Summary:

- As FAAMG peers have suffered, Apple has largely retained its value.

- We believe that Apple’s sheer efficiency is often overlooked by investors.

- Apple offers best-in-class return metrics for investors.

Scott Olson

What, Me Worry?

If you spend any time reading the financial press or stock analysis sites, then you may have noticed a recent trend forming around Apple (NASDAQ:AAPL): people are nervous. As tech stocks continue to suffer under the weight of rising interest rates and companies prepare for a recession of questionable magnitude that may or may not come, it can feel as though Apple investors are waiting for the other foot to drop. When, it seems, will the bad news that has engulfed Google (GOOGL) (GOOG), Amazon (AMZN), Facebook (META), and Microsoft (MSFT), come for Apple?

Investors of these beloved FAAMG (formerly FAANG, before Netflix (NFLX) was summarily removed and replaced with Microsoft) stocks can be forgiven for their worry, since it would certainly seem reasonable that Apple, now the tallest standing of the group, would be set for a fall next.

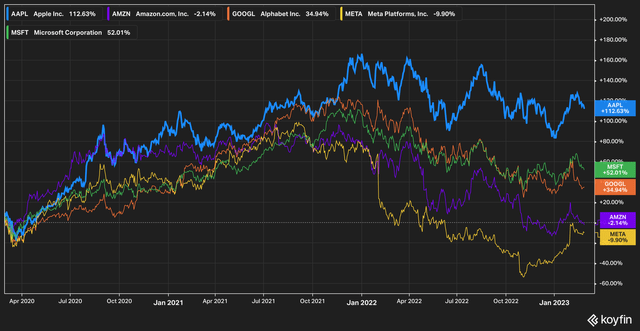

Over the past 3 years, Apple has returned 112%, more than twice Microsoft’s return of 52%, and three times Google’s return of 34%. Amazon and Facebook, meanwhile, have turned in negative three year performances of negative 2% and 9%, respectively.

While the other FAAMG stocks were all met with varying degrees of misfortune in the 2022 tech-wreck, in this article we intend to make the case for why Apple’s stock has, and will likely continue to, levitate above its FAAMG peers.

The Financials

At Ironside Research, we tend to divide problems into two camps when we review a company: issues that management cannot control, and issues that they can. While certain macroeconomic factors affect most businesses in the same way, effective management teams will generally find a way to ensure. Issues that are created in the business by management, or issues which management seems unable to resolve, are another beast entirely.

With that being said, Apple has very few internal problems for management to fix when it comes to operational efficiency and deployment of working capital. This is perhaps not unsurprising-Tim Cook was heralded by Steve Jobs as being one of the most brilliant operational minds out there, after all.

While many pieces have been written about the strength of Apple’s balance sheet and the enormity of its cash position, very little has been written about the company’s near-maniacal efficiency. This, we contend, amounts to something of a hidden asset for the company perhaps not fully appreciated by investors.

So, let’s dive into some working capital and near-term asset management metrics for the company.

Since most of Apple’s business is hardware driven, let’s start with inventory. We start here because, as the COVID-19 pandemic showed us, the ability to properly manage and forecast inventory and match it with demand is incredibly important.

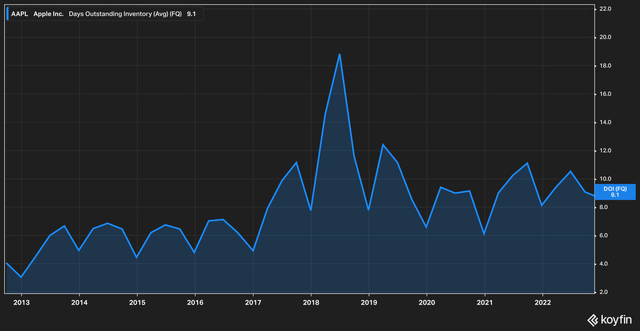

To do this, we’ll take a look at Apple’s days outstanding inventory [DOI]. Analyzing DOI allows investors to assess how effective a company is at managing its inventory by dividing cost of goods sold (the expense that revenue transforms to when paired with revenue) with revenue levels over a pre-determined period. It matters less to us whether a number is high or low than whether or not it is consistent-rapid fluctuations or upward trends over time may signal problems under the hood.

AAPL Days Outstanding Inventory (Koyfin)

With the exception of a quarterly spike in 2018, Apple has managed to keep its DOI remarkably stable, even through the height of the pandemic.

