Summary:

- Intel reported terrible quarterly results, but from a technical point of view, I see the stock well supported around $25.

- With free cash flow being negative right now, there seems to be the risk of Intel cutting the dividend.

- Although we should not ignore the short-term headwinds, Intel seems to be deeply undervalued.

Justin Sullivan

Last week, Intel (NASDAQ:INTC) reported its full year results for fiscal 2022 as well as results for the fourth quarter – and results were terrible. It is probably an exception that the CEO admits how terrible the results are, but Pat Gelsinger kicked off the earnings call with the following statement:

We made meaningful progress on several fronts in calendar year 2022, notwithstanding all the challenges, but we readily admit our results and our Q1 guidance are below what we expect of ourselves. We are working diligently to address the challenges brought on by current demand trends and remain confident in our long-term plans and trajectory.

In the following article we will look at the annual results in more detail and analyze the implications the results will have. And when looking at the articles that were published immediately after earnings were released, the verdict of Seeking Alpha contributors was clear: Sell the stock! In the meantime, we already saw some bullish articles and in the following article I will also take the contrarian role once again and argue that Intel is a solid long-term investment. I will also look at the safety of the dividend, but we will start by looking at the downside risk the stock might have in the short-term.

Technical Picture

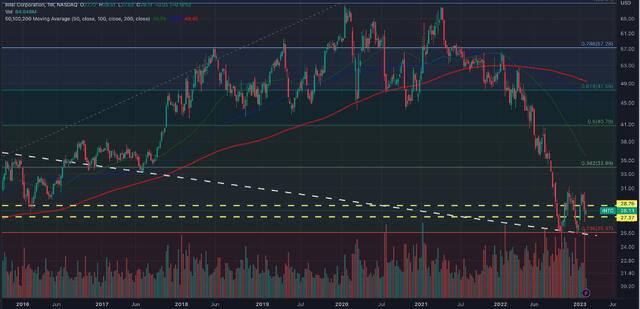

Similar to many other contributors I was (or I am) also bearish after earnings. However, I don’t see such a huge downside risk for the stock due to technical reasons. In my last article about Intel, I already talked about the strong support level we can find around $25. And in the weeks after the article was published the stock declined to that support level, which held so far. The stock bounced off that support levels twice and I am still confident the support level will hold once again. This is such a strong support level as we are not only finding previous lows and highs as well as the 23.6% Fibonacci retracement, but also a declining trendline, which has been in place since 2000 (white line).

Weekly Chart Intel (TradingView)

From the pre-earnings stock price of $30 I see a downside risk of 15% to 20% but expect the stock to find a bottom around $25. On the other hand, if Intel should break that trendline, I would see that as very problematic, and the stock might decline at least to $19 and maybe even lower as there are hardly any support levels which can be found in the chart.

Dividend

Another issue that might be problematic is the dividend. Management declared a quarterly cash dividend of $0.365 per share for the first quarter of fiscal 2023 – in line with the dividend in the previous four quarters. According to the pattern in the last few years, one could have expected a raise this quarter. Instead, during the earnings call the question was raised how stable the dividend is and if investors should expect a dividend cut. When asked about the dividend, CFO David Zinsner made the following statement:

Yes. Well, obviously, we announced a $0.365 dividend for the first quarter. That was consistent with the last quarter’s dividend. I’d just say the Board, management, we take a very disciplined approach to the capital allocation strategy, and we’re going to remain committed to being very prudent around how we allocate capital for the owners. And we are committed to maintaining a competitive dividend.

Now one can ask what a competitive dividend is. We could interpret the statement in a way that Intel is committed to keeping the dividend stable. But we could also interpret the statement in a way that Intel is aiming to have a similar dividend yield as its peers and most of the company’s peers have a much lower dividend yield.

On the other hand, it would be very weird if management is determining its dividend by looking at the dividend yield (compared to peers) as the high dividend yield of Intel is rather the result of the steeply declining share price and not because Intel raised the dividend so aggressive in the last few years.

