Summary:

- Apple had its biggest earnings miss in nearly seven years last quarter. It narrowly beat in the increasingly imperiled services segment.

- The market reaction since the earnings report does not reflect the elevated risk that is present in the world’s largest company.

- Building anti-trust momentum against Apple coupled with the prospect of perishable holiday demand makes me think the risk is to the downside.

- The fundamental issues facing China’s necessary and hurried exit from China have not changed. Apple’s India operations are facing challenges.

- Apple’s Services business showed some strength but it is facing problems of its own that were fortuitously masked by the narrow beat.

Getty Images/Getty Images News

Apple (NASDAQ:AAPL) reported its fiscal Q1 earnings on February 2nd. The report was its most significant earnings miss in about seven years. Yet, the report came a day after Jay Powell declined to rhetorically chide markets into falling, as was expected by many market participants, and the stock has rallied significantly since the miss. I published an article on January 18th hypothesizing that Apple’s then-upcoming earnings report would be its worst in a decade.

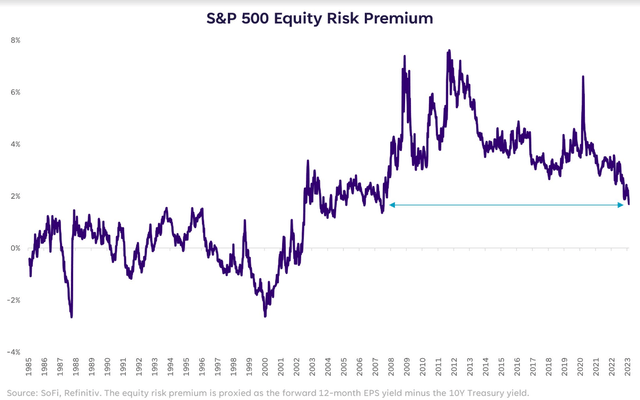

I was slightly off, but the market’s reaction to an alarming report doesn’t change my strong sell rating on the stock. There are better places to find more reasonably priced growth this year that are less exposed to increasing geopolitical tensions. The Equity Risk Premium suggests there’s a lot of pain to come for stocks with high multiples. Despite Apple’s resilience to its latest earnings miss, my research suggests that the potential downside for the stock in 2023 far outweighs the potential upside.

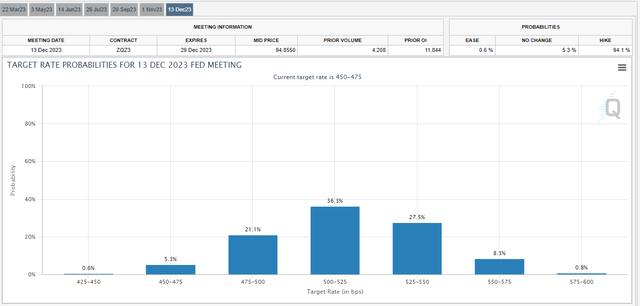

I also think a key reason for the subsequent rally was the market misinterpreting Jay Powell’s comments at the last Fed meeting. When he gave those comments, the stock market appeared to take it as a dovish pivot. However, the bond market has capitulated to the Fed and now implies that the terminal rate will be even higher than the Fed’s forecasts previously suggested. However, since the earnings report, the prospects of a dovish pivot in 2023 have decreased significantly, which means there will be persistent pressure on Apple’s premium valuation concurrently with slowing growth.

Despite a flurry of analyst downgrades after the riot and COVID interruptions at the firm’s massive facility in Zhengzhou (iPhone City), the firm still significantly missed the trimmed analyst forecasts. I have also made the argument (and stand by it) that with the issues in China and the growing risks of doing business, there is a secular risk for Apple that fundamentally threatens the “super profits” and high growth that have underpinned the stocks’ prolific rise in the last two decades.

The iPhone is already a maturing product responsible for an outsized portion of revenues. It seems likely that costs will increase significantly, which will pressure margins. The company reported that some component prices were going down, which could help margins in the short term. Still, my research indicates that this is only a short-term tailwind that doesn’t compensate for the additional uncertainty and costs that are increasingly surrounding Apple’s most essential product, the iPhone.

