Summary:

- Intel has reported very poor results, and its guidance for Q1 2023 was quite negative.

- Its current dividend cut was not unexpected, and the company should have cut it completely to save cash.

- Due to highly uncertain business prospects and a poor track record of strategy execution, Intel remains a trap.

JHVEPhoto/iStock Editorial via Getty Images

Intel (NASDAQ:INTC) has reported very weak operating trends recently and business prospects are highly uncertain, it remains a value trap even after its dividend cut.

As I discussed in a previous article some months ago, while Intel stock was offering a high-dividend yield at the time, its dividend sustainability was questionable and a dividend cut was likely ahead. The company defended its dividend some weeks ago, when it presented its annual earnings, but has recently decided to cut its quarterly dividend by 66%.

This is not surprising for investors who follow Intel more closely, which also explains why its share price didn’t react much to this news, as its business fundamentals have deteriorated considerably over the past couple of years, and to maintain its dividend at current levels it would need to increase its balance sheet leverage.

Intel will save significant cash from this decision, but its dividend isn’t sustainable and the company should have cut it completely in my opinion. In this article, I analyze its most recent earnings and business prospects, to see if value remains a trap or most of the negative news flow and sentiment is already priced in.

Recent Earnings & Dividends

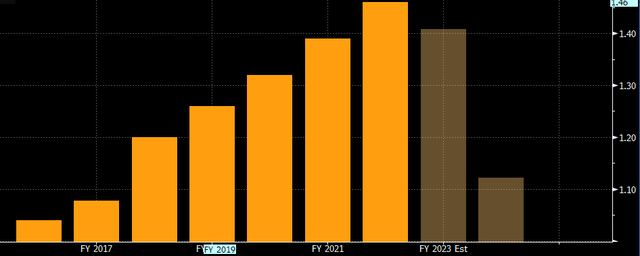

Intel released its Q4 and full year 2022 financial figures some weeks ago, which were quite weak. In Q4, its revenue was at the bottom of its guidance and 3% below market expectations, while its earnings were much weaker given that its EPS was 48% below street estimates, as can be seen in the next graph.

Earnings surprise (Bloomberg)

Its revenues in Q4 amounted to $14 billion (-28% YoY), its gross margin was 43.8% (down 12 percentage points compared to Q4 2021), and its EPS was only $0.10 (-92% YoY). For the full year, Intel generated revenue of $63.1 billion (-16% YoY), while in my previous article, the Street expectation was for revenue of more than $66 billion, its gross margin was 47.3% (vs. 58.1% in 2021), and its EPS was $1.84 (-65% YoY).

Investors should note that Intel’s most recent guidance was to generate EPS of $2.30, thus its last quarter of the year was much worse than management was expecting, which is a worrisome sign regarding a potential business turnaround.

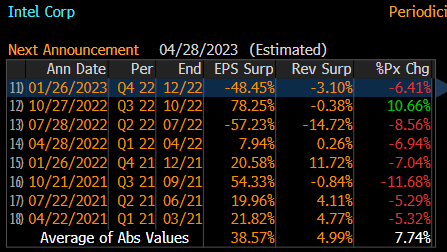

Regarding its dividend, before the cut, it was $1.46 per share annually, which means its dividend payout ratio related to 2022 earnings was 79%. This was a big increase from 28% in 2021, showing that Intel’s dividend sustainability was highly questionable.

While Intel had a very good dividend growth history, the rapid decline in its earnings led to a very high payout ratio, which was expected to worsen even more in 2023, given that Intel is expected to report a loss for the year. Moreover, most companies in the technology sector usually prefer to perform share buybacks instead of distributing dividends, which means Intel’s high-dividend yield was not a great support for its share price, as just based on dividend yield Intel was unlikely to attract much income-oriented investors.

Following the dividend cut, Intel will now distribute a quarterly dividend of $0.125 per share, or $0.50 annually, which at its current share price leads to a dividend yield of less than 2%. This is a similar yield compared to Taiwan Semiconductor Manufacturing Company (TSM) and almost double compared to ASML (ASML), which means Intel’s current dividend is more in-line with its closest peers and still above the technology sector average.

From a cash flow perspective, Intel paid about $6 billion in dividends during 2022, thus the dividend cut will enable it to save some $4 billion, which is a significant amount and will help finance its growth strategy focused on the foundry segment, which requires a lot of capital expenditures to build new factories.

