Summary:

- Intel Corporation’s Q2 earning report and its recently announced transition toward a 64-bit-only X86S architecture are more than bullish catalysts.

- They are also a key milestone of its turnaround plan in my view.

- With these catalysts, I expect future Intel chips to be faster, more power efficient, and thus more competitive in the chip market.

- I also see its AI potential being underestimated by the market.

Leon Neal

Thesis

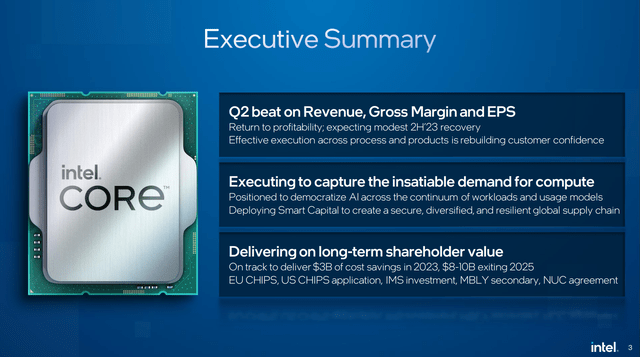

Readers following me know that I am a long-term bull on Intel Corporation (NASDAQ:INTC), betting on the execution of its turnaround plan. And I view its recent Q2 earning report (“ER”) as a solid step in this plan. The company reported a superb quarter, beating market expectations on both lines and also gross margin. The market apparently shares this bullish view, judging by the stock price actions after the ER. To wit, its EPS dialed in at $0.13, beating the consensus estimate by $0.16 (i.e., more than 100%). And revenue came in at $12.95B, beating consensus estimates by more than $812M (see the chart below).

Overall, I view the company to be well positioned to capture the secular growth of our computing needs on multiple fronts, ranging from chip design to manufacturing, and AI. Pat Gelsinger and his team are addressing the right issues effectively, the way I see things. The Q2 ER certainly provides a good example. However, as I will detail next, the ER, when viewed together with another recent announcement to abandon the legacy X86 architecture, provides an even louder message for INTC’s determination to innovate and embrace the future.

64-bit only X86S

Shortly before the Q2 ER, INTC just released a whitepaper in April (see chart below). In the whitepaper, INTC detailed a plan to transition toward a 64-bit-only architecture, called X86S (adding an S to its legacy X86 architecture). For readers unfamiliar with INTC chips, X86 was one of INTC’s most successful architecture – or even the chip industry’s most successful architecture in my view. Since INTC first released X86 in 1987, it has been dominating the market for most of the period since then.

The operative word here is “was.” Success creates its own problems. And in INTC’s case, it has been sticking to the X86 architecture for too long. And in the remainder of this article, I will analyze the implications of this transition. And my overall thesis is to argue that this is a bullish catalyst for INTC. I expect it to simplify INTC’s chip architecture, which would in turn make them more efficient and competitive in the market.

The key changes

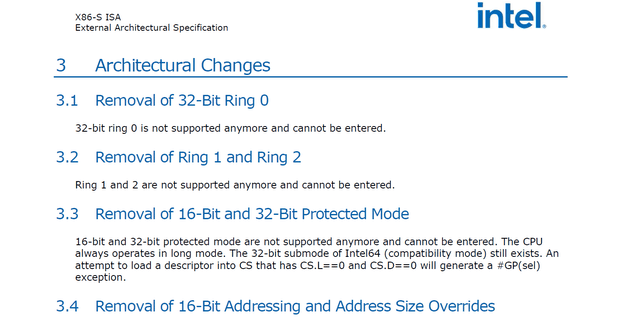

To fully appreciate the implications, I have to start with a little bit of technical details. The key idea of the X86S architecture is to prune the extensive support in the legacy X86 architecture, such as the 32-bit and 16-bit support (see the next chart below).