Apple’s Latest Earnings Report: A Look Under The Hood

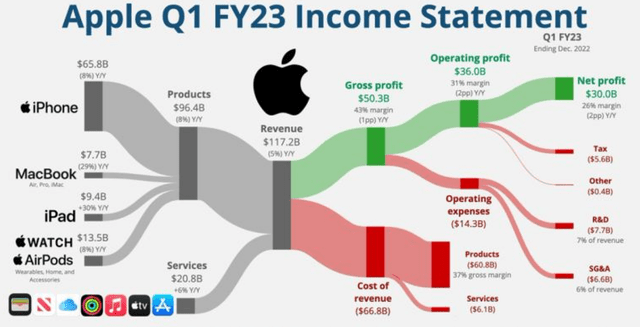

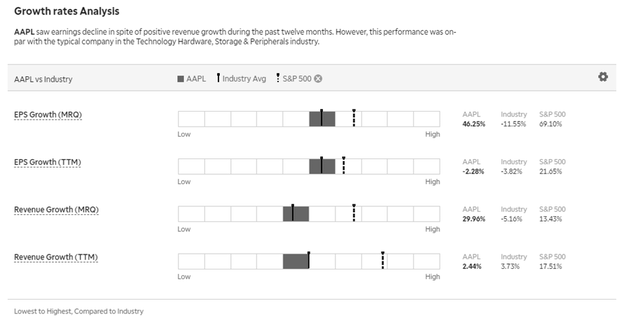

Apple’s revenue went down 5% from a year ago, but the 11% contraction in earnings is even more concerning and suggests the central reasons I’ve listed the stock as a sell are coming to fruition slowly. I acknowledge that the price action has been disappointing since the report for those who were short (including myself). Still, I am nonetheless proud of the analysis I did leading up to the report because it appeared to accurately foretell several of the company’s increasing headwinds that have become more apparent since. Let’s look at a rundown of Apple’s Income Statement to assess the last report more thoroughly.

As you can see, Apple only experienced growth in the iPad within its products, which accounts for the lion’s share of the revenue. The vital Services segment beat expectations, but just barely, and for a company as large as Apple, it’s fair to say by the skin of its teeth. The Services segment is particularly vital for Apple because it has a much higher margin than the hardware segments. Now Apple is the world’s largest company which means it has more levers it can pull than many firms, but still, the direction of margins was slightly down.

Because of the capital intensity and high risks associated with producing hardware at the scale Apple does, one of the main reasons it has been able to get such a high valuation is the growth in high margin Services. I’ll discuss why the headwinds in services will likely prove very problematic for the current valuation, but first, I want to discuss something far more fundamental, macroeconomic weakness.

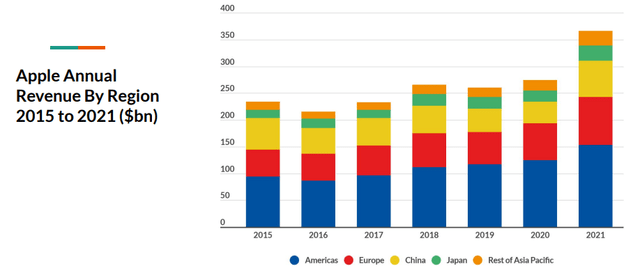

Apple is a global company, and there is increasing weakness in smartphone demand in important markets. For example, in China, weak demand has resulted in significant discounts on leading-edge iPhone models. I suspect Europe’s economic conditions could be adversely affected by the escalating conflict in Ukraine. India, which the company cited a lot on the recent call, could also be entering a period of economic weakness.

I believe there are excellent chances that Apple will not grow this year. If they do grow, I believe it will be at very anemic levels. Part of this is, of course, due to the extraordinarily tough comps the company faces after the COVID rush for its products. However, as we just saw last quarter, these comps, coupled with an increasingly beleaguered consumer, can make for some nasty surprises. A company as prodigious as Apple may indeed enjoy some deserved benefit of the doubt after its stellar record. Still, even the world’s largest company can’t manage its way out of increasing macroeconomic tailwinds if they are severe enough.

