Chevron: Not Worth The Risks Here – Likely No Margin Of Safety

Summary:

- The CVX stock is still trading above our preferred entry points of $130s.

- Even then, our number still suggests a notable premium of 36.8% against its historical share repurchases at an average price of $95 for the past 19 years.

- Investors whom add at these levels must proceed with caution in our view, due to the potential underperformance through 2023.

- With the ongoing Ukraine war, OPEC+ production cut, Russian export reduction through April, and China’s rapid reopening cadence, things may remain volatile for a while longer.

peepo

CVX Has Been Delivering Stellar Returns To Loyal Shareholders

Chevron (NYSE:CVX) is a dividend aristocrat and the company recently announced a hike in the quarterly dividend by 6.3%, while tremendously tripling its share repurchase program to $75B.

This feat was impressive, despite the drastic decline in WTI crude oil prices by -40.1% to $74.02 and natural gas prices by -77.1% to $2.22 per MMBtu at the time of writing, from the heights of $123.64 in March 2022 and $9.73 in August 2022, respectively.

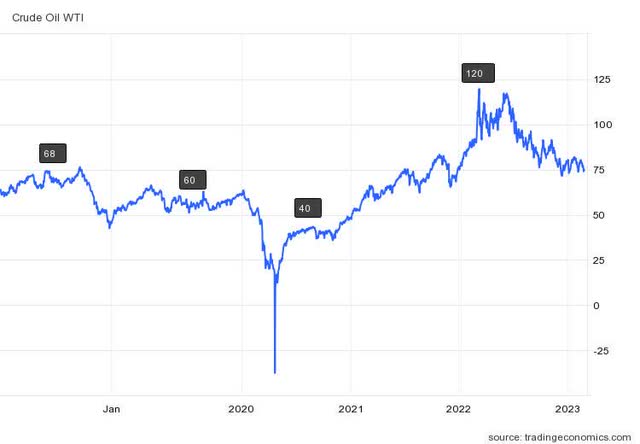

WTI Crude Oil Prices

In the short term, market analysts project that WTI oil prices may further decline due to the robust Russian oil exports to India, China, and Turkey, amongst others. Particularly, Russian exports expanded tremendously by +50% MoM in January 2023, with the country still producing an average of 10.9M b/d then, compared to pre-pandemic levels of 11.3M b/d.

Particularly, the surge in supply suggests that spot prices may trend downwards in the short term, which may then impact CVX’s Free Cash Flow [FCF] generation in FQ1’23.

For now, market analysts expect the company to deliver a FCF of $6.44B in FQ1’23 and $30.3B in 2023. This is attributed to the management’s forward guidance of a Brent break-even rate of $50 (in line YoY) and a lower selling Brent price at $80 (-16% YoY from average spot prices of $95). The projected FCF for FY2023 suggests a headwind of up to -19.4% YoY, though a massive expansion by +129.7% from FY2019 levels.

Nonetheless, investors need not fret since CVX’s dividends remain more than safe, with the projected total payout of $11.6B (+5.4% YoY) in 2023, based on its latest share count. This is on top of the historical annualized share repurchase rate of $15B. Its long-term debts of $23.33B (-23.9% YoY) by the latest quarter are also well-staggered through 2050, with only $5.6B due in 2023 and another $1.65B due in 2024.

Combined with the company’s excellent cash/ equivalents of $17.67B (+213.2% YoY) by the latest quarter, the CVX management has been executing brilliantly indeed, emphasizing shareholder returns and deleveraging thus far.

On top of that, we reckon that there may be tailwinds for the recovery of oil prices by Q2’23, attributed to Russia’s decision in reducing exports by up to -25% for March & April 2023, potentially triggering a shortfall of -2.5% globally.

In addition, the US SPR has been rapidly depleted to 1983 lows of 371.57M (-37.4% from December 2021 level) at the time of writing, prompting the potential halt of future sales through September 2023. To protect the country’s energy security, the Biden administration has expressed an interest in refilling the SPR once “prices get to somewhere in the $70 range on a consistent basis.”

