Summary:

- For Q4 2022, Intel’s results were nightmarish: big misses on revenue and EPS accompanied by extremely poor guidance for Q1 2023. Consequently, Intel shares tanked ~6.5% on Friday.

- In this article, I will share my analysis of Intel’s Q4 and provide an updated valuation for the company.

- Furthermore, we will review Intel’s technical chart and quant factor grades to make an informed investment decision.

- I rate Intel a modest “Buy” at $28.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

In the aftermath of its Q4 report, Intel’s (NASDAQ:INTC) shares are tanking. The semiconductor industry is fighting a tough macro environment; however, Intel’s financial performance for Q4 2022 and forward guidance for Q1 2023 are absolutely nightmarish. For me, Intel remains a multi-year play of national importance, and I view this latest quarter as another one of those bumps we expected to see on the road to glory:

- Intel: Gearing Up For A Bumpy Ride To Glory [25th October 2021]

Despite getting a technologist in Pat Gelsinger to fill the CEO role almost two years ago, Intel’s execution has shown no signs of improvement (not yet anyway). As you may know, Intel is in a heavy investment cycle as the once-formidable semiconductor giant works towards Gelsinger’s “IDM 2.0” strategy. While Pat has repeatedly talked up a big game at Intel; the company continues to lose market share. With that being said, Intel has an interesting product and process roadmap (5 process nodes in 4 years), and if Pat & Co. executes well over the coming years, Intel’s shareholders could be rewarded handsomely.

In this article, I will share my analysis of Intel’s Q4 and provide an updated valuation for the company. Furthermore, we will review Intel’s technical chart and quant factor grades to make an informed investment decision.

Breaking Down Intel’s Quarter

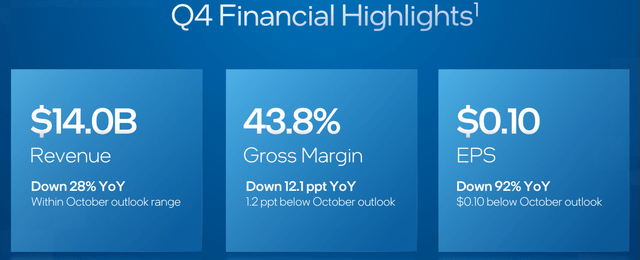

Amid an uncertain macroeconomic environment, the semiconductor chip shortage of 2020-21 has turned into a chip glut. Despite going into this quarter with significantly lowered estimates, Intel somehow managed to miss analyst estimates by ~$500M. The company blamed industry-wide demand challenges and competitive pressures for this revenue miss.

To add to this misery, Intel’s gross margins continued to deteriorate and came in at ~43.8% (down 1210 bps y/y). As a result of poor revenue and margin performance, Intel’s EPS dropped to $0.10 (y/y decline of 92%), well below the guidance of $0.20.

Intel Q4 2022 Earnings Presentation

From an earnings perspective, Intel had an awful quarter. That said, Intel generated $7.7 billion of cash from operations and free cash flows of $3.1 billion in Q4. From this free cash flow, the company paid dividends of $1.5 billion. Now, let’s dive deeper into the performance of each of Intel’s business segments to truly understand underlying fundamental trends.

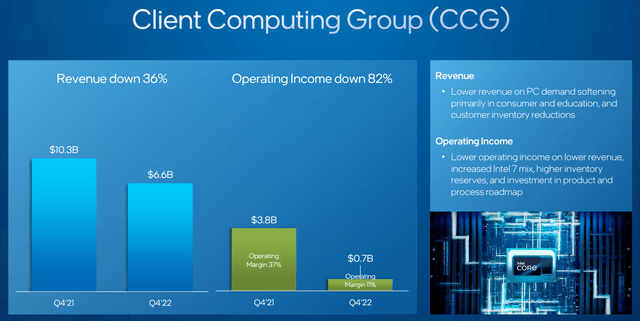

In Q4, Intel’s Client Computing Group revenue stood at $6.6 billion, down 36% y/y. After a massive demand boost from hybrid work during 2020-21, the PC market has slowed down drastically, and Intel’s CCG business is taking a big hit right now. Due to high channel inventory, Intel is undershipping massively; and the demand normalization in this segment is set to last for another couple of quarters. Hence, Intel’s CCG business is likely to remain under pressure in the near term.