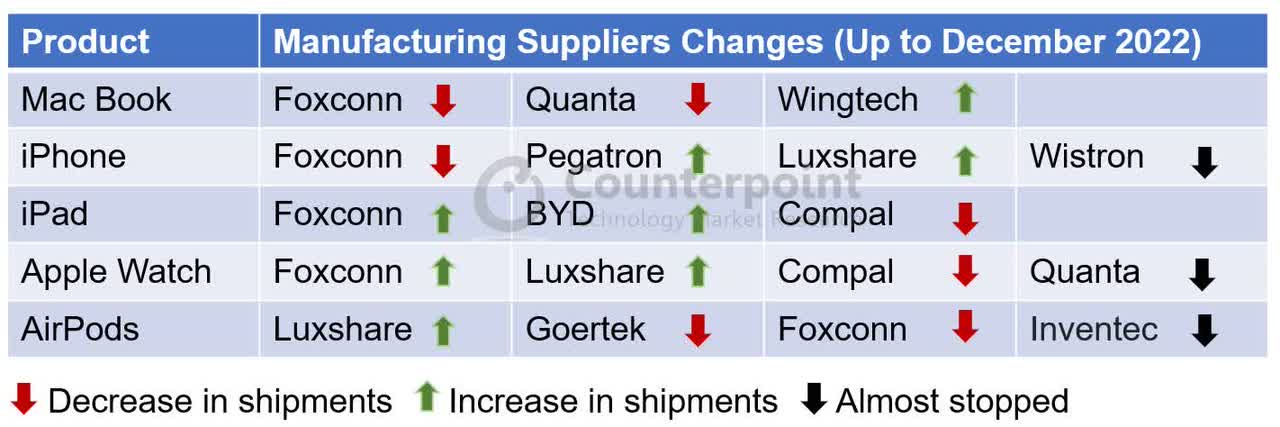

Efforts to Diversify Manufacturing Capacity Away From China Facing Obstacles

The watershed moment for me turning bearish on Apple was the riot at the Zhengzhou facility. Despite being aware of their problematic concentration in China for years, it appears this was also the catalyst that finally spurred Apple to diversify out of China. Many readers may not be familiar with why Apple produces iPhones in China.

While Steve Jobs had a lot of strengths, building advanced manufacturing capacity was not among them. For that, he needed a skilled operator named Tim Cook, who was the brains behind Apple’s sprawling manufacturing cluster. Indeed, this cluster was long the envy of the rest of Tech. Now, I believe it’s an albatross for the world’s largest company.

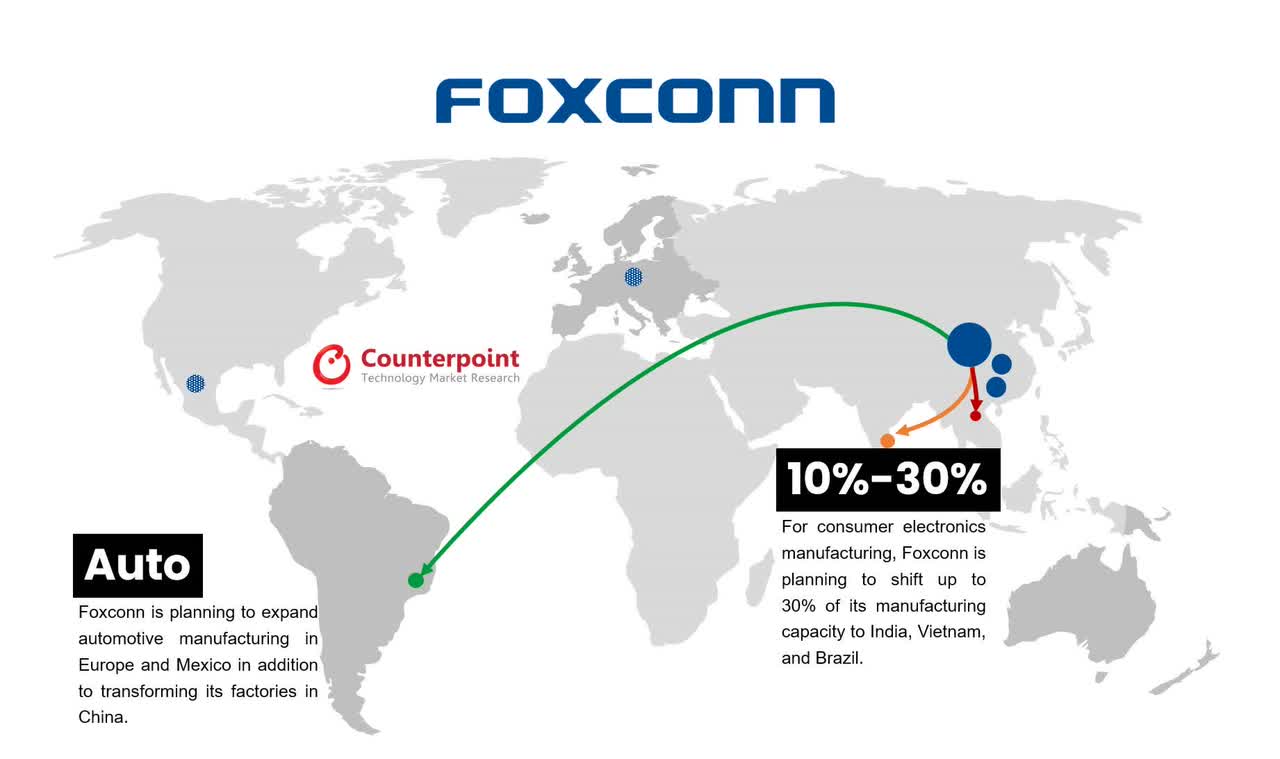

However, no country on Earth has the population and willingness to provide the levels of subsidization that the Chinese Communist Party provided. Apple has accelerated its efforts to diversify, with the production of less central products starting to move to Vietnam.

Counterpoint Global Manufacturing Research

However, to even get close to matching the scale of its China operations, there’s really only one country that can even come close: India. But operating in China with an incredibly centralized government on your side is a lot different than operating in the world’s largest democracy. India is a tougher country to navigate when setting up a massive manufacturing footprint, given the relative decentralization of political power.

As I predicted in my last two articles, significant problems are already emerging. According to the Financial Times, the efforts in India are behind schedule, and the production quality is significantly inferior to what’s possible in China. For example, one key factory only produces sufficient components 50% of the time.

This means there’s a long way to go and likely a hefty investment at the expense of margins before India can even come close to replicating Cupertino’s current jewel of the empire, Shenzhen. Since 2018, Apple has had more suppliers from China than from any other locale. So, it’s not just Apple’s efforts; it’s also Apple’s Chinese suppliers’ efforts to diversify geographically that could pose some risk.

Counterpoint Research

At the very least, there is uncertainty around iPhone capacity not currently reflected in the price. The worsening international relations between the United States and China increase the risk of reputational mishaps and domestic political risks. Apple has been getting increasingly uncomfortable requests from its Chinese hosts over the last few years. There are even growing concerns about Apple’s domestic data privacy policy.

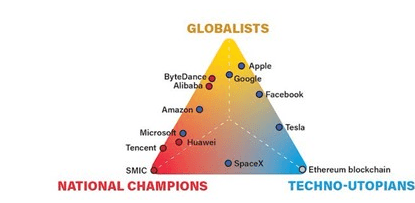

The growing rift between the United States in China, most recently exemplified by the US threatening to economically ostracize the world’s second-largest economy if they supply arms to Russia, now is going to potentially be an even bigger impediment to Apple than I previously theorized as bipartisan rage against China grows. Apple’s position in China was once the envy of Tech; now, I believe, it is a glaring liability as the tenor of Great Power competition continues to intensify.

