Summary:

- I have been a big oil bull since 2020 when I started to place my bets on the oil price super-cycle. In this article, I start by updating my thesis.

- In light of this discussion, British BP just decided to invest more in fossil fuels, as it sees higher returns and higher demand in its net-zero scenario.

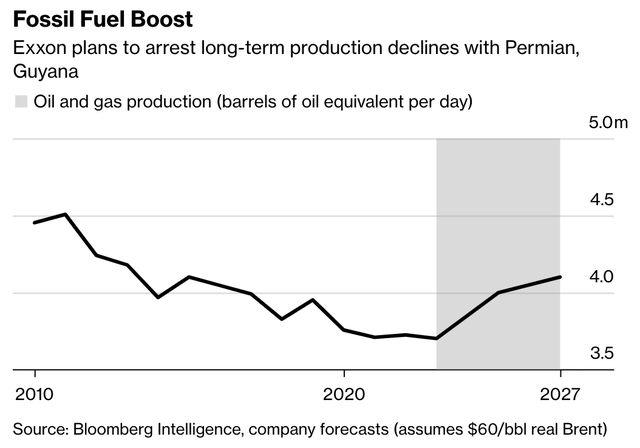

- Exxon Mobil is also boosting production. However, it remains in a better place as even its renewable projects have high returns.

- I am bullish on both BP and XOM. However, I would not invest in European majors, as American drillers remain more attractive.

francisblack

Introduction

Exxon Mobil (NYSE:XOM) and BP (NYSE:BP), two of the largest oil companies in the world, recently released their fourth-quarter earnings, revealing plans to invest in production growth despite subdued global investments in the oil and gas industry. In this article, we will examine the companies’ financial performance and delve into their intentions to increase production as they anticipate a high likelihood of an oil price super-cycle in the near future. The oil giants’ decision to boost investments in oil production is a bold move, considering the current state of the industry. However, as we will see, there are several factors that support the companies’ optimistic outlook on the future of oil.

Get ready for an in-depth analysis of Exxon Mobil and BP’s earnings, investments, valuation, and position in the oil market.

The Super-Cycle Is Here

Subdued production growth and improved demand change the playing field.

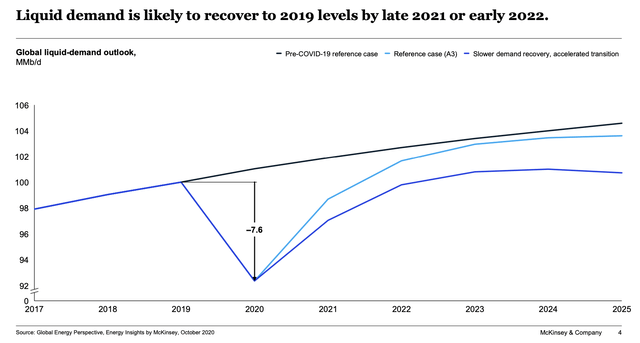

The core of my bullish oil price thesis has always been production. After all, I believe that demand isn’t slowing down. Using McKinsey’s model, it looks like demand will consistently rise to levels north of 100 million barrels per day. There are many similar models that all point to prolonged demand growth. The only models that show something else are net-zero models, which have been proven to be unreliable in 2022.

McKinsey & Company

In light of these developments, it’s a big problem that the world is transitioning toward green energy. Green energy itself isn’t a bad idea. However, the fact that it’s a forced trend is what makes these things so tricky.

Governments are stimulating renewable energy, funded activists are gluing themselves to streets to force an end to oil production, and major insurance companies are slowly exiting the industry.

This is the short version, but I think everyone knows what I’m saying. It’s a hostile environment for oil and gas producers. They know that if oil prices are to implode again, they cannot count on any support.

Hence, producers (in general) refrain from growing production as fast as they are technically capable of. After all, by keeping supply low, producers can avoid massive supply/demand imbalances that crush the price of oil. We witnessed it in 2015 and 2020.

