Summary:

- Intel Corporation reported another mixed quarter in Q3, with relatively weak results while the market tries to celebrate earnings beating guidance.

- The chip company continues to focus on cutting costs and capex, while peers are moving full speed ahead with advanced AI GPUs and increasing foundry spending.

- The stock shouldn’t be bought until Intel has turned around the business due to the stressed balance sheet and cash burn position.

rookiephoto19/iStock via Getty Images

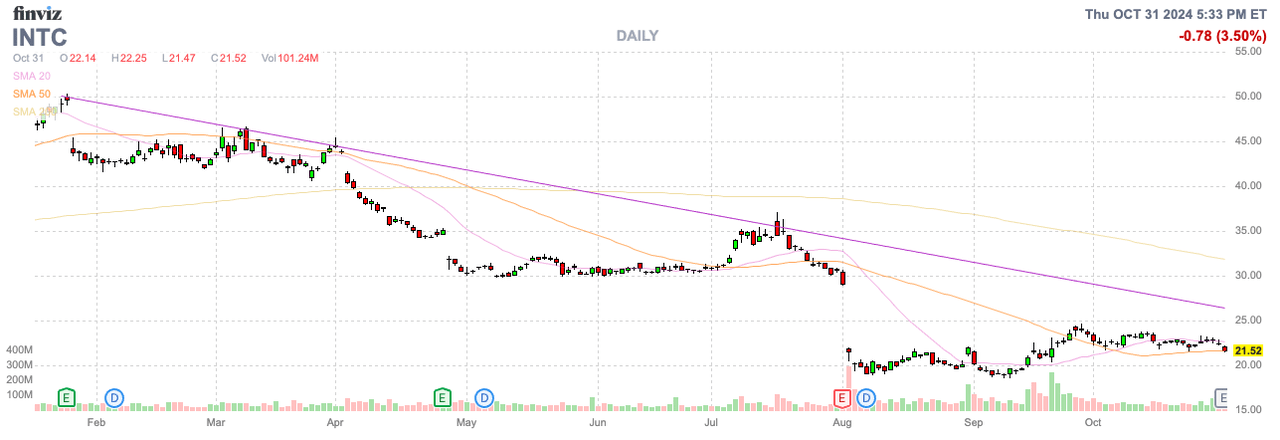

Intel Corporation (NASDAQ:INTC) stock jumped after finalizing plans to slash thousands of jobs in a move that isn’t a positive sign for the business. The once chip giant again reported mixed results in a sector with explosive growth. My investment thesis remains Bearish on the stock, especially on any major rally above $20.

Path Lower

Intel announced plans to lay off 16,500 employees from a workforce base far over 100K. The company has recently cut another 11K workers in what appears an annual event now.

While Wall St. initially looks positive on the plans to cut costs, these moves are highly disruptive in an industry with big growth opportunities. Of course, the issue facing Intel is that NVIDIA Corporation (NVDA) only spends ~$12 billion on operating expenses now, making the $22 billion annually spent by the now smaller company appear wasteful and inefficient.

The problem here is that 16,500 employees had a function, whether small or large. Someone new has to perform these job tasks going forward, or processes will be missed and work won’t get done. The risk is that these disruptions impact a customer or part of the chip design process, and Intel gets even further behind the industry leaders.

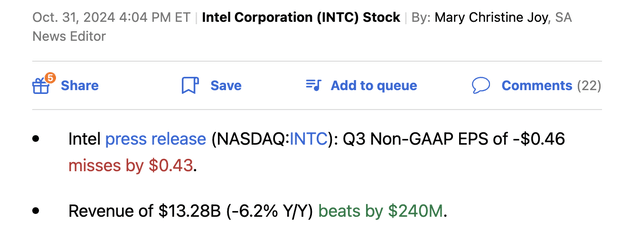

Intel already reported weak Q3 sales with revenues of $11.3 billion down 6% YoY. All the employee cuts won’t help the financials in the short term. Unless the chip company miraculously gets more efficient in the process, the business will face major headwinds in the next year.