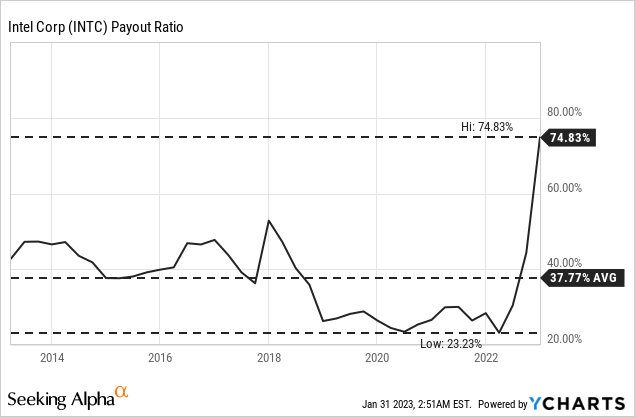

In fiscal 2022, the company had to pay $5,997 million in dividends. However, in fiscal 2022, the free cash flow of Intel was negative, and it probably would have been wise not to pay a dividend at all. When comparing the dividend of $1.46 to earnings per share of $1.94 in fiscal 2022, we get a payout ratio of 75% which is rather high. In the past ten years, the payout ratio was about 38% and in almost every quarter below 50%.

To be honest, I don’t have a clear opinion about Intel’s dividend. In general, I don’t want management to stick too hard to a dividend (and especially not to fight for the status of a dividend aristocrat at all costs). In the case of Intel, I would expect 2023 to be similarly difficult as Intel will continue to have extraordinarily high capital expenditures. But as long as the free cash flow improves again in fiscal 2024, Intel could probably maintain its dividend at current levels.

Balance Sheet

One could also argue that Intel has enough liquid assets on its balance sheet to finance the dividend. And with $11,144 million in cash and cash equivalents as well as $17,194 million short-term investments on December 31, 2022, the dividend is easily covered. However, it is a really bad idea to pay the dividend with cash from the balance sheet in my view.

Especially as Intel also has $4,367 million in short-term debt as well as $37,684 million in long-term debt on its balance sheet. When comparing the total debt to the shareholder’s equity of $103,286 million, we get an acceptable debt-equity ratio of 0.41. When comparing the total debt to the operating income of fiscal 2022, it would take 18 years to repay the outstanding debt. In my opinion, it is rather nonsensical to use the operating income from 2022 as it was exceptional low, and it seems rather unlikely for Intel to be able to generate only such a low operating income in the years to come.

And of course, Intel can use its $28.3 billion in liquid assets to reduce the debt levels and this would be enough to repay two thirds of its outstanding debt. When looking at $18 billion in operating income Intel could generate on average in the last few years, it would take only a little over two years to repay the outstanding debt (not using liquid reserves) which is acceptable.

Annual Results

The reason why we must ask these questions about the downside risk of the stock and the stability of the dividend are the horrible results Intel reported for fiscal 2022 and the fourth quarter. Intel missed expectations for earnings per share as well as revenue and the fourth quarter was a huge disappointment.

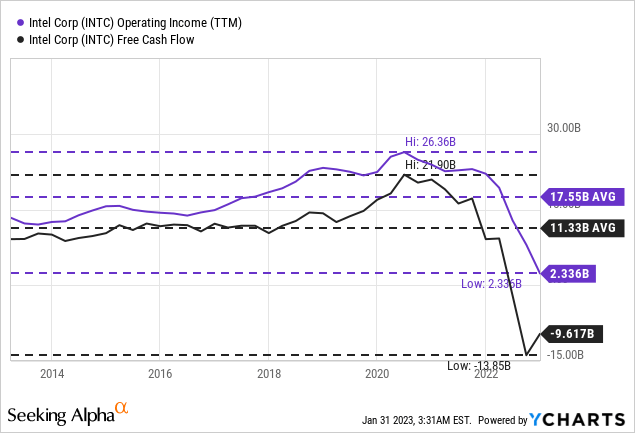

For the full year, Intel reported an annual revenue of $63,054 million and compared to $79,024 million in the previous year this reflects a top line decline of 20.2% year-over-year. Operating income declined even steeper and instead of $19,456 million in fiscal 2021, the company had to report an operating income of $2,334 million – 88.0% lower than the year before. Due to higher gains on equity investments ($4,268 million in fiscal 2022 compared to $2,729 million in fiscal 2021), net income did not decline as steep as operating income. Nevertheless, diluted earnings per share declined 60.0% from $4.86 in the previous year to $1.94 in fiscal 2022. And the adjusted free cash flow for fiscal 2022 was a negative amount of $4,075 million.