Mounting Issues in the Critical Apple Services Segment

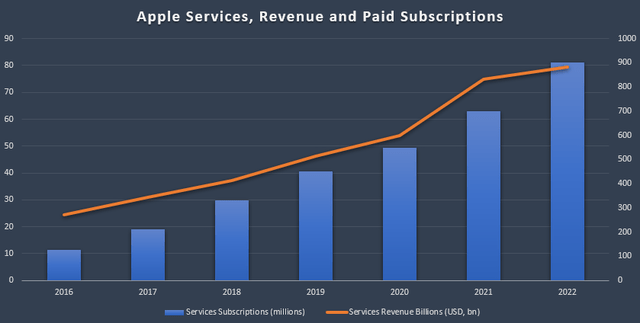

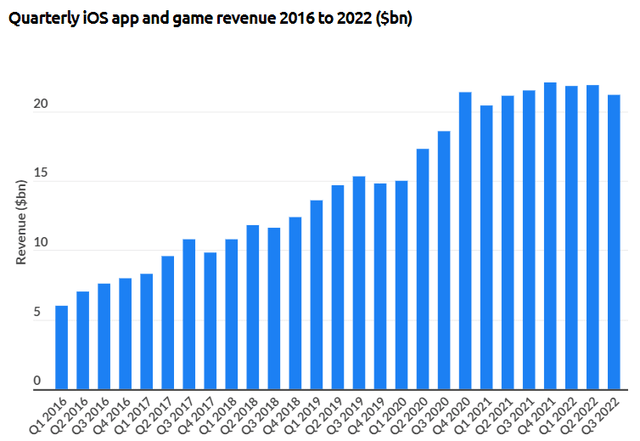

Apple’s Services Segment looks pretty rosy when viewed from 30,000 feet. The growth has been intense over the past decade and helped Apple get its increasingly premium multiple compared to the market. As you can see below, the growth over the past years has been awe-inspiring. But I see a lot of growing problems in this crucial segment that many analysts seem to be missing or ignoring, which is understandable given the size and scope of Apple’s business.

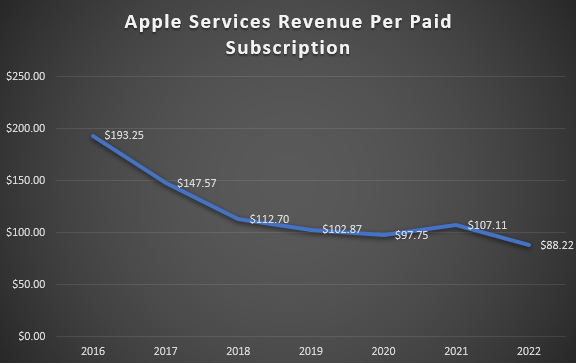

So, definitely, when we look at the growth from the high level, it looks appealing. However, suppose we dive into the details of services. In that case, we see some ominous emerging issues that suggest diminishing returns, slowing growth, and an increasingly high customer acquisition cost that will provide considerable obstacles for margins in the intermediate term once the short-term benefit of cheap components subsides. Look below at the revenue per paid subscription as it has evolved over the same time period displayed above.

Company Reports

Investors may not get the full picture from just listening to the earnings call. The headline numbers show growth, albeit slowing, but those new subscribers are increasingly less valuable to the company. When you’re at the scale of Apple, which is known for having affluent customers, it’s also a worthwhile question to ask: how many affluent customers are there in the world that the company has ‘t yet reached? With paid subscriptions now near a billion, the answer is not many.

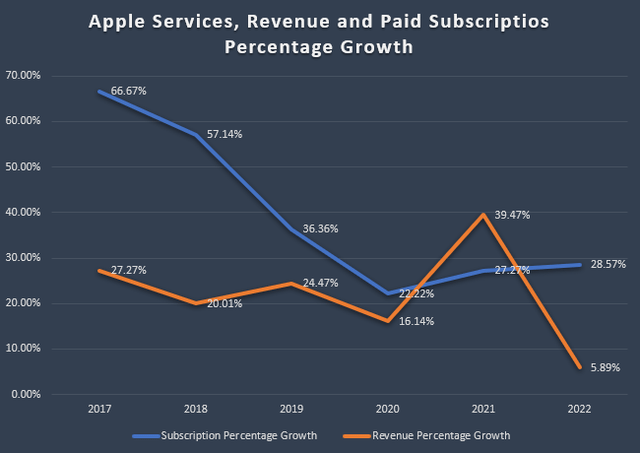

When you look at the percentage change of the critical metrics displayed above, paid subscriptions, and revenue of the Services segment, the picture is also much more alarming for shareholders than many sanguine analyst price targets on the stock would suggest. As you can see below, growth is significantly slowing in both of these metrics.

Company Reports and Author’s Calculations

So, the recent growth numbers in subscriptions and revenue for the services segment are both very far below their respective 5-year averages of 34.31% and 21.2%, respectively. And please remember that for four of the last five years, the growth in revenue per subscription has been negative. In fact, it has nearly been cut in half over the last five years. So, even if Apple can revert to higher growth levels, each subscriber added is much less valuable to shareholders than they were 5-years ago. There is nothing I have found to suggest that this trend will reverse.