Investors should note that while Intel’s dividend was covered by earnings in 2022, the same did not happen when based on cash flows. Indeed, Intel generated $15.4 billion in cash from operations, which was not enough to finance close to $25 billion in capex, much less its dividend. This means that Intel was financing its dividend through the issuance of debt, which is not sustainable over the long term.

At the end of 2022, Intel’s net debt was $8.2 billion and its net debt-to-EBITDA ratio was 0.5x. This is still a relatively low leverage ratio and Intel has good access to issue debt on capital markets, but to maintain a dividend that was completely financed by debt issuance is not the best approach over the long term.

Business Prospects

Regarding its business prospects over the short to medium term, Intel’s guidance for the next quarter was quite bad, as the company expects to report revenue between $10.5-$11.5 billion (-40% YoY), a gross margin of 39%, and a net loss for the quarter. As a rapid turnaround doesn’t seem likely, Intel’s financial figures and cash flow generation are likely to deteriorate further compared to 2022, which means Intel’s current dividend is clearly not sustainable and its management should have cut it completely, at least until its growth strategy starts to deliver some improvement in the company’s fundamentals.

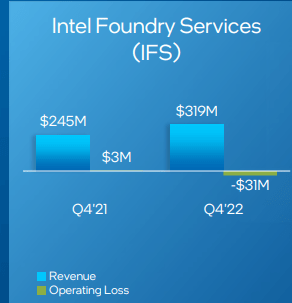

However, this is something that may take some time to happen, given that Intel’s foundry segment only represented 0.5% of total revenue in 2022, while its factories under construction will only be operational probably during 2024 or 2025.

Foundry segment (Intel)

This means that Intel’s woes are not easy to turn around, and an improvement in its operating trends during the next few quarters must come from its existing businesses, which continue to struggle due to fierce competition from AMD (AMD) and Nvidia (NVDA), and an improved macroeconomic situation. This is largely outside of the company’s control, which does not bode well for future earnings. This also explains why Intel only gave guidance for Q1, while for the full year, the company didn’t provide any guidance, but hopes for some economic improvement in the second half of 2023.

Due to this tough operating landscape, Intel intends to cut some $3 billion in costs in 2023, which will help to improve earnings and reach cost savings of $8-$10 billion by 2025. On the other hand, it intends to maintain its investments as expected to achieve the business transformation it presented in 2021. Regarding its product roadmap, Intel said that it’s ready to manufacture using the most advanced technology Intel 4, the first node deploying EUV, and is on track regarding Intel 3. This means that Intel can increase its competitiveness in the second half of 2023, which will be key for a potential revenue rebound.

However, as Intel has had several product setbacks in the past, investors shouldn’t be too excited about these prospects and wait to see if Intel can improve its competitive position in the CPU market with Meteor Lake this year and Lunar Lake in 2024.

Another positive factor for Intel’s earnings in 2023, is the change of the estimated lifetime of some of the company’s production machinery and equipment from five to eight years, which Intel believes to better reflect the economic value of its equipment over time. This will reduce its depreciation expense in 2023 by $4.2 billion (vs. total depreciation of $11.1 billion in 2022), an increase of $2.6 billion in gross profit, and a decrease of $400 million in R&D.

Nevertheless, despite this positive impact on Intel’s financial figures, the market is expecting 2023 to be another tough year for the company. Indeed, according to analysts’ estimates, revenue should be about $50 billion (-19.8% YoY) and is expected to report a loss for the year of around $2.5 billion. Capex is expected to be close to $20 billion, which will lead to a negative free cash flow of more than $7 billion.

In the following years, a recovery is expected given that revenue is estimated to be about $65 billion by 2025, only slightly higher than compared to 2022, but uncertainty right now is quite high and investors should take medium-term estimates with caution. Intel clearly needs to execute well on its business strategy to revert to recent weakness, which is not an easy task, and muted revenue and earnings are likely in the next few quarters.

Conclusion

Intel continues to report weak earnings and its recent decision to cut its dividend was not unexpected, and in my opinion, the dividend should have been cut completely, given that is not supporting its share price and Intel’s free cash flow is negative, thus a dividend payment does not make much sense.

While in the past bulls could argue that Intel was trading at much lower multiples than its peers and offered a high-dividend yield, this was destroyed recently by its reported losses and dividend cut. Intel’s current business prospects are largely uncertain and a rebound seems to be more wishful thinking than something reasonable to expect in the short term. Thus, Intel remains a trap until its fundamentals improve, which may take some time to happen.

Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments/FinTech, Semiconductors, 5G/IoT/Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.