NextEra Or Duke: Which One Of These Utilities Belongs In Your Portfolio?

Summary:

- NextEra Energy has a compelling, and growing, national renewable power business.

- Duke has recently sold its renewable unit and represents a more pure-play regional electric utility.

- We consider the key risk we think must be considered by investors who are considering utilities for their portfolio.

Artur Nichiporenko

It’s All About Power

It’s well known that utility stocks are typically defensive plays–they tend to operate stable businesses with monopolistic characteristics that offer products and services that people can’t, quite frankly, live without.

Dividend investors also find utilities attractive for the same reason. The stability of the business often leads to some of the most well-funded dividends that can be found.

With rising interest rates and a possible recession on the horizon, we think that investors would do well to consider space in their portfolio for utilities. In this article we’ll consider two large utility providers and the benefits they may offer investors, NextEra Energy (NYSE:NEE) and Duke Energy Corporation (NYSE:DUK).

Next Era Energy

Segments

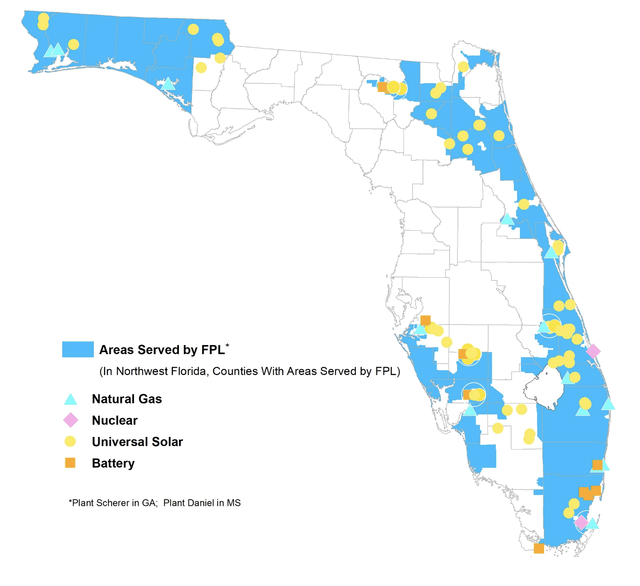

NextEra Energy operates Florida Power & Light [FPL], and NextEra Energy Resources [NEER]. FPL serves about 7.6 million customers across Florida, and provides power via natural gas, nuclear, and solar power.

FPL Service (Company Presentation)

The largest energy-generating component is natural gas with 76% of generating capacity, followed by nuclear at 11% and solar at 11%. The FPL segment also reported a profit of $763 million on revenues of $4 billion for 2022.

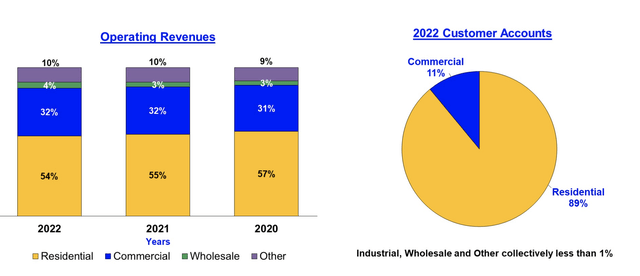

FPL Customer Mix (Company Presentation)

FPL primarily serves residential customers, which make up 89% of its accounts while commercial accounts comprise the remaining 11%. Commercial accounts make up a disproportionate amount of revenue, however, making up 32% of the company’s operating revenue.

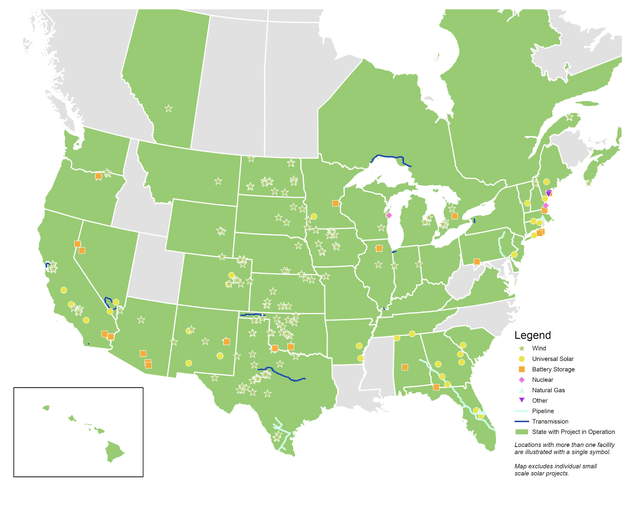

While FPL serves Florida alone, NEER provides a bit of geographic diversity. The segment operates renewables that are spread throughout the geographic United States.

