Summary:

- Intel will successfully complete their 5 nodes in 4 years goal, paving the way for technology leadership and supporting their foundry transition.

- Intel Foundry Services will provide a new source of revenue leading to greater EPS and will help offset costs associated with cutting edge fabs.

- Despite the negative sentiments, Intel finally got its act together and is positioned to take full advantage of the next semiconductor market growth cycle.

- Semiconductor demand growth and improved execution justify a share price CAGR between 14.0% and 33.6% between now and 2030.

SweetBunFactory

My 2030 Thesis

Intel (NASDAQ:INTC) is my highest conviction stock and currently represents just over 20% of my long portfolio. I am over exposed because I believe Intel will see the highest returns in the semiconductor industry over the coming years (and over 60% of my long portfolio is in semiconductors). My belief in Intel is two-fold.

First, global semiconductor market revenue is expected to increase from $574B in 2022, to $1,000B per year by 2030. The largest growth will be in data centers (AI, CPUs, storage), automotive (EVs, ADAS, infotainment), and telecommunications (5G). Intel stands to benefit directly from increasing data center demand, while Intel Foundry Services could provide manufacturing for all types of chips.

Second, Intel is turning the ship around when it comes to execution and technology. The biggest doubt I see in the comments sections of Intel articles tends to sound like ‘Intel will never catch up, they are too far behind, and they miss every deadline by years.’ This was true in the 2010s. Intel had become the dominant company and management cared more about profits than engineering excellence. In the short term this boosted EPS, in the long term it left Intel eating the competition’s dust.

However, Intel has turned around dramatically since Pat Gelsinger took over as CEO in February of 2021. His stated goal was to retake technology leadership within 5 years. Coming on 3 years in, Intel is at or ahead of all stated goals. Intel has also invented multiple new semiconductor technologies that will put it multiple years ahead of the competition as we enter the latter half of the decade.

The following article will explain why I believe Intel will (1) retake technology leadership, (2) continue to see demand for its chips despite strong competition, (3) attract foundry customers and potentially become the #2 fab in the world, and (4) what is it worth as an investor.

Intel Will Retake Technology Leadership

Intel’s node release schedule has been rocky to say the least. The 10nm and 7nm processes were delayed multiple times over several years. This allowed TSMC (TSM) to take the lead. The first chip using Intel 7 didn’t launch until November 2021, while TSMC began 7nm production in 2018.

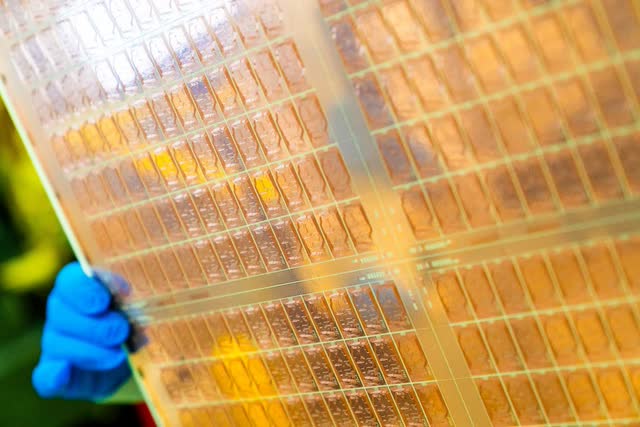

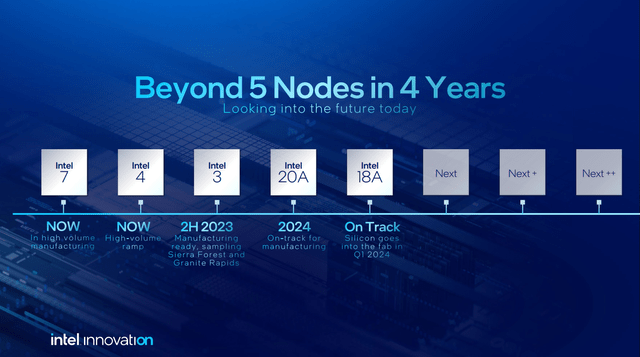

TSMC has been consistent with new node launches, 5nm in 2020, and 3nm in 2022. On the other hand, Intel’s launch rate is far more compact. Intel 4 went into production earlier this year and the first client chips using it just launched. Intel 3 is process complete and ready for manufacturing, Intel 20A is almost complete and is expected to be ready in the first half of 2024, and Intel 18A recently reached 0.9 PDK (when design specifications are locked in, allowing external customers to begin using it with their designs). Intel also showed off working wafers using all announced nodes at their 2023 Innovation Event.