The market is partially celebrating guidance for Q4 revenues of $13.3 to $14.3 billion, with consensus estimates up at $13.72 billion. Intel guided to revenue of $13.8 billion at the midpoint, but the numbers are still down massively from the $15.4 billion produced last year that investors have no reason to celebrate.

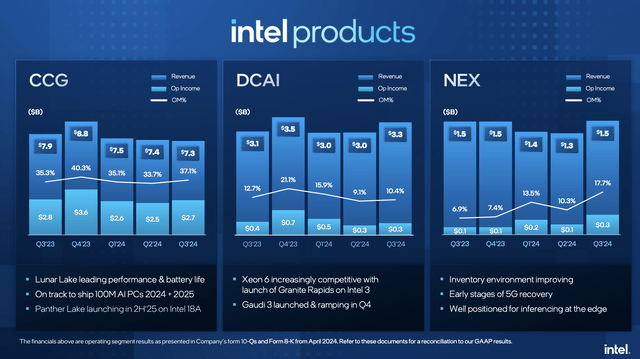

The data center revenues in Q3 were up 9% to $3.3 billion. The segment revenues were generally flat over the last year, with revenues hitting $3.3 billion last quarter, while even Advanced Micro Devices, Inc. (AMD) just reported related revenue growing over 120% to $3.5B and topping Intel. The smaller chip company even guided up AI GPU revenues, expecting another revenue jump in Q4.

Source: Intel Q3’24 presentation

Even the Foundry business reported revenues dipping, with the operating loss surging. At a time when the business should start humming along with the promises of 18A technology and surging compute demand due to AI, Intel is still going the wrong way.

Balance Sheet Stress

Intel ended the quarter with nearly $50 billion in debt, though the company does have cash and short-term investments of $24 billion, along with other assets. The problem is that the chip company has now only generated $5.1 billion in operating income YTD while spending $18.1 billion on capital expenditures, with adjusted free cash flow for Q3 ’24 alone down $2.7 billion.

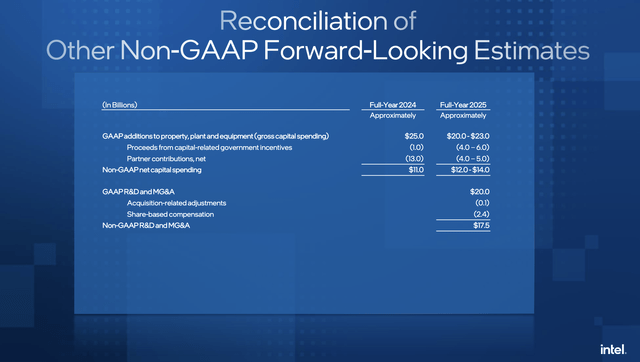

The company is getting chip incentives from the government, including the $3 billion recently in direct funding announced as part of the Chips ACT. The issue is that the quarterly results are so bad that Intel is teetering toward burning cash just to operate before paying for capex.

The guidance for Q4 predicts a $0.12 EPS, with gross margins rebounding to nearly 40%. The company is hardly forecasting a profit for the big holiday quarter, while competitors are all reporting record results. Even with all the government incentives and partner contributions, Intel still needs to spend $12 to $14 billion on capex next year.

Source: Intel Q3’24 presentation

As well, the chip company forecasts operating expenses still reaching $17.5 billion in 2025 despite all the employee cuts. The company seems to be scurrying around to reset the business, but Intel still doesn’t have the product issue resolved, and the company cutting spending doesn’t appear to tie in with the opportunity ahead in AI.

If Intel was forecasting strong sales from 18A technology, the company could move full-speed ahead with the existing employee base and focus on efficiency to get the most out of growing sales. The reality is that Taiwan Semiconductor Manufacturing Company Limited (TSM) plans to spend over $30 billion on capex in 2025 and Intel is only spending the equivalent of ~$20 billion, with some sales and profits assigned to partners.

Takeaway

The key investor takeaway is that Intel is rallying slightly on some better than feared results, but the company hasn’t solved any of the fundamental issues. The chip company isn’t growing and is cutting expenses at a time with AI demand is pushing the industry toward massive sales growth.

Investors should continue to avoid the stock and sell any rips for those still owning Intel with a market cap up at nearly $100 billion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.