Intel’s weak results could be indicative of further loss of market share to AMD (AMD), but we will learn more about it when AMD reports in the after-hours session today. As you can see below, Intel’s CCG business is experiencing negative operating leverage, and I think this margin pressure will continue as long as Intel’s spending on product and process roadmap remains elevated.

Intel Q4 2022 Earnings Presentation

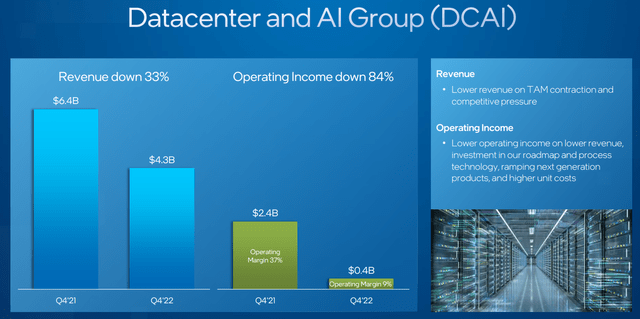

After reporting a disappointing set of numbers in Q3, Intel’s Datacenter and AI Group revenues dropped ~33% y/y in Q4 but rose 2.4% q/q. While some of the weakness is attributable to market contraction, I think rivals such as AMD and Nvidia (NVDA) are crushing Intel in the data center market. The launch of Sapphire Rapids should help Intel; however, the semiconductor giant really has its work cut out in this crucial market with rivals innovating faster than Intel.

Intel Q4 2022 Earnings Presentation

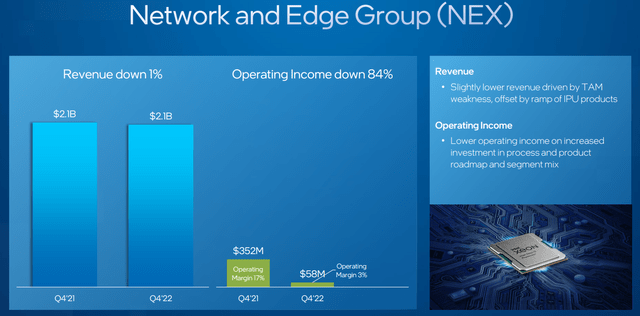

In Q4, Intel’s Network and Edge Group revenues were down only 1% y/y, with the ramp of IPU products offsetting most of the revenue decline driven by TAM contraction. Similar to its other business lines, Intel’s NEX segment showed poor operating margin performance.

Intel Q4 2022 Earnings Presentation

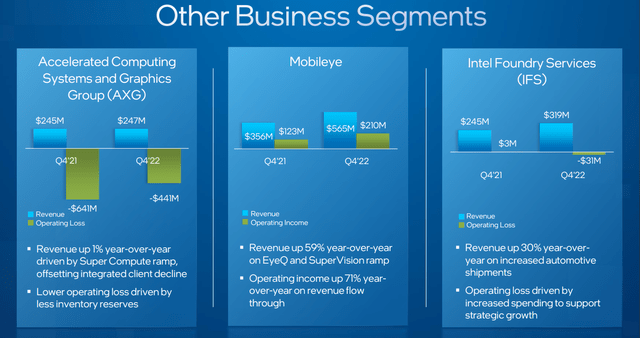

While Mobileye is now a publicly-listed standalone company, Intel still owns ~94% of Mobileye. And this is probably the only bright spot in Intel’s entire Q4 report – Mobileye revenues grew 59% y/y and operating income rose 71% y/y. The autonomous vehicle market may not reach maturity for several years; however, Mobileye has the potential to generate tremendous shareholder value for Intel investors!

Intel Q4 2022 Earnings Presentation

Intel’s Guidance Is An Absolute Nightmare

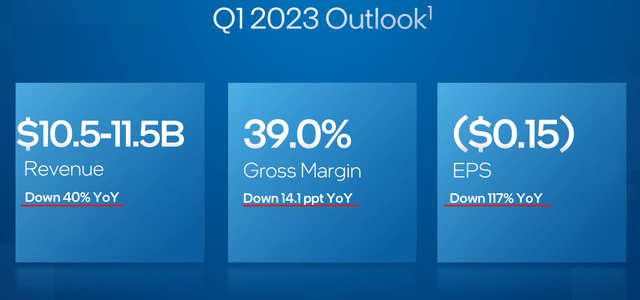

For Q1 2023, Intel’s management provided yet another kitchen-sink-like guidance, which is calling for revenues of $10.5-11.5B (down 40% y/y), gross margin of 39% (down ~480 bps sequentially), and a negative EPS of -$0.15!

