Summary:

- This is my 141st value buy endorsement for Intel. Intel has enough agility to overcome the negativity of investors/market traders.

- I now appreciate Intel as an AI company. Intel still owns more than 90% of Mobileye. Mobileye’s market cap has risen $10 billion since October IPO.

- An ad campaign to remake Intel as an AI-first company could improve its investment quality. The 38.1% CAGR of the $93.5 AI industry is a strong tailwind.

- I applaud that Jon Peddie Research reported Intel has 4% market share in discrete GPUs. This is already half of AMD’s 8% share.

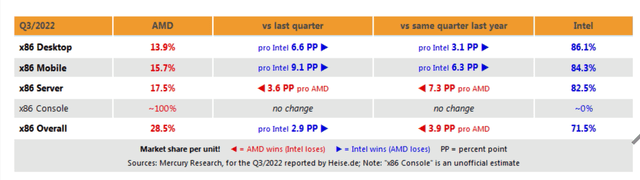

- Mercury Research’s Q3 2022 report says Intel’s overall market share in x86 processors is 71.5%. This is notably higher than Q2’s 63.5%.

Intel is a buy because it sells USB thumb drive-sized Movidius Artificial Intelligence computers. Alex Wong/Getty Images News

Investment Thesis

I opine that the near-term scenario is that Intel (NASDAQ:INTC) could dip further. INTC is already down 51.88% since my September 2021 buy recommendation. This is my 141st buy recommendation for this under-appreciated company. I found INTC attractive when it was trading at $54. Intel’s stock is now more attractive because its last closing price was less than $27. A 50% discount is a gift from heaven. I am grateful to the pessimists, skeptics, and shorts who gave INTC a YTD performance of -50.97%. My buy rating for INTC is simply because other people made it very affordable.

INTC trades at only 8.08x TTM GAAP P/E. This pessimism over Intel is not a permanent thing. Some investors will eventually realize that the current P/E valuation of INTC is much lower than its sector peers’ average P/E of 22.29x. INTC could rebound beyond $31 if next year’s data proves that Intel is regaining lost market share. Statista reported that Intel only had a 63.5% market share on Q3 2022. The Q3 Mercury Research report says Intel now touts more than 71% market share in x86 processors. Intel’s only x86 rival, Advanced Micro Devices (AMD), has less than 29%. Intel is winning back the market share it lost to AMD.

I am a computer technician. I don’t see Intel anymore as a mere supplier of x86 processors.

Intel is an Artificial Intelligence Company

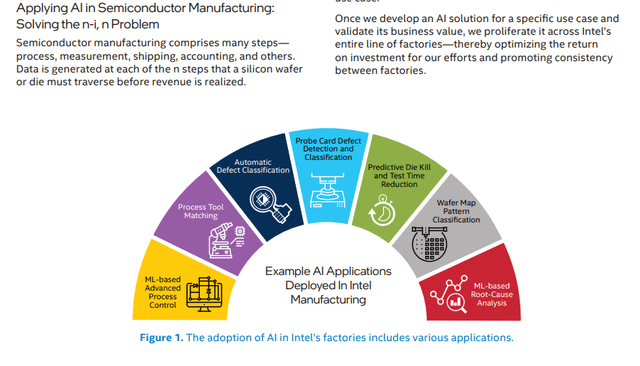

At 8.08x P/E, INTC is an affordable gambit in the $93.5 billion Artificial Intelligence industry. The 38.1% CAGR of the AI industry could help Intel reverse its declining revenue. Intel has comprehensive AI solutions. Intel is even selling its concept of high-value AI in its semiconductor manufacturing. INTC is a buy because Intel is now using AI to improve its production of x86 processors. AI could shorten the ongoing short-supply of Intel processors.

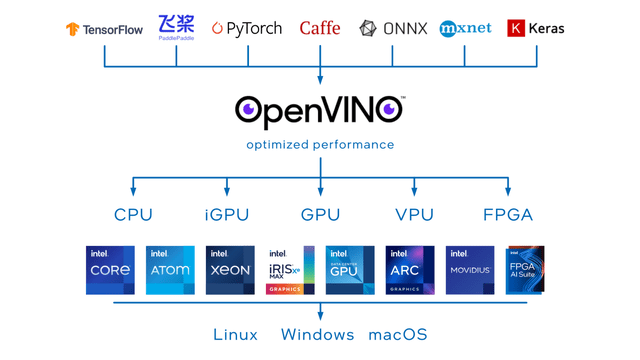

The full software/hardware suite of Intel has helped it find several partners and customers. Intel’s OpenVINO is cross-platform and works with top frameworks like TensorFlow and PyTorch. OpenVINO now powers the no-code enterprise AI/automation application builder Viso Suite.

INTC is a buy because Intel’s OpenVINO is enabling weak/lazy programmers like me do no-code deep learning and edge computing applications. For those who can seriously code, Intel’s oneAPI toolkits are available for free. Intel recently bought Codeplay to fortify its oneAPI suite of toolkits. All these AI software/toolkits are optimized to work with Intel processors and accelerators.