NNER Operating Footprint (Company Presentation)

In the NEER business, wind power generation accounts for 60% of production, while solar accounts for 14%, and nuclear for 8%. NEER operates three nuclear sites (2 in Wisconsin and 1 in New Hampshire). While the New Hampshire facility is expected to operate until 2050, the two Wisconsin plants are currently slated to be operational until 2030 (though the company has applied to extend the life of these plants by 20 years).

NEER generates about half of the revenue of FPL, bringing in $2 billion in top line in 2022. The net profit margin is, however, quite a bit better than its Florida counterpart, bringing in $996 million in profit for the year.

The total company’s revenue for 2022 was $20.9 billion with a $4 billion net profit.

The Dividend

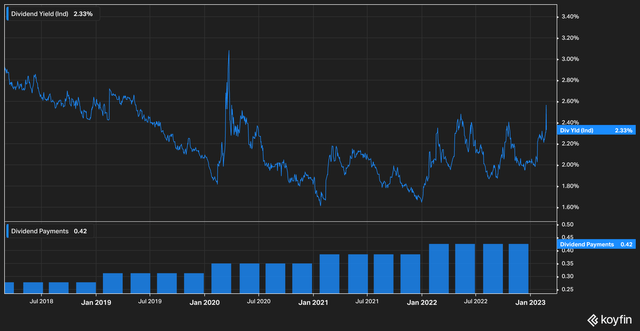

NextEra currently pays a $0.42 per share quarterly dividend, which works out to a 2.3% current yield. At current levels this represents a $3.3 billion annual cash outlay for dividends.

NEE Dividend (Koyfin)

On operating cash flows of $8.2 billion, the dividend seems comfortably covered. The worry, however, like for most utilities, is the amount of capital expenditure needed by the business. FPL incurred $9 billion of CapEx in 2022, making NEE overall free cash flow negative for the year.

Political Risk

NextEra recently found itself in hot water when on January 25th, 2023, it announced in an 8K filing that it had completed an internal investigation relating to recent allegations that the company had violated Florida campaign finance laws. The company assessed that it would not be found liable if allegations were to proceed and that the total estimated monetary risk was $1.3 million.

Of course, internal investigations can understate potential risks, and the public relations issue could be far greater than any small monetary penalty. While we don’t think the issue is likely to grow larger than it currently is, investors should be aware of its existence.

The Bottom Line

With a strong balance sheet and considerable national footprint, NextEra Energy is a strong contender for investors looking to buy into the utility industry. Key risks for NextEra are political and regulatory risks–particularly follow-on risks related to the company’s recent Florida campaign law issues.

Duke Energy

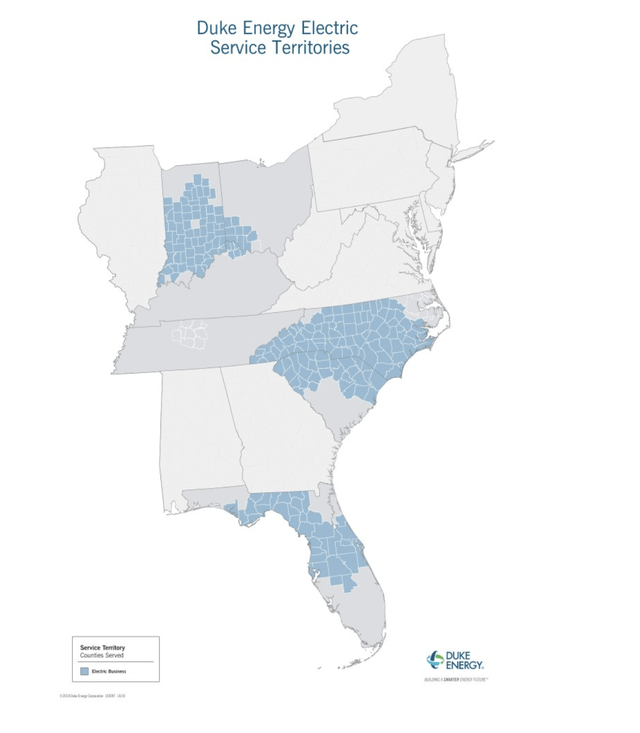

Duke provides power states along the eastern United States (and in the areas of Florida where power is not provided by NextEra).