Intel Q4 2022 Earnings Presentation

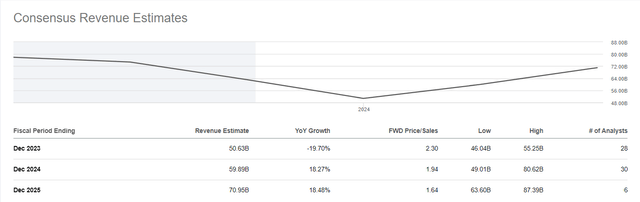

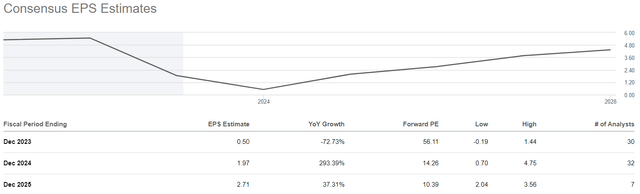

While Intel’s Q4 results were poor, its guidance for Q1 2023 is outright ugly! The macroeconomic backdrop is likely to remain challenging, and analyst estimates for 2023 are now calling for 2023 revenues to drop to $50B.

SeekingAlpha

SeekingAlpha

According to Intel’s management, the demand pressures should start to ease off in H2 2023, and the long-term TAM opportunity remains massive. As per Pat Gelsinger, Intel’s total addressable market could double by the end of this decade:

The digitization of everything accelerated by the four superpowers of AI, pervasive connectivity, cloud to edge infrastructure, and ubiquitous compute are driving the sustained need for more semiconductors and the market is expected to double to $1 trillion by 2030.

Due to the inevitable growth of semiconductors, Intel’s IDM 2.0 is worth taking a long-term bet on right now. While big question marks are hanging over Intel’s execution ability, I think Intel’s growth projections of 10-12% CAGR for the next 4-5 years are achievable [post a reset in 2023]. If Intel can deliver on these double-digit revenue growth targets, whilst bringing its gross margins back to the ~55-60% range after 2023, I think Intel would be the turnaround story of this decade.

Although Gelsinger’s hybrid-sourcing strategy should allow Intel to offer competitive semiconductors in upcoming years, Intel’s margins are likely to stay under pressure due to the use of external foundries like TSMC (TSM). Furthermore, Intel’s push for future revenue growth is being built on a costly expansion of its foundry business. If Intel fails to deliver on the goal of 5 nodes in 4 years, Intel will not catch up to the competition, and potentially could fall further behind technologically! With all this in mind, let’s build a conservative valuation model for Intel.

Intel’s Fair Value And Expected Return

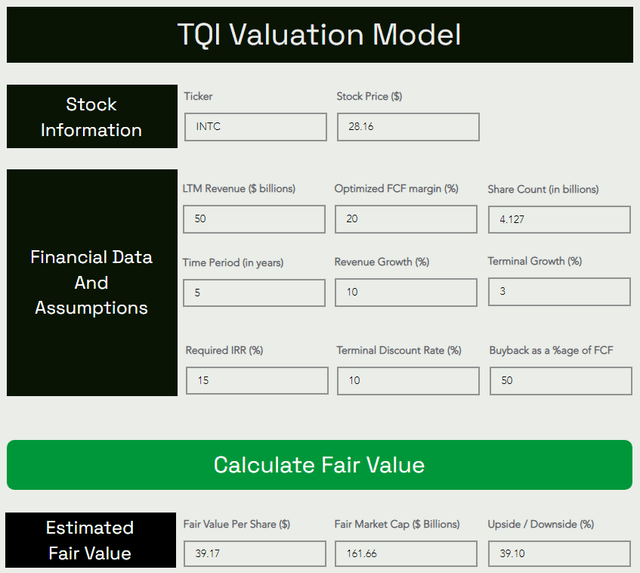

To account for the ongoing reset in Intel’s business, I assumed a revenue base of $50B (2023 estimate) in building my valuation model for the company. The rest of the assumptions are straightforward; however, if you have any questions, please share them with me in the comments section below.

