Summary:

- Micron Technology is poised to benefit from the growing demand for AI infrastructure on top of the upswing in legacy servers.

- The company’s advanced memory and storage chips are in high demand, with 2024 HBM chips already sold out and 2025 nearing capacity.

- HBM3E is expected to start being accretive in e2h24 as manufacturing scales. This growth should persist as more firms adopt AI infrastructure in the years ahead.

gorodenkoff

Micron Technology (NASDAQ:MU) is currently in the beginning phases of the next megatrend in AI infrastructure that is anticipated to experience significant growth over the coming years. As the supply capacity for GPUs loosens going into CY25, I anticipate strong tailwinds for Micron’s chips. 2024 HBM chips are already sold out and 2025 are nearing capacity. I believe this strength in demand will be strongly reflected in pricing strength for NAND and DRAM and will create a strong tailwind for revenue growth and margin expansion. I provide MU shares a BUY recommendation with a price target of $197.77/share at eFY25 EV/aEBITDA.

Macroeconomic Rationale

Overarching investment thesis: AI will be a major market driver for years to come as corporate use cases are uncovered, driven by software firms like Palantir (PLTR). I believe that this will push for greater expansion of regional data centers driven by firms like Oracle (ORCL), which in turn will drive the demand for infrastructure supplied by firms like Hewlett Packard Enterprise (HPE), Dell Technologies (DELL), and Super Micro Computer (SMCI). As demand for servers picks up, semiconductor designers and manufacturers will benefit from the upswing in demand as the backlogs of the above-mentioned firms grow. It has become clear that the bottleneck is derived from the semiconductor manufacturing side as this level of demand for Nvidia (NVDA) GPUs was not necessarily anticipated. As Taiwan Semiconductor (TSM) expands their manufacturing capacity, I believe the industry will slingshot into hypergrowth. My thesis for Micron is that once the GPU capacity is resolved, demand for Micron’s advanced memory and storage will accelerate beyond the current state. With eFY24 capacity sold out and much of eFY25 capacity being spoken for, I believe Micron has significant upside potential in both supplying these critical chips and the ability to price in this heightened demand.

Micron Operations

Micron is experiencing a significant revival of their memory chip business as the end market turns to leveraging more advanced performance accelerators that require more memory. As companies turn to utilizing AI in the workplace, requirements for semiconductors will become more sophisticated for executing these more advanced functions. Considering that we are still in the early stages of AI adoption across the corporate environment, I believe Micron has entered a new memory chip bull wave that will be realized going into CY25. This turn to more advanced infrastructure will drive growth in Micro’s HBM3E, DDR5, and data center SSD chips.

The most common theme amongst tech executives is production bottlenecks and the inability to acquire an adequate supply of GPUs. This can be seen across infrastructure integrators like Dell Technologies, Hewlett Packard Enterprise, and Super Micro Computer who each are experiencing strength in demand for their next-generation server infrastructure. Micron’s growth trajectory falls within the mix as AI-enabling infrastructure is primarily being placed into backlog as GPUs remain in tight supply. I believe that there will be a major ramp-up in CY2h24/1h25 as advanced chip manufacturers are anticipated to increase manufacturing capacity for these chips. As outlined in my report covering Nvidia, Taiwan Semiconductor will be doubling their CoWoS capacity by the end of CY24, which should allow for improved supply chains in building these advanced servers. I believe we will experience a cascading effect once this capacity comes online.

I believe one of the driving factors in Micron’s growth in eFY25 will be the adoption of their higher silicon-content chips, the HBM3E, across data center servers as this chip reduces power demand by 30% with higher capacity rates. This higher performance storage chip will be utilized in Nvidia’s Blackwell GPU, which has a 33% higher HBM attach rate. Given the growth in backlog seen through HPE and Dell, it’s prevalent that there is strong demand for this level of infrastructure. Accordingly, management at Dell recently reported sequential improvements to their legacy server business, which should create some tailwinds for Micron’s DRAM and SSP. Micron management did mention that the firm is experiencing tailwinds in cloud infrastructure as the firm experiences sequential record new peaks for SSD. I believe that as legacy server sales pick up across the infrastructure integrators, Micron should experience some uplift as a result of inventory drawdown. This can also push up prices for DRAM and NAND chips if the industry can remain disciplined.

In terms of edge compute, I believe forecasts may be overstated for CY24 as cost-cutting efforts take effect. According to Gartner’s 2024 IT spend forecast, CIOs surveyed anticipate most IT-related projects to be focused on cost control. The survey also suggested that the use of GenAI in the workplace will likely not take hold until 2025. With this in mind, I anticipate a cascading effect in IT spend starting with a ramp-up in servers in CY24 through 1h25 and further as GPU capacity becomes more available, followed by investments in higher gig-rate networking equipment, and finally investments in edge AI-enabled workstations. My thesis is predicated on the notion that there isn’t much use for higher-powered workstations if they aren’t fully being utilized due to the lack of the back-end infrastructure and data in transit. With these assumptions, I believe AI at the edge will ramp up in later 2025 or 2026. Given the rapid pace of evolution across the AI/ML space, I believe organizations will opt to delay investing in edge compute as early iterations may be phased out or replaced faster than one might anticipate.