When looking at the different segments, we get a mixed picture with some segments reporting great numbers. However, the two segments which are contributing the biggest part of revenue (and especially the biggest part of operating income) had to report a steep decline.

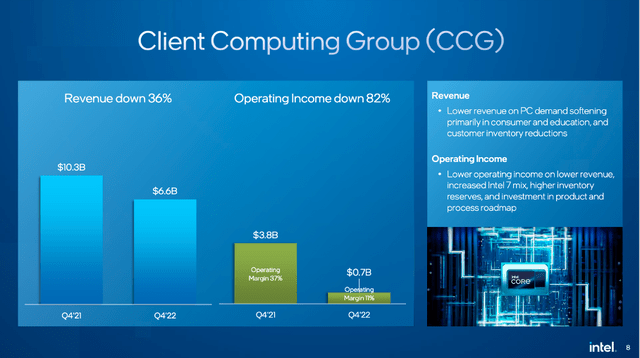

CCG (Client Computing Group), which is responsible for the biggest part of revenue and operating income reported steep declines. In fiscal 2022, revenue declined 22.8% year-over-year to $31,708 million and in the fourth quarter revenue declined even 35.7% YoY to $6,625 million. Operating income for the full year declined 60.0% YoY to $6,266 million and 81.6% YoY in the fourth quarter to $699 million.

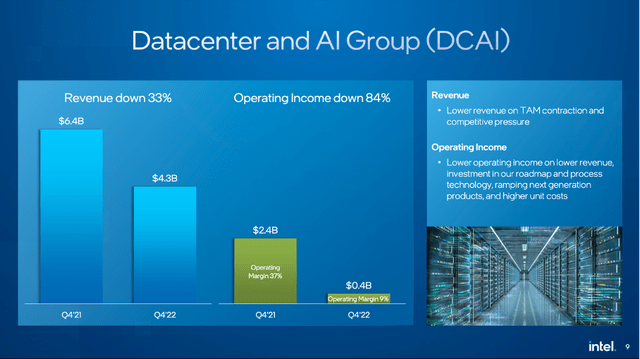

The second major segment, which is responsible for a huge part of revenue is DCAI (Data Center and AI Group). And for the full year, revenue declined “only” 15.4% YoY to $19,196 million while revenue in the fourth quarter of fiscal 2022 declined 33.0% YoY to $4,304 million. Operating income declined even steeper – 72.9% in fiscal 2022 to $2,288 million and 84.2% YoY in the fourth quarter to $371 million.

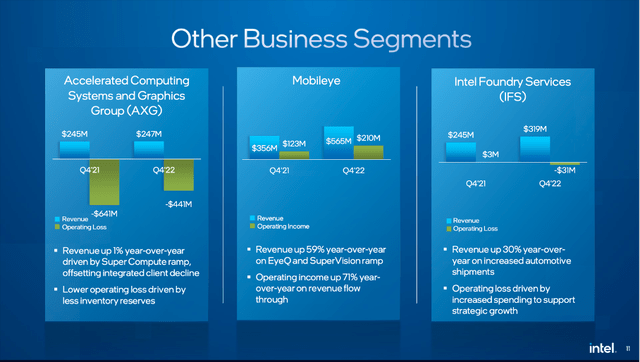

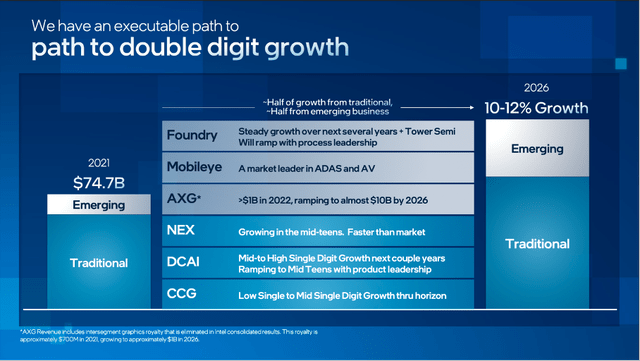

While Intel’s traditional business is struggling, the emerging segments are still increasing and could report solid growth. Especially its Mobileye business segment, which reported high growth rates – 34.8% YoY growth for revenue and operating income increased 24.5% YoY to $690 million. Intel Foundry Services also increased revenue from $786 million in FY 21 to $895 million in FY22, but the segment also reported an operating loss of $320 million.

