Summary:

- PayPal Holdings, Inc. has largely recovered from post-Q1 earnings losses, as confidence remains in its “transition year,” bolstered by a robust cash flow outlook and capital returns program in the near term.

- However, we believe heightened execution risks have emerged, particularly in the Venmo monetization component of PayPal’s long-term growth roadmap.

- PayPal’s longstanding competitor, Apple Pay, has initiated its foray to P2P payments with “Tap to Cash” via the latest iOS 18 update.

- This raises risks of severing P2P traffic to Venmo, which is a key customer acquisition gateway to the app’s adjacent payment solutions aimed at bolstering user monetization.

JHVEPhoto

PayPal Holdings, Inc. (NASDAQ:PYPL) stock has largely recovered from losses incurred following a softer-than-expected earnings outlook for 2024, which management dubs as a “transition year.” The swift recovery was largely expected, as we had discussed in the previous coverage. Specifically, PayPal’s recent quarterly performance continues to reinforce confidence that the company is approaching an inflection point in restoring its previously disruptive roots in digital payments.

Yet, Apple (AAPL), at its WWDC keynote this year, though dominated by AI momentum, did not forget to emphasize its foray in digital payments either. Specifically, the tech titan has introduced Apple “Tap to Cash”, a simplified peer-to-peer (“P2P”) payment feature that will roll out with the upcoming iOS 18 update. The new feature introduces significant risks to PayPal’s ambitions in beefing up Venmo monetization – a key initiative to the company’s turnaround strategy under the leadership of CEO Alex Chriss.

The latest development is a stark reminder of the substantial chokehold that Apple’s massive devices installed base has on the tech industry. Recall Meta Platforms’ (META) the worst days post-ATT (App Tracking Transparency), when Apple had the social media giant’s core advertising business in a deadlock by severing a critical data pipeline. Now PayPal risks coming to terms with a similar headwind, as if ongoing challenges to its “transition year” were not enough.

Admittedly, Apple Pay and Apple Wallet functions have long been viewed as a significant share gainer in the U.S. digital payments market, with the competitive threat likely already priced into PayPal’s valuation at current levels. Yet, the latest introduction of Apple Tap to Cash is likely to pose incremental risks to PayPal’s growth ambitions, which should not be overlooked.

In the following analysis, we will dive into the potential implications of Apple Pay’s latest update to PayPal’s forward growth roadmap, particularly pertaining to its Venmo monetization plans. Based on our sensitivity analysis, the anticipated market share cannibalization headwind from Apple could potentially reverse the PayPal Holdings, Inc. stock’s recent gains again. As a result, we are downgrading our rating for PayPal to neutral given raised execution risks ahead, with ensuing volatility likely to return as a dominant theme for the stock in the near-term.

What is Apple Tap to Cash?

While AI integration was the key theme of Apple’s WWDC 2024 keynote, the latest iOS 18 update includes a modest, yet highly practical, new feature to Apple Pay – namely, Tap to Cash. The new feature allows iPhone users to engage in P2P payment transfer simply by tapping the two devices together. The feature is powered by a combination of Apple’s digital payment features, with Apple Pay facilitating the payment process and funds coming out directly from users’ Apple Cash account in the Apple Wallet. Apple Tap to Cash is likely only applicable to American iPhone users for now, given it requires linkage to Apple Cash – which is only available in the U.S. This effectively competes head-on with PayPal’s flagship P2P payment solution, Venmo.

Tap to Cash effectively expands Apple’s reach into the digital payments TAM by unlocking convenient P2P payment capability. This is likely to further reinforce Apple Pay’s rapid growth into one of the default digital wallets recently – especially following the widespread adoption of contactless payments during COVID. Apple Tap to Cash will also prioritize users’ increasing demand for security and privacy. All P2P fund remittances facilitated through Tap to Cash will not require access to personal payment information.

