Microsoft: The Valuation Is Too Rich For This Behemoth

Summary:

- Microsoft is down over 20% from its peak in the fall of 2021, but shares still trade at a premium valuation of 26.7x earnings.

- MSFT is in the news for its recent investment in OpenAI (the company behind Chat GPT) and ongoing regulatory drama with the acquisition of Activision.

- The company continues to buy back stock despite the rich valuation.

- Investors can count on continued dividend growth on top of the current 1.1% yield.

- With a market cap near $2T, I have a hard time seeing how the stock will outperform moving forward simply due to the massive size of the company.

Ron Wurzer/Getty Images News

It’s been a while since my last article on Microsoft (NASDAQ:MSFT), the tech giant with a market cap of $1.85T. That article was in May, and shares are down about 10% since then. While I prefer Microsoft’s stock to other big tech companies like Google (GOOG) (GOOGL) and Apple (AAPL), I think the large cap tech stocks are not going to outperform in coming years like they have in recent history.

Investment Thesis

Microsoft is a high margin cash cow that essentially operates an online toll booth with its Office segment, along with Azure and other notable business segments. They continue to grow internally, but they also have investments externally, including Open AI and Activision, which are two notable recent examples. Microsoft’s valuation is too rich for me right now at 26.7x earnings. I think it’s a hold for now, but I will start looking closer if we get near 20x earnings. They have continued to buy back loads of stock despite the rich valuation, but the 1.1% yield has continued to grow for years. With a market cap nearing $2T, I have a hard time seeing how the stock will outperform moving forward simply due to the massive size of the company.

Chat GPT & Activision

I skimmed the most recent 10-Q, and there wasn’t a whole lot there that would be interesting for investors familiar with the company. Revenues increased slightly while net margins decreased a bit. The business remains a high margin cash cow, but the most interesting recent development with Microsoft is their investment in OpenAI. Their $10B investment in OpenAI, the company behind the infamous Chat GPT tool, comes on the heels of layoffs. They plan to reduce headcount by 10,000, which adds to the pattern of layoffs in the tech sector in recent months. They are planning to add the Chat GPT tool to Bing and other Office products, but I’m curious to see how things develop and if it adds significant functionality to Microsoft’s offerings.

As I mentioned in my last article, Microsoft is still going through the motions to complete the Activision (ATVI) acquisition which was announced about a year ago. I still think the deal is likely to go through at $95 per share, but several regulatory bodies are taking a closer look at the deal, including the FTC. I think the deal is likely to go through, but we will see how things play out. Many expect the deal to close by the middle of 2023, which would provide solid double digit returns for investors buying shares of Activision. However, some Seeking Alpha contributors that Activision has double digit downside if the deal falls through.

Valuation

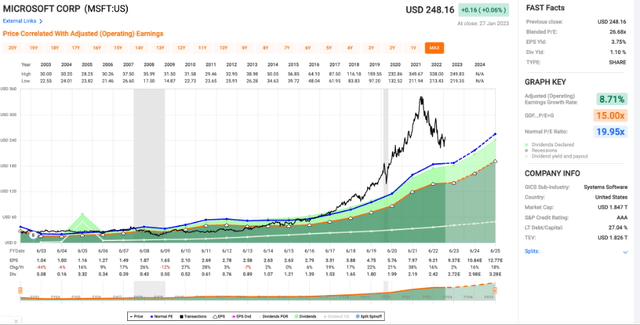

Microsoft went from a boring value stock in 2008 and 2009 with a single digit P/E ratio to being the high growth, high margin cash cow that the market has given a premium multiple. We have basically seen continuous multiple expansion since 2013, which peaked at a P/E just over 40x in the fall of 2021. I think this was driven by impressive operating results and growth, as well as continued inflows from passive funds. While shares are down significantly from their peak (over 20%), shares still aren’t cheap today.

Price/Earnings (fastgraphs.com)

Today, Microsoft trades at an earnings multiple of 26.7x. Growth is projected to be pretty good in 2024 and 2025 and I think that puts shares in the hold category today. I wouldn’t be a buyer above a 20x multiple, which we might not see for a while. Part of this is simply due to the size of the company. At a market cap of $1.85T, it’s hard to imagine massive returns for investors based solely on the huge market cap. What could entice investors is the continued buyback program to go with a 1.1% dividend with long track record of consistent growth.

Buybacks & Dividends

At the end of the quarter, Microsoft had $31.5B remaining on their current $60B authorization. In the first six months of fiscal year 2023, Microsoft spent $9.2B to repurchase 37M shares. These repurchases in the first half of the fiscal year exclude $1.8B spent on shares for employee compensation. While Microsoft has been buying back loads of stock for years, I’m not a huge fan of the current buyback program simply due to the valuation.

I would rather see more aggressive dividend increases. I said something similar in my previous article, but with shares above 26x earnings, I would rather see that cash go towards dividends. The company has a payout ratio just over 30% so they have plenty of room to increase their dividend without overdoing it. The yield now sits at 1.1%, which isn’t much for investors looking for current income, but they have consistently grown the dividend for years.

Conclusion

While Microsoft is an impressive business with great margins and a rock-solid balance sheet, I don’t see the stock outperforming from the current share price. This is primarily due to the expensive valuation at 26.7x earnings. There are a couple other things that could be a drag on returns. One of these is passive fund flows, which has been a tailwind for large tech stocks for the last decade until 2021. If the inflows reverse and turn into outflows, that will have an outsized impact on Microsoft’s stock. The other thing that could factor in is the cyclical performance of market sectors. Tech dominated after the 2008 financial circus, but I’m of the opinion the energy and real assets will outperform in coming years.

Microsoft continues to make investments in growth, internally and externally. I’m curious to see how the company integrates Chat GPT into its offerings. While I think AI will have its applications, I don’t know if it will be worth the large price tag. I do think the Activision acquisition, if it closes, will be worth the price tag. It will bring in large household names like Call of Duty and Candy Crush to compliment the company’s impressive gaming segment. Microsoft is a quality business the market knows it. Some investors are willing to pay a premium and buy shares today, but 26x earnings and a market cap of $1.85T is too rich for me, which is why it remains on my watchlist for now.

Disclosure: I/we have a beneficial long position in the shares of ATVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.