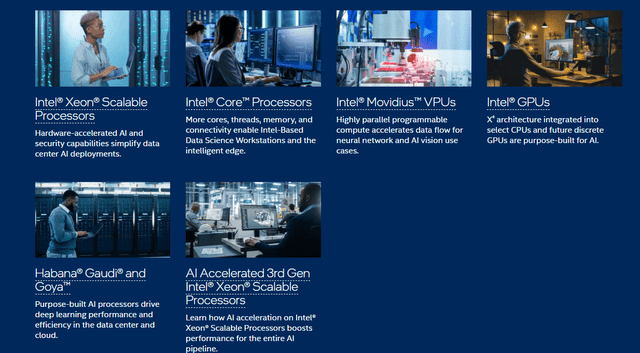

Going forward, a marketing campaign to reinvigorate Intel as an AI-first company could help its stock rebound in 2023. Intel’s list of acquisitions touts AI-centric firms like Habana Labs, Movidius, Mobileye (MBLY). Intel bought Mobileye for $15.3 billion in 2017. The low valuation of INTC seems to ignore that MBLY’s market valuation when it did its IPO last October was only $17 billion. Mobileye’s market cap is now $27.25 billion. I opine that this $10 billion appreciation of MBLY is not yet reflected in Intel’s currently low valuation. Intel retains 750 million Class B (10x voting power of Class A) shares of Mobileye. The IPO, private placements, and option exercise amount all to 52,413,158 Class A shares. Intel therefore still owns more than 90% of Mobileye.

Intel Remains Dominant

Intel is a buy because it still dominates the x86 processors market for servers, desktop PCs, and laptops. As of Q3 2022, Intel’s desktop x86 desktop market is 86.1%, up 6.6 PP (percentage points) quarter-over-quarter. For x86 mobile (laptops and 2-in-1 tablets), it’s 84.3% (+9.6 PP QoQ) for Intel. As for the x86 server processor industry, Intel still commands 82.5% share, down 3.6 PP QoQ.

The desktop processor dominance could only get better for Intel. Its net flagship Core i9-13900K just got overclocked to 9GHz. This new world record was achieved while disabling the said processor’s Efficient cores and hyperthreading.

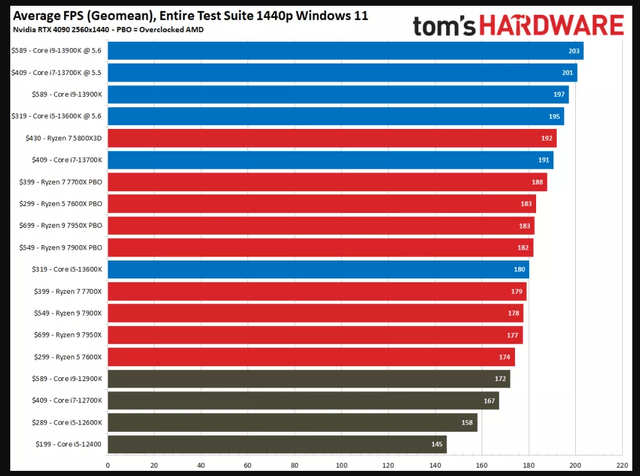

Intel is a buy because Tom’s Hardware has already tested and proved that Intel’s latest processors outperform AMD’s overclocked Ryzen products. The $589 Core i9-13900k @5.6 GHz is currently king of the hill as per Tom’s Hardware’s chart below. It is worth noting that the $319 Intel Core i5-13900K also outperforms the overclocked $699 Ryzen 9 7950X.

The dominance of Intel on desktop PC processors could improve thanks to Xiaomi’s (OTCPK:XIACY) decision to use Intel processors on its first small form factor PC. Xiaomi’s laptops are all powered by Intel. Another strong smartphone, Realme, has also launched an Intel-powered laptop. It is a tailwind for Intel when Chinese smartphone leaders use its processors in their expansion to desktop PC and laptop products.

I opine that any company that has more than 71.5% market share in a duopoly industry deserves a 10x or even a 12x TTM GAAP P/E valuation. The investing public should give Intel fair treatment. The depressed stock price did not make me forget that Intel is still very profitable. The TTM net income margin of INTC is still high at 19.13%. This is better than AMD’s 9.96%. I like AMD. However, I cannot afford the 41.77x TTM P/E price of AMD. I prioritize INTC over AMD because the latter does not pay a dividend.

The continuing negativity over INTC has given it a dividend yield of 5.6%. Intel’s other attractive feature is that it has paid dividends since 1992. This consistency in distributing profits to shareholders is why you should hold on to or go long on INTC.

The other reason why you should value INTC higher is Jon Peddie Research’s report. Intel ended Q3 2022 with a 4% market share in discrete GPUs. This is already half of AMD’s market share of 8%. AMD has been in the discrete GPU business for almost two decades now. Intel only launched its desktop grade Arc GPUs last June in China.