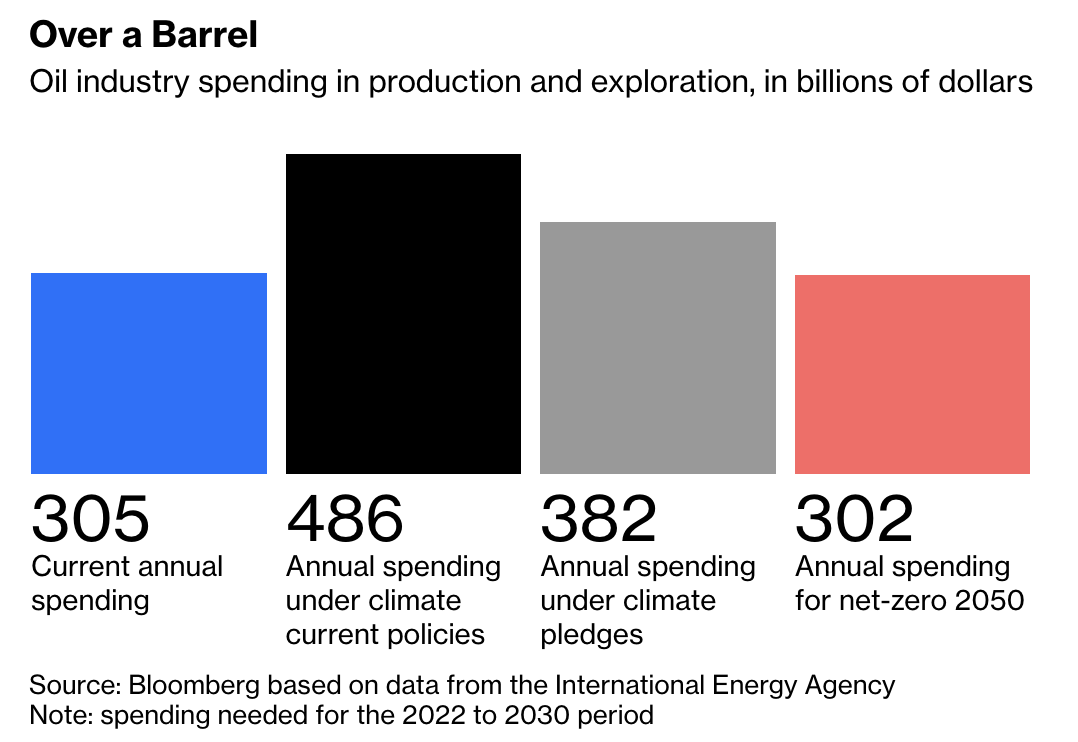

In November, I wrote that the oil industry spent $305 billion on oil production in 2021. The International Energy Agency estimates that spending of at least $466 billion in annual spending from 2022 to 2030 is needed to meet the world’s oil needs – based on current climate pledges.

Bloomberg

Even if big oil were to follow net zero pledges, it would have to grow spending by 25% from current levels until 2030!

Again, oil production needs to increase. Even if it follows models that predict a sudden and steep decline in oil demand – that is a big deal.

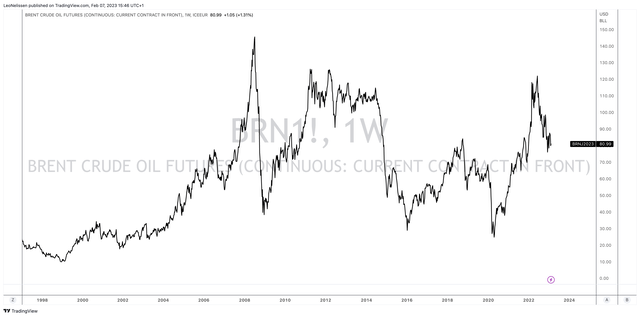

It explains why oil (in this case, ICE Brent) is still trading at $80 per barrel, despite global economic growth slowing and a high probability of a recession.

TradingView (ICE Brent)

I believe that if this were a normal supply growth environment, oil prices would be well-below $60.

Moreover, a major reason for subdued drilling that I discussed in December is inventory strategy, as the quality of oil inventory in the US is declining.

One of the reasons why oil production growth is falling is the fact that producers in basins like Eagle Ford and Bakken have drilled most of their best wells. In the past few years, a number of companies ran into trouble after running out of high-quality inventory (Oasis Petroleum, Whiting Petroleum, and Cabot).

Companies need to be careful when it comes to Tier 1 (the best assets) inventory management. Estimates are that in 2018, 28% of Tier 1 wells were drilled in the Permian.

In 2022, that number likely breached 60%.

