Summary:

- We made multiple cases to stay out of Intel, and the idea has been directionally correct.

- At this stage of the cycle, the general mentality is to buy the dip.

- Unfortunately, sentiment on Intel is not conducive to that.

- We tell you why we see $20 before $40.

inthevisual/iStock Editorial via Getty Images

When we last covered Intel Corporation (NASDAQ:INTC), we gave it a pass and suggested investors do the same. Specifically, we said:

Our take is that the dividend needs to be reduced to give INTC flexibility. This has to happen before the rating agencies have that hard talk, because by then, a lot more damage has been done. The market is celebrating the results (up 7% as we type this), but we see this as an oversold bounce that will fix itself. Mobileye Global Inc. (MBLY) has raised very little cash for the company and won’t change trajectory of things. Look lower for a buy point and be prepared to say farewell to that fat yield.

Source: Be Prepared To Kiss That Fat Yield Goodbye

The post earnings bounce went a little further but we are now back at the same point. We update what is happening on the fundamentals and tell you why $20 is more likely to happen first versus $40.

Cyclicality Still At Play

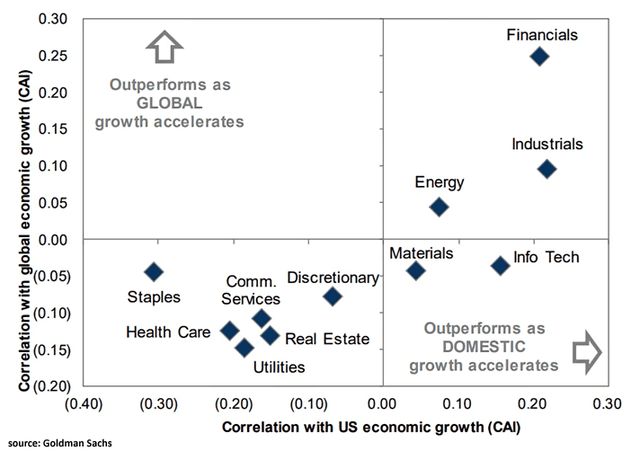

Information technology in general and semiconductors in particular, remain extremely cyclical. Sure, the expanding uses have perhaps dented the extent of the boom-bust cycles, but they remain in play.

The stage is still set for a sharp slowdown to grip this area and reduce both revenues and earnings. While timing may be uncertain, the Federal Reserve is definitely bent upon making sure full employment does not result in runaway inflation. Once recession hits, we will see the true impact on INTC.

Data Crumbling

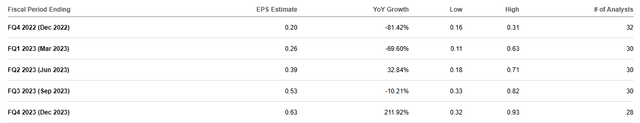

The last data points shows that the Federal Reserve is indeed succeeding. General business conditions as measured in the Empire State Manufacturing Survey plunged to negative 32.9. The drop was a whole 22 points, month over month.