Implications to Venmo

As previously discussed, FedNow remains a growing immediate risk to PayPal’s monetization ambitions for Venmo. This is largely due to the government-introduced P2P payment solution’s convenience enabled through inherent integration with users’ bank apps, which effectively bypasses account linkage and verification requirements on Venmo.

We believe Apple’s newly introduced Tap to Cash presents an even greater risk, given its significant iPhone installed base and Apple Pay market share in the U.S. Specifically, more than half of global iPhone users have activated Apple Pay. In the U.S., Apple Pay already garners more than 90% of total digital wallet transactions, outpacing competing third-party payment apps and on-device payment solutions. Hence, the integration of Tap to Cash will likely lean in further to the role of convenience in reinforcing Apple’s share of digital wallet payments going forward.

A greater threat is Apple’s directly overlapping user demographics with PayPal’s Venmo app. Specifically, more than half of millennial and Gen Z digital wallet users in the U.S. use Apple Pay daily, underscoring favorable prospects of Tap to Cash adoption. The superior convenience of Apple Tap to Cash, even when compared to FedNow, will likely amplify competitive risks facing Venmo’s monetization from P2P transactions.

Admittedly, PayPal has likely acknowledged intensifying competition in P2P payment solutions, hence its recent focus on expanding monetization avenues for the Venmo app through innovative features. This includes the recent introduction of enhanced Venmo business profiles, which aims at improving user adoption and engagement, and effectively paves the way for further monetization through adjacent features like digital advertising. Yet, elevated P2P payment market share dilution risks from Apple Tap to Cash could erode engagement critical to adjacent revenue streams supportive of Venmo’s long-term growth trajectory.

More importantly, we view Apple Tap to Cash as a significant risk to Venmo’s ambitions in improving its market share in facilitating money in / money out opportunities from users – a key accretive factor to PayPal’s consolidated transaction margin dollars. Specifically, Venmo has only recently started to gain traction in reinvigorating growth and monetization through reinforcing new product update rates, such as the Venmo debit card and cash back credit card. The company has recently disclosed a 21% y/y increase in Venmo debit card usage, with relevant accounts driving 6x incremental revenue to the platform on average compared to a P2P-only customer. Improved features on Venmo have also been critical to acquiring new user fund flows, with the figure reaching $18 billion on average each month. Meanwhile, the number of balance-funded P2P users on the platform also grew 17% y/y. This has been a key accretive factor from Venmo to PayPal’s consolidated transaction margin dollar growth, given interest income earned on expanding deposits.

Yet retaining balance-funded accounts, and expanding user deposits and stickiness to the platform, remains a challenge for Venmo. And the recent introduction of Apple Tap to Cash, which already benefits from a massive installed base at launch, is likely to exacerbate the situation for Venmo. Management had disclosed that 80% of net new user fund inflows to Venmo leave the platform within 10 days. This suggests that Venmo remains a secondary consumer digital payments platform, with much work to do still to bolster the app’s capture of “money in [and] money out opportunities” ahead.

Admittedly, Venmo has started to demonstrate consistent positive progress in driving customer acquisition, retention and monetization with the roll-out of additional features beyond P2P payment solutions recently. But the latest launch of Apple Tap to Cash accordingly raises execution risks ahead for PayPal, as it presents as a roadblock to one of the key components in the company’s comeback plan. Specifically, intensified competition will effectively temper Venmo’s recent efforts in driving sustained accretion to the company’s consolidated transaction margin dollars, and raise uncertainty to cash flows underpinning the stock’s valuation prospects.

