Summary:

- Under current conditions, Intel Corporation’s thesis is largely a CEO Pat Gelsinger thesis in my view.

- The key dividing issue between bears and bulls is whether his turnaround plan will work (or is working) or not.

- This article provides my independent and data-driven evaluation.

- And I will conclude that Gelsinger’s Intel Corporation management team has been effective in executing the plan.

Chip Somodevilla

Thesis

The way I see things, the key dividing issue between Intel Corporation (NASDAQ:INTC) bears and bulls is his turnaround plan. More specifically, bulls and bears fiercely debate: A) whether the plan is a sound plan to start with or not; and B) if so, whether Gelsinger and his team can execute the plan effectively.

The debate often gets subjective, for good reasons. Elevating personnel performance is as much an art as a science. And the goal of this article is to provide my independent and data-driven evaluation. And you will see that the core thesis here is to explain why my answers to both questions A and B above are “Yes”.

For readers unfamiliar with the background, Pat Gelsinger, after taking the CEO role at Intel Corporation, outlined a comprehensive plan to revitalize the company and position it as a leader in the semiconductor industry. The plan, known as IDM 2.0, involves several key elements. It will be too much to include all these elements in this article. And, therefore, I will focus on the following three elements here:

- Investment in advanced manufacturing technologies to improve production efficiency and increase the company’s competitiveness.

- A renewed emphasis on innovation and research, with a particular focus on areas such as AI, 5G, and security.

- A focus on delivering leadership products in core markets such as the data center, PC, and Internet of Things (“IOT”) segments.

The remainder of this article will provide my assessment of these three elements.

Advanced manufacturing technologies

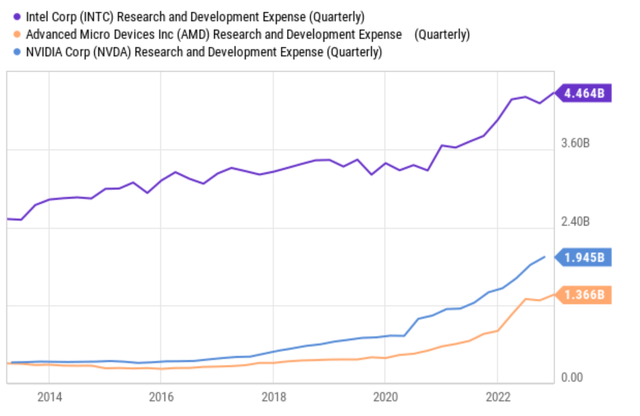

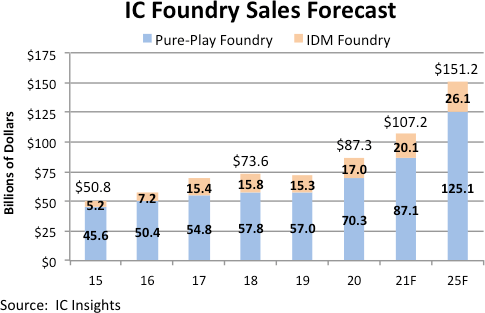

The issue that attracted the most attention is Intel’s fab initiative to reclaim its leadership position in advanced chip manufacturing. I view this strategy as the right move at the right time as the digitization revolution across every industry accelerates at an unprecedented pace. As seen in the chart below, the global foundry industry is expected to grow into a $100 billion market in the 4~5 to years. I expect much of the growth to be driven by emerging technologies such as AI, cloud, 5G, and IoT computing, which are all the areas that Gelsinger is focusing on either via internal efforts, partnerships with other companies, and also strategic acquisitions.

Notably, the recently-passed CHIPS Act could support Intel’s fab initiative substantially by providing additional funding in terms of tax credits, R&D support, and also the construction of new fabrication facilities. On the acquisition from, Intel has acquired Tower Semiconductor recently, an acquisition that I anticipate to accelerate its vertical integration with direct access to a wafer foundry. Another recent acquisition was Moovit, an Israeli mobility-as-a-service (MaaS) company that provides real-time public transit information to users around the world. This is an acquisition that could strengthen Intel’s capabilities in the autonomous vehicle space, or IoT space in general, for years to come in the way that I see it.

Source: Fab Forecast 2019-2025 provided by AnySilicon

Renewed emphasis on innovation and research

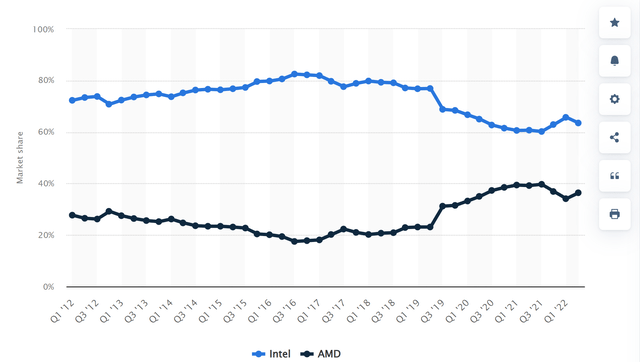

Intel has been known for its substantial investments in research and development (“R&D”) efforts even before Gelsinger took over. Historically, Intel’s R&D spending was among the highest in the semiconductor industry, investing billions of dollars each QUARTER to advance its technology and products. And as seen in the chart below, after Gelsinger took over, the R&D expenses ramped up noticeably and far exceeds close peers like Advanced Micro Devices (AMD) and Nvidia Corporation (NVDA).