In other words, once demand comes back, I expect oil prices to rally above $100 again, which offers tremendous opportunities. Oil majors know that, which is why I am writing this article.

British Petroleum Changed Its Mind (A Bit)

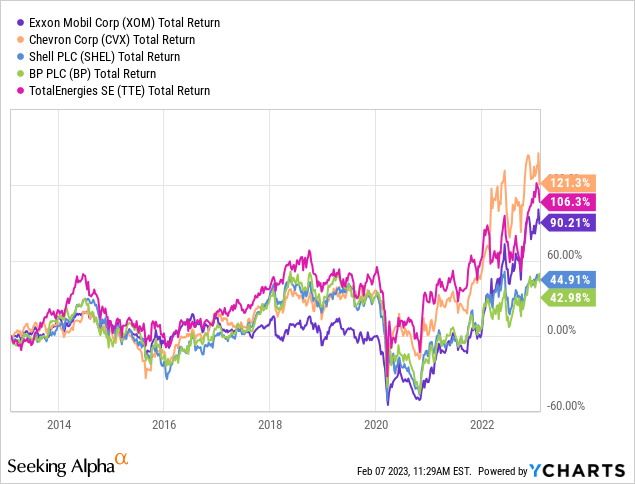

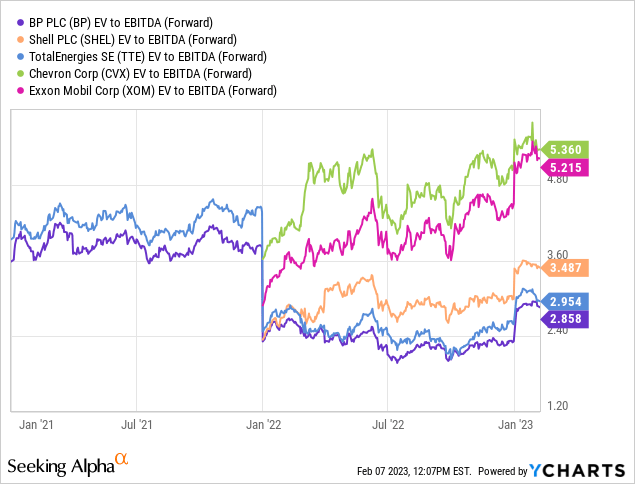

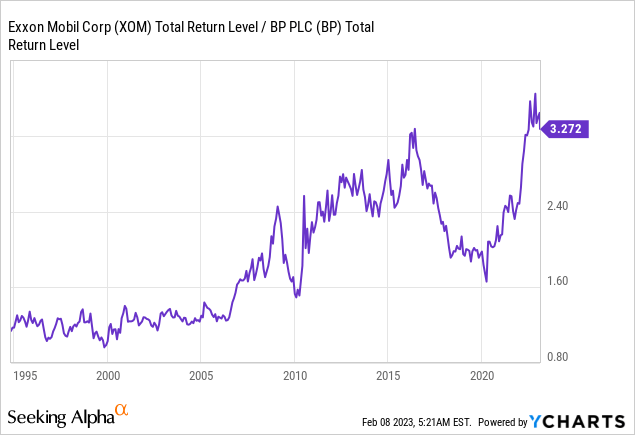

The one thing everyone is talking about is the poor performance of European oil majors. Both BP and Shell (SHEL) have significantly underperformed their American peers. French Total (TTE) was able to keep up with its American peers.

I hold close to 20% energy exposure in my dividend portfolio. I own Exxon Mobil, Chevron (CVX), and Valero (VLO). I have often been asked why I don’t like European majors. Ten years ago, I gave the same answer I am giving now: I don’t like their pivot to renewable energy. While I like some diversification, like a move to hydrogen or renewable diesel, I want oil companies to focus on what they do best, especially in a world where oil demand is still going up.