TQI Valuation Model (TQIG.org)

TQI Valuation Model (TQIG.org)

As per these results, if one were to buy Intel at today’s price of ~$28 and hold the stock for five years, they could expect a CAGR return of ~12%. Since these returns are higher than the hurdle rate (10%) of TQI’s Buyback-Dividend portfolio, I continue to like Intel from a valuation perspective.

Reviewing INTC’s Technical Chart And Quant Factor Grades

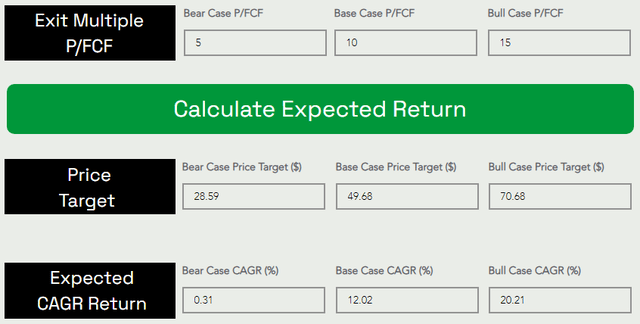

After suffering a catastrophic decline in 2021-22, Intel’s stock appears to be forming a Stage-1 base in the $24-32 range since September 2022.

WeBull Desktop

Technically, Intel’s stock recently got rejected from the upper end of this base, and a re-test of the lower end of the base could materialize in the near term. In the event of a deep recession, Intel may go lower; however, if we get a soft or softish landing then the downside is probably capped at ~$24.

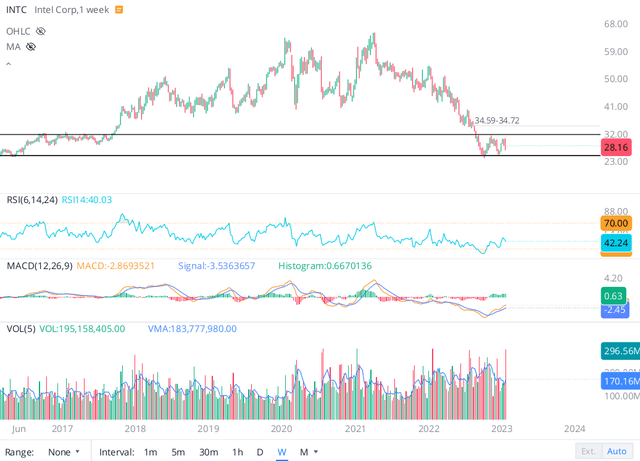

SeekingAlpha Quant Ratings

According to SA’s Quant Rating system, Intel is rated 3.25/5, with strong grades for Valuation (“A”) and Profitability (“A+”) being offset by weak grades for Growth (“F”), Momentum (“D+”), and Revisions (“D+”). In my view, Intel’s Profitability grade is set to deteriorate over the coming quarters as earnings turn negative in 2023, and with negative or depressed earnings, Intel’s relative valuation will suffer too. Hence, I think Intel’s quant factor grades are headed from “Hold” to “Sell” rating in the next 6-12 months. This is why I do not like Intel as a near-term buy.

Intel’s Dividend Is Not Under Serious Threat For Now, But Things Could Change Quickly

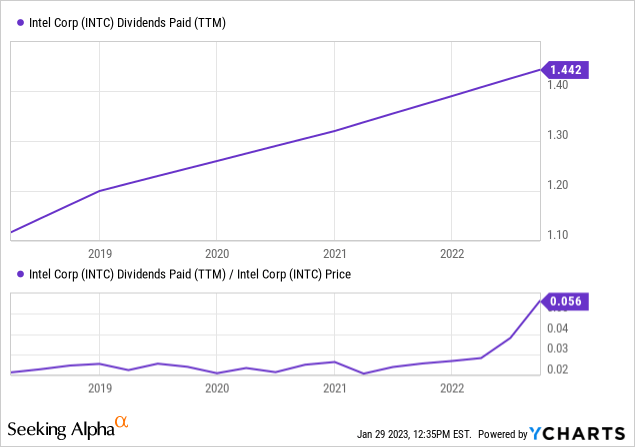

Due to a sharp decrease in its stock during 2022, Intel’s dividend yield has spiked up to 5.6%, which is relatively high in the technology complex. While Intel’s dividend yield seems enticing, a sharp rise in dividend yield generally represents the increased risk of a dividend cut.

