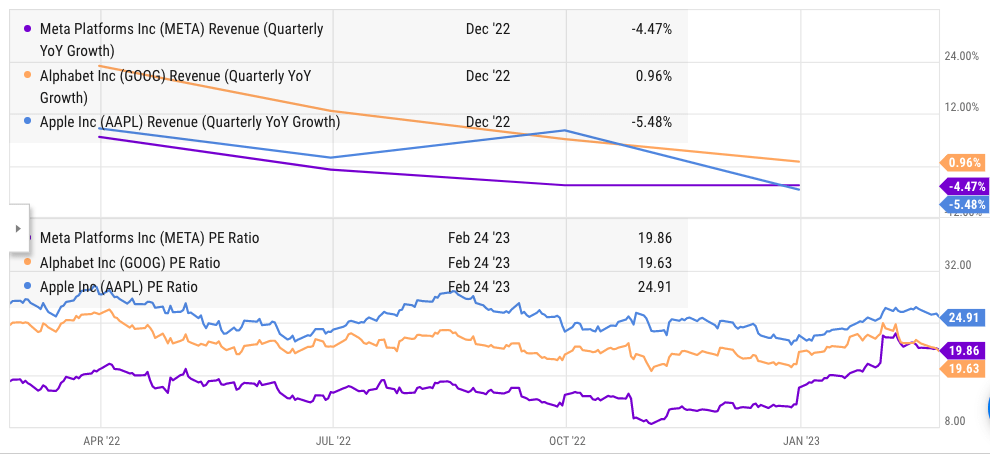

Impact on Apple stock

As mentioned above, Apple stock has seen a tailwind of 5.2% annually for its EPS due to buybacks. If the company limits buybacks, this positive factor will not be available for the stock. Apple stock is already trading at a higher valuation multiple compared to other big tech peers. The company has also reported a significant decline in revenue and net income in the recent quarter. These factors together can make a perfect storm for the stock which could lead to a correction in the next few quarters.

YCharts

Figure 4: Apple’s valuation multiple and revenue growth in comparison to Meta and Alphabet. Source: YCharts

Long-term Apple investors should closely look at the impact of a possible reduction in buyback pace. The future calculation in EPS growth and buybacks will change dramatically when we factor in the decline in net cash position of Apple and a lower free cash flow due to investment in TV+ and other services.

Investor Takeaway

Apple has invested over half a trillion in buybacks over the last ten years. This has allowed the company to expunge 40% of its outstanding stock and boost EPS by 5.2% annually. The tailwind due to buybacks will not be available in the future as Apple reaches close to net cash position. The company has less than $50 billion in net cash. It also needs to invest heavily in building a successful streaming business.

Apple stock has a PE multiple higher than other tech peers while it is suffering a slowdown in important segments like Services and Wearables. We should see higher investment in new products and services by the management to restart growth. This limits the resources available for buybacks. Any future EPS and stock price valuation model should include the impact of this trend and the possibility of a correction in Apple stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.