5 nodes in 4 years (Intel 2023 Innovation Event)

The node release rate is so rapid, server and client chips are being made on different processes because they are launching at different times in the year. Xeon processors (servers) will use the Intel 7, Intel 3, and Intel 18A nodes, while client processors will use Intel 7, Intel 4, and Intel 20A nodes. While the goal of 5 nodes in 4 years is being met, it is more realistic to call the release schedule 4 nodes in 1 year. This is unheard of in the industry where TSMC’s 2 years per node is the norm. Intel would have been better served had these releases happened earlier to spread out the expenses and revenue generation, but here we are. I would rather have lower utilization efficiency because nodes are launched quickly than for Intel to continue lagging.

Unique Technology That Gives Intel an Edge

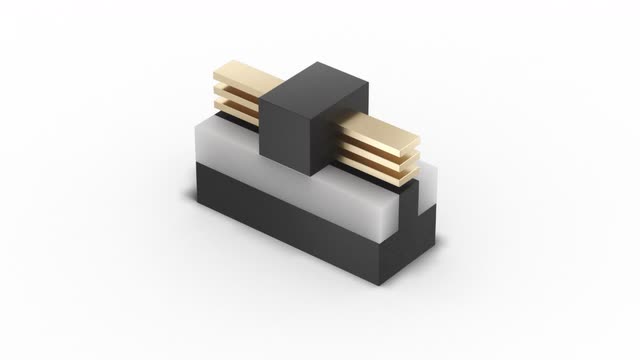

RibbonFET: Intel will be the first to implement gate-all-around (GAA) transistors using their RibbonFET technology. GAA transistors allow wires to be vertically stacked rather than horizontally aligned. This allows for denser packing of transistors and greater power efficiency.

RibbonFET / Gate-All-Around Transistor (Intel)

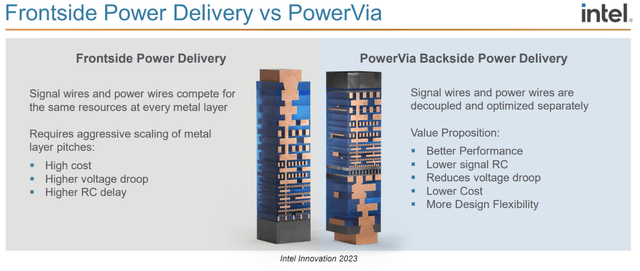

PowerVia: PowerVia is Intel’s version of backside power. To simplify greatly, chips can be thought of as three main layers. The current arrangement is a silicon wafer, followed by logic, capped off with power delivery. PowerVia flips this order. In the middle is the silicon wafer, then the logic is placed on one side of the wafer, while the power delivery is placed on the other. The power is connected to the transistors using microscopic holes-called vias-through the silicon wafer. Separating power and logic allows for greater density due to fewer space conflicts and provides improved thermal performance.

PowerVia vs. Frontside power (Intel, Applied Materials Panel Discussion during IEDM 2023)

Advanced Packaging: Packaging encompasses all the components and layers that connect a chip with its surroundings. This includes protective housing, electrical contacts to the motherboard, and interconnects between chiplets. This is the one area where Intel never lost its lead. Intel has the most advanced chiplet technology-where multiple smaller chips are combined into a single larger chip-using EMIB to connect chiplets, and Foveros to stack chiplets on top of each other. In September, they announce a new all glass substrate that will enable more chiplets to be integrated into a single chip, better power delivery, and improved thermal performance.

