Summary:

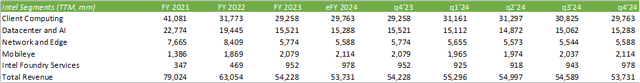

- Intel guided an underwhelming Q1’24 and may experience lackluster year as the firm faces challenges in the data center, telco, and consumer markets.

- Intel is faced with a soft macroeconomic backdrop with potentially softening corporate IT and telco project spend.

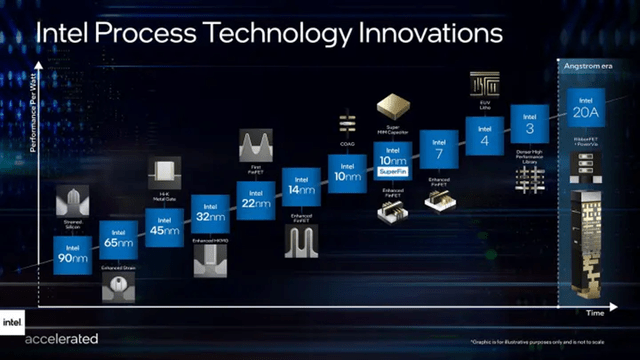

- Intel’s roadmap includes the release of the Intel 20A and 18A processes, which will bring them back into competition with rivals.

FinkAvenue

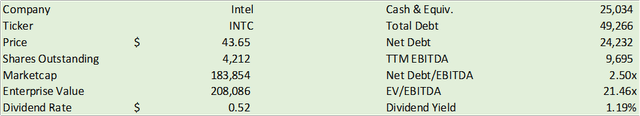

Intel (NASDAQ:INTC) ended FY23 in a very lackluster fashion with underwhelming q1’24 guidance with the promise of an exceptionally strong roadmap years down the road. With their sights set on becoming the go-to foundry for advanced chip packaging, Patrick Gelsinger portrayed optimism in becoming the second largest foundry by 2030. With soft guidance for q1’24, I anticipate another lackluster year for Intel as the firm navigates a softer data center, telco, and consumer market. I provide INTC shares a SELL recommendation with a price target of $35.08/share at 2.75x eFY24 sales.

As Mr. Gelsinger treks down his 3rd year since returning to Intel, the firm has made strides towards Mr. Gelsinger’s envisioned transformation and is nearing the goalpost. Intel has some large prospects in the data center, with the Intel 20A process on Arrow Lake expected to ramp production in 2024 and the 18A process on Panther Lake reaching manufacturing readiness in 2h24 with expected production in 2025.

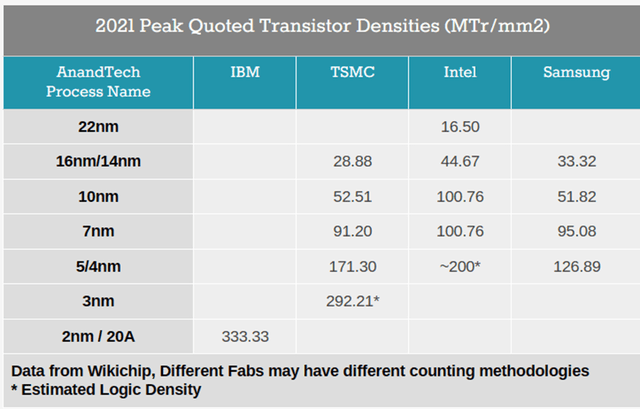

Intel 20A is the company’s 2nm process and is said to be equivalent in architecture to Taiwan Semiconductor’s (TSM) 5nm chips, while the 18A, or 1.8nm process, is closer to the 4nm. These chips will feature their RibbonFET and PowerVia architectures and utilize High-NA EUV lithography. Though this will be significant in bringing Intel back into play with its competitors, the firm still falls short of TSMC’s 3nm process, who started volume production in q4’23, leading Intel to continue playing catch-up. One point worth mentioning is that Intel has more transistor density when compared to competitors’ chips.

