Summary:

- Patience is a virtue, and Intel investors could sure use some right now.

- The bar’s been set low for Intel, and worsening visibility into its multi-year capital-intensive turnaround strategy that’s been further stunted by a cyclical downturn is driving confidence to a standstill.

- Until cyclical tailwinds return, there will not be much near-term respite for the stock.

Chip Somodevilla

Intel’s stock (NASDAQ:INTC) has been largely stuck in a crossfire of industry- and market-driven headwinds, in addition to incremental pressure from a challenging feat in a company-specific turnaround that CEO Pat Gelsinger has been trying to orchestrate since his return in 2021. At this point, there is little company-specific advantage at Intel left that can offer reprieve to the stock’s mediocre performance within the near-term. Spanning the industry-wide PC slump, a macro-driven decline in enterprise IT spending, and intensifying competitive headwinds, all of which have become downside drivers for Intel’s stock recently, with added pressure from a gloomy forecast for the current quarter. Increasing hawkishness from the Fed also strips the stock of any near-term market-driven recovery, while visibility into prospects of the company’s turnaround efforts remain low.

However, we believe management’s weak guidance for the current quarter, paired with the recent decision to slash dividends, have sufficiently de-risked the stock from any further company-specific downside surprises investors have yet to price in. Yet, this also leaves Intel’s shares swimming naked in the current macro backdrop, with little to no company-specific advantage to mitigate its exposure to broad-based risk-off market sentiment.

Specifically, considering acute execution risks stemming from its capital-intensive IDM 2.0 strategy, the stock remains highly vulnerable to persistent market headwinds driven by mounting macroeconomic uncertainties – the worst of which being the risk of inflation becoming entrenched at stubbornly high levels, and continued monetary policy tightening pushing the economy into recession, driving a further market-wide correction in valuations. But the stock’s current discount to peers with a similar growth profile also makes it equally primed to capitalize on the recovery trade once the cyclical downturn in PC demand and broader enterprise IT spending returns, even if IDM 2.0 remains years from realizing any positive P&L impact. This is because Intel’s existing business still benefits from a sprawling market share in processors critical for powering servers and workstations despite growing competitive headwinds in recent years. So until the broader economy recovers, there is essentially little near-term reprieve for Intel from a valuation perspective, especially as risk-off sentiment in equities adds incremental drag on the stock’s performance. With broader near-term market risks still skewed to the downside though, and little visibility into the broader recovery timeline as well as the prospects of Intel’s company specific turnaround strategy, we continue to stay on the sidelines on this one.

The Intel Struggle

Management’s message during Intel’s fourth quarter earnings call was clear – the company’s near-term prospects are not looking good, and getting it back up on its feet will be a challenging long-term feat, compounded by pains from the cyclical PC downturn and looming macroeconomic uncertainties weighing on enterprise IT spend. Intel is expecting current quarter consolidated sales to decline by 40% in the mid-range, guiding between $10.5 billion to $11.5 billion in revenue, with the lower range being the “smallest quarterly total since 2010”. And no particular operating segment is expected to bring meaningful relief in the near-term, with management expecting sequential double-digit declines for almost all of its business units.

This includes impending challenges to Intel’s data center and AI sales, which has been a relatively more resilient corner in the ailing semiconductor industry, indicating the chipmaker’s loosening grip on its leadership in the field. Intel now holds a leading market share of more than 70% in server processor sales, fed from persistent demand in high-performance computing (“HPC”) and recent momentum in AI developments. But this figure is in stark contrast to the close-to-90% Intel had started 2022 with, as it cedes share to rivals like AMD (AMD) due to continued delays in the roll-out of its competing products in the field. Specifically, Intel’s latest and greatest fourth generation Sapphire Rapids Xeon server processors had only started shipping in January following multiple delays, yet its performance still falls behind rival AMD’s fourth generation EPYC equivalent:

Specially, AMD’s newest generation of EPYC sever processors continue to hold a technology advantage over equivalents made but key rival Intel. The 4th Gen EPYC processors – a line-up marked by Genoa, Bergamo, Genoa-X, and Siena variations optimized for different applications – are manufactured on TSMC’s (TSM) 5 nm process. Not only do the latest generation of EPYC server processors boast 25% more performance-per-watt and 35% better performance overall compared to the preceding 3rd Gen Milan EPYC processors, they also outperform Intel’s equivalent – the fourth generation Sapphire Rapids Xeon server processors – which are still being manufactured on the 7nm process. As discussed in a previous coverage, smaller nm processors are more powerful because it reduces the space between the high volume of transistors within a single chip, and effectively lowers the “distance travelled by electronics to perform work”, thus enhancing energy efficiency while enabling faster computing.

While Intel is already expecting to roll-out the all-new Sapphire Rapids’ successor, Emerald Rapids, in the second half of 2023, the upgrade will remain on the Intel 7 node, highlighting the challenge it faces in stemming the ever-widening performance gap with rival products. Although Intel is already working on the next generation Granite Rapids and cloud-optimized Sierra Forest Xeon server processors, which are slated for launch next year, their performance will likely remain inferior to AMD’s planned fifth generation “Turin” EPYC processors, which are expected to be manufactured on TSMC’s (TSM) 5nm and 3nm processes to unlock greater performance capabilities. In addition, Sierra Forest’s 2024 launch also comes after that of AMD’s cloud-optimized Bergamo equivalent, which will start shipping in the first half of the current year. With both products featuring up to 128 cores to compete head-on for share in cloud-specific applications, Sierra Forest’s later entry to the market continues to underscore Intel’s struggles in regaining share in a field it once led by wide margins.

In addition to DCAI, Intel’s client computing segment, which contributes to the bulk of its consolidated sales, is expected to experience further deterioration through the first half of the year as the cyclical PC market downturn persists:

…PC TAM deteriorated faster than expected due to macroeconomic headwinds. Customer inventory remains elevated beyond our previous expectations and will continue to burn into the first half of 2023.

Source: Intel 4Q22 Earnings Call Transcript

Despite an 11% increase in the average sale price of CPUs, the client computing segment was unable to offset the impact of a contracting PC market. With the company guiding a 40% y/y drop (mid-range) in first quarter revenues, Intel’s core client computing segment is likely to experience another sharp acceleration in related sales decline in the current quarter and through the first half. This is consistent with the slew of weak near-term outlooks provided but some of Intel’s top PC-making customers, including Dell (DELL) and HP (HPQ):

The PC market remains challenged. From a historic 2021, the PC market slowed markedly in June and experienced a sharp decline in calendar Q4…customers [are delaying] PC purchases in the face of macroeconomic and hiring uncertainty.

Source: Dell 4Q22 Earnings Call Transcript

The outlook gave hope that HP can weather a downturn afflicting the PC industry. After a sales boom fuelled by remote work during the pandemic, HP has been struggling with plummeting demand for computers. Preliminary data from research firm IDC shows that PC shipments dropped sharply in the fourth quarter of 2022. Among major suppliers, HP saw one of the steepest declines, according to IDC.

Source: Bloomberg News

We now expect the overall PC market unit TAM to decline by a high teens percent in FY2023. Specifically, for Q2, we expect Personal Systems revenue will remain under pressure near-term and decline sequentially by a high single-digit. We expect revenue to improve over the course of the back half of the year as elevated channel inventory levels are expected to normalize by early fiscal Q3.