Most of us migrated to 64-bit Windows years ago when Windows 7 was released (in 2009, BTW). Then, in case you were wondering why X86 kept all the lower-bit support after so many years, the keyword is backward compatibility. The x86 instruction set is backward compatible, meaning that 64-bit processors can still run 32-bit applications.

As a result, Windows 7 (and other Windows versions) can run on all Intel x86 chips because it can run in both 32-bit and 64-bit modes. When Windows 7 is installed on an Intel x86 chip, it will automatically detect the processor and choose the appropriate mode. If the processor is 64-bit, Windows 7 will run in 64-bit mode. If the processor is 32-bit, Windows 7 will run in 32-bit mode.

As you can see, it was (again, past tense) a pretty smart idea. In fact, I view this backwards compatibility as a key reason why the x86 architecture has been so successful. It allowed for a smooth transition between different generations of processors, without the need to rewrite all of the software.

X86’s issues and X86S’ potential benefits

But times have changed so much since Windows 7. The need for 16-bit or 32-bit support has become less and less relevant. At the same time, backward compatibility for 16-bit and 32-bit execution not only requires coding resources but also hardware resources. At the chip design and manufacturing level, the corresponding circuits have to be engraved by the lithography machines on the X86 chips to support these 16-bit and 32-bit functions.

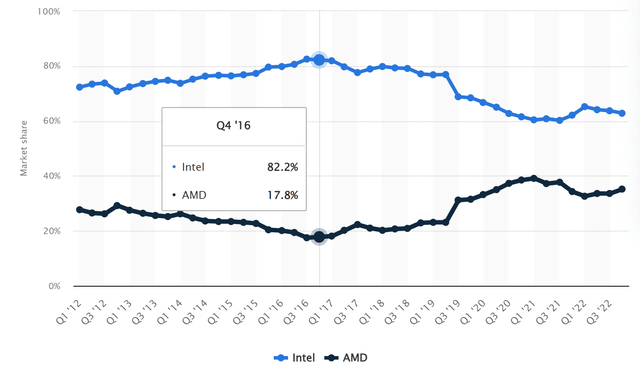

The issues with the X86 are probably best capsulated by its market share (see the next chart below). In recent years, competitors such as AMD (with its Zen architecture) and Apple (with its M-series chips) have been eating away at the market share of X86 rapidly. The market share of traditional x86 computers has fallen like a landslide from its peak level of 80%+ in 2017. On the server front, the picture is similar: X86 has also been losing ground (to ARM mostly)

As such, the transition to X86S could bring about several benefits both on the software and hardware front. On the software front, those older modes are not used in contemporary apps or operating systems anyways most of the time. On the hardware front, without these grandparent features, there will be more space on the chip for newer and more valuable functional modules.

And earlier cases from other companies seem to support this transition as well. For example, about 2~3 years ago, Qualcomm and MediaTek gave up 32-bit support on their chips. And the performance of their new chips on Android phones improved immediately so they become finally competitive when compared to Apple’s A-series chips (which has given up 32-bit support further back).

AI potential undervalued

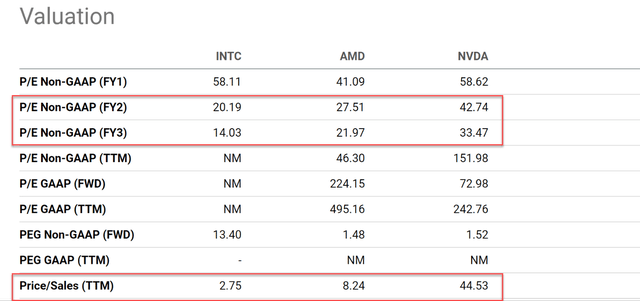

In terms of valuation, INTC trades at a fraction of other chip stocks such as Nvidia Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD). As seen in the chart below, its FY2 P/E hovers around 20x, about a quarter below AMD’s ~27x, and less than ½ of NVDA’s ~43x. In terms of top line multiples, it is not an exaggeration to say that its P/S ratio of ~2.7x is simply ridiculous when compared to AMD’s ~8x and NVDA’s 44x.