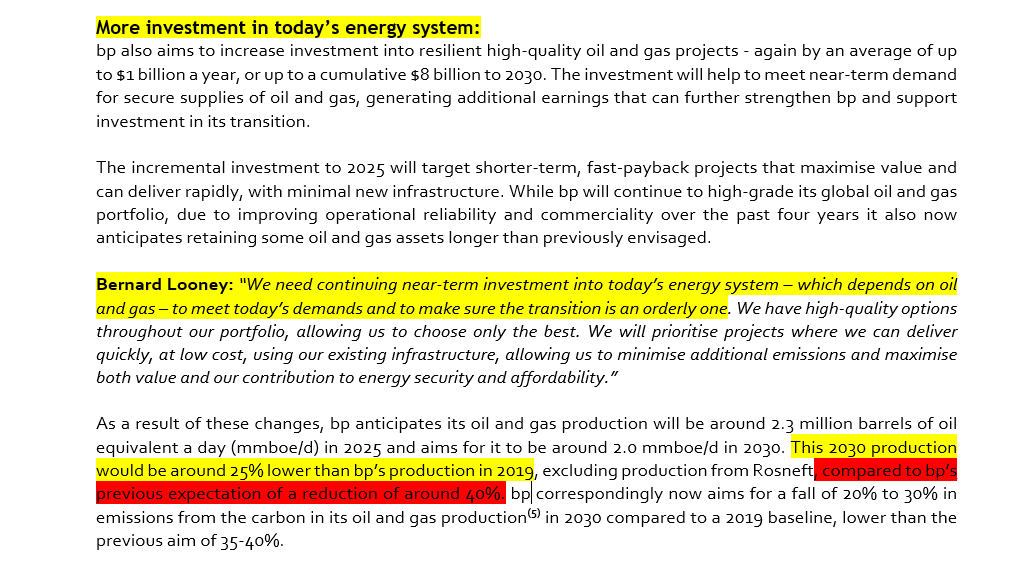

BP is one of the kings when it comes to satisfying calls for renewable energy. As Javier Blas wrote, CEO Looney aimed to reduce oil and gas production by 40% by 2030 when he took over in 2020.

What’s so fascinating about BP is that it has bet on the wrong horse. In addition to promising further spending in renewables, the company is now seeing a production decline of 25% by the end of this decade – not 40%. I don’t have to explain that this is a massive difference.

Javier Blas

I still believe it is far from perfect (to put it mildly) to target these production cuts. However, it’s a step in the right direction.

Essentially, BP is dealing with an identity crisis. It wants to invest in oil and gas as it knows that’s where the big bucks are made. However, it is also prone to pressure from activist investors, governments, and other organizations that want to see oil gone to reach 2050 climate targets.

For example, after BP announced its quarterly results, voices got louder that energy companies aren’t taxed enough. Needless to say, the industry immediately responded by making the case that this would further reduce supply growth.

To combat these social/political pressures, BP decided to give in, by investing billions in renewables.

Last year, Goehring & Rozencwajg hit the nail on the head when they assessed how incredibly inefficient some of these renewable investments were.

In just the last year BP, Shell, and Total have committed to a massive offshore wind build-out off the coast of New York and New Jersey. BP announced three huge offshore wind projects off the coast of Massachusetts and Long Island. The estimated installed capacity for all three projects (Beacon, Empire Wind 1 and Empire Wind 2) totals 3,300 megawatts. BP will own 50% in all three projects.

[…] Using $5.50 per watt as a base, the wind projects just discussed will now cost Shell, BP, and Total a combined $17 bn for 3,100 megawatts net to them. BP will be on the hook for $9 bn to build 1,650 megawatts net to them.

[…] Windfarms, much like biodiesel, have a vastly inferior energy efficiency compared with traditional hydrocarbons. On an “un-buffered” basis — that is, without any storage backup — the best offshore windfarm produces in an EROEI of 10-15:1. “Buffering” the wind farm with battery storage (desperately needed, but so far barely implemented), drops the EROEI to between 5-10:1, compared with 30:1 for traditional hydrocarbons.

BP achieves returns between 6% and 8% in its wind and solar projects. Its bioenergy, hydrogen, and charging points investments return 15%. That’s why the company is pushing harder for these projects. After all, investing in renewables is much more lucrative in these areas.

As you can imagine, this explains why American companies get better valuations. There are simply more desirable in an environment of (expected) rising oil prices.