Sensitivity Analysis

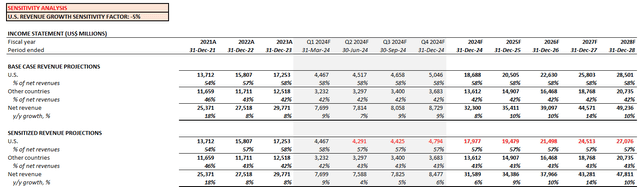

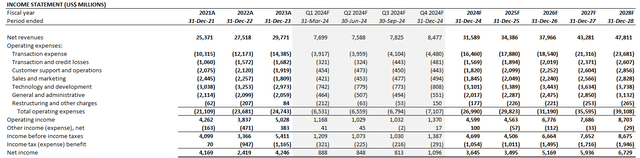

As discussed in the earlier section, Apple Tap to Cash will work with Apple Cash. This implies that the feature will roll out in the U.S. market only, clashing directly with Venmo’s core operating region. Considering the anticipated user demographics of Apple Tap to Cash, which overlaps directly with Venmo’s dominant user base, we believe PayPal risks facing an annualized revenue headwind of up to 5% in the U.S.

In our sensitivity analysis performed to gauge the anticipated impact on PayPal’s valuation prospects, we have built on our previous base case fundamental projections and applied a 5% annualized discount to growth for estimated revenues generated from the U.S. While anticipated Venmo monetization contributions to PayPal margin transaction dollars remain nominal, they remain a critical component to PayPal’s long-term earnings growth trajectory.

We believe the sensitized factor is reasonably reflective of the heightened competitive threat that Apple Tap to Cash brings to Venmo’s P2P platform. It effectively risks severing a key customer acquisition gateway for Venmo, and potentially thwarts the platform’s efforts in improving its role from being a secondary to primary consumer payment solution provider, and driving sustained margin accretion to PayPal through incremental opportunities.

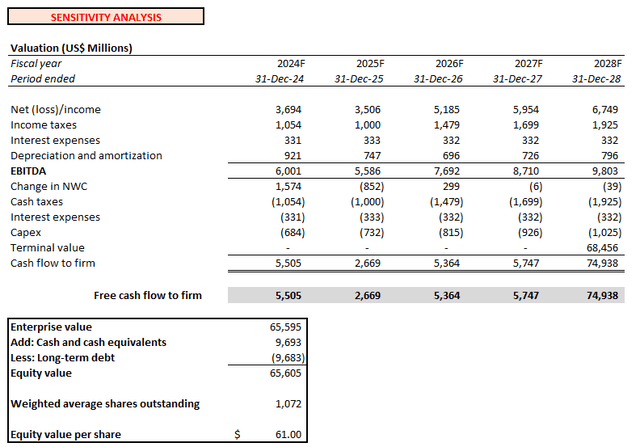

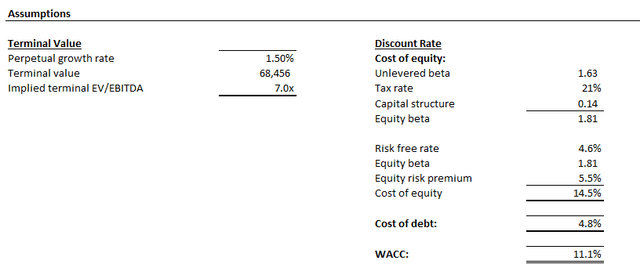

By applying the same cost structure and valuation assumptions (11% WACC and 1.5% implied perpetual growth) from the previous base case fundamental analysis, a 5% annualized discount to U.S. revenue growth will result in an estimated intrinsic value of $61 apiece for PayPal.

Conclusion

Admittedly, PayPal continues to demonstrate strong cash flows to support ongoing growth investments and its competitive capital returns program. But the latest Apple update accordingly diminishes the appeal of PayPal’s long-term outlook in regaining market leadership in digital payments.

The ensuing net negative implications on PayPal stemming from Apple’s upcoming iOS update should not be overlooked, in our opinion, with relevant risks still underappreciated at the stock’s current levels. We believe the launch of Apple Tap to Cash increases the urgency for PayPal to right its Venmo ship – a core product in its portfolio for capturing engagement from high-spending millennials and Gen Zs. This accordingly heightens PayPal’s exposure to execution risks ahead of its transition year, potentially turning it into a “one step forward, two steps back” story.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.