JPMorgan Chase: The Price I’ll Start Buying

Summary:

- Purchasing good banks like JPMorgan near tangible book value has always been profitable for me.

- However, they’re seldom available at such bargain prices.

- Therefore, the more practical question is: How much of a premium would I be willing to pay?

- I’m happy to pay a premium of up to 10 times its dividends, which translates to a target share price of about $115 for JPMorgan under current conditions.

JoeDunckley

Investment thesis

JPMorgan Chase (NYSE:JPM) ended 2022 on a positive note. Fourth quarter profits of $3.57 per share were about 7% higher than the prior-year tally of $3.33. However, banks are certainly facing some uncertainties going forward with the future of interest rates and also the possibility of an overall recession. And attempts to predict these risks and the earnings of a complicated operation like JPM seem like a non-starter to me.

Facing times of great uncertainty, it’s crucial to return to basics. And here are two basics that I regard as self evident when it comes to investing in banks:

- Buying good banks near tangible book value (“TBV”) should be a no-brainer. By paying only for the book value, you get all the “other stuff” for free, such as future earnings and all intangible assets (reputation, customer relationship, et al).

- For the valuation of banks (or stocks in general), relying on a smaller but more dependable set of parameters is far more effective than using a large but more ambiguous amount of data.

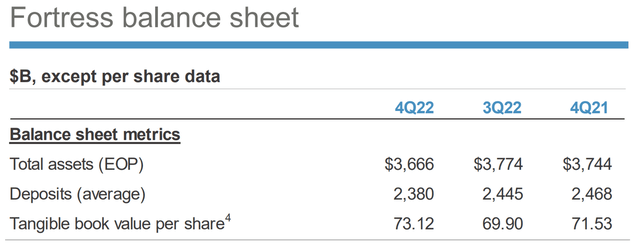

If these basics also are self evident to you, then buying JPM would be a simple decision if its price were to fall to ~$73 (its most recent TBV as shown in the chart below). Although this scenario is highly improbable – it didn’t even occur during the COVID fire sale as seen in the next chart. However, it did happen before (like during the European bank crisis around 2010) and whenever it happens, it’s truly a generational opportunity.

As such, the more practical question is: How much of a premium should we pay above the TBV? And the thesis of this article is to explain that I’m willing to pay a premium of up to 10 times its dividends. Given its current financials, this translates into a target price of $155. And as you also can see – this approach only involves two of the most unambiguous parameters (the TBV and the dividend), which also complies with my second point above.

And I will elaborate more next.

JPM: a historical perspective

As just mentioned, high-quality banks are seldom available for purchase at TBV as demonstrated below by JPM’s history. JPM has historically been priced at an average of 1.45 times its TBV. Even during the peak of the COVID panic sale, the stock price remained above the TBV (albeit by a quite slim margin only). The last time JPMorgan was available for purchase below TBV was during the peak of the European banking crisis during 2010~2012 as seen – a truly generational opportunity.

Given the rarity of such ideal entry opportunities, the more practical question is how much of a premium should we pay. And the following section will explain why I’m willing to pay a premium of up to 10 times its current dividends.

Source: author based on data from Yahoo Finance

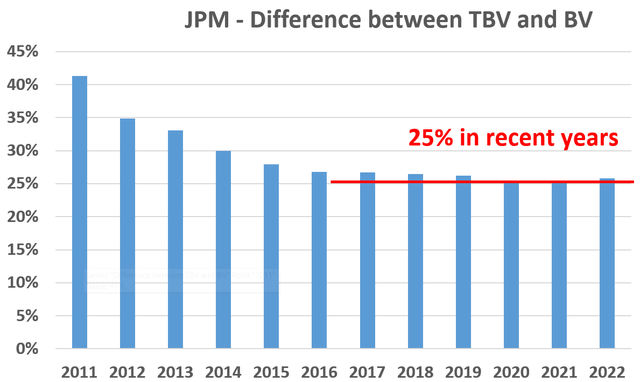

Buy banks at TBV + 10x dividends

For businesses that generate profits mainly based on tangible assets (good examples include banks and real estate operations), an effective (and also intuitive) approach to understanding their business model and also valuation is to consider two key pieces of information: tangible assets and dividends. Details are in my earlier article, and the gist is that:

- If you think like a long-term business owner (instead of a stock trader), then investing in such stocks is nothing more than buying a piece of assets (monetary capital in the case of banks or real estate properties) to collect income (interests for banks and rents for REITs). So the investment value consists of two parts: the value of the property itself and the future rent.

- Our valuation method approximates the first part by its book value and the second part by 10x of its dividends. In other words, the investment value (“IV”) of such a stock should be: IV = BV + 10 x dividend

- As aforementioned, this method is anchored in the most easily obtainable data with the least amount of uncertainty: TBV and dividends.

