Summary:

- Lucid presented its production outlook for FY 2023 last week.

- The outlook was not as bad as investors make it out to be: Lucid could double its production on a year over year basis, in the best-case scenario.

- Fears over a demand slowdown are weighing on Lucid.

- Lucid’s balance sheet will support the firm’s production growth.

David Becker

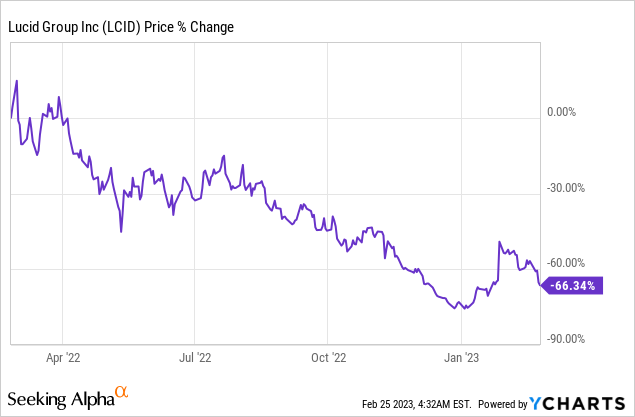

Lucid Group (NASDAQ:LCID) reported earnings for the fourth-quarter on Wednesday and the company’s shares tanked 14% afterwards. The electric vehicle maker failed to meet Q4’22 revenue expectations and presented its production outlook for FY 2023 which could translate to only 39% production growth year over year. Fears over a demand slowdown are now weighing on Lucid’s valuation, but the market reaction is likely overblown. l believe Lucid is a strong EV company with a well-funded balance sheet that has very attractive prospects for revenue growth. LCID stock also has long-term potential to revalue to the upside!

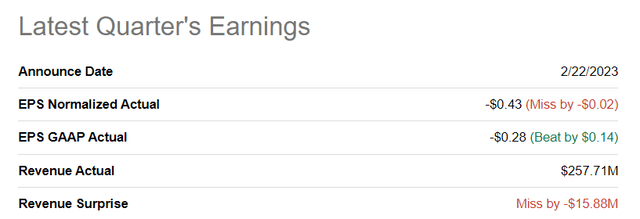

Lucid fell short of revenue expectations

Lucid’s fourth-quarter revenue fell short of expectations with the EV maker reporting Q4’22 revenues of $257.7M compared to a consensus estimate of $273.6M. Lucid’s GAAP EPS beat by $0.14 while adjusted EPS missed by $0.02.

Lucid’s production guidance for FY 2023

Lucid already released its production numbers for the fourth-quarter and full-year in January. The electric vehicle maker produced 3,493 electric vehicles in Q4’22, showing 53% quarter over quarter growth. In total, Lucid produced 7,180 electric vehicles last year which slightly exceeded the company’s production guidance of 6,000-7,000 EVs.

The new guidance for FY 2023 calls for an annual production volume of 10,000-14,000 electric vehicles, a range that represents a year over year growth rate between 39% and 95%.

While the realization of the low-case production point of 10 thousand electric vehicles would certainly be a disappointment, the guidance implies considerable upside in the potential manufacturing volumes. In the high-case scenario, Lucid could almost double its production year over year. The guidance range is unusually wide, but likely reflects ongoing uncertainty about demand for electric vehicles as well as continuing issues with the supply chain.

Reservation update reflects a potential demand issue for Lucid

Lucid disclosed 28 thousand reservations for its Lucid Air and higher-spec models as of February 21, 2023, a number that doesn’t include the purchase commitment for up to 100 thousand electric vehicles, made by the Kingdom of Saudi Arabia in FY 2022. Lucid’s current reservation total represents a potential sales volume of about $2.7B, implying an average sales price of approximately $96 thousand.

As of November 7, 2023, Lucid had more than 34 thousand reservations representing a total sales value of $3.2B, meaning Lucid’s reservations have dropped quarter over quarter. This drop could indicate that demand for electric vehicles is easing at a time when consumers continue to suffer from high inflation. It also potentially suggests that not all customers on Lucid’s reservation book are willing to follow through with an actual purchase. For Lucid this could be a potential headwind going forward… if there is more evidence that demand for electric vehicles is slowing.

