Summary:

- Intel highlighted its expectations of a larger and faster-growing TAM for its data center and AI business at a recent investor event.

- INTC’s prior takeover of Habana Labs in 2019 has put the company in a good position now to compete in the AI inference market with Gaudi chips developed by Habana.

- I upgrade my rating for Intel to a Buy, taking into account the positive takeaways from the company’s recent investor conference relating to its 2027 TAM and AI inference opportunities.

JasonDoiy

Elevator Pitch

My rating for Intel Corporation’s (NASDAQ:INTC) shares is a Buy.

In my prior article for Intel published on January 12, 2023, I wrote about INTC’s prospects in the short term and long term. With the current write-up, my focus is on the takeaways from Intel’s recent investor event on Wednesday, March 29 which led to a big jump in INTC’s stock price.

I have decided to raise my investment rating on Intel from a Hold previously to a Buy now following the company’s recent investor event. The Total Addressable Market or TAM for INTC’s data center/AI business is expected to grow at a faster rate and become much bigger in a few years’ time than what the company had earlier guided for. Specifically, the AI inference market holds great promise for Intel, considering the superior performance of its Habana Gaudi chips.

INTC’s Share Price Jump On Wednesday

INTC’s share price rose by +7.6% to close at $31.52 at the end of the March 29, 2023 trading day. It is noteworthy that this was the biggest stock price increase for Intel in more than four months since the +8.1% spike in its shares on November 10, 2022.

According to an early November 2022 Seeking Alpha News article, INTC had announced the launch of “new Xeon chips” as part of plans to contend with its “competitors in high performance computing” on the day prior to its +8.1% stock price surge on November 10 last year.

In the next section, I touch on what had been the share price catalyst for Intel on Wednesday.

Takeaways From Intel’s Recent Investor Conference

This time round, Intel had disclosed a number of key financial metrics as part of its Data Center and AI Investor Conference hosted in the morning of November 29, 2023.

Firstly, INTC revealed at its recent investor presentation on Wednesday that the TAM of the company’s “data center and AI logic silicon business” is estimated to expand by a CAGR in excess of +20% from more than $40 billion at the end of 2022 to over $110 billion by 2027.

In comparison, Intel had previously forecasted at the company’s 2022 Investor Meeting on February 17 last year that its data center and AI logic silicon business’ TAM will grow from $30 billion to $65 billion between 2021 and 2026, which translated into a relatively more modest +16% CAGR.

In other words, the company is guiding that the TAM for its data center and AI logic silicon business will expand at a faster pace and become bigger than what was expected earlier.

Secondly, Intel highlighted in its Data Center and AI investor conference presentation slides that the “growth in AI” is a significant driver of the expansion in TAM for its data center and AI logic silicon business. Specifically, INTC is of the view that the TAM for AI silicon can be as large as $40 billion in 2027.

Thirdly, INTC noted at the March 29 investor event that its “48-core fourth-gen Intel Xeon” coupled with its “new AMX (Advanced Matrix Extensions) AI accelerator engine” is able to achieve a “performance gain of 4x” as compared to “a 48 core fourth-gen AMD (AMD) EPYC” on specific “AI imaging and language workloads.” This provides support for the thesis that Intel can be competitive with its rivals in capitalizing on growth opportunities in AI.

These positive takeaways from Intel’s recent investor event helped to push INTC’s stock price up on Wednesday.

2019 Acquisition Laid The Foundation For INTC To Compete In AI Inference Today

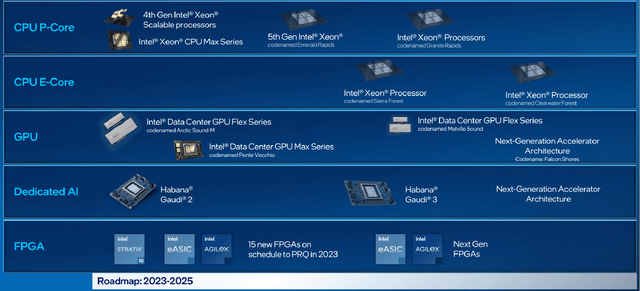

Towards the end of 2019, INTC bought over Habana Labs, an “AI chipmaker” which “develops programmable deep learning accelerators for data centers”, as mentioned in a December 16, 2019 Seeking Alpha News article. Today, Habana Labs’ Gaudi chips are a key component of Intel’s data center AI architecture as highlighted below.

INTC’s Data Center AI Architecture

Intel’s March 29, 2023 Data Center And AI Presentation

According to an August 4, 2021 report published by research firm Omida, Nvidia Corporation (NVDA) boasted an 80% market share in the AI processor market, which is defined narrowly by Omida as “chips that integrate distinct subsystems dedicated to AI processing” excluding CPU (Computer Processing Unit) chips from Intel and other peers. This piece of research highlights the growth potential for Intel in the AI inference segment where a wide range of hardware can be utilized, which is in contrast with the AI training segment that is dominated by NVDA’s GPUs (Graphic Processing Units).

Intel should be competitive in the AI inference market judging by the performance of its current Habana Gaudi 2 chip. At its March 29, 2023 Data Center and AI investor event, INTC stressed that the Habana Gaudi 2 chip’s performance in terms of “deep learning inference” is twice as good as “the most popular GPU” that it is competing with. In its Data Center and AI investor conference presentation slides, Intel also cited AI company Hugging Face’s comments that the Habana Gaudi 2 chip used in an open source LLM (Large Language Model) known as Bloomz developed by Hugging Face allows for users to “run inference (three times) faster than with any GPU currently available on the market.”

In summary, the battle for leadership in the AI inference market is still wide open (unlike NVDA’s dominance of the AI training segment), and there is a good chance for CPUs to grab a meaningful share of this particular segment which favors Intel. As indicated in its March 29, 2023 investor presentation, INTC thinks that generate compute or CPUs (versus external compute or external accelerators) could potentially account for 60% of $40 billion AI silicon TAM in 2027. INTC didn’t rule out the possibility of CPUs accounting for an even larger proportion (more than 60%) of the AI market in future, noting at the recent Data Center and AI conference that “many of the inference opportunities are really going to be well addressed with the CPU.”

Closing Thoughts

I deem Intel’s shares to be worthy of a Buy rating now. The company’s recent investor presentation reveals valuable insights about INTC’s data center/AI business’ growth potential and the AI inference market’s growth opportunities. This explains why I have turned bullish on INTC’s stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!