Netflix Shares Are 30% Overvalued

Summary:

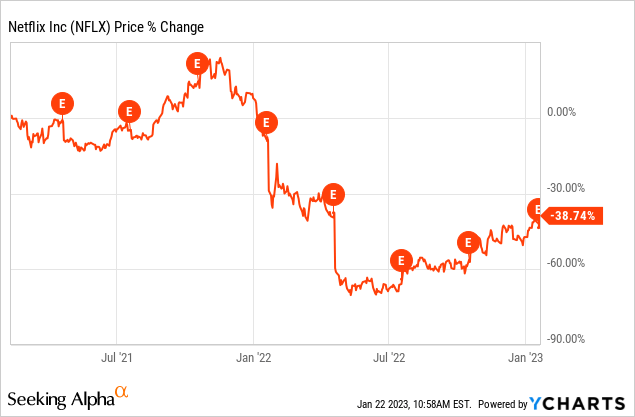

- Netflix, Inc. share price recovered losses after a Q2 2022 tumble as the company posted better-than-expected net adds in Q4 2022 and climbed back to $360.

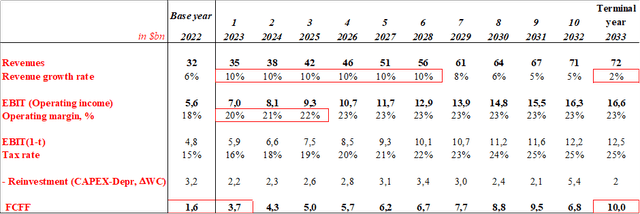

- Netflix management targets double-digit revenues growth and attractive operating margin above 20%, while generating free cash flow for investors going forward.

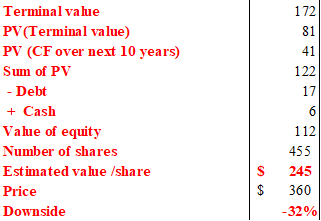

- Even with these optimistic assumptions, the Netflix, Inc. estimated fair share value lies at $245 according to our discounted cash flow model. Every 50bps interest rate hike wipes out $25 in Netflix value per share.

lcva2/iStock Editorial via Getty Images

In our previous article “Netflix: The Case For $600 Share Price,” we laid down the assumptions of what would justify $600 as a fair share value for Netflix, Inc. (NASDAQ:NFLX). The company had to sustain double-digit subscriber growth coupled with margin expansion to defend its share price.

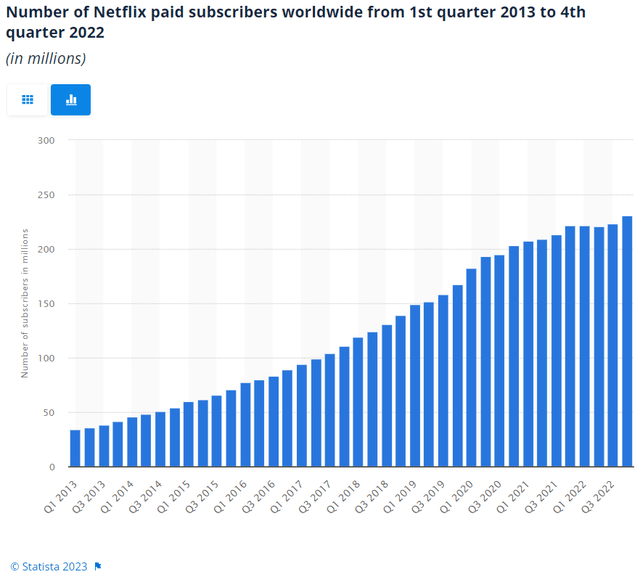

A year later, the Netflix share price crumbled, as the company failed to keep up with its COVID growth rate and the number of members actually declined for the first time.

Netflix subscribers (Statista)

Investors were disappointed by the Q3 22 quarterly results as well, and the share price lost another 50% in January 2022, falling from $350 to $175.

Since then, Netflix share price has recovered from the second drop after the company posted better-than-expected net adds in Q4 22.

In a way, we are back to square one with Netflix – the company found new ways to grow, such as ads revenue, and is planning put the end to shared membership.

In the Q4 ’22 Shareholder Letter, Netflix management stated its determination to the following goals:

Our long term financial objectives remain unchanged – sustain double digit revenue growth, expand operating margin and deliver growing positive free cash flow.

No doubt, these goals pour honey into investors’ ears, and if in years before the main question was whether Netflix can become cash flow positive, now the major concern is around growth.

Strategic Changes at Netflix

There have been plenty of changes in Netflix strategy in the past year and there will be more coming in the next quarters. Apart from the price increase at the beginning of 2022, the company has introduced accounts with ads (and a lower membership price) in November 2022.

We believe branded television advertising is a substantial long term incremental revenue and profit opportunity for Netflix.

Netflix is also working on gamification, where about 50 games are available on mobile app. The company has acquired four game studios and is determined to expand their offering in this segment.

As a next step, in Q1 ’23 Netflix will introduce paid shared accounts, which might lead to some cancellations short-term, but the company hopes for a gradual membership increase long-term.

Speaking of members, Netflix no longer focuses on membership net additions and stopped giving guidance, probably due to the fact that company’s business model is more nuanced now. Revenue and revenues growth is the new key metric for company’s management going forward.