Passing TSMC

With the coming availability of Intel 3, Intel will tie TSMC, and they expect to become the technology leader next year with the launch of 20A and 18A nodes. TSMC’s current road map has their first N2 variant (2nm) scheduled for 2025, a year behind Intel.

The Foundry Transition

If you build it, they will come. This is the core idea behind Intel Foundry Services (IFS) transition strategy. Intel is investing $100B across 4 locations in the US and they have plans to invest up to $80B in Europe across multiple countries. Intel is offsetting expansion costs through government assistance provided by the CHIPs act and deals negotiated directly with host countries. Governments are willing to provide large subsidies because they want to control the semiconductor supply chain rather than rely on Asia, principally Taiwan.

IFS demand will come from three main sources. First off, Intel will continue to use its own fabs and will always be its own #1 customer. Demand will also come from customers looking to diversify their supply chain; this includes geographic and provider diversification. Lastly, the semiconductor industry is growing, and Intel can gain foundry business without having to take customers from TSMC, Samsung, or other foundries.

The rate of customer adoption will largely depend on technology and price. If Intel can regain technology leadership, it will be able to attract work from leading chip designers. The one area TSMC will always be able to pressure Intel on is price. TSMC operates in lower cost regions which will allow it to undercut Intel in a price war. However, there are limits to pricing because equipment is a significant portion of the cost of semiconductor manufacturing. Additionally, companies that directly compete against Intel, such as AMD (AMD) are unlikely to become IFS customers.

Intel has already achieved IFS customer wins. So far three large customers have signed agreements to use Intel 3 and 18A nodes. Separately, Tower Semiconductor (TSEM) is partnering with IFS to provide advanced foundry and 300mm wafer production despite Intel’s failed acquisition of Tower-which is a good thing because Intel was over paying. It has also been announced that Intel is partnering with Synopsys (SNPS) to provide design tools specialized for Intel 3 and 18A that can be used by external customers.

Valuing IFS

Intel will begin reporting IFS with its own P&L starting in Q1 2024. IFS will be the second largest foundry in the world by revenue just from Intel’s internal usage. My goal here is to determine the value IFS can add to Intel based on the services it provides to external customers. Revenue related to internal usage is merely an accounting change. The justification behind IFS getting its own P&L is twofold. By acting as a separate entity, IFS has greater incentives to find cost efficiencies, while Intel’s product teams are less inclined to order rush shipments (which are more costly). Additionally, making IFS independent provides an IP separation between the chip design and foundry portions of Intel. I don’t expect Intel to pass TSMC in total market share even if Intel has better technology. There will always be political and business reasons why fabless customers would prefer a pure foundry over a mixed foundry and designer.

To estimate the impact external customers could have on IFS revenue, I created the sensitivity chart below that estimates external IFS revenue as a percentage of TSMC’s revenue. Since long-term external demand is not known, I am willing to project IFS revenue reaching a third of TSMC’s revenue. This would result in $20-27B in new annual revenue for Intel.

Intel wants to increase their gross margin to 60% and operating margin to 40% of revenue. This is ambitious, but not completely ahistorical for them. Up to 2021, Intel consistently had gross margins near 60%, but operating margins were around 30%. Margins are currently reduced due to low cyclical demand and high CAPEX; more on this later. I expect margins to return to historical norms in the coming years, this implies an operating margin between 25% and 30%. With 4.22B shares outstanding, IFS could add $1.19 to $1.90 in EPS. Under the unlikely scenario that IFS matches the size of TSMC, EPS could increase by $3.98.

IFS revenue projection (By Author)

I am estimating the share price contribution from IFS revenue using the P/E Non-GAAP multiple (Intel does not have a GAAP P/E at the moment due to high CAPEX spending resulting in a GAAP loss) and the price to sales ratio. The analysis below uses the 5-year average value for each metric (P/E = 10.38, P/S = 2.87). This results in an average present value for IFS between $13.03 and $19.00 per share. I have also included 2030 projections assuming a 50% growth in semiconductor demand.

