Summary:

- Intel stock has surged recently due to positive developments, including an expanded partnership with Amazon AWS.

- Despite Intel’s CapEx-heavy, free-cash-flow-negative status, its valuation offers upside potential, making INTC stock a Buy.

- Intel aims for positive adjusted free cash flow by 2025, improving liquidity and reducing leverage through strategic measures.

- Intel’s turnaround efforts show promise, but significant work remains to transform it into an excellent company.

JHVEPhoto

I never thought I’d be writing a bullish article on Intel (NASDAQ:INTC), but I guess any stock can be worth buying at the right price. Intel gained 6.4% on September 16 and another 8% in after-hours trading to a price of $22.58 after some positive developments. In this article, I’ll go over these developments and how they affect the investment thesis. I’ll also go over what I don’t like about the business and then talk about its valuation, which is the part that makes me bullish.

Overall, Intel isn’t what I would consider to be an excellent company. Sure, it’s showing some promise in its turnaround efforts, particularly via its strategic partnership with Amazon’s (AMZN) AWS, but there’s still a lot of work to be done.

Currently, Intel remains a CapEx-heavy, free-cash-flow-negative business (not referring to adjusted free cash flow) with a lot to prove. However, the valuation is its saving grace. I believe the stock’s discount to its book value per share, along with a potential increase in book value over the years, gives it upside potential. Therefore, I rate INTC stock as a Buy.

Why Intel Stock Is Rising

The main reasons that Intel stock is seeing momentum are the new funding it received and the AWS deal, but we’ll go over all the recent developments, as they’re also relevant.

Intel Receives More Funding

First, Intel gained 6.4% on September 16 after news that it will receive “up to $3B in direct funding under the CHIPS and Science Act for the Secure Enclave program.” The Secure Enclave program is centered around initiatives for the U.S. Department of Defense. This is on top of the $8.5 billion that the firm will be given (announced in March) under the CHIPS and Science Act.

Clearly, the government is willing to consistently give direct funds to Intel, and it can potentially receive even more funding in the future at this rate.

Then, in after-hours trading, the stock gained 8%. Why was that? It was because Intel’s CEO, Pat Gelsinger, wrote a message to his employees “regarding the next phase of Intel’s transformation,” and this letter contained some positive news.

The AWS Deal Is Big

The biggest news was probably Intel’s deal with AWS. The deal will have Intel producing chips for Amazon, starting with an AI fabric chip that will be manufactured using Intel’s 18A foundry process technology. Additionally, Intel will develop custom Xeon 6 chips using its Intel 3 process node. It’s a “multi-year, multi-billion-dollar” deal. Not only is this a future revenue generator for Intel, but it shows that big-time companies still trust Intel’s products.

Intel Wants To Turn The Foundry Business Into A Separate Subsidiary

Gelsinger also provided an update on the Intel Foundry business. Intel wants to turn its foundry business into a separate subsidiary. This could help attract more customers and potentially raise outside funding.

Specifically, in the letter, Gelsinger stated, “A subsidiary structure will unlock important benefits. It provides our external foundry customers and suppliers with clearer separation and independence from the rest of Intel. Importantly, it also gives us future flexibility to evaluate independent sources of funding and optimize the capital structure of each business to maximize growth and shareholder value creation.”

A Focus On Efficiency And Cost Cutting

Intel wants to become more efficient regarding its Intel Foundry manufacturing buildout. Part of these plans include a two-year pause in its projects in Poland and Germany based on anticipated market demand, while strategically pushing forward in key areas like the U.S. and Malaysia.

In Malaysia, Intel wants to create an advanced packaging factory, but the company will be sure to “align the startup with market conditions and increased utilization of our existing capacity.”

Regarding other cost-cutting plans, Intel will be laying off 15,000 employees and scaling back two-thirds of its real estate by the end of this year.

Plans To Sell Altera

Intel owns Altera, a programmable logic device company that it acquired in 2015 for $16.7 billion. It plans to sell part of its stake and prepare the company for an IPO. This would help Intel raise cash, especially if there’s hype around the IPO, so I believe it’s a positive.

