Summary:

- Intel announced an $11 billion bond offering this week.

- Fresh capital should get the company through 2023.

- Additional short-term expense should keep payout steady.

Justin Sullivan

A couple of weeks ago, chip giant Intel (NASDAQ:INTC) submitted a very strong entry for worst quarterly earnings report of the current earnings season. Not only did the company miss street estimates on the top and bottom lines, but guidance for the current period was much worse than even the most bearish expectations. With the company currently in the midst of a heavy investment cycle, there have been numerous concerns about the stock’s annual dividend. This week, Intel made a major move that should allow the meaningful cash payout to continue on for now.

Intel’s adjusted free cash flow was a negative $4.075 billion for the full year in 2022. This was a negative swing of about $7 billion from 2021, and the reported figure was slightly worse than the bottom end of guidance. With GAAP earnings likely to be lower this year, and perhaps even negative, the cash flow situation is a big question mark at the moment. Here is what the company’s CFO had to say on the Q4 conference call:

Adjusted free cash flow will be below our Investor Day guide of approximately neutral in the first half of 2023 and return back towards guardrails in second half 2023.

At the end of 2022, Intel had $28 billion in cash and short term investments on the balance sheet. This amount does not include its longer term and more strategic investments, like its stake in Mobileye (MBLY), that the company partially monetized last year through an IPO. The balance sheet also had $42 billion in debt, so Intel is in a net debt position, but it’s not like the company is going out of business anytime soon.

With the company going to be adjusted free cash flow negative again, at least for the first part of the year, investors and analysts have wondered about the dividend. Last year, Intel paid out just under $6 billion in cash dividends, and that number will rise slightly this year due to more shares outstanding. The company did not repurchase any shares in 2022, so stock based compensation is leading to some dilution right now.

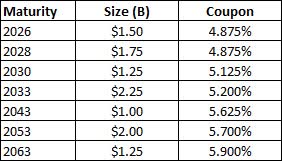

Those who are worried about the company’s long term future might overreact in the short term and say the dividend should be cut or even eliminated. However, Intel expects to get back to meaningful free cash flow generation in 2025 and beyond, as discussed in last year’s Investor Meeting. Thus, a major company like this with a rich dividend history probably doesn’t want to make any knee jerk reactions, even if there is a short term cost to keeping the payout at its current annual yield of more than 5%. Earlier this week, Intel announced a major bond offering detailed in the table below.

February 2023 Bond Deal (Company Filing)

In total, the company raised $11 billion before expenses. The total interest cost was a little over $583 million per year, or a weighted average yield of 5.30%. Considering we are no longer in a near zero interest rate environment, that’s not a terrible cost considering these bonds go out to 40 years. The overall added expense here is about 14 cents in pre-tax earnings per year, or just a few pennies per quarter.

With analysts expecting the company to get back to $3 or more in earnings in just a few years, this isn’t a major cost for the company. Also, the total bond offering was almost twice the size of the dividend, so the cost to keep the dividend was only about $300 million or so, depending on how you look at it. The rest of the offering proceeds will be used for general corporate purposes, including the major spending cycle that hopefully pays off in the future.

Since the awful Q4 earnings report, the street has obviously become a bit more bearish on the name. The average price target has declined by about $3, currently sitting just above $28. That implies about 3.5% of downside from Tuesday’s close, although I’ve argued previously that I wouldn’t be interested in buying unless the stock is in the low to mid $20s, given how weak the business is in the short term.

In the end, Intel’s major bond offering this week should provide insight as to the company’s thoughts on the dividend in the near term. The chip giant will likely burn through a few billion more in cash this year, but the fresh capital raised should cover that plus the $6 billion or so annual payout. While Intel’s debt pile will build up a little, hopes are that meaningful cash will start to be generated once this investment cycle is complete. While I wouldn’t personally buy any shares just yet, long-term investors in the name are getting a more than 5% yield currently.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.