Summary:

- Tremendous Tesla, Inc. Q4 results should not mask other promising developments.

- Tesla has several additional routes to long-term growth, not including the more speculative areas of activity.

- New markets in Asia, Insurance and Energy Storage all promise a rosy new future.

- Demand for Tesla products is very strong everywhere, but particularly in Asia.

Xiaolu Chu

The Q4 2022 figures for Tesla, Inc. (NASDAQ:TSLA) quite logically caused the stock price to soar. Even the most persistent and stubborn bears found it hard to pluck any bad news out of the figures.

Quite simply, the company had very strong auto sales in the USA, in Europe, and in China. This was at a time of economic troubles and of Covid. It evidenced the vibrant pent-up demand.

The strong growth will no doubt continue into 2023 and 2024. My recent article detailed these trends, which I will not duplicate here. Furthermore, these strong figures have somewhat masked the imminent revenue surge from three growing sectors:

* Sales in Asia outside China.

* Insurance.

* Energy Storage.

These three areas are all growing more rapidly than the company’s rapidly growing auto sales in general. Other news areas such as robots and AI are much discussed in the media but are purely speculative. These three are definite and here and now in 2023. They are another good reason to be bullish long-term about the company.

Asian Sales

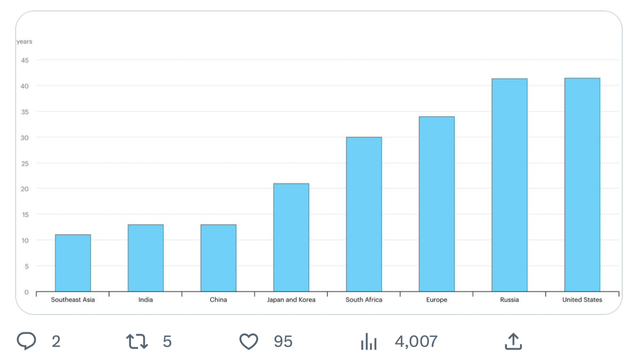

China is the world’s largest auto market. Even more so it is the world’s largest market for EV’s. Asia is the most populated continent and in general has a younger population and better growth rates than elsewhere.

The market in China has started the year very strongly for Tesla yet again. Surveys show that Chinese consumer reaction to the price cuts are very favorable. This coincides with a much faster than expected return to strong growth in the Chinese economy. Increased savings over the past few years will likely lead to a strong year for auto sales as the covid threat recedes. The IMF is predicting 5.2% growth for the Chinese economy in 2023.

Sales in January were 66,051 despite coinciding with the long Chinese New Year holiday. Factory production in Shanghai is being ramped up to 20,000 units per week. That would give over 1 million units per annum for Shanghai at a time when the company expects 1.8 million sales for the year as a whole. Last year it was estimated that Shanghai had an annual capacity of 750,000 autos.

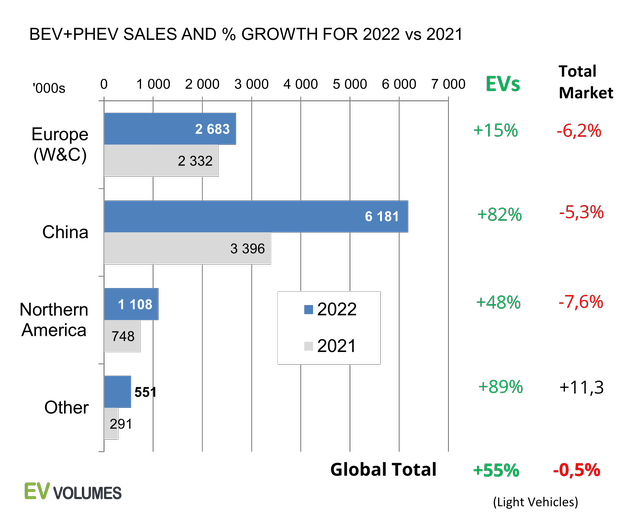

General electric vehicle (“EV”) trends show that ongoing investments in the Shanghai plant are wise. The figures illustrated below evidence this:

China, and elsewhere in Asia, are the key markets for EV manufacturers. The USA, in particular, is becoming less and less important.