IFS potential share price contribution (By Author)

AI Demand Doesn’t Mean the End of CPUs

A core narrative surrounding semiconductors, specifically data center focused chips, has been the explosion in demand for AI processing and the belief that AI will replace everything. This is an inherently flawed view because it does not recognize where AI falls in the software stack. AI demand is accretive to existing workloads, it is not a replacement for them. What I mean by this is that all existing things we need CPUs for (processing data, running apps, computational work, etc.) won’t go away because of AI. Instead, AI is a new feature that is built on top of everything that has come before it, but AI cannot exist by itself.

When it comes to AI training chips, Nvidia (NVDA) is the undisputed king because they focused on creating the necessary software and hardware for AI before AI was cool. But training is not using, and the chips best suited to training are not the best for using AI. The number of companies that will train AI models is limited, but the number of users of AI models is everyone.

For their latest generation of chips, Intel has introduced the AMX instruction extensions that provide CPUs an accelerated way to execute AI programs. AMX will give Intel CPUs an advantage in the coming years as AI models become more readily available. The average consumer doesn’t need a Nvidia H100, they just need a system capable of running the AI generated by Nvidia H100’s.

Valuation

Intel has been aggressively discounted for the past few years. The share price peaked at $63.32 in April 2021, bottomed out in October 2022 at $24.14, and didn’t begin to rise until March of this year. The selloff was driven by declining sales and skyrocketing CAPEX expenses. Revenue reached its lowest point in Q1 of this year and has trended up in the last two quarters and management guidance expects this trend to continue.

I have plotted Intel’s revenue and CAPEX expenses below. Historically, CAPEX was 20%-30% of revenue. Intel’s desire to retake process leadership and create a world class foundry capable of serving external customers has driven CAPEX expenses to almost double. At the same time, declining revenue has caused the CAPEX expense ratio to increase to 50% of total revenue. Over time I expect this increased CAPEX as a percentage of revenue will normalize at a lower level as revenue rebounds and CAPEX declines once the new fabs are complete.

Note about the chart, 2023 YTD only includes the results from 3 quarters, the full revenue for the year will be depressed compared to 2022, but it won’t be as bad as it looks in the graph.

Revenue vs CAPEX trends (By Author)

Chip demand is recovering, which will help Intel’s revenue generation going forward. The Client Computing Group (CCG) has passed its sales bottom because OEM partners have sold through their reserve inventories and the sale of personal computers have started to increase again after substantial pull-forward during the pandemic. The Data Center and AI Group (DCAI) will also see substantial gains in the coming quarters. In Q3, Sapphire Rapids passed one million units sold. By the end of Q4, it is anticipated that two million units will be sold. Additionally, higher core count processors (which are more expensive) are just now becoming widely available for sale which will boost average selling prices. Demand for Gaudi – their AI training chip – has doubled in the past quarter as companies look for a cheaper alternative to Nvidia.

DCAI product roadmap (Intel – DCAI Investors Webinar, 2023)

Nvidia currently has the lead in AI products because of their superior software (hardware is best measured in capacity per dollar, and Nvidia is charging a large premium at the moment). While Nvidia’s ecosystem is closed, Intel has been working with open source developers to create hardware agnostic, write once run anywhere solutions including oneAPI, SYCL, and OpenVINO. In the long run, taking the open source route is better because Intel can benefit from the work of other contributors and transparency earns more friends than building a walled garden.