Another metric we point to is Apple’s ability to run a wildly efficient cash conversion cycle [CCC], which measures how quickly a company can convert inventory back into cash. Companies with a positive CCC generally have a positive working capital structure, which means they may have to pay suppliers before cash is received from customers.

Negative CCC implies that a company has the ability to generate cash well before supplier bills come due.

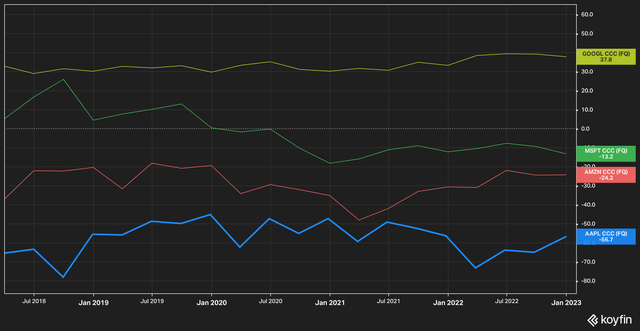

Quarterly Cash Conversion Cycle (Koyfin)

Apple’s CCC runs an astounding negative 56 days, which means that it can hold (and deploy) cash for almost two months before suppliers must be paid. This creates a powerful flywheel element for Apple’s cash management, and speaks to the power it wields with suppliers. It also bodes well for Apple’s ability to ride out near-term challenges as they arise.

Amazon, by comparison-a company which is no operational slouch and is also a negative working capital company-has a CCC of negative 24 days, while Microsoft clocked in at negative 13 days. Google’s CCC, meanwhile, runs a somewhat surprising positive 37 days.

These metrics are important, and we also point out that when it comes to a looming recession, investors aren’t dealing with an unseasoned management team at Apple. Company leadership, as evidenced above, successfully navigated the most challenging global supply chain environment in history-we suspect they will be able to ride out a recession.

In A League Of Its Own

To gird our argument as to why Apple won’t go the way of its FAAMG brethren, let’s examine how it performs in comparison.

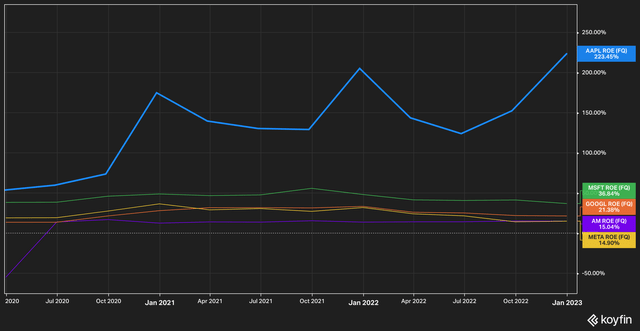

First, let’s start by examining returns on equity. When compared to the other FAAMG stocks, Apple pretty clearly emerges as being in its own orbit, generating more a return on equity 6x greater than Microsoft.

Some investors shun return on equity since it doesn’t take debt into account. However, we think it’s useful because it shows us the effect of having a rock-solid balance sheet. It’s also a testament to Apple’s credit that it can generate this ROE despite having higher debt ratios than every other company listed besides Amazon (which is expected due to Apple’s hardware business).

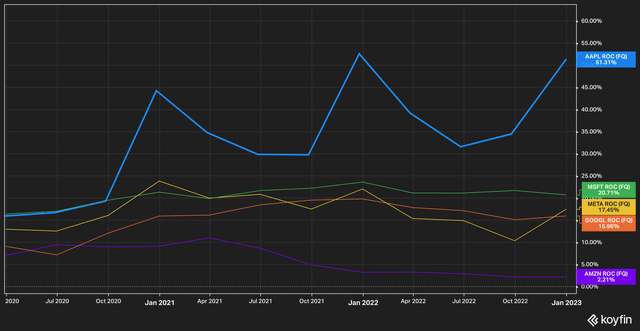

Returns on capital-which takes debt into account-tells a similar story.

FAAMG Return on Capital (Koyfin)

Once again, Apple stands head and shoulders above its FAAMG peers, generating a 53% ROC last quarter, more than double its closest competitor in Microsoft, which posted an otherwise impressive 20% ROC.

While we haven’t yet discussed what external risks Apple faces, we assume that at this point those with a negative viewpoint on the stock will say–so what? Couldn’t all that just mean that the stock is priced to perfection?