A big reason that INTC trades at such a discount is mostly due to the market’s perception of its AI potential the way I see it. In short, the market perceives NVDA and AMD (especially NVDA) to reap the main benefits of the AI future. However, I see INTC as a viable competitor in the AI space, too.

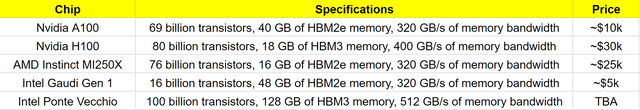

The following table summarizes a few of the main AI chips. As seen, I view INTC’s Gaudi and Ponte Vecchio series as viable replacements for AMD’s MI250X and also NVDA’s A100/H100 chips. Note that the Intel Gaudi Gen 2/3 and Ponte Vecchio chip are not yet available in the open market yet. So, their prices are not yet known. However, I expect them to be priced similarly to the other high-end AI chips shown here.

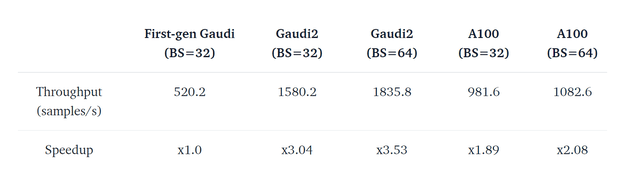

In terms of performance, INTC’s chips are reported to offer better performance in benchmark AI tasks. For example, the following study assessed the abilities of Gaudi Gen 1, Gen 2, and also the A100 80GB chips for both AI training and inference on models of various sizes. And as seen, the A100 indeed offered a 1.89x to 2.08x speedup compared to the Gaudi Gen 1 chips. But Gaudi Gen 2 chips offered better speedup performance than the A100. In imaging processing applications (e.g., generating images from text cues with Stable Diffusion), Gaudi Gen 2 chips also outperformed A100.

During the ER conference call, CEO Pat Gelsinger particularly commented on INTC’s AI pipelines and mentioned the Gaudi chips (see the quotes below). Based on the performance and price data I gathered, I fully share his view.

The surging demand for AI products and services is expanding the pipeline of business engagements for our accelerator products, which includes our Gaudi, Flex, and Max product lines. Our pipeline of opportunities through 2024 is rapidly increasing and is now over $1 billion and continuing to expand with Gaudi driving the lion’s share.

Source: AI benchmark testing (huggingface.co)

Risks and concluding thoughts

INTC faces multiple downward risks, too. Here I won’t repeat many of the issues analyzed by many other Seeking Alpha authors already. During the ER, the company’s management mentioned that they expected some softness in demand in the near future (say, the next one or two quarters). As I analyzed earlier, the company, other with the rest of the chip sector, also has some inventory burn that needs to be processed.

Also, the transition to X86S could trigger some potential risks, too. First, INTC is still in an early stage of this transition. For example, it is soliciting industry feedback on the proposed changes in the X86X. Second, throwing away support for lower-bit applications could lead to the loss of some legacy users, which is viewed as taboo by some people in product development. I agree with this viewpoint in general, although I am not too concerned in this particular case. I do not expect this transition to cause a loss of legacy users because INTC has already matured virtualization techniques that could still allow the booting of legacy software with the new X86S.

All told, my view is that the positives of INTC’s overall transition far outweigh any potential risks even if it means the loss of some users. I expect its planned transition to make future INTC chips faster and more power efficient. Together with its foundry initiatives, I also expected a cost advantage. All combined, I see these catalysts to make INTC products more competitive in the chip market. At the same time, I also see Intel Corporation’s AI potential being miscalculated by the market, offering an opportunity for investors to tap into the AI future at very reasonable valuation multiples.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.