Intel’s recent move to split its GPU business in two could help it compete better. The consumer GPU group goes under its client computing segment. The acceleration and AI GPUs group is under its data center segment. Bundling consumer Arc GPUs with Intel processors is a valid tactic. Arc consumer GPUs, I believe, are being bundled on desktop PCs and laptops sold by major computer vendors. This could boost Intel’s discrete GPU market share to above 8% by the end of 2023.

Downside Risks

The most obvious risk in buying INTC is that the technical indicators are still bearish for it. I won’t be surprised if this stock goes below $24 soon. Intel’s stock has dipped more than 50% this year, and yet its RSI score is 34.39. It has not yet dropped to below the RSI oversold threshold of 30. The last closing price of $26.09 is lower than Intel’s 5-day EMA of 26.46. This is lower than its 13-day EMA of 27.27. INTC, therefore, has a bearish EMA technical indicator.

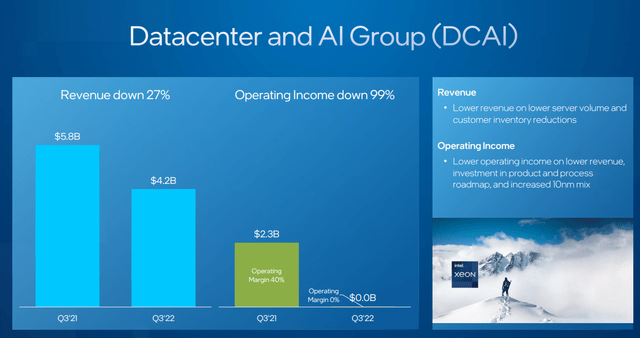

This can get worse because the PC industry is again declining. This is bad for Intel’s biggest revenue generator, the Client Computing Group. Intel is already handicapped with a -7.44% forward revenue growth estimate. It currently has a TTM revenue CAGR of -11.21%. The other headwind is that AMD is gaining market share on x86 servers. Intel is winning back market share on laptop and desktop processors, but it is a downer that AMD saw its Q3 server share grow. AMD’s increasing market share in server processors could largely explain why the Q3 Data Center segment of Intel has a 0% operating margin.

I opine that Intel could use its old contra-revenue tactic to defeat AMD’s growing server market share. Intel has a net operating cash flow of $13.67 billion, and its total cash is still more than $22 billion. Intel can afford a counter-revenue campaign to safeguard its $4.2 billion data center business.

Final Words

I am a computer technician. Intel is a buy because of its future windfall from consumer and enterprise AI products & services. Intel still owns more than 80% of x86 desktop, laptop, and server processors. This company is still very profitable. Intel has been a consistent and generous dividend payer. I say INTC deserves at least a 10x P/E valuation. My fearless price target for INTC is therefore 20% higher than $26, or $31.2.

Wait patiently for others to keep making INTC more affordable, and then buy lots of it. The steep drop in INTC’s price has resulted in a Stochastic Oversold Buried short-term bearish trade signal. The fast stochastic of INTC is below 20 and has been so for the past five trading days.

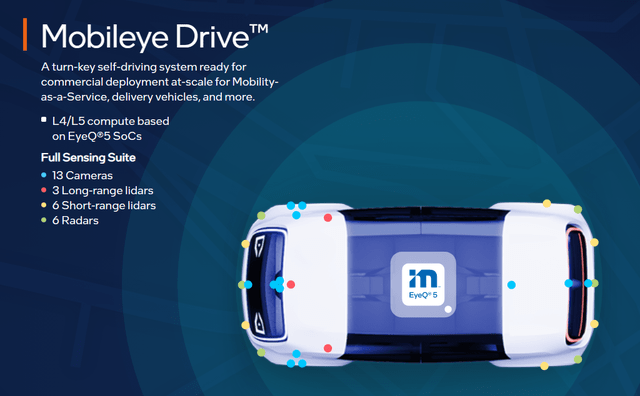

Intel should transform itself as an AI-first company. It should market its processors as Intelligent processors with AI capabilities. Mobileye could eventually have a $50 valuation if Intel and its AI partner Baidu (BIDU) starts working on making self-driving taxis. Mobile Drive is Level 4/Level 5 self-driving technology using EyeQ 5 SoCs, 13 cameras, 3, long-range lidars, and 6 short-range lidars.

OpenVINO and oneAPI could eventually attract my attention should I fail to learn to C# programming next year. I already know a little bit of Python. OpenVINO supports Python-friendly AI ML/DL frameworks like TensorFlow, Keras, MXNet, and PyTorch. OneAPI has a Python-friendly data analytics toolkit.

My buy rating for INTC is also based on my personal bias. Intel could eventually help transform me from just being a computer technician into an ML/DL AI app developer. The $30 that Seeking Alpha will probably pay me from writing this buy thesis for INTC will not go to beer. It will go to a savings account, so I could buy that Intel Core i5-13600K.

Going forward, all Seeking Alpha payments on my INTC articles will go toward building Intel Intelligent computers for my own/others’ gaming/programming/video editing pleasure. Intel processors are hackintosh-friendly. I make good beer money transforming Wintel laptops and desktop PCs into Big Sur or Mojave hackintosh computers.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.