Serviceable Addressable Market (SAM) Update

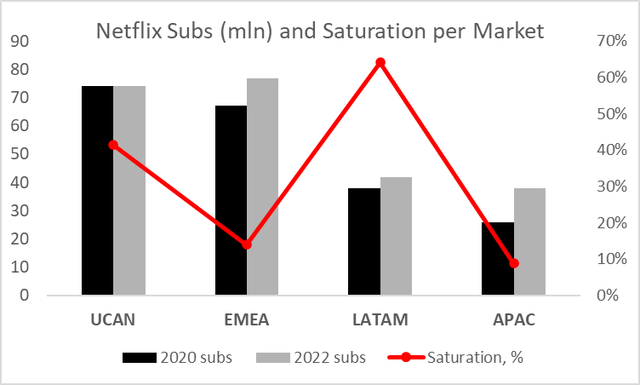

Netflix added virtually no members in UCAN region in the past two years, whereas its member count in APAC jumped by 50% from 25m at the end of 2020 to 38m at the end of 2022, probably not least due to the success of the Squid Game series in 2021.

Its APAC member base still represents only about 8% of Netflix’ estimated serviceable addressable market (SAM), suggesting that the platform still has ample room for growth.

At the same time, average revenue per membership in APAC region is only half of that in the UCAN region and has been falling in the past year due to the strengthening of the U.S. dollar. All in all, we still see great potential in APAC region for Netflix.

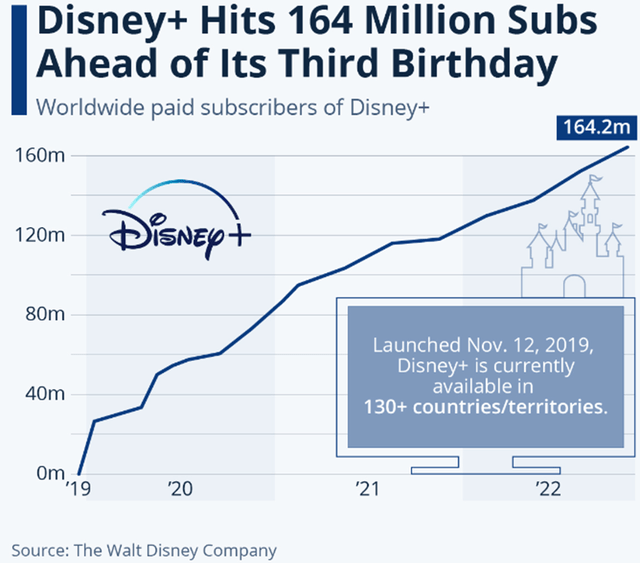

About a third of Netflix 231m paid members are based in the US, where the competition is breathing down Netflix’ neck with Disney+(DIS) reaching 164m in subs in in November 2022, less than three years after its launch.

Therefore, we see the U.S. market as quite saturated and not a major driver of Netflix’ double-digit growth in the future.

Netflix Discounted Cash Flow (DCF) Model Update

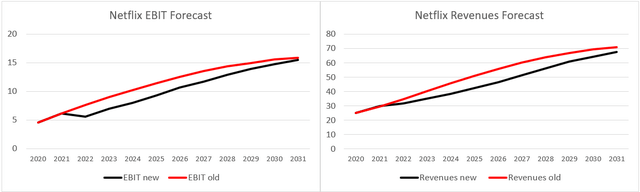

When we looked at our assumptions from two years ago, we noticed that they do not significantly differ from our current assumptions. Netflix is still expected to reach about $70bn in Revenues by 2031 and generate about $17bn in EBIT.

Our current forecast incorporates actual numbers for 2022 and assumes a slightly higher average growth rate (10%) to come up with the same results at year 10. Both models project free cash flow (“FCF”) of about $10bn in year 10, which is basically one of the most important parameters in determining company’s value (about 70%-80%, depending on the discount rate).

So are Netflix shares still worth $600? Unfortunately not.

Discount Rate Elephant in DCF Room

In our previous model, we used an unusually low discount rate of 4.7%, due to the at-that-time low risk free rate and low beta of NFLX stock. However, current 10-year treasury bonds rate stands at 3.5%, more than 2% higher than at the time of our previous valuation. This is a result of the FED policy to increase the Fed Funds rate to fight inflation. Every 50bps increase in interest rates translates into $25 drop in fair value for Netflix shares.

As for the beta of NFLX stock, after the dramatic NFLX share price movements in 2022, Netflix cannot be considered a low-beta stock anymore. We use beta of 1 in our current valuation (up from 0.83 in our previous).

As a result, weighted average cost of capital (WACC) went up to 7.8% from 4.7% two years ago and the estimated fair value per share currently stands at $245, offering a 32% discount to the current share price.

Author

Sensitivity Analysis

WACC: If we change the discount rate (WACC) to 6.5%, which is only 3% above the 10-year treasury bond rate, fair share price would increase to $333, which is close to the current share price. WACC of 8.5% would warrant $213 in estimated fair share value.

Revenue growth: Management promises double digit growth, however, should Netflix achieve only 6% revenues growth in the next seven years, its estimated fair share value would drop to $206.

As you can see, Netflix fair share value has a number of assumptions, with significant downward risk and not so much upside potential.

Conclusion

Netflix, Inc. shares are not worth $600 anymore, not only because of softer growth, but also due to higher required return. Our updated DCF model with 7.8% required return suggests a fair share value for Netflix, Inc. of $245.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Maximize your income with the world’s highest-quality dividend investments.