Guidance, Outlook, Growth

Due to increased macroeconomic uncertainties, Intel is not providing an outlook for full year 2023, but an outlook for the first quarter of fiscal 2023. However, the guidance is not great and during the earnings call, the following statement was made by Pat Gelsinger:

First, on the macro. We expect macro weakness to persist at least through the first half of the year with the possibility of second half improvements. However, given the uncertainty in the current environment, we are not going to provide revenue guidance beyond Q1. Dave will provide guidelines for capital spending, depreciation and adjusted free cash flow in his prepared comments.

And for the full year of fiscal 2023, analysts are expecting lower revenue as well as lower earnings per share. While revenue is expected to decline about 8% to a consensus of $58.14 billion, earnings per share are expected to decline about 11% to $1.64. We all know that semiconductor companies are operating in a cyclical industry and therefore we should not be surprised when cyclicality hits again. In my opinion, we are headed towards a global recession and semiconductor companies are hit in such a scenario.

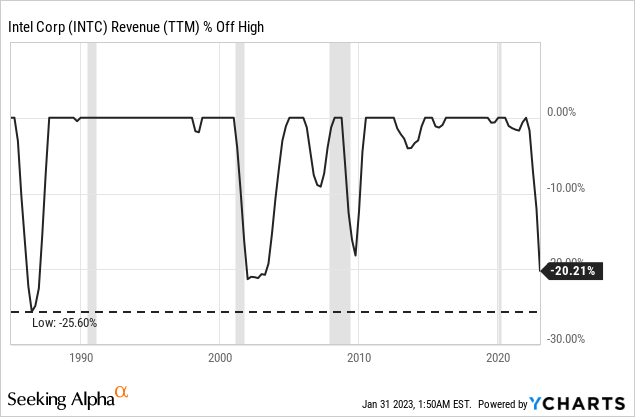

When looking at past results, revenue declined 18% during the Great Financial Crisis and in the years following the Dotcom bubble, revenue declined 21%. In the 1980s, revenue even declined by 26% and why should it be different this time? So far, revenue has declined 20.21% and we are therefore in line with previous recessions.

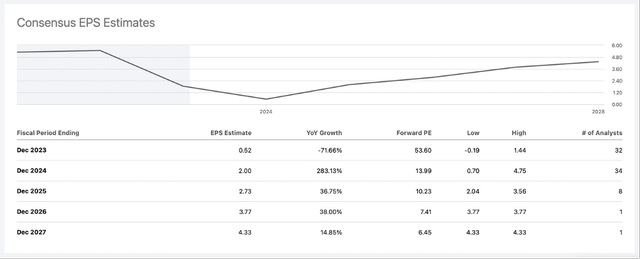

Intel EPS Estimates (Seeking Alpha)

While analysts are expecting a challenging year in 2023, they are optimistic for the years following 2023 and are expecting high growth rates again. But despite these high growth expectations, Intel likely won’t reach its previous EPS until fiscal 2026 (at least according to analysts).

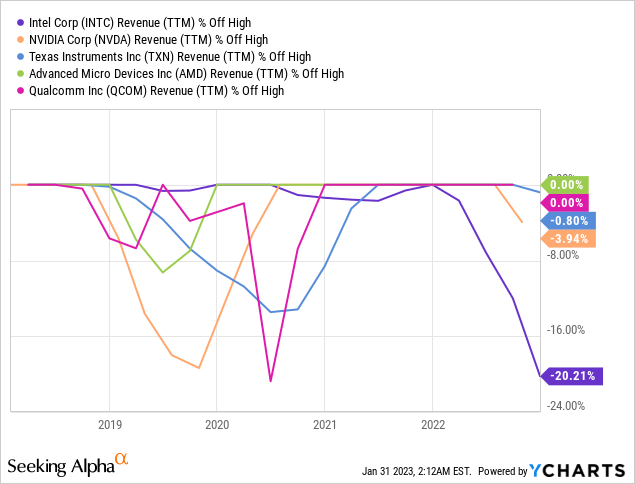

Macro headwinds are certainly contributing to Intel’s weak performance, but that can only be part of the explanation. When looking at competitors and other semiconductor companies we also see struggling businesses, but Intel was hit particularly hard. Advanced Micro Devices (AMD) or Texas Instruments (TXN) were reporting much better numbers. The bottom line (especially the negative free cash flow) can be explained by high capital expenditures, but the top line is clearly showing a weakening demand.