Source: HP Inc. F1Q23 Earnings Call Transcript

With income being a function of sales, management’s forecast for Intel’s first quarter earnings is equally dire, with a continuation of losses. The company is expecting gross margin at 39% in the current quarter, representing a whopping 11 percentage point decline from the prior year. While Intel management continues to reinforce its commitment to realize cost-savings of $3 billion in the current year – with $1 billion coming out from cost of sales – the company remains a long way from the previous 51% to 53% range it aspires to return to over the “medium term”. Recognizing the challenge in preserving margins and cash flows under the currently pressured cost environment, with incremental headwinds from its capital-intensive growth investments coinciding with macro turmoil, Intel’s recently painful decision to slash its “competitive dividends” was the only prudent choice in our view. Yet, the longer-term gross margin target of 54% to 58% looks to be even further out of reach, nonetheless, despite cost reduction goals of $8 billion to $10 billion by mid-decade, of which two-thirds is expected to come out of efficiencies in cost of sales.

Specifically, there remains little visibility into how Intel could achieve said longer-term profitability goals, considering it would require a substantial sales ramp-up to scale such a pace of margin expansion. And as mentioned in the earlier section, significant execution risks remain on that front, as the materialization of Intel’s technologically competitive new nodes (i.e. Intel 4, 3, 20A, 18A) remains years out (considering no delays to plan), while rivals are already capitalizing on opportunities in that front today, with even more advanced technology to come in the latter half of the decade. Specifically, the prospects of IDM 2.0 remain to be seen, with uncertainties over whether the return to Intel’s foundry roots will be the “winning formula” that the company needs. There is still much work left to do for Intel to restore investor confidence in this turnaround plan, with the persistently weak near-term outlook undermining management’s efforts.

The capital-intensive endeavour will also bring forth an inevitably significant cash burn trajectory, despite the company’s diligence in securing every dollar of external funding available, spanning federal subsidies from the U.S. and EU’s respective Chips Acts, and Semiconductor Co-Investment Programs (“SCIP”). Considering added cost challenges from the capital-intensive IDM 2.0 strategy lasting through at least 2024, and related returns not expected to ramp-up until at least years after (if the turnaround is successful), we expect aggressive cost-cutting efforts (e.g. workforce reduction; C-suite pay cuts) to be a key driver of Intel’s margin expansion strategy in the next little while, which alone will be insufficient in driving the profitability metric back towards the 50%-range within the foreseeable future. With free cash flows inevitably under pressure as a result of diminishing margins and an aggressive investment cycle over the near- to medium-term stretching its check-book thin, the only realistic reprieve for Intel right now is if the industry’s inventory glut normalizes as planned before the end of the year to alleviate pressure on its finances.

Diving Into Fundamentals

On the fundamentals front, we view management’s weak guidance for the current quarter as appropriate given the current operating environment. A bleak first quarter will no longer be a surprise for investors, and is likely a reality already priced into the stock’s current market value. The second quarter is unlikely to show substantial improvement on the top-line either given anticipated TAM contraction in core verticals alongside economic deterioration, though continued cost-cutting efforts (e.g. layoffs, pay cuts, divestitures, etc.) will have a more evident impact on margins over time, with incremental relief from reduced depreciation expenses driven by the increase in the estimated useful life of Intel’s production machinery and equipment from the previous five years to now eight years.

Even in the optimistic case where Intel – and the broader semiconductor industry – experiences recovery in the second half of the year as a result of normalizing inventory levels, growth will likely remain subdued given looming recession risks. With the Fed fixed on targeting tightness in the labour market next to ensure inflation returns to its 2% target range, consumer spending weakness will likely persist, while enterprise orders will also remain slow to manage budgets under acute macroeconomic uncertainties, and impact hardware demand at Intel. But considering “PC usage remains strong” with Intel’s installed base about 10% higher than pre-COVID levels, an expected economic recovery next year – or at least greater clarity on the macro outlook by then – will likely restore high single-digit to low double-digit growth at the company exiting 2024, with a conservative assumption for further improvements post-2025 when anticipated returns from IDM 2.0 start to ramp.