However, with market offers being too expensive thus far, there are only two possible outcomes in the foreseeable future, in our opinion. Either the SPR may remain lean as the new normal or the administration may have to raise its offer to match market prices.

Either way, the tightening of market supply may further support the recovery of WTI crude oil prices to between $80s and $90s. This may be further aided by China’s rapid reopening cadence and potential increase in demand by 7% through 2023. As a result, CVX may report an improved performance from H2’23 onwards in our view.

So, Is CVX Stock A Buy, Sell, or Hold?

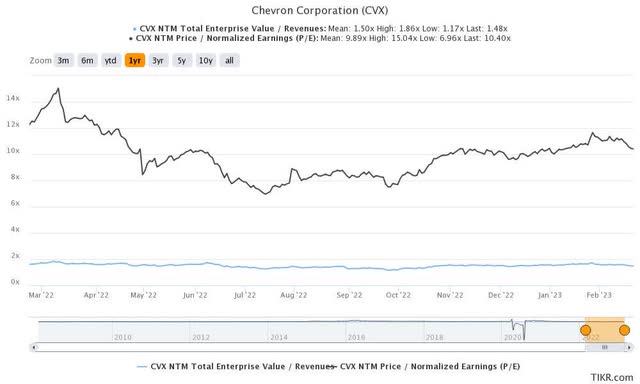

CVX 1Y EV/Revenue and P/E Valuations

CVX is currently trading at an EV/NTM Revenue multiple of 1.48x and NTM P/E of 10.40x, lower than its 3Y pre-pandemic mean of 1.58x and 18.61x, respectively. Otherwise, it is slightly higher than its 1Y P/E mean of 9.89x.

Based on its projected FY2024 EPS of $14.47 and current P/E valuations, we are looking at a moderate price target of $150.48, suggesting a minimal upside potential from current levels.

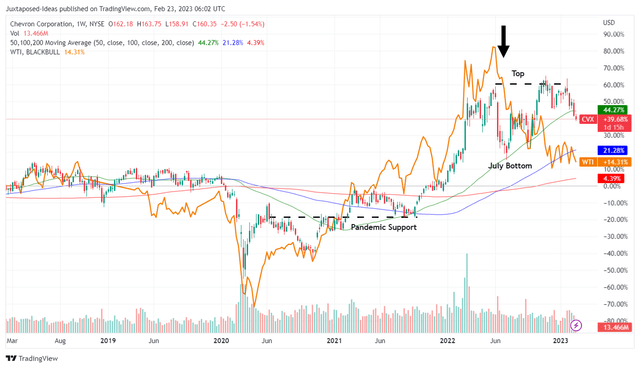

CVX 5Y Stock Price

This is unsurprising, due to the notable disconnect between the WTI crude oil price and the CVX stock price. In contrast to previous patterns, the oil stock now trades rather optimistically at $160.35, despite oil prices declining to $74.02 at the time of writing.

While it appears that the CVX stock has returned to its previous September 2022 support levels, we are less certain due to the notable downward slide over the past four weeks.

Assuming that the selling continues, we may see a further downward pressure on the stock in the intermediate term, testing its previous July bottom in the $130s. Interested dividend investors should then nibble at those levels for an improved forward yield of 4.64%, against its 4Y average of 4.53% and sector median of 4.29%, based on the proposed quarterly dividends of $1.51 in 2023.

In the long-term, a sustainable floor is likely at the $90s, attributed to CVX’s historical cadence of repurchasing stocks at an average stock price of $95 for the past 19 years.

However, it is uncertain when we may see those levels again, with the Ukraine war still ongoing and OPEC+ determined to cut production through 2023. Combined with the factors discussed above, we prefer to rate the CVX stock as a Hold at these levels, due to the potential volatility and the minimal margin of safety to our price target.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.