The other half of my investment thesis is consumer vs. corporate. I believe consumer spending in the next-generation AI-enabled PCs, laptops, and smartphones will not see a large ramp-up until mid-2025 as consumers are faced with heightened inflationary pressures that are driving up the cost of living. I believe consumers may delay their refresh cycle or wait for future iterations for the same reasons as listed above. As mentioned in my report covering Broadcom (AVGO), I anticipate consumer devices to remain relatively flat throughout CY24 as a result of these inflationary pressures.

Overall, I believe the qualitative story aligns to benefit Micron in the coming years, assuming that demand for AI infrastructure continues to experience growing demand. As more industries move into developing LLMs and neural networks for aggregating massive amounts of data to optimize operations, I believe that what we have seen is just a drop in the bucket in terms of growth.

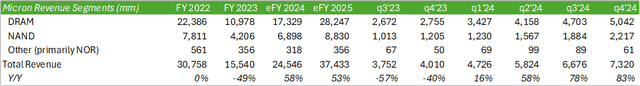

Looking ahead to eFY24, management is very optimistic in terms of growth and pricing. As the supply/demand narrative becomes more balanced, Micron should have the flexibility to price up NAND and DRAM. This will partially be driven by the offsetting production effects of manufacturing the higher capacity chips as manufacturing capacity is relatively limited. Building a forecast for financials, I do not expect HBM to reach economies of scale until late 2024-to-early-2025. Management anticipates data center server shipments to grow by mid-to-high single digits in CY24 as traditional servers return to growth. As mentioned above, I anticipate AI servers to be a slow burn throughout 2024 and I expect sales for these servers to pick up throughout 2025 as GPUs remain in tight supply. This will be driven by Taiwan Semiconductor increasing their CoWoS capacity towards the end of 2024. As we get closer to the ramp-up phase, I anticipate HBM3E to pick up significantly as the product will be a part of Nvidia’s H200 Tensor Core GPUs.

As for automotive and industrials, I believe these two segments will be a mixed bag as Marvell Technology (MRVL) voiced headwinds in industrials with strength in automotive. Even in a flat automotive sales market, I believe Micron will still have the ability to realize growth as vehicle ADAS systems and infotainment systems become more advanced and require more chips to function.

As for operations, I anticipate Micron to experience a gradual upswing in margins throughout the duration of eFY24 and significant strength in eFY25 as advanced nodes scale. I anticipate adjusted free cash flow to be near breakeven for eFY24 and significant growth in eFY25 as a result of high demand and operational scale for their advanced server chips. I believe that eFY25 will be a strong year for Micron as all operating segments, including edge devices, data center, and automotive to bring in positive cash flow for the company.

Valuation & Shareholder Value

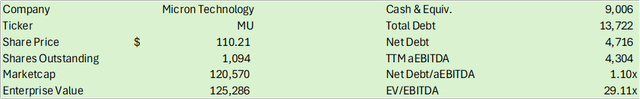

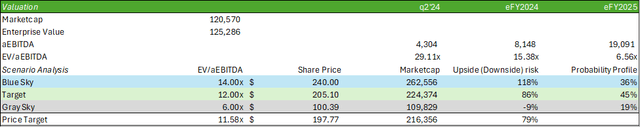

MU shares are currently trading at a mid-cycle 29.11x EV/aEBITDA which should price into the valuation as the firm’s margins reflects the forecasted growth in the coming years. I anticipate MU’s valuation to normalize during this period while simultaneously experiencing significant share appreciation.

Considering multiple scenarios for share price trajectory, I believe 12x EV/aEBITDA is a strong midpoint for shares as the firm goes through its upcycle. For the blue-sky scenario to occur, I believe Micron will need to experience significantly higher-than-anticipated growth predicated on AI infrastructure demand. Though this scenario is perfectly feasible, growth will be determined by exogenous effects primarily resulting from capacity debottlenecking. The gray-sky scenario will be the result of these bottlenecks not resolving as quickly as anticipated, leading to a build-up in inventory which may result in softer NAND and DRAM pricing and a softer upswing. Geopolitical is a risk factor to consider as tensions between China and Taiwan remain heightened. This may result in tighter GPU supply which can trickle into capacity demand for Micron’s memory and storage chips. Overall, I am bullish on MU and anticipate the upswing to continue throughout the cycle. I provide MU shares a BUY recommendation with a price target of $197.77/share at 11.58x eFY25 EV/aEBITDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.