Consumer Intelligence Research Partners

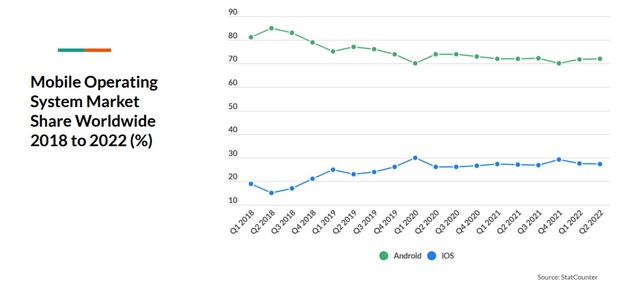

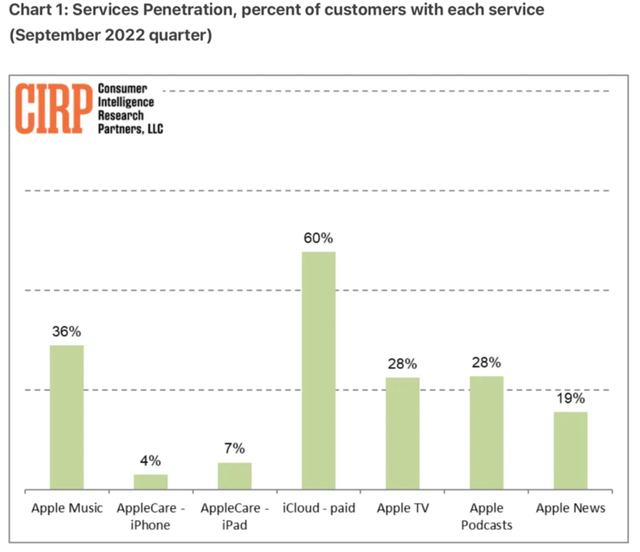

Some analysts have pointed out that many segments of Apple Services are underutilized by their customers compared to the penetration of devices. This may be true, but that doesn’t mean achieving further growth is a shoo-in. Indeed, it suggests that many of Apple’s competitors in particular segments, like, Netflix (NFLX), have incredibly competitive products that will be hard to dethrone. The other thing is that iOS is not seeing much global progress compared to Alphabet’s (GOOGL) operating system, which remains dominant in international markets.

Other areas that are primary drivers of Services revenue, like gaming, may experience some significant weakness as the consumer continues to show diminishing purchasing capacity. My research suggests that Apple’s diminishing returns in Services have only just begun, and a lot of efforts to make their offerings more competitive will be expensive. This means that the main driver of margin expansion may shift to neutral or reverse. I don’t see many analysts approaching the services business comprehensively, but when you do, there’s a lot of reason for alarm. There are also succession issues in the vital segment.

Antitrust Momentum From DOJ Will Most Acutely Affect the Crucial Services Segment

The Wall Street Journal reported that antitrust efforts have gained significant momentum. It looks like the government is out for blood. Apple’s critical services segment is primarily driven by the App Store, which will likely be the focus of the Justice Department’s thrust. This effort should not be underestimated, given the importance of Services for both margins and growth. Also, Uncle Sam’s antitrust concerns focus on the lucrative App Store. This subsection of the Services segment is responsible for 78% of subscription revenue. Here’s the thing, I think the App Store would already plague services just because of its slowing growth, as you can see below.

Data.ai, Sensor Tower, Business of Apps

But the antitrust issues center around some of the most lucrative parts of Apple’s business and the parts that are largely responsible for the ability to continue expanding margins. The following business practices, which drive the high profitability of the Services Segment, are coming under increasing scrutiny. And the Wall Street Journal article linked above suggests the Feds really mean business on this stuff. I think the analyst community really underestimates Apple’s antitrust risk. Uncle Sam’s antitrust efforts could scrutinize or amend the following areas and diminish one of Apple’s most important drivers of superior margins.

- App Store Fees are particularly despised by app developers and particularly lucrative for Apple. A meaningful reduction in these fees would be very problematic for the services segment. There are credible arguments as to why they are too high and show preferential treatment to some over others.