FRED

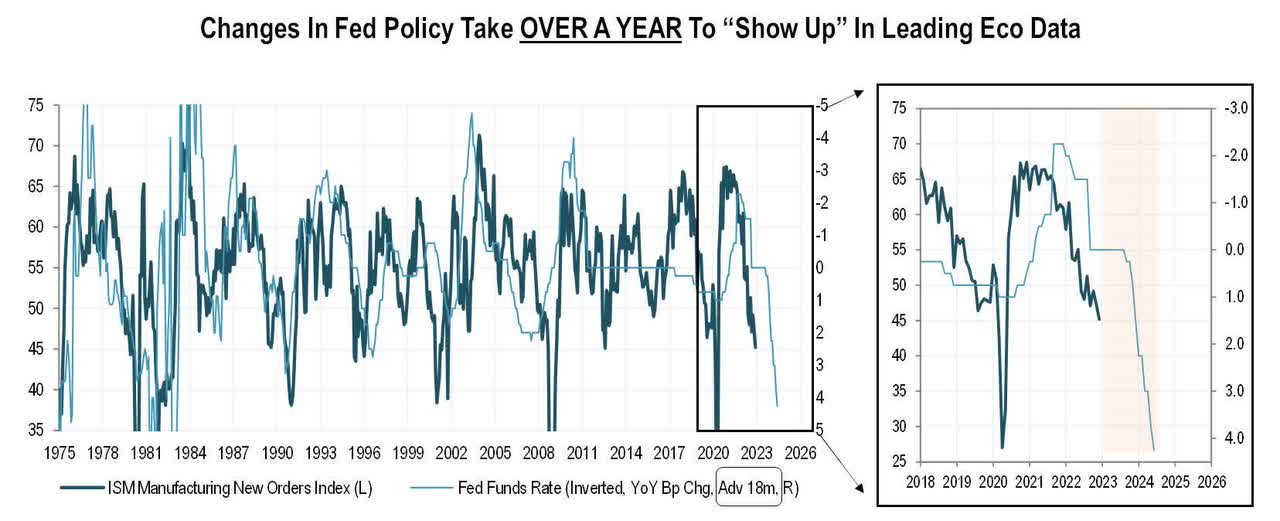

Delivery times held steady, while inventories moved higher. New orders and shipments declined substantially and average workweek shortened. Due to the lag between Federal Reserve policy changes and the economic data, we believe this is still early in the slowdown. Generally it takes a 6-12 months for the impact to flow through and we are seeing the impact from the first rate hikes.

Michael Kantro-Twitter

The Federal Reserve is still hiking into this and we believe the slowdown will surprise investors in 2023.

INTC is Not Priced For It, And It Is Not Even Close

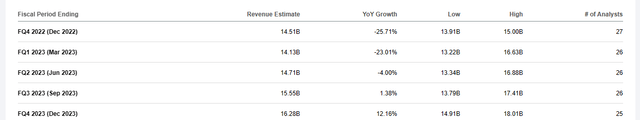

For Q4-2022, which will be reported in the week ahead, expectations are for a 26% revenue decline.

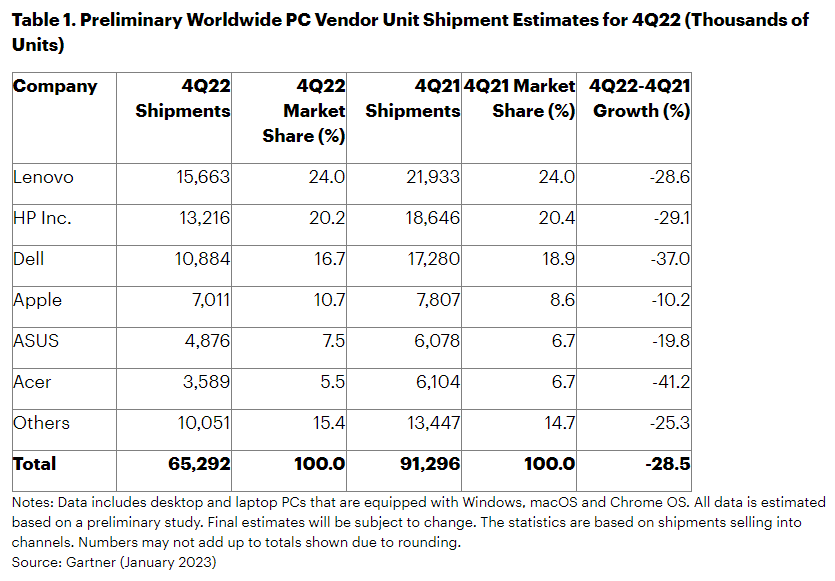

This fits with what Gartner is seeing. PC shipments, arguably not a complete measure of the whole situation, fell 28.5% in Q4-2022 vs Q4-2021.

Gartner

Revenues of course depend on pricing per unit and number of units. We don’t believe INTC had good pricing power in Q4, so a negative revenue surprise is definitely in the cards here. What is more troubling is that analysts refuse to give up the idea that the cycle will take time to bottom. Currently the idea is that Q1-2023 will see the trough and by Q4-2023, revenues will climb 12% year over year.

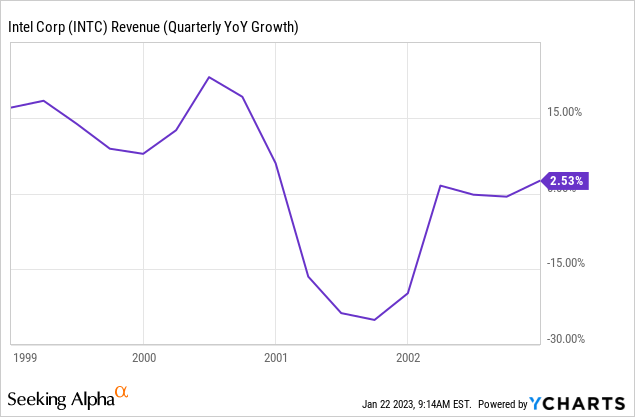

This is a ridiculous notion if we do in fact have a recession. Historically, INTC’s revenues take a long time to bottom and certainly have no chance of growing during a recession. In 1999-2003 timeframe, when the official recession was from March to November 2001, INTC’s year over year revenues stayed deeply negative till the second quarter of 2002.