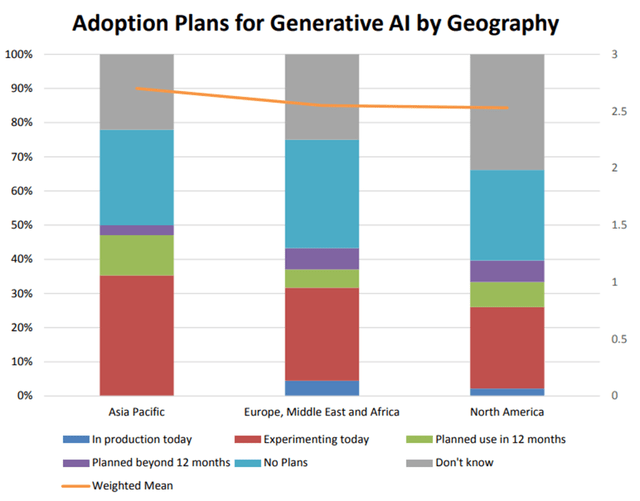

One of the driving factors Mr. Gelsinger mentioned throughout the call is the renaissance of AI everywhere, from gaming PCs to HPC and on-prem data centers. Contrary to competitors’ focus on hyperscalers and cloud infrastructure, Intel’s emphasis is on localized endpoints across data centers and the network infrastructure. Though it may be too soon for excitement as a significant proportion of corporate leaders have little to no plans to implement generative AI, this can potentially mean that the runway for utilization stretches further out. Though generative AI doesn’t capture all usage for AI, machine learning, large language models, or any other form of data science, it is one of the most intuitive and can be the most easily utilized by a typical non-technical user.

Dresner Advisory Services, LLC

Management does anticipate their DCAI segment to have TAM growth in the low-20% CAGR, reaching $110b by 2027. Looking at Intel’s roadmap for future generation data center chips, Intel is planning to release Sierra Forest, their next-gen Intel Xeon chip, in 1h24, Granite Rapids following Sierra Forest, likely in q3/q4’24, and Clearwater Forest in 2025.

Macroeconomy

I believe Intel may experience some significant headwinds throughout 2024 in a variety of their segments. As outlined in their earnings call, telco is expected to have a soft 2024 as capital investments for 5g technology have modestly stalled. Ericsson (ERIC) experienced a huge miss in their q4’23 earnings results with a -10% pullback on total organic revenue with their networks segment down -23%. Nokia (NOK) experienced much of the same downward pressure with q4’23 net sales down -21%.

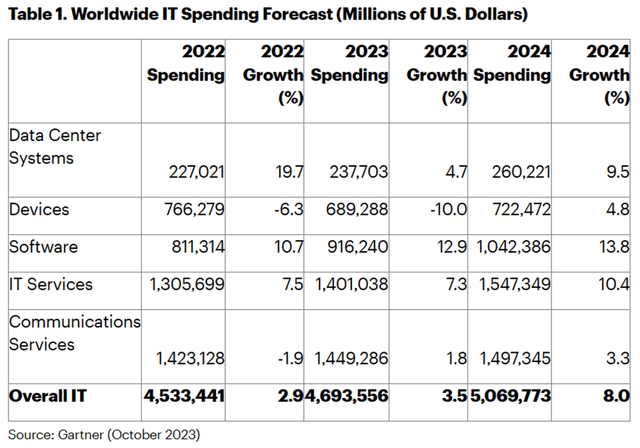

On server, Samsung’s (OTCPK:SSNLF) 2024 outlook was modestly bearish as they anticipate a gradual recovery offset by potentially softer corporate IT spend. Though the data is dated for their q3’23 results in October, I believe the theme remains relevant as companies seek to continue to cut costs into FY24. In addition to this, the Wall Street Journal reported budgets softening in corporate cybersecurity departments, an area that has historically been viewed as recession-proof. Contrary to this view, Gartner is forecasting 8% growth in IT spending for 2024 with limited spending dedicated to GenAI.