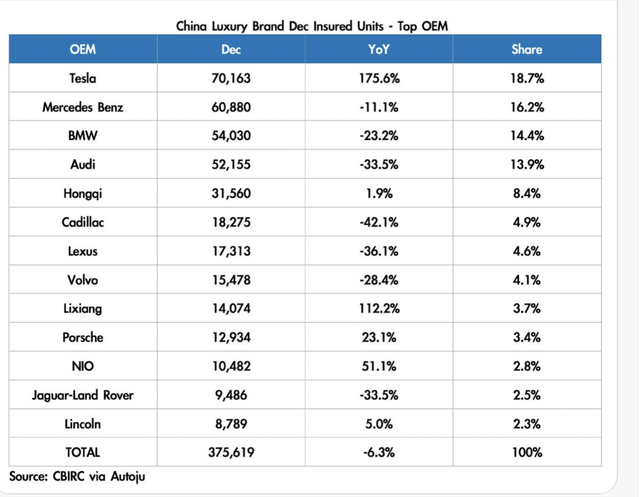

Tesla is not only taking share from EV companies but is the leading luxury brand in China as well, as illustrated below:

The Asian market is increasingly to be seen as the major market for the company, at least for autos. Most of these potential 1 million units out of Shanghai will be supplied to Asia. Shanghai is the company’s primary auto production base. This is despite the fact that auto production is also being stepped up in the USA and in Europe.

At the analyst call, it was made clear that Tesla expected to hit 1.8 million sales in 2023. There was an aspiration to hit 2 million. As the Q4 results and 2022 full year update detailed, total deliveries for the year came to 1,313,851 autos. That was a gain of 40% (total production grew 47% so 2023 sales have started with a bang from the goods in transit). Existing strong markets remained buoyant. For instance sales in California in 2022 were 212,586 units. The pace of growth in established mature markets will naturally reduce over time. However recent reports suggest that demand, for instance, for the Model Y in the USA remains very high as lead-times extend out. This has led to Tesla already increasing some Model Y prices again. Bears had mistakenly speculated that the Tesla price cuts showed demand had collapsed.

Throughout Asia, the company is just starting to touch the huge potential. Previously there was just not enough stock to spare from existing major markets in the USA, in Europe and in China. Increased Shanghai production should solve this problem and enable Tesla to start to reach out to the potential in other markets. My article in September last year analyzed many of these markets for Tesla.

* Taiwan: Tesla has about 80% of the EV market and they only started to sell the Model Y there in December. The company has had problems fulfilling Taiwanese demand as political considerations mean it is not possible to ship there from Shanghai. The Model Y’s are now arriving from Germany where it is thought the factory took out some of the supply earmarked for Norway to start to meet demand from Taiwan. The company recently announced the opening of its 100th Supercharger station in the country.

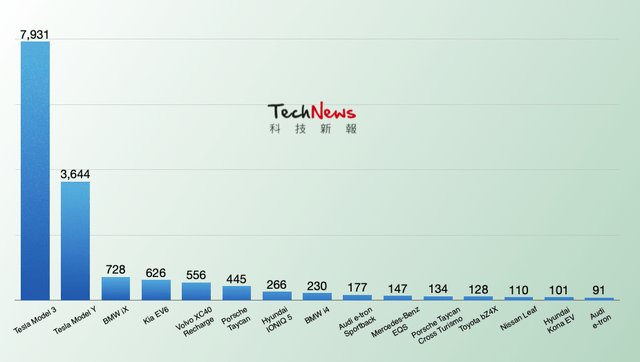

* South Korea: the world’s 7th largest auto market remains a strong market for Tesla despite some seemingly protectionist measures from the Government. The Hyundai “Ioniq 5” and the Kia “EV6” may become strong competitors. According to Energy Trend, Tesla was clearly the dominant player last year as illustrated below:

That was with the first consignment of Model Y only appearing in December.

* Indonesia: Musk has met with the Indonesian President to discuss huge investments in this country of 280 million, the world’s fourth largest. These encompass nickel supply for a Gigafactory in the country and subsidies for the sale of EVs. Although some way down the line this could have huge repercussions long-term for the company.

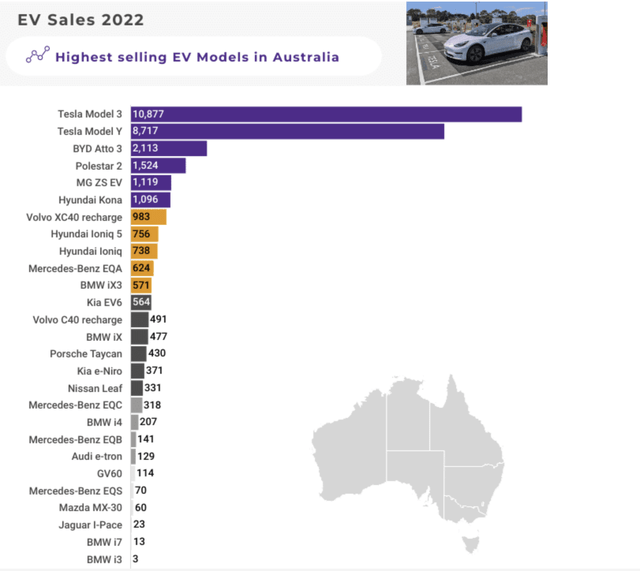

* Australia: Tesla dominates this market as the illustration below shows:

Customers did commonly complain in 2022 about long lead-times as other markets were given priority by supply-constrained Tesla. However Tesla still managed 58% of the EV market. Its 19,594 sales are likely to increase strongly in coming years as sales of EV’s ramp up under government encouragement. Tesla already had a good brand name and presence in the country due to its energy storage business there.

