Summary:

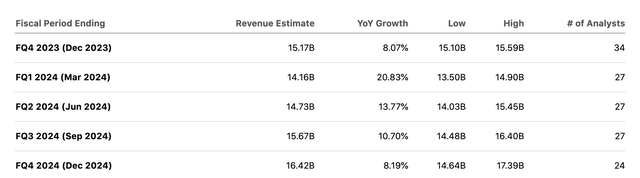

- Intel has rallied to nearly $50 despite lower revenue projections for Q1’24 and strong competition from Nvidia and TSMC.

- The chip company continues to report sales below pre-Covid levels, with Q1’24 revenues projected to be $1.5 billion below consensus estimates.

- The company’s focus on building up its foundry business has allowed competitors to surpass them in AI GPU chip demand.

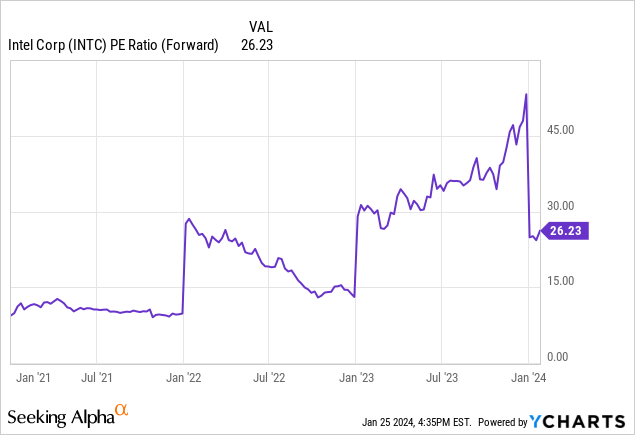

- The stock trades at up to 30x lowered EPS targets for 2024.

Leon Neal

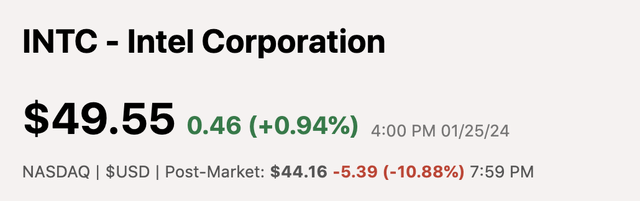

The soaring demand for AI GPU chips has sent a lot of the semiconductor sector stocks higher in the last few months. Intel (INTC) has become a prime beneficiary despite the company still on path to report far lower revenues in 2024 than the peak levels during Covid. My investment thesis is more Bearish on Intel following the rally in the chip giant back to nearly $50 and a likely double top.

Source: Finviz

Sideways Path

After the close, Intel reported Q4’23 results generally above the analyst forecasts as follows:

-

Intel press release (NASDAQ:INTC): Q4 Non-GAAP EPS of $0.54 beats by $0.09.

-

Revenue of $15.4B (+10.0% Y/Y) beats by $230M.

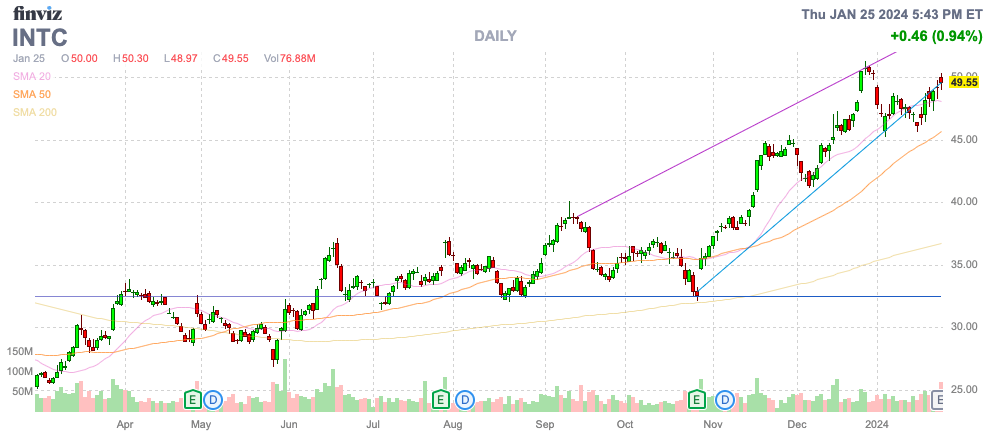

While the chip company beating estimates can provide some positive sentiment for the stock in the short term, investors need to keep in mind the actual growth relative revenue levels. Intel reported sales rose 10% to $15.4 billion, but the chip company is still reporting numbers below the pre-Covid levels.

Intel has cut costs up to $3 billion in 2023 to make the company profitable again, even at the lower revenue levels. Remember though, Nvidia (NVDA) is in the process of surging past Intel for the largest chip revenues and TSMC (TSM) has the majority, if not all, of AI GPU chip production and advanced packaging.