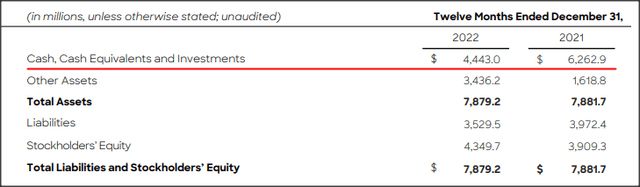

Lucid’s balance sheet: a key asset for the EV company

Besides producing a well-received all-electric passenger car in the premium sedan segment, I believe Lucid’s key advantage over other US-based EV makers is its balance sheet. Lucid has been backed by Saudi Arabia’s sovereign wealth fund PIF for years which has allowed the EV company to build a comfortable cash cushion to finance the ramp of the Lucid Air.

Lucid had $4.44B in cash and cash equivalents on its balance sheet at the end of FY 2022. Cash resources dwindled year over year as the company expectedly ramped up Lucid Air production and revenues. In FY 2022, Lucid generated a net loss of $1.3B on net revenues of $608.2M which implies that Lucid has enough cash to finance the production ramp at least over the next two years without having to worry about running out of funds.

Lucid’s net losses are also narrowing quickly: in FY 2021, the EV maker reported a net loss of $4.7B compared to loss of $1.3B in FY 2022. Lucid, I believe, has the best chance of all other EV companies to achieve profitability in the next few years.

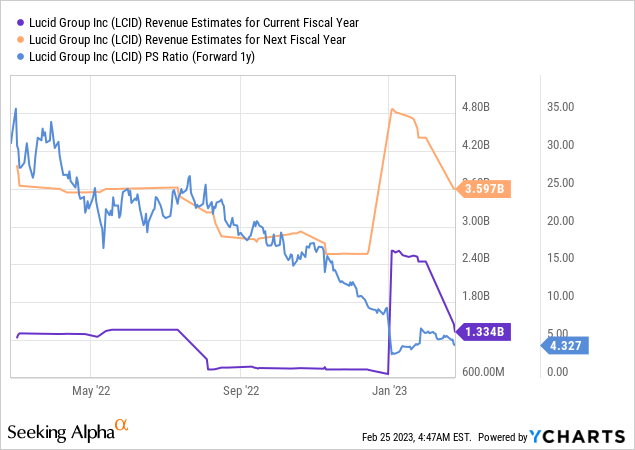

Lucid’s valuation

Lucid grew its revenues more than 2,100% in FY 2022 to a record $618.2M. In FY 2023, Lucid is expected to grow its top line 119% to $1.3B, before growth of 170% to $3.6B is projected to happen in FY 2024. Lucid’s revenue growth prospects remain attractively valued: with shares trading at just $8.51, Lucid’s prospects are valued at a P/S ratio of just 4.3 X which is significantly below Lucid’s 1-year average P/S ratio of 18.6 X. I also believe that the potential for slowing EV growth are also more than fully reflected in Lucid’s valuation.

Risks with Lucid

The two biggest commercial risks for Lucid right now are a potential slowdown of EV demand as well as new production problems in FY 2023. Additional bottlenecks, either on the side of supply or demand, could impact the way that Lucid as a stock investment is perceived by EV investors. A drop-off in revenue projections/estimates could also be a considerable risk for Lucid’s shares in the near future.

Final thoughts

I don’t actually believe that Lucid’s production forecast for FY 2023 was that bad which is why I am getting greedy and buying the drop. In the high-case scenario, Lucid could come very close to doubling its electric vehicle production in FY 2023, on a year over year basis. The reservation update possibly indicates that not all customers that placed an order have the intention to complete a purchase. If Lucid’s following earnings releases confirm the suspicion that a demand problem is developing in the EV market, shares of Lucid may be experience further short term weakness. The long term runway, however, looks solid and the company’s strong balance sheet provides multi-year support for Lucid’s production growth!

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.