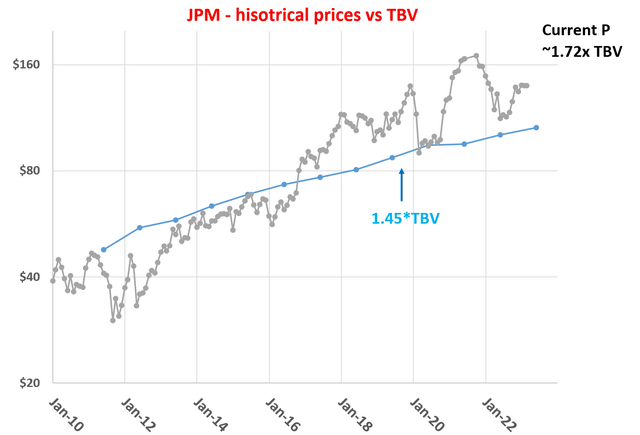

The following chart applies the approach to JPM. It shows the historical stock prices of JPM since 2010 compared to its IV calculated by the method above (the orange line). As you can see, the IV captured the actual market price closely in the long term.

To wit, JPM’s current IV, based on its latest TBV of $73 per share and dividends of $4 per share, comes out to be about $115. At a price of ~$140 as of this writing, it’s about 21% higher than the IV: a bit too much for me.

And next, I will look under the hood a bit closer and examine the TBV, dividends, and also its operations a bit closer.

Author based on Seeking Alpha data

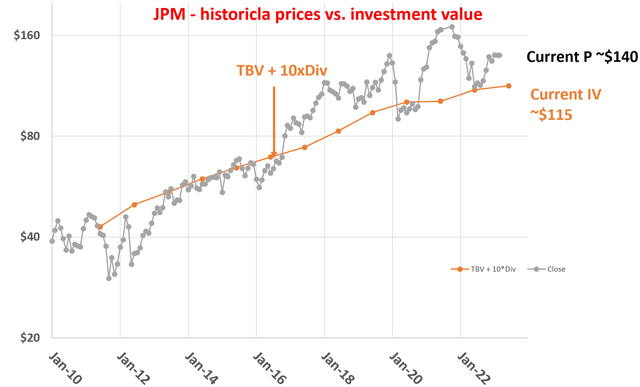

TBV vs. BV

One key reason that I think the current price is too high is that even TBV itself involves a margin of error. Given the vast scale of JPM (trillions of dollars of assets and liabilities) held by a large bank, probably no one (even its own executives) truly knows its current worth, let alone how it could change in the future. As I’ve argued in previous articles,

If you find this hard to agree with, consider a much smaller-scale challenge: Determining the current net worth of your household. Even for liquid assets like stocks, their value fluctuates quite a bit from day to day. Less liquid assets, like your home, have an even larger margin of error. And when you factor in even less liquid assets like collectibles, intellectual property, or business contracts, the margin of error increases exponentially. These uncertainties are severely compounded for a large bank like JPM.

But in the end, TBV is the best that we have. The chart below provides an estimate of uncertainties by showing the disparities between the TBV and the BV, which also includes all intangible assets. As seen, the differences exceed 40% for JPM in 2011 and have hovered around 25% in recent years. Currently, the gap stands at approximately 26%. Notably, the discrepancies are more significant during uncertain and turbulent market conditions. For instance, from 2011 to 2013, the difference declined from over 40% to about 30% before stabilizing as market conditions improved. And such variance always is a crucial consideration in my estimation of the target price – always leave some room for margin of safety.

Source: author based on Seeking Alpha data.

Other risks, business prospects, and final thoughts

Besides the valuation premium mentioned above, there’s some other uncertainty surrounding how the bank will perform in the near future. There’s a realistic possibility that the economy will enter into a recession given the macroeconomic conditions: High inflation, an inverted yield curve, and ongoing geopolitical conflicts. The company has been pressured by these headwinds in the first nine months of 2022. And as a consequence, despite a stellar Q4, its full-year earnings per share (an EPS of $12.09) still represented a 21% decrease relative to its 2021 EPS of $15.36.

On the positive side, JPM is one of the most diversified banks, so weakness in one business segment could be offset by strength in another. The company is well capitalized and boasts a fortress balance sheet as mentioned earlier. The common equity tier 1 capital ratio stood at an excellent 13.2% according to the Q4 earnings report. Leverage and liquidity coverage ratios were in excellent health conditions too.

All told, I see JPM as an excellent bank at a premium valuation under current conditions. Its current price of ~$140 is more than 20% higher than its investment value. The price that I will start buying is around $115 assuming there is no change in its TBV or dividends.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.