What I Don’t Like About Intel

There are quite a few things I don’t like about Intel. First, I generally don’t like investing in companies that spend so much on capital expenditures (I do make exceptions depending on the business/industry), as high CapEx hinders FCF generation.

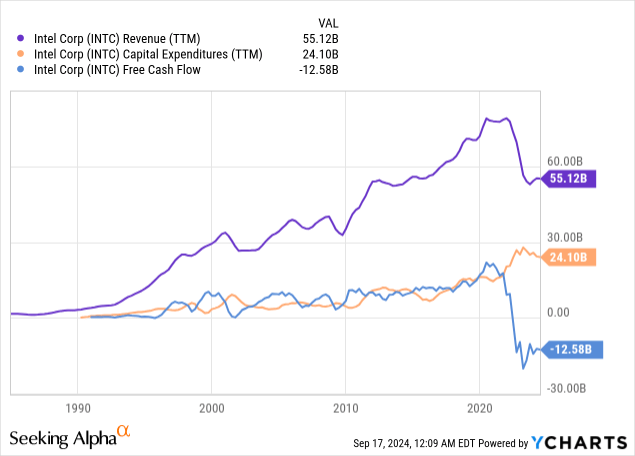

Especially in Intel’s case, the company has spent so much on CapEx recently with nothing to show for it. In 2021, 2022, and 2023, it spent $20.33 billion, $25.05 billion, and $25.75 billion, respectively, on CapEx. Meanwhile, revenue has only declined since then, and free cash flow has gone deeply negative.

If I’m investing in a company that’s spending that much per year, I’d want it to at least grow its revenues. I recognize that its plans are long-term in nature, meaning the revenue growth can eventually happen down the line, but it’s just not what I look for when scanning for high-quality companies. There are too many variables.

I also don’t like how far it has fallen behind the competition over the years, mainly Advanced Micro Devices (AMD) in the CPU market and Nvidia (NVDA) in the GPU market.

This has caused many problems, of course, but a big one is that it made Intel’s gross profit margin fall from 61.7% in Fiscal 2018 to 41.4% for the trailing 12 months. At the same time, AMD’s gross profit margin grew from 37.8% to 51.4% in that same period. Nvidia’s gross profit margin rose from 61.2% in Fiscal 2019 (ended January 2019) to 76% in the past 12 months.

Basically, Intel has the traits of stocks that I generally dismiss. However, any stock can be worth buying if the price is right. Therefore, let’s get to its valuation below.

Any Stock Can Be A Buy If The Price Is Right

The valuation is the only thing that has me somewhat bullish on INTC stock. Currently, Intel has a book value per share [BVPS] of $26.95 based on $115.23 billion in equity and 4.276 billion shares outstanding. That’s 19.35% higher than its most recent after-hours share price of $22.58. But that’s not my entire valuation thesis, although that does present a base for upside potential.

The thing is, if you’re going to buy a stock that’s at a discount to its book value, you have to see if that book value has been declining or is expected to decline in order to avoid a value trap.

Notably, Intel’s BVPS has been increasing over the years. For instance, in Q2 of 2020, its BVPS was $19.28 (according to FinChat.io), meaning that it has grown at a 4-year CAGR of 8.73%. This figure has actually grown every year since at least 2014, and it even increased by an impressive 11.7% from Q2 2023 to Q2 2024.

How Intel’s Book Value Per Share Can Keep Rising

I see this trend continuing for a few reasons. Take a look at the quote below from David Zinsner, Intel’s CFO, as it will help explain why I see BVPS rising. He stated the following during Intel’s Q2-2024 earnings call:

“In 2025, with OpEx of approximately $17.5 billion and net CapEx of $12 billion to $14 billion, we expect to achieve positive adjusted free cash flow. The suspension of the dividend, initial Altera capitalization, and positive adjusted free cash flow should significantly improve our liquidity in 2025 and position us to begin the process of meaningfully decreasing our leverage.”

Also, in the earnings call, Pat Gelsinger said, “Reductions across OpEx, CapEx, and cost of sales total well over $10 billion in direct savings in 2025.”