* Thailand: Tesla recently announced it was entering this market. Service centers and Superchargers will be up and running by March. At the showroom opening in November orders were taken on the first day for 2,442 mixed Model 3 and Model Y. The government has set a target of 30% of the country’s vehicles to be EV’s by 2030.

* New Zealand: Tesla was the market leader by far in 2022. It sold 4,226 units Model Y and 2,781 units Model 3 despite only actively marketing in the second half of the year. Although only quite a small market for autos, the government has a policy the country to transform totally to EV’s in coming years.

* Singapore: Tesla is the market leader for EVs in this small but affluent market.

* Malaysia: It is believed that Tesla is about to open up with a program of service centers and chargers for direct sales.

* India: This is a huge auto market, the world’s 4th largest, in what is now the world’s most populous country. Some observers consider it will be a substantial revenue earner for the company. In my opinion it will be many years before this is so.

* Japan: the world’s 3rd largest auto market has proved somewhat resistant to the lure of BEV’s. Last year only 59,999 EV’s were sold in Japan. That amounts to 1.7% of the total auto market. 2023 may prove to be the start for EV fortunes in Japan. The world’s two biggest EV players, Tesla and BYD, are both ramping up operations there. Japan’s domestic manufacturers had concentrated on hydrogen fuel cell vehicles but this looks to have been an error.

Everywhere in Asia we are seeing Tesla starting to ramp up operations as the company now has the capacity ex Shanghai to meet huge interest from Asian consumers.

Insurance

This is not much discussed, but will garner more and more attention in the near future. Currently its financials are not separately itemized. At the Q4 analyst call, CFO Zachary Kirkhorn gave some updates on the financials on this:

We’re currently at a $300 million annual premium run rate as of the end last year. We’re growing 20% a quarter: it’s growing faster than the growth in our vehicle business.

17% of Tesla owners in the USA who have the product available have signed up for it. This is driven by the fact that rates from standard insurance companies are high for Tesla vehicles. It is thought that Tesla’s in-house insurance costs Tesla owners about 30% less on average. It is a dynamic product whereby the insurance a driver pays is based on their driving habits, as it obviously should be. It tracks driving habits such as hard braking or following too closely behind another vehicle. Customers can see how they rate for insurance purposes on the Tesla app.

It is an example of how technology and data can over-turn an old-fashioned industry whose way of calculating premiums has not adapted much since the dawn of auto insurance. Insurance could be yet another industry which is disrupted by arch-disrupter Elon Musk.

The division acts as a further incentive for a consumer to buy a Tesla. In addition, as Musk explained at the analyst call, the information the company has gleaned from the division has enabled them to make changes to minimize the cost of repair.

It can be expected that the Insurance division will expand rapidly. This is despite some statutory handicaps in most markets which slow down progress. In February job openings began to appear in Europe for the division. It is interesting that Tesla’s biggest competitor worldwide is going down the same route. BYD Auto (OTCPK:BYDDF) are in advanced talks to buy troubled Chinese insurer Yi An P & C Ins Co. As with Tesla, they would use this as a conduit for buyers of its cars.

Insurance is another example of Musk shaking up a conservative business for the benefit of consumers. Insurance offerings will help solidify the leading position of Tesla and BYD in the world EV market. Its direct revenue implications for Tesla as a separate division are still hard to itemize.

Energy Storage

This division received more attention than usual at the Q4 analyst call.

There is good reason for this. As my January article laid out, the division should contribute a minimum annual $6 billion in revenue once the Lathrop facility is fully up and running. Storage deployed in 2022 increased 64% to 6.5 GWh. In Q4 it increased 152% to 2.5 GWh as production continued to ramp up rapidly to accelerate sales. That 64% increase compares to the 40% increase in auto deliveries for the year.

The new Lathrop factory will have a capacity of 40 GWh. It is rumored that it is close now to full capacity production but that is not confirmed. The impressive size and operation of the facility is illustrated by a video here from the company.

However details from a Twitter account which tracks this closely suggest the factory is aiming to ship out 200 Megapack per week only by mid-year. With each Megapack selling for about $1.6 that would amount to $320 million per week, or $1.3 billion per month, or $16 billion per annum for Megapack alone (in fact that is a conservative estimate. For instance the product is listed in California at $2,596.910 but it is understood that substantial discounts are often given).