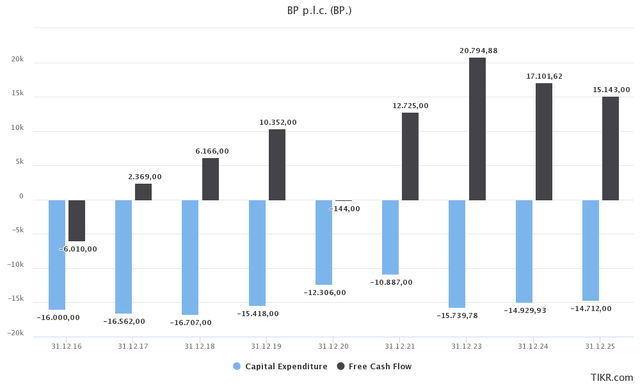

With that said, the company’s current CapEx and free cash flow expectations pave the way for high shareholder returns. While sell-side analysts expect oil prices to moderate, the company is still expected to do $17.1 billion in 2024 free cash flow. This translates to a 15% free cash flow yield using its $113 billion market cap.

TIKR.com

However, there’s a downside to this yield. The company expects annual CapEx to be in the $14 to $18 billion range. Analysts are looking for a number closer to $15 billion. Especially in a high-inflation environment, it’s likely that we will see adjustments in the months ahead.

Based on these numbers and an average price of $60 Brent, the company aims to achieve two things:

- Buy back $4.0 billion in shares per year (3.5% of its market cap).

- Hike dividends by 4% per year.

Note that dividend resilience is based on $40 per barrel Brent and the numbers I list below. This is important to keep in mind, as prices below these levels will have a major impact on distributions. Please also note that I do not expect such a situation to occur anytime soon, as I remain bullish on a long-term basis.

A resilient dividend remains bp’s first priority within its disciplined financial frame. It is underpinned by a cash balance point* of $40 per barrel Brent, $11 per barrel RMM and $3 per mmBtu Henry Hub (all 2021 real). – BP

Moreover, the company expects oil to average $70 per barrel in 2030. That’s up from $60. This triggered a comment from J.P. Morgan, which highlighted the super-cycle view.

“Its outlook has moved in line with our oil supercycle view,” Christyan Malek, global head of energy strategy at JPMorgan Chase & Co., wrote in a note.

While the company’s decision to invest more in fossil fuels is smart, Javier Blas makes the case that the company’s projections aren’t that great for investors. In order to boost shareholder returns, the company will need prices north of $70 per barrel Brent. That number is based on 2021 dollars. Assuming 3% inflation, BP would need oil to rise to $85 per barrel by 2030 to commit to strong shareholder returns.

Oil is at $80 now. Again, I think it is possible, but it is only possible if the bull case for oil remains strong until 2030. To be honest, I believe BP knows very well that oil isn’t going anywhere. Hence, I expect more adjustments to production in the quarters ahead.

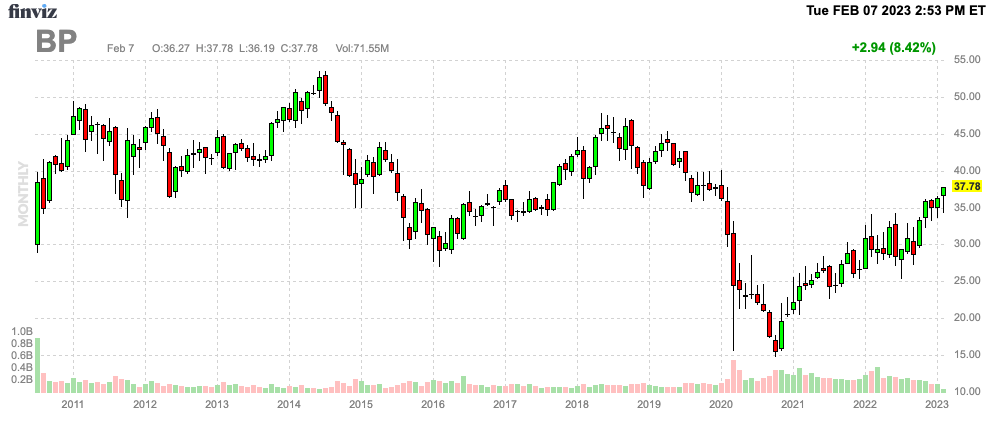

All of this being said, I am bullish on BP, based on my bullish oil thesis and management’s change of heart.

FINVIZ

However, I still do not believe that BP is a great place to put one’s money.

I believe that Exxon is a much better bet.

Exxon’s Shareholders Win Big

Like BP, Exxon is also firing on all cylinders. In its fourth quarter, the company generated $3.40 in adjusted EPS, which is $0.12 above expectations. Its quarterly revenue reached a stunning $95.4 billion, which was $5.2 billion higher than expected.