Intel is hit hard due to the combination of a declining demand and investing heavily which is leading to high capital expenditures. However, I am still confident these short-term problems can be resolved, and the investments Intel is making right now will contribute to high revenue growth and without these extremely high capital expenditures, the company can generate billions of free cash flow again in a few years from now.

Intrinsic Value Calculation

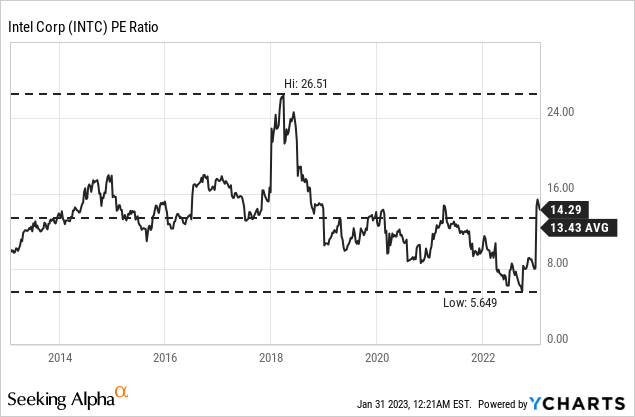

When trying to determine an intrinsic value for Intel and talking about valuation, we can start by looking at the price-free-cash-flow ratio. However, as Intel reported a negative free cash flow, we can’t use this metric right now. On the other hand, we can look at the price-earnings ratio. Right now, Intel is trading for 14.3 times earnings, which is a lot higher than the P/E ratio of 6 for which Intel was trading a few months ago. Intel is now trading slightly above the 10-year average (13.43), but the P/E ratio still seems reasonable.

And while we can look at simple valuation metrics for first hints, using a discounted cash flow calculation seems a better way to determine an intrinsic value. In past articles, I calculated an intrinsic value of $65 for Intel. Let’s provide an update to that calculation, but – spoilers – we will reach a similar intrinsic value for Intel (even when using conservative assumptions).

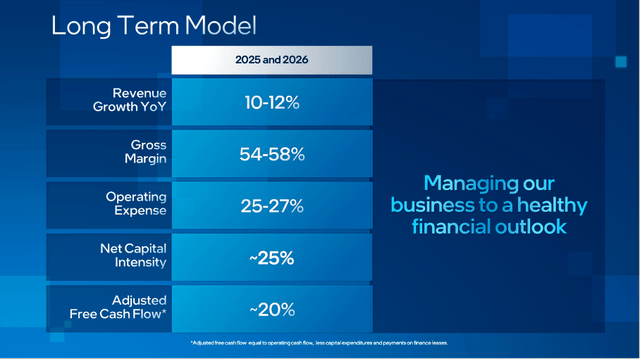

When looking at the last Investor Day in 2022, management was optimistic for the mid-to-long term future (while already acknowledging some tough years ahead). I honestly don’t know if management is still so optimistic about the years 2025 or 2026. Let’s also be cautious and assume the company will not reach its adjusted free cash flow target of 20% before 2027 and let’s also assume Intel will reach $100 billion in revenue in 2027 (an assumption that seems neither too conservative nor too optimistic). For 2023 we assume $0 free cash flow and in the following three years we assume free cash flow gradually improving ($5 billion in 2024, $10 billion in 2025 and $15 billion in 2026).

And let’s also be cautious and assume only 4% growth for the years following 2027 (way below Intel’s ambitious goal of double-digit growth). When calculating with these assumptions, we get an intrinsic value of $60.38 for Intel resulting in about 120% upside potential for the stock.

Conclusion

When you read the headline, you probably thought I am insane. But in my opinion, Intel should be trading at least for $60. And I mentioned that patience is required as Intel won’t reach such a stock price in a few weeks or months. Considering the current struggles of the business, I can understand that investors are not willing to ascribe a higher valuation multiple to Intel.

However, investors should be forward thinking and try to anticipate the future. And in my opinion, it is reasonable to bet on Intel improving again in the years to come and building on this premise, the current share price is not justified. Of course, I am not ignoring the risk of a global recession and that semiconductor companies – like Intel – are hit hard in such a scenario. But in my opinion, this is already priced in and for about $25 Intel actually seems to be a bargain (despite some challenging quarters ahead).

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.