Even then, the growth was extremely modest off those levels.

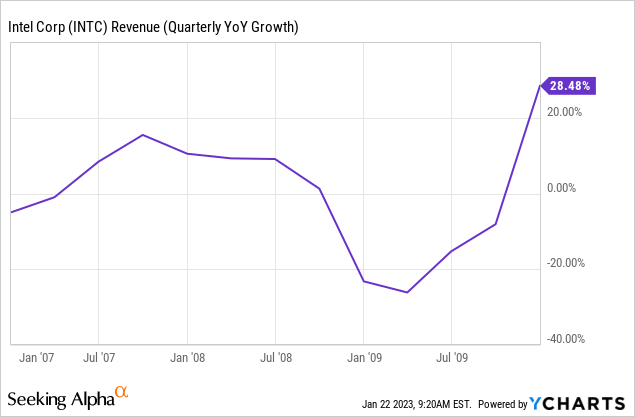

In the great financial crisis, the official recession lasted for 18 months and ended in June 2009. INTC’s revenues only went positive year over year after the end of the recession.

Alongside the optimism on revenues, analysts expect an even faster rebound for earnings. Quarterly run rate is expected to more than triple, during a recession.

If these events do happen, it will be a first for a highly cyclical company to expand revenues by double digits and triple earnings during a recession.

Verdict

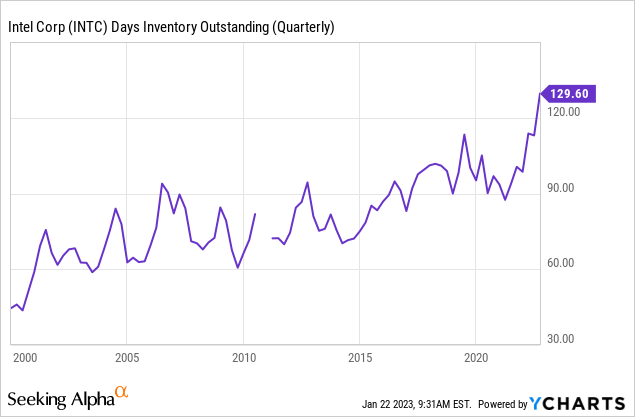

The only aspect of INTC that makes it appear cheap is the fat dividend. Our outlook calls for that dividend to not be covered by earnings any time in the next 18 months. Coupled with huge capex requirements, the stress on the company is rather clear. Analysts seem to be quite sanguine considering the challenges posed to INTC. Days of inventory outstanding on the balance sheet looks extremely bad for pricing power.

Note that INTC went into the 2001 and 2008 recessions with far less bloat on its balance sheet and it still got creamed.

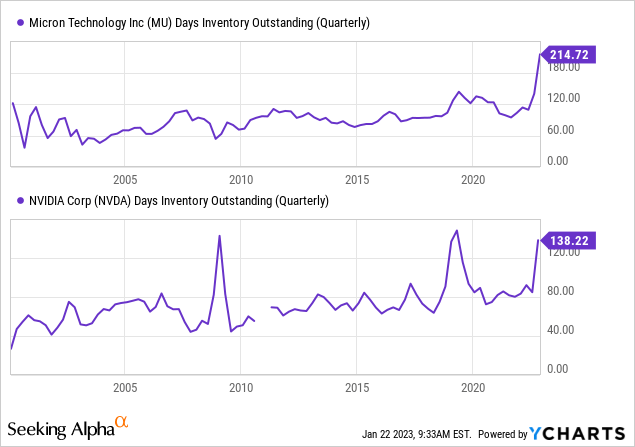

We are seeing similar warnings from other semiconductor stocks including Micron Technology (MU) and NVIDIA Corp (NVDA).

All of this gets us to $20 before $40.

INTC won’t bottom until analysts throw in the towel. INTC will likely also have to cut the dividend before we see a final trough in the stock. On our personal trade side, we had sold the $30 naked calls as a means of shorting the stock, but they expired worthless, so we just pocketed the fat premiums. If we get a good bounce in the stock, we may sell some naked calls again.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have a beneficial short position in the shares of QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our recently introduced and growing Fixed Income Trading & Long Term, Portfolios.

Explore our method & why options may be right for your retirement goals.