Duke Service Areas (Company Presentation)

Duke’s customer mix follows roughly the same lines as NextEra’s, with residential making up a little less than 90% of overall revenues and commercial picking up the rest.

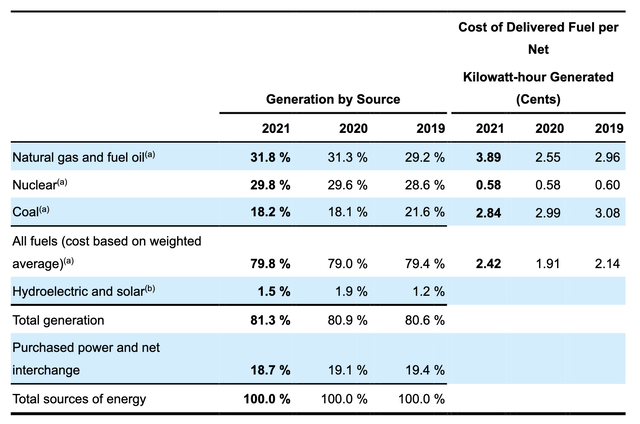

Duke does, however, draw a significantly larger amount of its power from nuclear resources than NextEra.

Duke Power Mix (Company Presentation)

With almost 30% of its power coming from nuclear sources, Duke is able to generate power at lower cost per kilowatt-hours, but of course has sizable capital expenditures to maintain and de-commission nuclear plants.

Duke is also currently in the middle of ongoing rate reviews. While utilities can often pass rate increases to customers incrementally, some states and jurisdictions require rate reviews for utilities to increase prices. In a rising interest rate environment, it is critical that utilities be able to raise rates commensurate with at least the maintenance necessary CapEx costs. In South Carolina, Duke was recently successful in gaining acceptance of its rate review, pending final approval. The company is also seeking a rate review in the Carolinas that would allow it to raise residential energy prices by almost 18% over the next three years.

The Dividend

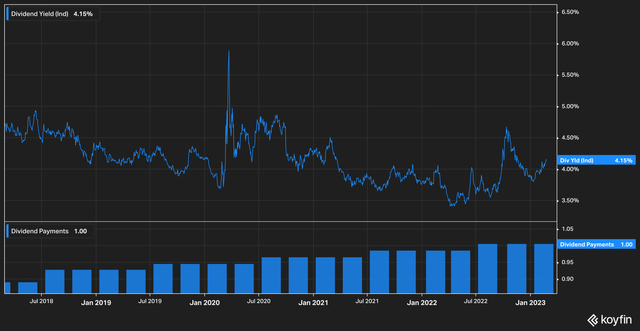

Duke currently pays out $1.00 per share in dividends per quarter for a current yield of 4.15%.

Koyfin

This results in dividend payouts of a little more than $3 billion annually. In 2022 the company reported a net income of $2.5 billion, and cash from operations of $5.9 billion. If these numbers seem a bit low to investors, it’s because the company incurred a $1.3 billion charge from discontinued operations. Once these operations are fully divested from the books, financials are expected to return to more normal levels.

What’s That Charge About?

The discontinued operation mentioned above is the divestiture of Duke’s renewables business. The reason for the write-down is that the company had already collected renewable related tax credits for the business, which it sold for $4 billion.

The sale, we think, will have a largely positive outcome for the company and its investors. By getting out of the renewable market and focusing on its regulated utility business, the company will not be a subject to the vagaries of open-market power pricing and thus be able to generate more stable returns over time.

The Bottom Line

With a strong dividend and good balance sheet, we are heartened by management’s decision to cut costs and divest businesses that are likely to fare poorly in a rising rate environment. With enough geographic dispersion in its customer base that disruptions like hurricanes and other natural disasters will not affect a disproportionate amount of customers, we think Duke has prepared itself well for any challenges ahead.

Key Utility Risks

One thing that all utility investors should keep in mind is the specter of rising interest rates. Utility companies in particular can be hurt by these if they are not judicious in their spending since they often rely on bond issuances to fund their growth projects.

Further, as discussed briefly above, many utilities cannot blindly pass on cost increases to customers, but must instead undergo regulatory reviews and approvals to do so. It’s important for investors to understand before investing in a utility exactly how the company can pass price increases onto their customer base.

In Conclusion

While Duke Energy currently delivers a higher yield that may be more attractive to dividend investors, we think that both Duke and NextEra are companies that are making good investments for their corporate futures. Those wishing for a more pure regulated power play will likely be more interested in Duke stock, while investors seeking for a company with a burgeoning renewables business may find attractive value in NextEra stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.