That leaves aside the continuing revenue that the company gets from its “Powerhub” operating software. This provides a single user interface integrated picture using “Autobidder,””Opticaster,” and “Microgridder” software packages. It adds greatly to division revenues after the initial sales revenue has been accounted for. This is a factor often ignored by observers.

The company’s auto revenue in 2022 was $81.462 billion. Lathrop would enable energy storage to run at about 20% of total company revenue if energy storage had been fully up and running last year. It is unlikely to make that percentage in 2023 as auto revenues will presumably rise substantially this year. It does however indicate the potential of the division. The company has declared many times that energy storage revenue could equal auto revenue, as for instance recorded here.

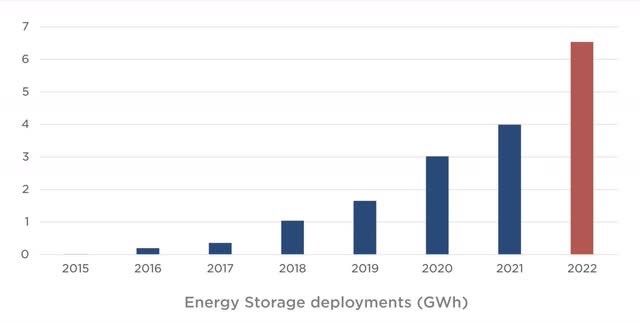

What is not in doubt is that the division’s already strong growth (admittedly from a low base) is set to take off. Recent years deployments are illustrated below:

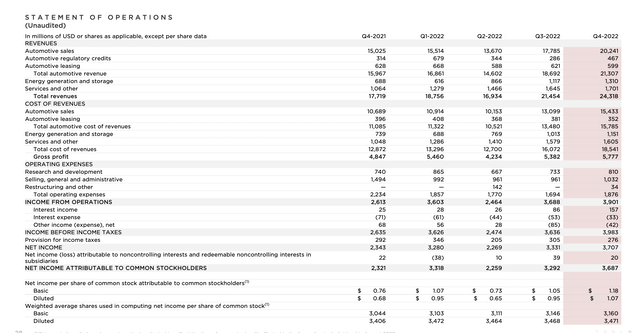

With lead-times for the commercial Megapack and residential Powerwall stretching into 2024, one can posit about 40 GWh of annual energy Megapack storage revenue when production is fully up and running. The residential Powerwall will additionally provide about 4 GWh this year. That will increase as the product becomes available in more countries. The revenue for energy storage as per the recent Statement of Operations is reproduced below:

Energy storage revenues in 2022 amount to approximately $3.9 billion. That was on approximately 6.5 GWh of energy storage supplied. The pending increase up to 40 GWh would amount to revenue of about $22.24 billion.

That may be more than what is produced at Lathrop available to the energy storage division. Tesla’s other battery production sources may increase capacity available to storage, but that would depend partially on auto demand.

The demand for batteries for energy storage represents another reason why the company’s capex will be high for years. The company has forecast capex of between $7 billion and $9 billion for both 2024 and 2025.

There is of course a lot of synergy between autos and energy storage and this will increase in coming years. For instance California utility PG&E (NYSE:PCG) recently announced a major new program for VTE (vehicle to everything) and VTG (vehicle to grid) developments. This trend is made to order for Tesla with its domination of the California EV market and strong energy storage business, both commercial and residential. That is a coming application.

Indeed Morgan Stanley released a fascinating and detailed report last year stating

Tesla is uniquely positioned to accelerate necessary re-architecting of the U.S. grid.

That is a whole new potential field of Tesla being an electricity distributor at the center of a distributed energy ecosystem which is not the main subject of this article. However details of the age of peak plants in the USA shows the massive new market arriving as per the data below:

At the conference call, Musk emphasized they were ramping up Megapack production and stated:

The Energy business had its strongest year yet across all metrics, led by steady improvement in both retail and commercial storage.

He saw the three pillars of a sustainable energy future as being EV’s, solar and wind, and stationary storage. He said ambitiously the company was looking at how it could ramp up production to 1,000 GWh for energy storage.

Conclusion

The Asian auto market and Energy Storage will undoubtedly, in my opinion, be at the center of very strong growth for Tesla in 2023 and in years to come. The direct revenue implications for Insurance are hard to predict at present. Insurance will certainly produce indirect revenue benefits as it makes Tesla vehicles a more attractive option for consumers.

Much of these developments has not been factored into calculations by analysts. There are problems, such as Twitter, which adversely affect Tesla’s stock price in the short run. These are factors not directly tied to the company’s innate bullish demand picture.

On a pure basis of product demand and future promise, allied to the strong balance sheet, Tesla is a strong Buy long term. Short term, the Tesla stock price will remain volatile.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA BYDDF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.