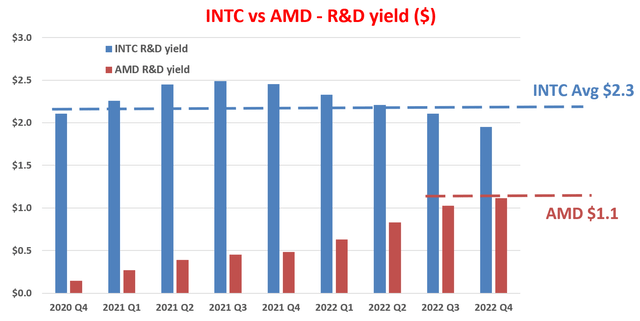

The next important question is the yield of the R&D expenses. How effectively do the R&D expenses turn into profits? And my analyses, plotted in the next chart, show that Gelsinger has been doing an extremely effective job on this front. As detailed in my earlier article, this chat is made using a variation of Buffett’s $1 test on R&D expenses. More specifically,

The purpose of any corporate R&D is obviously to generate profit. Therefore, it is intuitive to quantify the yield by taking the ratio between profit and R&D expenditures. This way we can quantify how many dollars of profit has been generated per dollar of R&D expenses. I used the operating cash flow as the measure for profit. Also, most R&D investments do not produce any results in the same year. Therefore, I assumed a 3-year average investment cycle for R&D and used a 3-year moving average of operating cash flow to represent this 3-year cycle.

As seen, INTC’s R&D yield has been superbly consistent and also healthy both in absolute and comparative terms. In relative terms, it has been $2.3 in recent years, far exceeding the $1 passing score. In relative terms, an R&D yield of $2.3 is competitive against the FAAMG stocks (whose average yield is about $2.0) and also against its close peers such as AMD.

Source: Author based on Seeking Alpha data

Delivering leadership products

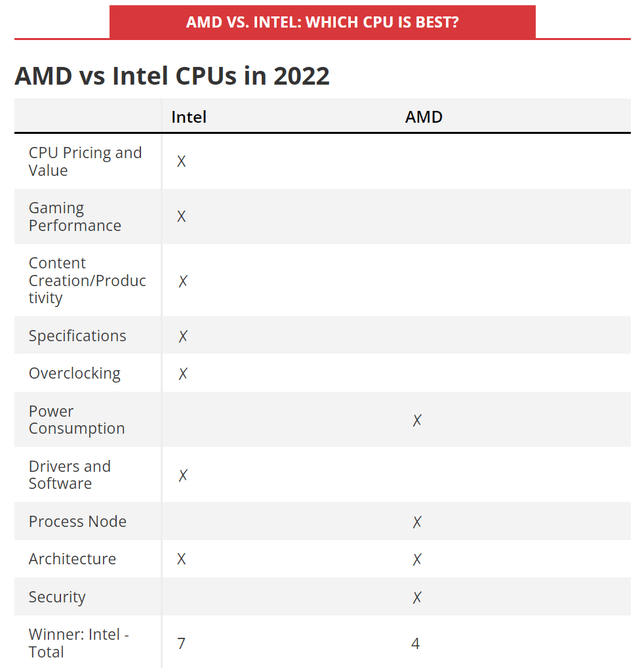

Intel has historically held a dominant market share in the PC CPU market, far exceeding other competitors such as AMD, as seen in the chart below. At its peak, Intel’s market share in the PC CPU market was more than 80% back in 2016, while AMD’s share was below 20%. Admittedly, in recent years (starting around 2019), AMD has made significant gains in market share and has been challenging Intel’s dominance with its Ryzen processors, which offer competitive performance at lower price points. As seen, Intel’s market share has declined to the current level of 64%, while AMD advanced to about 36%.

The market share dynamic between Intel and AMD is likely to continue to evolve and change over time. And BTW, I am bullish on both stocks. I view the chip pie to be large enough and growth rapid enough to accommodate more than 1 winner. Here, I just want to point out a few key thoughts. First, Intel is still dominating the CPU market. Second, Intel’s new CPUs are beginning to catch up with AMD’s in my view. As detailed in this report, the newest Intel CPUs in 2022 are overall better than AMD’s as seen in the chart below. The report compared their competing chips from these leaders holistically using metrics (such as price, performance, driver support, power consumption, and security) and concluded Intel to be the clear winner.

Risks and final thoughts

There are certainly risks and uncertainties ahead for these key turnaround elements. For example, on the fab front, the company has certainly made significant advancements as aforementioned. Besides those progresses, Intel has also advanced in key technologies such as extreme ultraviolet (EUV) lithography and progressing well with its new fabrication facilities. However, on the other hand, Intel has also faced a number of challenges, including delays in its 10 nm manufacturing process and increased competition from other companies such as TSMC and Samsung. Furthermore, the market share dynamic between Intel and AMD is likely to continue to evolve and change over time.

To conclude, a key dividing issue between Intel Corporation bears and bulls involves Gelsinger’s turnaround plan. In this article, I provided my evaluation based on a more data-oriented and objective approach. And my conclusion is that: A) the plan is sound; and B) Gelsinger and his team are executing the plan effectively. This conclusion is based on assessing the importance of the foundry industry, Intel Corporation’s progress in this space, the R&D investments and yield, and also its market share dynamics relative to AMD.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.