To put it in my own words, Intel has a few things going for it that can help it increase its equity value. First, it expects positive adjusted free cash flow. For the record, its adjusted FCF includes “Net partner contributions and incentives received (cash expended) for property plant and equipment,” meaning things like the direct funding it gets from the government. Since it expects a positive figure, it will add to Intel’s book value.

Next, the dividend suspension will save the company money. It was paying a $0.50 per share dividend (annualized), so that’s basically $0.50 book value per share savings per year. Further, the money it can raise from selling its Altera stake can potentially raise its equity value, depending on whether it can sell at a good price.

Moreover, the $10 billion in expected cost savings for 2025 and the expected headcount reductions mentioned earlier are other money savers. And let’s not forget the multi-billion, multi-year AWS deal, which can surely help boost profits and, thus, BVPS. Lastly, as it decreases its leverage, it will pay less in interest expenses, which can positively impact its earnings.

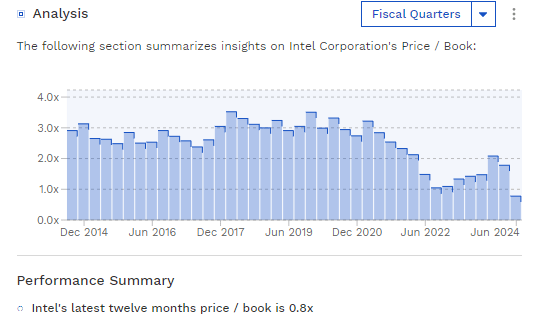

The Price/Book Multiple Is Historically Depressed

Below, you can see that INTC stock is trading at its lowest-ever price/book ratio in at least the past 10 years. I’m not saying that it can get back to 2.0x or 3.0x, but I think it can at least get to 1.0x or slightly above that, especially given the factors mentioned above.

Intel’s Historical Price/Book Ratio (Finbox)

Gains Can Come From Multiple Expansion And BVPS Expansion

Put simply, my thesis is that INTC stock can see upside potential as its price/book ratio heads to 1.0x or higher and as the BVPS itself rises over time. It’s a one-two punch. I believe mid-to-high single-digit increases in BVPS are reasonable to expect (in line with the long-term average growth in BVPS).

Risks To My Thesis

Although INTC stock is trading at a discount to its BVPS, which is rare, that doesn’t mean that it necessarily has to climb back up to its BVPS. It can become one of those stocks that trades at a low multiple for many years, especially if it doesn’t properly execute its plans. Additionally, if its execution is poor, there’s no guarantee that its BVPS can rise from here. I’m just assuming that it will be based on the available data.

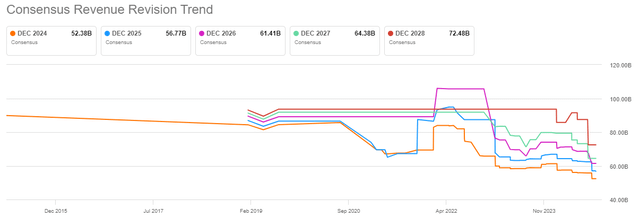

One other thing to consider is the consistent downward revisions that Intel has seen from analysts over the years. Take a look at its revenue revision trend below, for example. Around this time last year, analysts expected INTC to generate $58.84 billion in 2024 revenue. This estimate has now come down to $52.38 billion. Therefore, Intel estimates are not so reliable, and if downward revisions keep happening, then INTC stock can fall further.

Intel’s Revenue Revisions (Seeking Alpha)

The Bottom Line On INTC Stock

Again, I’m surprised that I’m giving a Buy rating to Intel, as it’s generally the type of stock that I’d avoid. It is facing intense competition and has been spending lots of money with not much to show for it. Further, its non-adjusted free cash flows have turned negative in recent years.

Nevertheless, the valuation has come down enough to where I see a margin of safety. INTC is trading at a notable discount to its book value per share, and I expect this discount to eventually disappear. On top of that, its BVPS can continue increasing (as it has every year in the past decade) as the company executes on its cost-reduction plans and potentially generates positive adjusted free cash flow for 2025.

Lastly, the recent developments regarding the AWS deal and the new funding it received only help bolster the bull case, as I believe they will boost the company’s financials. Thus, I currently rate INTC stock as a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INTC, INTC:CA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.