In 2023 and 2024, very little IT spending will be tied to GenAI. However, organizations are continuing to invest in AI and automation to increase operational efficiency and bridge IT talent gaps. The hype around GenAI is supporting this trend, as CIOs recognize that today’s AI projects will be instrumental in developing an AI strategy and story before GenAI becomes part of their IT budgets starting in 2025.

John-David Lovelock, VP Analyst, Gartner

The researcher also suggested that organizations are focusing their projects on cost control, efficiencies, and automation while curtailing long-term IT projects.

Michael Dell was very optimistic about AI compute in his fireside chat with Toni Sacconaghi at Bernstein. In his interview, Mr. Dell mentioned that their AI-optimized backlog doubled to $1.6b at the end of q3’23 with their sales pipeline growing 3x sequentially. He mentioned that they’re “just starting to see some demand” from the PC or workstation side, making me believe that customers are a little more reluctant to make large purchases of these high performance workstations.

we’ve been somewhat surprised at how elongated this down cycle has been and look, the PC has generally been a defined life appliance where at some point the new one gets that much better that you’re just compelled to replace it… the refresh is coming. Nobody knows exactly when.

Michael Dell

My final thoughts on Intel before getting into their financial performance relate to Intel Foundry Services. Management discerned that Intel will be setting up IFS as a separate legal entity in 2h24, allowing for broader manufacturing for competing chip designers. I believe this will also open the door for IFS to take government funding under the CHIPS Act as many of the shareholder benefits Intel provides, such as dividends and share buybacks would either need to be limited or eliminated prior to receiving grants or tax credits. I believe that this aspect was taken into consideration when deciding on separating IFS from Intel’s core business.

There may be additional challenges in developing their Arizona foundry. TSMC has raised concerns relating to a skilled labor shortage for manning their future foundry that will also reside in Arizona. As J.P. Morgan analyst Gokul Hariharan reported in Barron’s in October 2023:

We believe difficulty in tool installation, skilled labor availability, uncertainty/delay in appropriation of CHIPS Act monies and overall weaker demand for leading edge processes all contribute to this delay.

Gokul Hariharan, Analyst J.P. Morgan

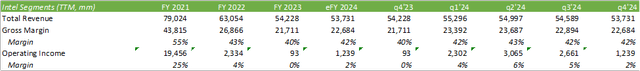

Financials

Intel is expecting to have a rocky FY24 with $1b in revenue headwinds in their non-core segments and soft growth in PC demand. Management also anticipates a double-digit sequential decline in their data center segment in q1’24 before improving throughout the duration of FY24. Management does anticipate 44.5% gross margin for q1’24, an uptick from the previous year’s period. I do anticipate modest gross margin expansion as the firm scales their AI chips; however, I do anticipate a small decline at the topline as the market for PCs and workstations remains soft.

Valuation & Shareholder Value

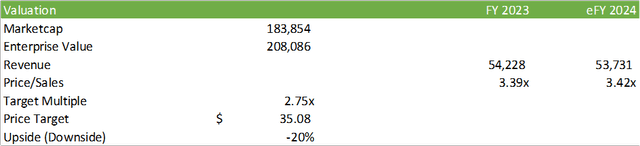

Based on the soft guidance for eFY24, I believe INTC shares are overvalued at their current price. Even with the pullback experienced post-earnings, I believe INTC shares still have further downside risk. Considering my estimates for eFY24 revenue and their historical price/sales trading multiple, I recommend INTC shares with a SELL recommendation with a price target of $35.08/share.

On a tactical basis, this price target is supported at the 0.382 retracement from their recent pricing cycle. I believe that there may be some further downside catalysts, including a softer PC market than anticipated as well as reduced corporate spend in the IT department. On the flip side, I believe these could potentially reverse if consumer interest in higher powered computing at the corporate level picks up with generative AI. Though I do expect utilization of LLM to continue to pick up, I don’t anticipate as fast of a ramp-up for localized data lakes as we’ve seen amongst the hyperscalers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.