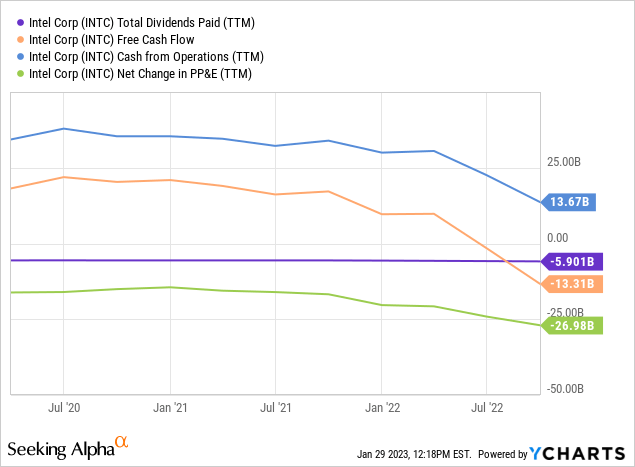

As we know, Intel is going through a heavy CAPEX spending cycle, with ~$27B spent on PP&E in the last twelve months. During this transitionary period, a sharp drop in revenues, margins, and operating cash flows has resulted in a complicated cash-burn situation at Intel.

In Q4, Intel generated a positive FCF of $3.1B and paid $1.5B in dividends. However, in the last twelve months, Intel reported negative free cash flows of -$13.3B, and management’s latest commentary suggests that Intel is set to report negative free cash flows for the first half of 2023 too.

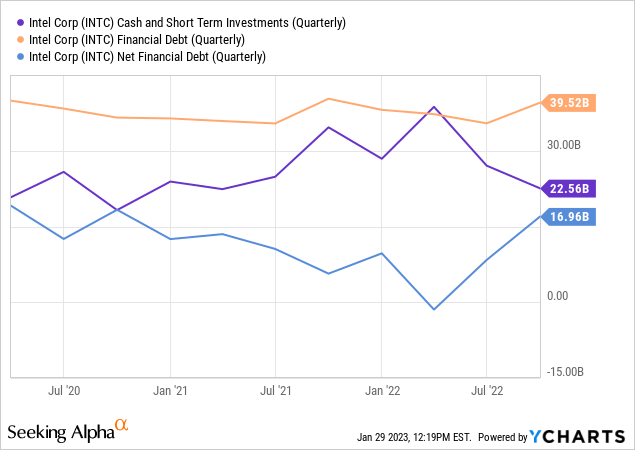

As you can see on the chart above, Intel’s financial debt is rising and its cash position is dwindling, causing the net financial debt to shoot higher. Given the uncertain macroeconomic environment and Intel’s ongoing investment cycle, the management may be forced to cut dividends in the second half of 2023 (especially if we end up in a recession). Hence, if you are looking to buy Intel solely for the purpose of earning a dividend, you may want to look elsewhere.

Concluding Thoughts

Despite an obvious deterioration in financial performance, Intel remains a company of national importance as the only scaled semiconductor manufacturer in the Western hemisphere. Given the uncertain macroeconomic environment, Intel’s financial performance is likely to remain in flux during 2023. However, Intel looks like a decent buy at current levels based on forward-looking valuations.

Intel’s stock is forming a base in the $24-32 range, and while I would prefer buying towards the bottom of this range, getting in here at ~$28 is fine too. Based on a mix of fundamental, quantitative, and technical analysis, I think Intel is a modest long-term buy at current levels. And I strongly prefer slow, staggered accumulation in this counter. If you are looking at Intel as a short-term buy or as a way to earn dividends in the near to medium term, I would urge you to look elsewhere!

Key Takeaway: I rate Intel a modest long-term “Buy” at $28.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why I tailored my marketplace service – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

TQI’s core idea is to generate wealth sustainably through tailored portfolio strategies that meet investor needs across different investor lifecycle stages. Each of our five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation.