Summary:

- Micron Technology remains a buy despite recent underperformance, driven by strong AI-driven demand and expected recovery in PC, smartphone, and consumer electronics markets.

- Short-term concerns in the chip sector and inventory buildup by manufacturers have impacted Micron’s ability to raise prices immediately.

- Micron’s FY 2025 outlook is robust, with record revenue and profitability expected, supported by increased CapEx for advanced technology and new fabs.

- The cyclical nature of the memory chip industry poses risks, but Micron’s valuation suggests significant upside potential, making it an attractive investment.

vzphotos

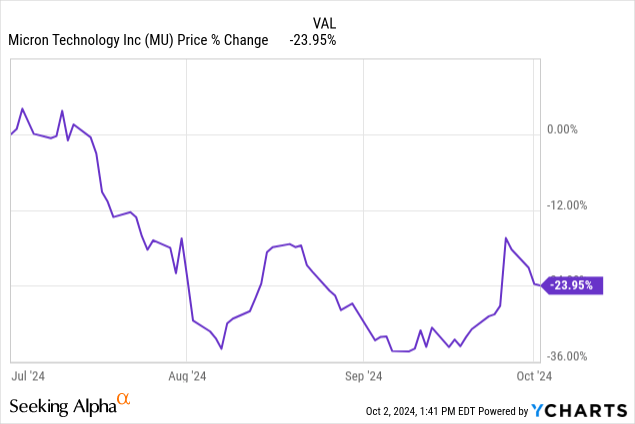

Micron Technology (NASDAQ:MU) has underperformed since I last wrote about and recommended the stock on April 19, 2024. Immediately after the April recommendation, the stock was up over 40% and reached a high of $157.54 on June 18. It has been all downhill from there. As of October 2, the stock is down around 6% compared to the S&P 500’s (SPX) similar drop of 6%. One of the reasons that the stock is down is overall bearishness in the chip sector due to several short-term concerns. Two analysts downgraded the stock on September 12 and cut the price target, which only soured investor sentiment in early September.

On the other hand, Micron recently reported earnings on September 25 that topped analysts’ revenue and earnings estimates. Management also gave an optimistic outlook for fiscal year 2025. The stock rose around 15% to $109.88 the day after reporting but has since slid to around $100.

Despite the market’s short-term bearishness about the stock, my reasons for recommending it remain intact. We are still in the early innings of an Artificial Intelligence (“AI”)- driven cycle that should propel Micron’s revenue growth and profitability over the next several years. Additionally, demand for memory chips in the personal computer (“PC”), smartphone, and consumer electronics industries should return over the next year, further boosting the company’s results. This article will discuss why some analysts are lukewarm on the stock, management’s expectations in the memory market, and the company’s fourth quarter FY 2024 report. It will also review one risk, the company’s valuation, and why I maintain my buy rating.

Short-term worries

Before Micron reported fourth-quarter earnings, Chief Executive Officer (“CEO”) Sanjay Mehrotra answered questions at the Deutsche Bank Technology Conference on August 28, 2024. The market anticipates the beginning of a sharp upturn in the memory market after several down years. When the analyst started the Deutsche Bank conference by asking, “What near-term trends does Micron see in the memory market?” Some analysts were disappointed to hear that the upcycle may not begin as fast as they initially thought.

CEO Mehrotra said at the conference:

So the smartphone and PC customers have built some inventory, and that really is primarily for three reasons: They see the pricing trend up going up. So in preparation for that, that’s the first reason. The second, really one being that, they see strong data center demand. They understand the HBM [High Bandwidth Memory] factor that is a tailwind to the industry demand-supply environment. They see supply tightness, so in preparation for supply tightness, they have taken on some inventory as well. And the third one, of course is that, AI content in smartphone and PCs continues to grow. And they look at AI smartphone and PCs penetrated further as we go ahead over next few quarters, and of course, next few years and in preparation for their own demand increase content in AI devices. So these are really the three factors that smartphone and PC customers have built some inventory.

The above commentary means, in simpler terms, computer manufacturers think that heavy demand for memory chips in the data center will eventually lead to demand exceeding supply, allowing memory manufacturers like Micron to raise prices. HBM chips often wind up in AI or high-performance computing applications. So, the HBM factor reference means more market demand for higher productivity chips used in AI applications. Computer manufacturers are buying more HBM DRAM chips than they need today and putting the excess in inventory to lengthen the time before they must go out and buy these same chips at higher prices. Computer manufacturers’ building inventory can negatively impact Micron because it makes it harder to raise prices and generate more revenue in the near term. The PC (Personal computer) and smartphone markets have a dynamic similar to the data center market. PC and smartphone manufacturers are buying as many HBM chips as possible to build up inventory in preparation for manufacturing AI PCs and smartphones.

CEO Mehrotra also discussed a few additional areas of weakness:

We have shared before and as is well known in the broad industry reports that consumer retail channels, industrial, automotive tend to be relatively weaker right now, as well as China has some weakness too. But overall, there are long — strong longer-term trends in industrial in automotive markets again driving healthy content growth, as we look ahead into the future.

In more straightforward language, the CEO conveys in the above commentary that consumers are not buying enough PCs, smartphones, and other devices to justify consumer electronics manufacturers ramping up production. Until manufacturers ramp up production in response to consumer demand, it will be harder for Micron to raise memory chip prices. Similar dynamics apply in the industrial and auto industries and the Chinese market. This weakness shouldn’t last long. The CEO’s commentary suggests that each of these markets is already at a bottom or coming off a bottom.

The bottom-line effect of all the trends above is encapsulated in the following comment from the CEO at the conference, “So when we look at all of these factors and all of these trends, when we look at our Fiscal Q1 [2025] we think our bit shipments will be somewhat flattish to slightly up in Fiscal Q1 [2025] versus Fiscal Q4 [2024].” Bit shipments refer to the storage capacity of all the units shipped instead of the number of chips shipped.

Some analysts may not become enthusiastic about the company until they see that the supply versus demand equation favors Micron. Analysts may be looking for increased bit shipments, as rising bit shipments can signal rising demand for memory chips.

Future expectations

Micron Fourth Quarter FY 2024 Earnings Deck.

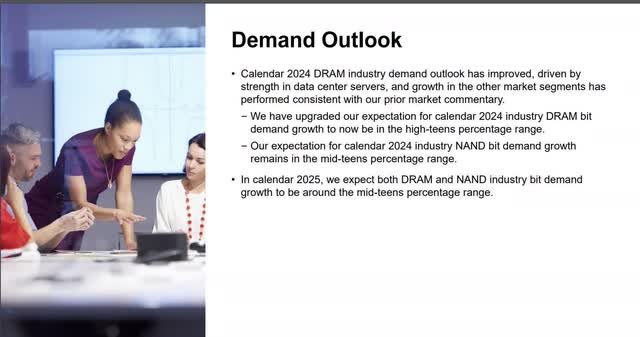

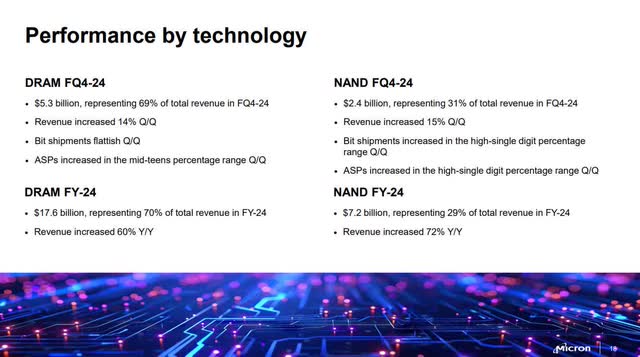

Micron manufactures DRAM (short-term memory) and NAND (Long-term memory) chips. I discussed these chips in more depth in my first article on Micron. The company generated 70% of its FY 2024 total revenue from DRAM, 29% from NAND, and 1% from specialized NOR chips. As a result, when management discusses their industry outlook, they focus mainly on the dynamics in the DRAM market and, secondarily, the NAND market. The NOR market is very rarely mentioned.

The above Demand Outlook discusses how the demand environment for DRAM has improved due to strong demand from the data center market and other market segments like PCs and mobile coming off a bottom in 2024. Management also believes that higher-than-expected demand growth for DRAM and NAND in 2024 and 2025 will create a market that can support price increases, a positive for Micron. Let’s look at the Supply Outlook.

Micron Fourth Quarter FY 2024 Earnings Deck.

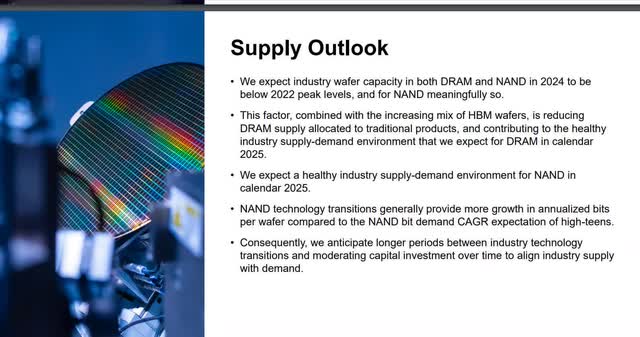

The above outlook means that memory chip manufacturers, as a whole, produced fewer wafers for DRAM and NAND chips in 2024. The above outlook also explains that memory manufacturers have increased the supply of HBM DRAM to satisfy the market’s insatiable demand for chips that can power AI applications. As a result of memory manufacturers’ shift towards HBM memory chips, there is a smaller supply of traditional memory chips, which creates a favorable environment for raising DRAM prices for non-AI applications. The above outlook also discusses the NAND memory industry returning to a healthy supply versus demand market. The last point in the above image essentially means that memory manufacturers will carefully manage how many NAND chips and technology upgrades they sell customers to ensure a balanced supply and demand to create a favorable pricing environment.

The sum of the supply and demand outlooks creates an excellent environment for Micron to raise prices in 2025. Let’s examine the company’s CapEx (capital expenditures) plans.

Micron Fourth Quarter FY 2024 Earnings Deck.

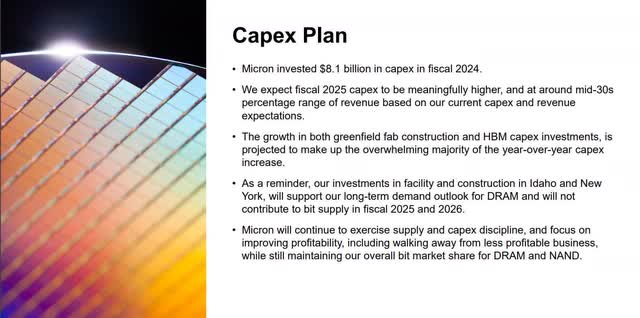

Generally, it is good when memory manufacturers raise CapEx meaningfully, as long as the spending goes toward technological advancement or new plants. In this case, Micron is investing in constructing “greenfield fabs” (increasing manufacturing capacity on undeveloped sites) and new technology innovations like HBM, which increases the company’s revenue growth potential.

Micron Fourth Quarter FY 2024 Earnings Deck.

The company’s fourth quarter FY 2024 earnings release stated:

We are entering fiscal 2025 with the best competitive positioning in Micron’s history. We forecast record revenue in fiscal Q1 and a substantial revenue record with significantly improved profitability in fiscal 2025.

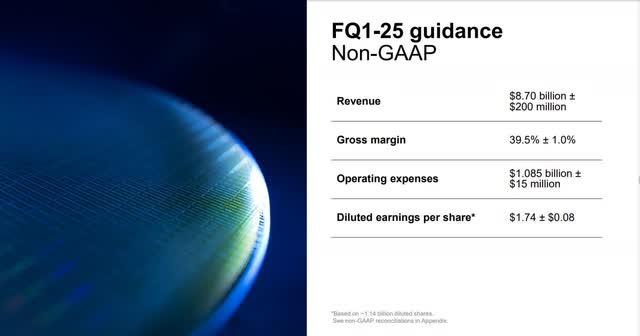

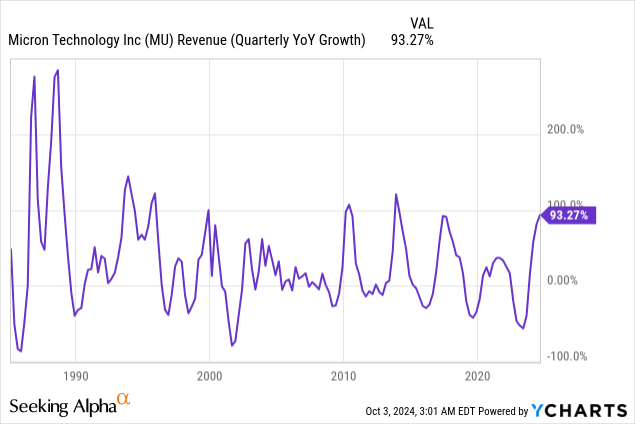

If Micron hits its first quarter FY 2025 revenue guidance of $8.7 billion, revenue growth will be 85% year over year and 11.5% sequentially. Micron’s first quarter FY 2024 revenue growth was only 16% over the previous year’s second quarter, so substantial revenue acceleration compared to last year. Its non-GAAP (Generally Accepted Accounting Principles) gross margin guidance is 39.5% compared to 1% in the first quarter of 2024. The company’s first quarter FY 2025 non-GAAP earnings-per-share guidance calls for $1.74 versus a $0.95 loss last year.

Company fundamentals

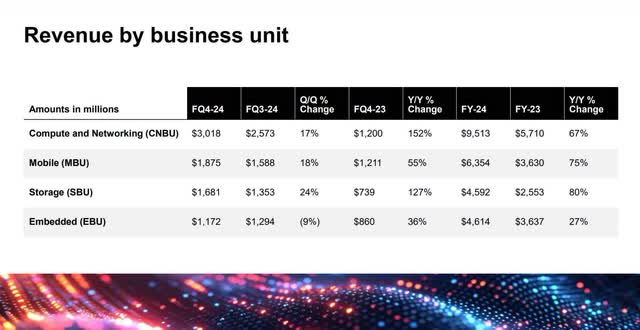

Micron reports revenue in four segments: the Compute and Networking Business Unit (“CNBU”), the Mobile Business Unit (“MBU”), the Embedded Business Unit (“EBU”), and the Storage Business Unit (“SBU”).

The company’s 2023 10-K states, “CNBU includes memory products and solutions sold into client, cloud server, enterprise, graphics, and networking markets.” Client represents DRAM sales to manufacturers of commercial and consumer PCs (Personal Computers). Cloud server is DRAM sales to support cloud computing. Enterprise is DRAM sales to enterprises supporting hybrid cloud and edge solutions. Its 10-K states that graphics sales are HBM DRAM chips “incorporated into gaming consoles, PC graphics cards, and graphics processing unit-based data center solutions, which are the driving force behind applications such as AI, virtual and augmented reality, 4K and 8K gaming, and professional design.” The networking market consists of DRAM chips for 5G infrastructure, data center networking, and other networking requirements.

MBU consists of NAND and DRAM memory for smartphone, tablet, and mobile PC products.

SBU comprises SSDs (solid-state devices) and SSD component solutions for enterprise, cloud, client, and consumer storage markets.

EBU consists of DRAM, NAND, SSDs, and NOR chips for the IoT (Internet of Things) market, which includes devices for the automotive, industrial, and consumer markets. EBU consumer devices include:

- Digital home assistants.

- Set-top boxes.

- Digital cameras.

- WiFi routers.

- Ultra-high-definition televisions.

- Augmented reality and virtual reality headsets.

Micron’s fourth quarter FY 2024 report shows that the CNBU, MBU, and SBU markets are doing well. However, weakness in the auto and industrial IoT market still holds the EBU market back.

Micron Fourth Quarter FY 2024 Earnings Deck.

The following image shows Micron’s DRAM and NAND performance for the fourth quarter of FY 2024 and annual FY 2024. Note that ASPs (Average Selling Prices) increased sequentially for DRAM and NAND. DRAM increased in the mid-teens sequentially, and NAND increased in the high single digits. The increases were a significant improvement over the fourth quarter of FY 2023, when DRAM ASPs declined sequentially in the high-single digits, and NAND ASPs declined in the mid-teens. Since increasing ASPs generally means increased revenue and profitability if the company keeps costs stable, this number is important for investors to monitor. ASPs trending down may signal the end of a memory chip cycle.

Micron Fourth Quarter FY 2024 Earnings Deck.

Another vital metric to monitor is bit shipments. Ideally, investors want to see a rising demand for chips with a rising ASP, which translates to increased revenue.

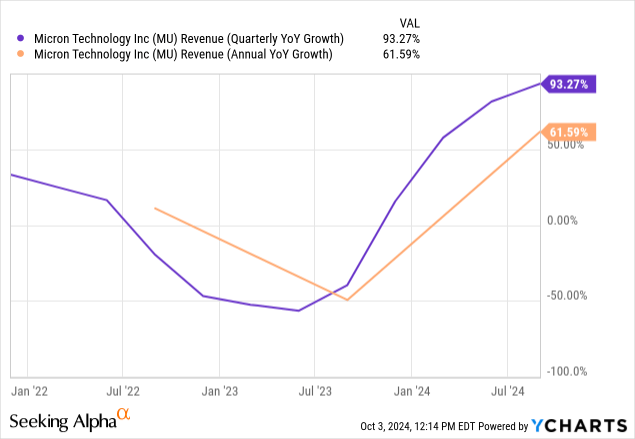

Micron’s quarterly total revenue grew 93% year over year to $7.8 billion, beating analysts’ estimates by $104.47 million. Its annual revenue grew 62% year over year to $25.1 billion.

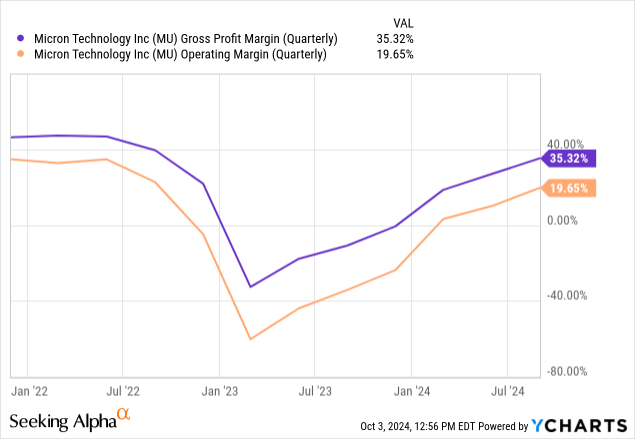

The chart below shows Micron’s gross and operating margins recovering from negative margins in FY 2023 downcycle. Its GAAP (Generally Accepted Accounting Principles) gross and operating margins were 35.32% and 19.65%, respectively.

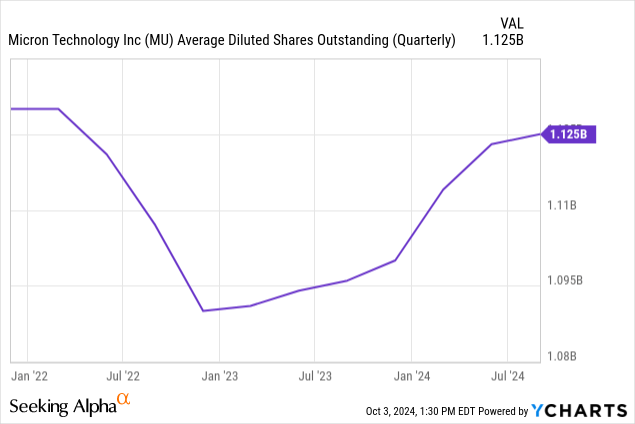

Management emphasizes non-GAAP metrics in its earnings presentations to represent a clearer picture of profitability without non-cash expenses. Most of Micron’s non-cash expenses in the fourth quarter were from stock-based compensation (“SBC”). The company’s SBC-to-revenue in the fourth quarter was 2.75% and 3.32 annually, so it doesn’t excessively dilute investors.

Micron’s fourth quarter GAAP diluted earnings per share (“EPS”) $0.79, beating analysts’ estimates by $0.01.

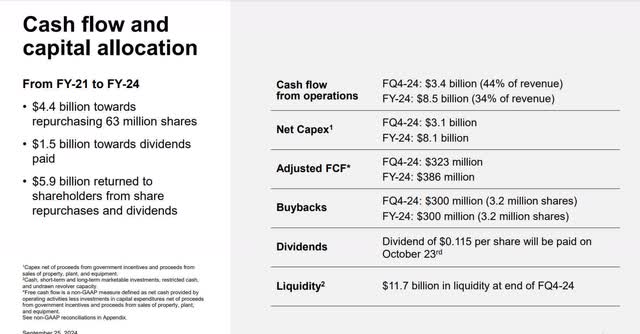

The following image shows Micron’s fourth quarter FY 2024 cash flow and capital allocation.

Micron Fourth Quarter FY 2024 Earnings Deck.

At the end of its fiscal year, which ended in August, the company had $8.1 billion in cash and short-term investments and $12.96 billion in long-term debt. Micron’s net debt-to-EBITDA ratio is 0.53, indicating a solid ability to pay its debt using cash and operating profits. However, this number can change drastically in a down cycle. For instance, in the fourth quarter of FY 2023, its net debt to EBITDA was 2.2, a higher risk level.

Risks

Unless one has nerves of steel, buy-and-hold investors are better off avoiding Micron, as the chip memory industry is cyclical and commoditized. When the memory industry is in an upcycle, revenue growth accelerates until it peaks in one to three years. After the market peaks, it may take around a year before revenue growth reaches the bottom of a trough, and the cycle begins again-memory chip manufacturers also often become unprofitable near or at the bottom of a cycle. When the market identifies that chip supply exceeds demand, causing memory chip prices to fall, it will rapidly sell off the stocks of companies in the memory chip sector. If you decide to buy and hold it, ensure you have the mental toughness to ride out the extreme price movements in the stock over an entire cycle.

The stock dropped around 48% from $95.77 on January 22, 2022, to $49.54 on December 30, 2022, which should give people a good idea of the extreme price movements in a down cycle. It took until March 1, 2024, to close at $95.59. So, if an investor rode the cycle down and back up again, it took around two years to break even with Micron if an investor purchased the stock in late 2021 or early 2022.

Some investors may attempt to time the market, which can be extraordinarily difficult. To do so, one must follow the industry closely and develop a keen understanding of how the chip industry functions. However, even a deep understanding of the industry may not be enough. Even experts sometimes make mistakes. Consider your risk tolerance before investing in the company, regardless of your investment strategy.

Valuation

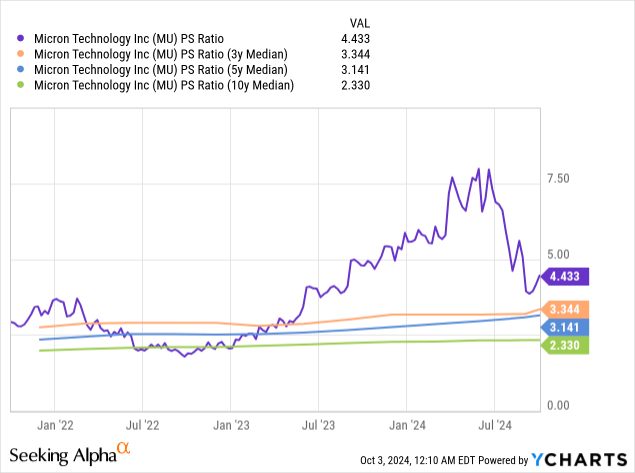

Micron’s price-to-sales (P/S) ratio is 4.433, well above its three-, five-, and ten-year median. Thus, the stock is potentially overvalued, as its P/S ratio is much higher than its median.

Micron’s one-year forward price-to-earnings-to-growth (“PEG”) ratio is 0.18 (Micron’s one-year forward P/E of 7.92 divided by its FY 2026 analysts’ estimated EPS growth rate of 42.71%). Since its one-year forward PEG ratio is well below 1.00, some investors would consider this stock grossly undervalued.

If Micron’s one-year forward P/E matched its FY 2026 estimated EPS growth rate (a one-year forward PEG ratio of one), the stock price would be $541.13, up 442% over its October 3, 2024 closing price of $99.85. Still, investors should be careful about assuming that Micron will achieve a price of $541.13, as the market is aware that the company is in a cyclical industry and may not be willing to drive its valuation as high as the one-year forward P/E suggests it is fairly valued.

Micron is a buy

TrendForce published an article in July that stated (emphasis added):

TrendForce’s latest report on the memory industry reveals that DRAM and NAND Flash revenues are expected to see significant increases of 75% and 77%, respectively, in 2024, driven by increased bit demand, an improved supply-demand structure, and the rise of high-value products like HBM. Furthermore, industry revenues are projected to continue growing in 2025, with DRAM expected to increase by 51% and NAND Flash by 29%, reaching record highs. This growth is anticipated to revive capital expenditures and boost demand for upstream raw materials, although it will also increase cost pressure for memory buyers.

When memory chip prices rise, the three leading members of the memory chip manufacturing oligopoly of Samsung, SK hynix (OTCPK:HXSCF), and Micron will often generate significant revenue growth. Investors who invest early in this memory chip industry upcycle may see meaningful stock price appreciation. If you are looking for potentially strong stock returns over the next one to three years, consider buying this stock. Micron remains a buy recommendation. The only reason I won’t give it a best-buy recommendation is that some investors may be unable to stomach the potential volatility. Micron remains a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.