Summary:

- Intel’s top investment of 2023 is due to increased demand for computing in the artificial intelligence wave.

- Strong performance in Q4 with revenue of over $15 billion exceeded expectations.

- Intel’s outlook for the current quarter shows incredible growth YoY, especially in gross margin and EPS.

Justin Sullivan

Intel Corporation (NASDAQ:INTC) was our top investment of 2023, outperforming the market by a significant margin. The artificial intelligence wave has substantially expanded demand for computing, and Intel has been able to take advantage of that surge in demand. At the same time, the company has been growing from a weak point in its reputation and strength, as it continues to chase 5N4Y.

Still the company was recently dealt a massive blow, with China blocking the use of Intel and AMD processors in government computers. Intel continues to make a substantial percent of its revenue from China. As we’ll see throughout this article, the company’s performance on its goals and assets support long-term shareholder returns.

Intel Overview

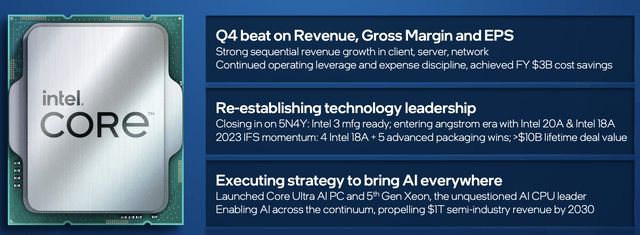

The company had relatively strong performance for the 4Q, beating expectations across the board.

The company has seen segments perform better than expected. It’s also continued to achieve strong cost savings. The announcement also recently came through that the company would receive $8.5 billion in Chips Act founding, the largest recipient, which is something that will dramatically help the company’s competitiveness going forward.

The company is closing in on 5N4Y. Intel 3 is manufacturing ready and the company is entering the manufacturing era. It’s worth noting that none of these numbers actually refer to physical numbers on the chips anymore. Regardless, it’s still impressive. TSMC has said that its 3 nm node will be ahead of Intel 18A, but that remains to be seen.

Still Intel has some important design wins such as backside power delivery. The company is working to bring artificial intelligence to the masses and it has one competitive advantage no one else does as the only company producing its own silicon that’s then sold directly to customers.

Intel Q4 Financial Highlight

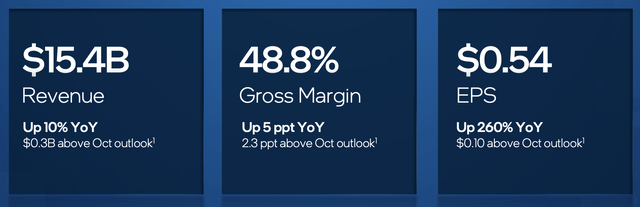

This highlights the nuances of the end of the year earnings, which came out arounds 2 months ago.

The company saw more than $15 billion in revenue, up 10% YoY, and ~2% above the company’s October outlook. The company is seeing an almost 50% gross margin, a staggering 2.3% above the Oct outlook, and up 5% YoY. The company’s quarterly EPS was $0.54 also dramatically above the outlook, supporting by the company’s strong margins.

The company’s strong earnings here keeps its P/E at ~20 a relatively modest level that can continue growing.

Intel Segment Performance

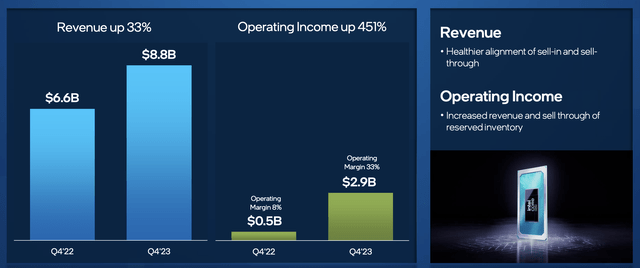

The company’s client and consumer business continues to be its strongest with a strong recovery in revenue supporting even stronger recovery in margins and operating income.

The company saw almost $3 billion in operating income as operating margins more than quadrupled. The company’s revenue was up 33%, as what was a massive amount of excess inventory in the market has declined. That means that there’s been a higher alignment of the company seeing demand for the processors that it manufacturers.

Still this remains a volatile segment, and one that we expect to be heavily affected (by a yet to be announced amount) from the Chinese government announcement. It’s not particularly surprising, we expect the Chinese government to continue to ban products that it can make at home as it fights a continued trade war with the United States.

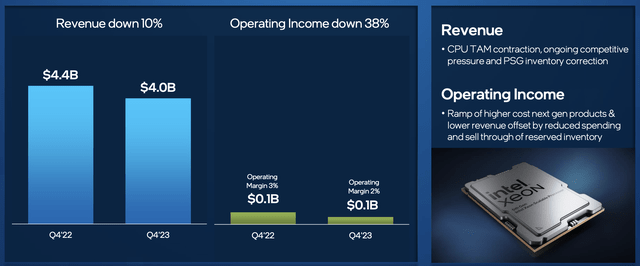

The company’s datacenter segment has seen revenue decline, but operating margin remain reasonable. The company has seen the high-end CPU server market contract in the face of continued GPU and server demand. However, the company has built a new Gaudi3 chip to compete with the H100 from Nvidia and other major AI processors.

The chip is competitive by speed and with Intel having its own cloud, it’s definitely price competitive. More importantly, unlike AMD or other cloud companies getting their start, Intel has an incredibly entrenched relationship with large server and cloud operators. That will make it much easier for the company to ramp up the GPU.

Intel Outlook

The company’s outlook for the current quarter is less than the year-end madness, but still incredibly strong YoY, especially if the company can beat guidance again.

The company is expecting ~$12.6 billion in revenue with 44.5% in gross margin and $0.13 in EPS. Those last two numbers are incredible growth YoY. The chip business has incredibly high fixed expenses, and that means that a small increase in revenue can lead to much faster increase in margins and EPS.

That outlook is strong. However, what we’ll be looking much closer at is the launch and long-term success of the Gaudi 3 and other artificial intelligence efforts from the company.

Thesis Risk

The largest risk to our thesis is two-fold. The first is that the company manufactures its own silicon. It plans to use TSMC for certain tiles to minimize that risk, however, it needs to show a continued ability, with the massive capital expense, to compete.

The second is that the company needs to turn consumer dominance, and democratized chip production with TSMC, into an ability to continue dominating. It needs to deliver artificial intelligence solutions to customers.

Conclusion

Intel has had another negative announcement over its head, with China banning Intel and AMD in government computers. That comes a few days after a success, with the announcement from the U.S. government that it would be giving $8.5 billion to Intel as part of the U.S. Chips Act. Overall, the company is continuing to use its expertise to outperform.

We expect the company’s earnings to remain strong. The company is recovering year over year and profits continue to remain strong. The company’s Gaudi 3 processor is exciting, but the company needs to show an ability to get it into the hands of customers and meet demand. And it needs to do it while dominating at chip manufacturing.

That remains to be seen. Still we remain long, let us know your thoughts in the comments below!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.