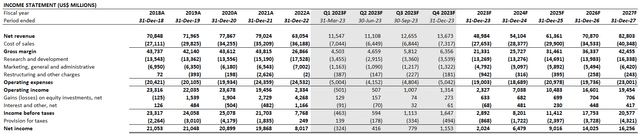

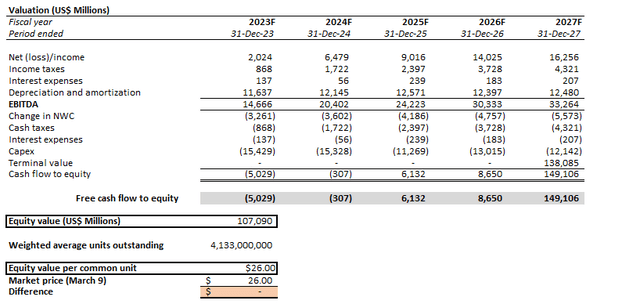

Intel Valuation Analysis (Author)

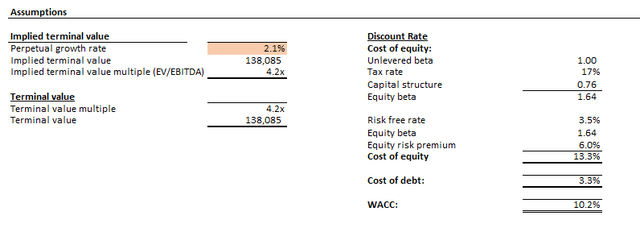

On the valuation front, it is clear that the market is now pricing in a very conservative outlook on Intel’s turnaround efforts. The stock reflects perpetual growth of about 2% at current levels, offset by a relatively lower cost of capital on Intel’s future cash flows thanks to its stronger investment-grade risk profile, despite recent ratings downgrades by Fitch Ratings, Moody’s Investors Service, and S&P citing “considerable execution risk” alongside “significant intermediate-term negative FCF”.

Intel Valuation Analysis (Author) Intel valuation assumptions (Author)

This implies the market has yet to price in the anticipated incremental value from IDM 2.0, considering blended economic expansion prospects across Intel’s core operating regions paired with longer-term secular growth trends in the semiconductor industry could exceed 3%.

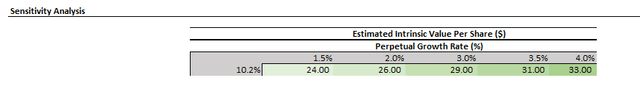

Intel Valuation Sensitivity Analysis (Author)

At current levels, the stock largely reflects investor expectations for elevated execution risks instead, in addition to other external downsides pertaining to macro headwinds and industry challenges (e.g. PC slump, reduced IT spend, inflationary pressure, competition, etc.).

Intel_-_Forecasted_Financial_Information.pdf

The Bottom Line

Intel’s stock appears fairly priced for what it is given its operating environment today, without much reflection of the competitive edge and market share gains that the company aspires to achieve under the IDM 2.0 strategy. At best, the market is pricing in some reprieve driven primarily by the eventual industry recovery and secular growth trends that Intel will benefit from, but not much incremental specific to promises made under IDM 2.0 (e.g. regaining market leadership, substantial margin expansion with scale, etc.), highlighting the lack of investor confidence in the stock.

Unless IDM 2.0 shows structural evidence that it will work in helping Intel regain a strong grip in a market where it excels – whether that will be in foundry manufacturing, or hardware applications for client computing, HPC, network infrastructure, autos, and other verticals – with a robust cash flow generation trajectory reinforced, the stock is unlikely to see meaningful incremental upside potential from current levels. We view the stock’s risk-reward pay-off as fair at best at current levels – while Intel’s stock will eventually experience some recovery as a result of external factors (e.g. economic / industry recovery), there remains little supporting an intrinsically-driven valuation upside story based on what it has put on the table today. And in the immediate-term, there is also little that can be done at Intel to mitigate its exposure to broader market risks that remain skewed to the downside for the foreseeable future, which makes us incrementally cautious about the stock’s near-term outlook.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!