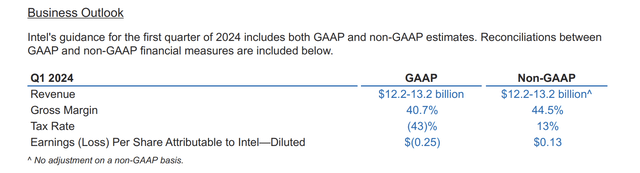

The previous chip giant no longer has the ability to command premium prices leading to large profits. The key to the weak Q1’24 guidance is the non-GAAP margin at only 44.5% and the lack of guidance beyond the March quarter while sales are surging at competitors.

Source: Intel Q4’24 earnings release

The company guided to Q1’24 revenues of only $12.7 billion versus consensus up at $14.2 billion. The biggest question is where demand ends up in the rest of the year, especially considering Intel has trailed both Nvidia and AMD (AMD) with soaring AI chip demand.

Some of the Q1 weakness comes from the previous warning from Mobileye Global (MBLY) forecasting an inventory correction to start 2024. The amount of revenue at question with Mobileye is only a few hundred million while Intel has forecasted the Q1 revenues nearly $1.5 billion below the midpoint estimates.

The chip company is still forecasting the plan to achieve five nodes in four years to regain transistor performance leadership, but Intel isn’t there yet. The Intel Foundry Services business grew 63% to $291 million in Q4’23, but those gains are wiped out as CEO Pat Gelsinger has heavily focused his time at the chip giant on building up the foundry business, while the company allowed even AMD to pass them with AI GPU chips.

While Intel is guiding to Q1’24 revenue just topping $12 billion, Nvidia is on pace for FQ1’25 (April) revenue of over $21 billion. In just a year of surging AI GPU chip demand, Nvidia is the far bigger chip company while Intel is busy spending up to $25 billion annually on building up foundry capacity to catch TSMC with no guarantees this occurs.

While Intel suggests their AI accelerator chips demonstrate price performance leadership, the market doesn’t appear interested. On the Q4’23 earnings call, CEO Pat Gelsinger suggested AI chip revenues at only $2 billion:

Our Gaudi 2 AI accelerators continue to demonstrate price performance leadership compared to the most popular GPUs… Our accelerated pipeline for 2024 grew double digits sequentially in Q4 and is now well above $2 billion and growing. We recently increased our supply for both Gaudi 2 and Gaudi 3 to support the growing customer demand and we expect meaningful revenue acceleration throughout the year.

Even AMD is now forecast to produce up to $10 billion in AI GPU revenues this year. UBS hiked the price target to $220 based on a prediction the company can exit the year with the large AI chip revenue run rate while Intel struggles to even grow the business.

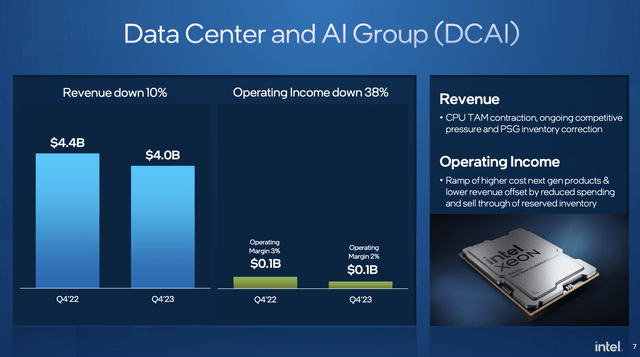

As a comparison, AMD was only forecast to produce 2024 revenues topping $22 billion, so a new $10 billion business is a nearly 50% boost to overall sales. Intel reported the related Data Center and AI revenue actually dipped 10% in the last quarter in a sign of where demand has fallen despite the boost from the AI accelerator chips.

Source: Intel Q4’23 presentation

Big Cuts

Even before the big guide down for Q1, Intel already traded at 26x forward EPS targets. Analyst will have to cut 2024 estimates dramatically with the Q1 estimate of $0.13 versus analysts up at $0.32.

At most, an investor should assume Intel does no more than a $1.50 EPS in 2024 considering much higher revenues in 2022 only produced a $1.67 EPS. The stock recently traded in the $20s and this guidance is supportive of a return to those levels. Investors definitely don’t want to own the chip company at the $44 price in after-hours trading with the dip nowhere reflective of the weak Q1 numbers and the signals from management not providing 2024 guidance.

At best, the stock likely trades at 30x lowered 2024 EPS targets. The company only forecasts being around free cash flow breakeven for the year as capex spending approaches the $25 billion levels of the last few years.

Intel has nearly $50 billion in debt, though the company has $25 billion in cash. The problem is that the chip company continues to face the pressure of paying $2.1 billion to investors via the ongoing dividends, even after the cut to only $0.50 per share going forward.

Foundry competitor TSMC reinforced plans to spend ~$30 billion in capex for 2024. The big concern here is that Intel doesn’t recapture foundry leadership, leaving Nvidia and AMD ahead in new chip designs for the data center where Intel remains the weakest.

Takeaway

The key investor takeaway is that Intel provided limited reasons for the stock to have rallied the last few months, much less all the way up to $50. Investors should dump the stock without AI leadership and still behind TSMC in the foundry business, regardless of plans to catch up to the foundry leader in the next few years.

The stock has rallied too much on the AI hype and Intel is hardly participating in soaring demand for AI chips.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.