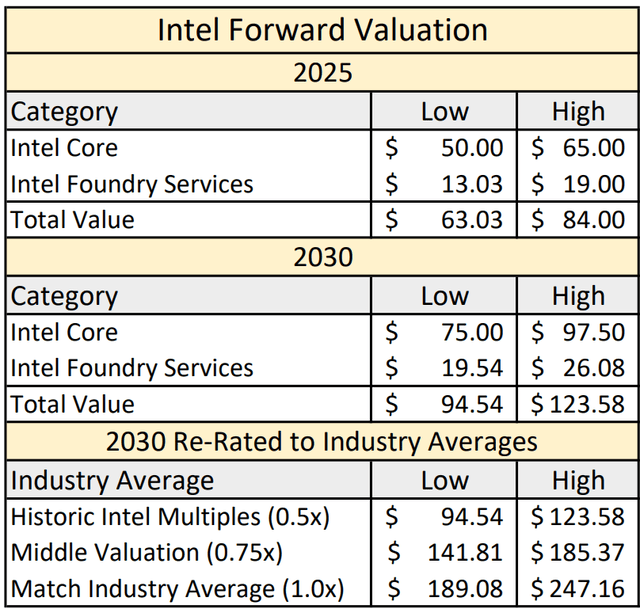

To determine a price target for Intel I am looking at two components. Intel Core encompasses all of their traditional products and spin-offs such as Mobileye (MBLY), while IFS considers external foundry customers only. Demand for Intel’s core products is rebounding despite stronger competition, combined with cost cutting measures, I expect Intel will regain its prior valuation from 2021. The IFS valuation is copied from above. It is highly unlikely that Intel will generate IFS revenue at my estimates above by 2025, but the stock market is forward looking and will price in expected IFS revenue so long as Intel can ink supply agreements. My 2030 estimates assume 50% total growth, in line with analyst expectations for semiconductor market growth overall. Lastly, I have included potential price ranges if Intel is re-rated to match its industry peers. Due to poor performance in the 2010s Intel’s valuation metrics (P/E, P/S, etc.) have been roughly half of industry averages. If Intel can execute their strategy a re-rating could see the stock price double on improved sentiment.

My 2030 low end price target is $94.54 which corresponds to a 14.0% CAGR and my high end price target of $247.16 implies a CAGR of 33.6%. If Intel can grow at my high end estimate, but the market does not re-rate them, then the high end price target would be $123.58 for a 19.1% CAGR.

Intel forward valuation (By Author)

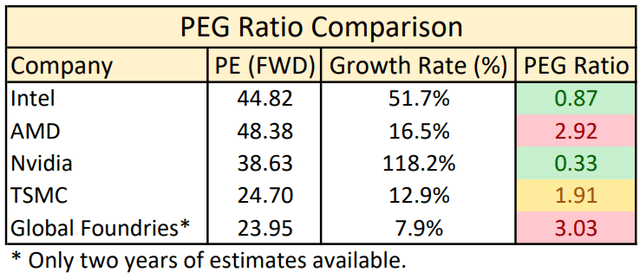

The final question to ask is Intel’s current valuation fair compared to the competition? Intel has a PEG ratio of only 0.87 which indicates the stock is cheaply priced compared to its expected growth. Lower PEG ratios mean you are paying less for future growth. The estimated growth rates are the average of 2024-2027 and come from Seeking Alpha’s consensus EPS estimates.

PEG ratio comparison (Growth rate estimates – Seeking Alpha; PEG – By Author)

I would rate the current share price as fairly valued based on the low PEG and improved performance. The recent runup in Intel’s share price was driven by analyst upgrades to 2024 performance. From a technical perspective, the stock price was rejected near the 50% Fibonacci retracement and near-term consolidation provides an entry point for new or expanded investment.

Conclusion & Risks

Intel is my largest position because I believe the upside potential far outweighs downside risk. The semiconductor market is going through a global upheaval as countries compete for dominance and Intel will most certainly be used as a pawn in this fight. I expect Intel to benefit from the jockeying, but China represented 27% of sales for Intel in 2022. Changes in trade restrictions could reduce or in the worst case eliminate these sales.

Intel’s foundry transition also presents opportunities and risks. If Intel can retake process leadership while providing production capacity at competitive prices, then Intel stands to gain significant market share from fabless designers looking to diversify. However, if Intel does not produce a competitive alternative, then their fab investments could become a costly mistake.

I am investing in Intel for the long term since they are well positioned for the next semiconductor market cycle, have technical management, and emphasize technical ability over next quarter’s financial results. The Intel of today is far different from the Intel of the 2010s. Therefore, I am giving Intel stock a buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC,TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.