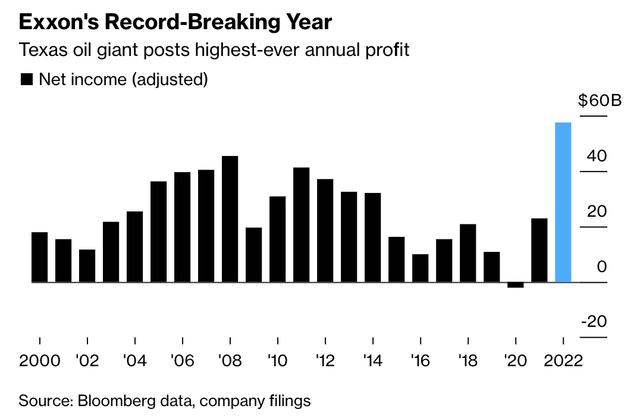

On a full-year basis, the company did roughly $58 billion in net income, which makes 2022 its best year ever. Not even 2011 came close when Brent averaged more than $100 per barrel.

Bloomberg

These results included $6.9 billion in structural cost savings versus 2019, up from $5.3 billion in 2021. The company aims to meet its target of $9 billion in savings by the end of this year.

Needless to say, the White House quickly responded, calling the company’s profits “outrageous”, and calling for windfall taxes on its profits.

Reuters

“The latest earnings reports make clear that oil companies have everything they need, including record profits and thousands of unused but approved permits, to increase production, but they’re instead choosing to plow those profits into padding the pockets of executives and shareholders while House Republicans manufacture excuse after excuse to shield them from any accountability,” the White House said.

The comments are wrong, as Exxon is growing oil production, which we will discuss in this article. These comments are also dangerous, as it once again signals to the industry that Washington leadership is trying everything in its power to pressure oil and gas. None of them called for a windfall tax on vaccine producers during the pandemic. None of them called for windfall taxes on big tech. I can go on, but I think my point is clear.

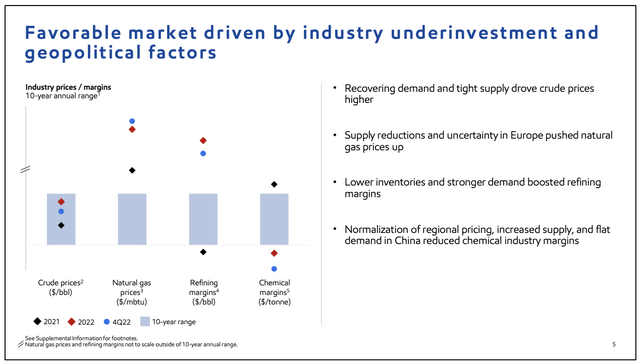

Exxon recognized what the problem is in the industry way before it generated record earnings. In its 4Q22 earnings, the company reiterated its view on the market.

Exxon Mobil

The company sees significant underinvestment in the industry, causing supply to be diminished and unable to meet recovering demand.

Hence, the company benefited from strength in its three fossil fuel segments: crude oil, natural gas, and refining. Chemical earnings suffered from poor margins due to softening demand and pricing issues.

According to CEO Darren Woods:

In crude, recovering global demand and depleted supply are resulting in tight markets made more volatile with concerns over the conflict in Ukraine. Crude prices increased by more than $30 per barrel with average prices for the year settling near the upper end of the 10-year range.

Natural gas prices rose to record levels this spring amid supply reductions and uncertainty in Europe. While natural gas prices moderated recently, the average for the year was significantly above the 10-year range.

Refining margins are also well above the 10-year historical range. Their notable increase in 2022 reflected the high number of refinery closures during the pandemic, low levels of inventory, and recovering global demand.