- Apple’s process for reviewing and removing apps is also under additional scrutiny. If it is shown to remove apps to gain a competitive advantage, this would be a painful thorn in the side of the Services segment.

- Pre-installed apps and preferential treatment for some partners over others is always a complaint, and this argument could be gaining more teeth. Apple’s “walled garden” ecosystem could be found to be detrimental to competition, and of course, this would likely also mean higher costs.

- Section 230 is going to be reconsidered by the Supreme Court this week. While Apple is less exposed than many big Tech peers, let’s also remember the company received an estimated $20 billion last year from Google to make its search engine default on Apple devices. So, Google’s antitrust liability is also Apple’s.

Risks to My Bearish Thesis

Listen, my dear readers, shorting Apple isn’t for the faint of heart. I’ve proven that to myself after this last earnings report. However, I have personally averaged down on many of my Apple puts that expire on March 17th, and as of today, they are almost back in the green. I think they will expire significantly in the money, but they may not. It’s always dangerous to underestimate the abilities of a management team as prolific as the top folks at Apple. So, I know there might be some frustration from my last pre-earnings article. Still, I have firmly convinced the fundamental support for the current valuation is even more tenuous than it was going into that report. But there are some key risks to my bearish thesis:

Ian Bremmer Bulletin

- Demand could recover in China, and Europe’s economic prospects could increase, which would help alleviate some of the macroeconomic headwinds.

- Services worries could be turned around by new efforts to restructure the division. However, I do think it’s more likely this raises costs. Nonetheless, the Services story has primarily been one of success, and its possible management gets over the hurdles in front of the division.

- A detente in geopolitical tensions would be helpful for the stock’s prospects and could cause me to re-evaluate my bearish position. Recent flareups of rhetoric between Chinese and US diplomatic officials cast a pall over Apple since it was perhaps more dependent on an environment of global cooperation among its mega-cap peers.

- A smashing success in new initiatives (which could be announced at the coming investor day). Plans that excite the market on the iCar or the coming AR headset could cause some upside movement in the stock. However, one of the key reasons I’ve been bearish is because of repeated setbacks on these two projects. Given Apple’s scale, it’s important to remember that for any new initiative to move the needle on growth, revenues would have to be so prodigious that success essentially has to be absolute.

Conclusion

Ok, so that’s a lot to process. I am bearish on the world’s largest company for many particular and nuanced reasons. As I’ve said a lot in previous articles, I’m not an Apple perma-bear, and I have nothing against this fantastic company. I do also believe the company will return to a heyday in the future and will demonstrate value. Still, tough comps resulting from a stellar performance through COVID have created a hard environment that makes Apple less of a no-brainer than in the past three years.

The externalities of Big Tech, including Apple, are coming into starker and starker relief in the social debate. One of the few issues uniting both major US political parties is resentment, ire, and sometimes even rage at Big Tech. As a Californian, I am very proud of what they’ve achieved. But always remember that they used to call Intel (INTC) by the doomed moniker “Wintel.”

So, there’s a lot to consider here, but the argument for why Apple likely has a downside in store is also quite simple. Across many metrics, as you can see above, Apple’s growth metrics are less than the market’s. Yet, it enjoys a significant premium to the market’s valuation. You can think of the issues I’ve discussed in detail, all providing evidence for why this dynamic won’t shift anytime soon. Of course, I may be wrong about Apple. I will eat humble pie if I am.

Apple’s recent resilience, despite its largest earnings miss in years, illustrates why selling the stock short is a hazardous proposition. The best way to get execute this thesis is with put options or by selling covered calls. Apple is the largest stock in the world and has a highly liquid options market. I believe Apple will experience pressure over the next few months. I’d be wary of expirations going further out than September until we know more about the Fed’s progress in fighting inflation because when markets can see through to rate cuts, the stock will likely soar.

Nonetheless, I have spent a lot of time ensuring my bearish thesis for the stock is sound, and I am confident in my sell rating for the stock. Of course, I hope I’m wrong in a sense because when a stock this big is involved, you’re talking about the fortunes of a lot of good, hardworking people. In the words of Jimmy Cliff, the harder they come, the harder they fall, one and all.

Disclosure: I/we have a beneficial short position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.