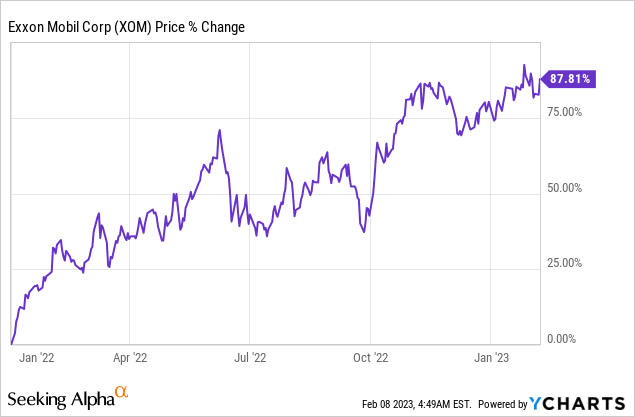

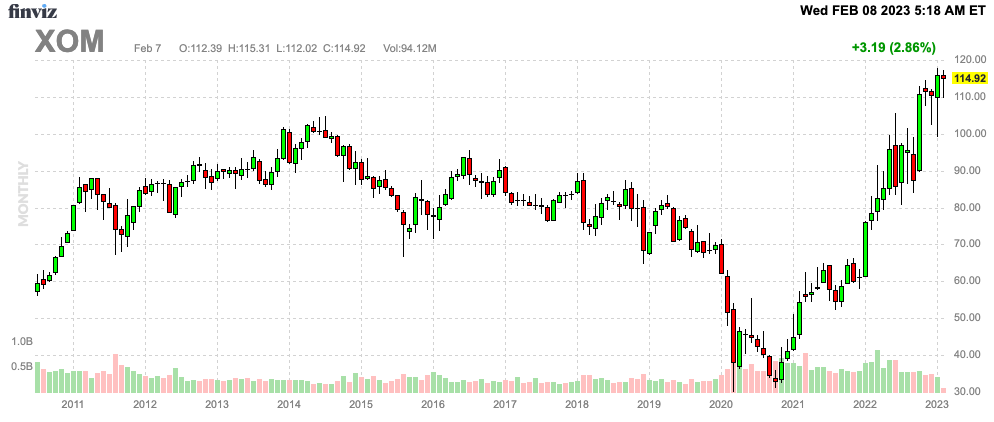

As a result, Exxon shareholders benefited greatly. On top of close to 90% in capital gains, the company hiked its dividend by slightly more than 3% and increased its buyback program.

In 2022, a total of $30 billion was distributed to shareholders. Half of this consisted of dividends. In 2022, the company increased its buyback program twice.

In 2023 and 2024, the company will buy back shares worth $35 billion, which is roughly 7.4% of the company’s $470 billion market cap.

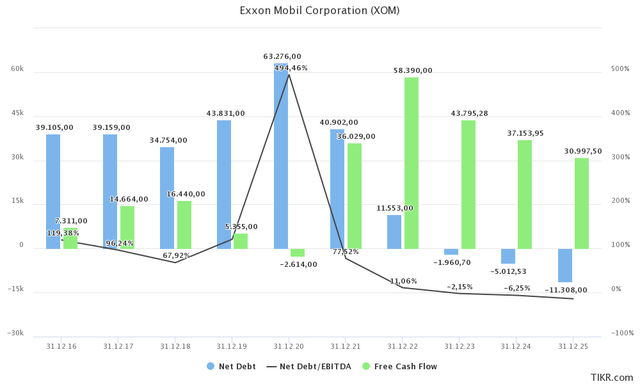

The company also retired $7 billion worth of debt. $5 billion was retired in the fourth quarter alone. The debt-to-capital ratio is now 17%. The net debt-to-capital ratio is a mere 5%. The company has a double-A credit rating from all three major credit rating agencies.

Bear in mind that with this steep drop in debt, the company is now in an even better position to distribute cash to shareholders.

Note that even with moderating oil prices (analysts expect this in their future assessment of the company), Exxon is in a good spot to do more than $37 billion in 2024 free cash flow. This translates to roughly 8% of the company’s market cap. This supports further dividend hikes and buybacks. I even expect dividend growth to be boosted in the years ahead.

TIKR.com

That said, the company is further ramping up production growth, as it sees plenty of opportunities in what is now a highly profitable fossil fuel industry.

Consistent with our strategy, we continue to invest in advantaged projects with high returns, low cost of supply, and lower emission intensity. These investments enabled us to grow Upstream volumes by 25,000 oil equivalent barrels per day despite the loss of 140 Koebd of production from divestments and the expropriation of Sakhalin-1.

In Guyana, the company increased production by more than 160 thousand barrels per day with the startup of Liza Phase 2 in the first quarter.

In the Permian, production grew by 90 thousand barrels per day.

These two areas are expected to boost the company’s production for years to come. After all, these new investments have helped to expand the company’s profit margin from 10% in 2012 to 14% in 2022.

Bloomberg

The company is also starting up its Beaumont refinery expansion in Beaumont, Texas. This is the largest US refinery investment in a decade and the only current expansion to the refinery network in the US – or any western nation, which explains tight supply.

Moreover, I am glad that the company’s renewable energy plans are mainly based on low-carbon solutions, carbon capture, and lower-emission fuels. These projects have returns of at least 10%, which means the company is unlikely to “waste” CapEx dollars on fancy projects to please activist investors.

In Low Carbon Solutions, we are advancing a broad portfolio of competitively advantaged hydrogen, CCS, and lower-emissions fuels projects. We plan to invest $17 billion from 2022 to 2027, with portfolio returns in excess of 10%. As we’ve begun to build this business, we’ve been extremely encouraged by the robust customer and partner response. Our experience, capabilities and competitive advantages developed in our traditional businesses are recognized and valued in this new, lower-emissions business making us a preferred partner

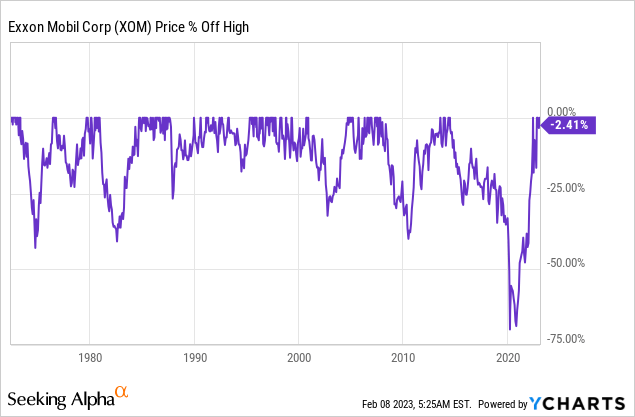

With all of this in mind, I remain bullish on Exxon. However, I’m not a big buyer at these levels. As some readers might know, I’m mildly bearish on the stock market, as I believe that investors are expecting the Fed to be too dovish. Hence, as much as I love oil, I wouldn’t bet against a correction of 10-15% in the months ahead.

FINVIZ

Note that 10-15% sell-offs are common. It doesn’t need a huge recession to get energy stocks down. Hence, I make the case that investors should only buy energy stocks during these corrections. Even last year, we had several fantastic opportunities to buy energy.

Moreover, I expect Exxon to outperform BP on a long-term basis. Yet, BP is in a slightly better spot in the short term, as the market is pricing in the belief that BP might shift even more toward fossil fuels in the quarters ahead.

With that said, here’s my takeaway.

Takeaway

We started this article by discussing the oil super-cycle. Supply in the industry remains subdued due to environmental policies, inventory protection, and the fact that returning cash to shareholders leads to higher returns than boosting production in some cases.

Meanwhile, demand expectations show no signs of weakness, as not even the ongoing EV transition is seriously hurting demand.

Companies like BP are finally recognizing this, which leads to a bigger focus on fossil fuel production growth.

The same goes for Exxon. Exxon is investing in high-return growth projects in the Permian and Guyana. However, unlike its European peers, Exxon does not have a lot of renewable energy exposure. It mainly invests in carbon capture, hydrogen, and related, which come with much higher returns than most investments in solar and wind.

The good news for oil bulls is that these investments are unlikely to change the bigger picture a lot. Underinvestment in the industry is severe, and it needs way more than a few production hikes to change that.

If politicians want to make an impact, they will need to embrace fossil fuels as an energy source that isn’t going away anytime soon. They need fossil fuels to pave the way for an affordable transition. Not a forced transition leading to high energy inflation. Unfortunately, and almost needless to say, I don’t expect that to happen.

Hence, I remain bullish on oil companies. However, I would wait for some stock price weakness before buying (more).

Concerning BP, I remain bullish as well. I expect short-term outperforming returns as investors re-assess the situation. However, I am still not investing a penny in European majors, as political pressure isn’t going away. I see no reasons to expect that Europeans can catch up with American producers when it comes to capitalizing on the oil price super-cycle.

(Dis)agree? Let me know in the comments!

Disclosure: I/we have a beneficial long position in the shares of XOM, CVX, VLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.