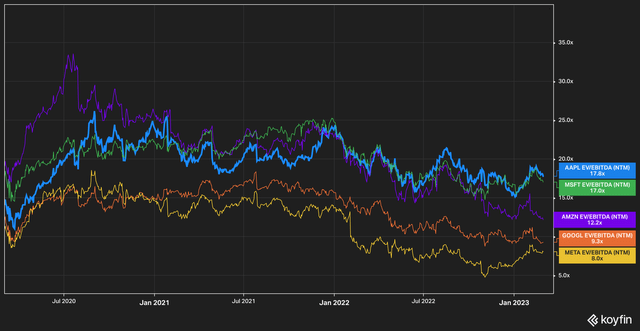

Well, let’s take a look. On a forward EV/EBITDA basis, Apple does trade at a premium to its FAAMG peers (with the exception of Microsoft).

Given the disparity in returns on capital and equity, it might be a little surprising to see that Apple and Microsoft are valued almost equally at 17x forward EV/EBIDTA. The other three stocks in the FAAMG grouping are not particularly far behind with Facebook rounding out the bottom of the pack at 8x.

To us, this is not the kind of valuation we would expect to see for a company that generates a return on equity more than 6x its nearest competitor. In fact, one could argue that its valuation seems low given the return metrics that Apple has consistently turned out quarter after quarter.

Projections

In a time where corporate financial projections continue to fall, Apple’s has held relatively stable.

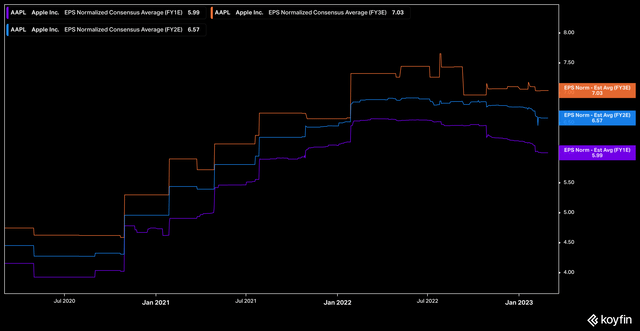

Apple 1-3 Year Forward Estimates (Koyfin)

While estimates for 2023 have fallen modestly, estimates for 2024 and 2025 have only flattened. Of course, estimates are just that–estimates–but it is a testament to the quality and stickiness of Apple’s products and services that the company can retain essentially flat estimates looking out one to three years while most companies are undergoing large downward revisions.

The product pipeline, while speculative, appears to be robust as well. In addition to AR/VR headsets, Apple has a large experimental division known the XDG team (Exploratory Design Group, essentially Apple’s under-the-radar equivalent to Google’s moonshot team), which is focused on a variety of product innovations.

This addresses one of the largest concerns for Apple hand-wringers–how will the company continue to innovate and replicate its past success? While we may not have the definitive answer today, we know that Apple is spending quite a bit to continue its penetration of the healthcare and healthcare monitoring market.

To wit, Bloomberg recently reported that the XDG team has made great strides in its effort to develop a no-prick blood glucose monitor that can take readings directly from an Apple Watch. A breakthrough in this field would be enormous and open a massive new market for Apple.

Experimental conjecture aside, let’s also not forget that Apple’s flagship iPhone product only continues to gain market share.

What Are The Risks?

Earlier we alluded to risks that management can control vs those which are outside management’s control. A risk that is somewhat outside of Apple’s control is its geopolitical exposure. The company’s supply chain is almost inseparably intertwined with China at the moment, which seemed benign enough for a while, but today carries a highly uncertain degree of risk.

The company is making efforts to reduce its exposure to China, but a meaningful de-coupling is likely to take years to complete, and be fraught with difficulties.

Of course, legal challenges for a company of Apple’s size always loom in the backs of investor’s minds. While in the past the idea of a trust-busting regulator shaking things up seemed much more hypothetical than not, in today’s anti-corporate environment (one where the DOJ recently brought an antitrust suit against Google) the threat seems far more tangible.

Lastly–but perhaps most importantly–the biggest risk for Apple is succession risk. Tim Cook’s time as CEO has been so good that it’s easy to forget just how fraught his ascension was treated by the financial press at the time. When visionary founders leave, after all, things tend to go south. Cook could have as little as three years left at the company. With this timeline, the board is likely to have already begun succession planning. The big question for long-term investors is–will lighting strike at Apple for a third time?

The Bottom Line

As equity markets teeter in the face of multiple sources of uncertainty, investors are more likely to cling to value and quality than anything else. In our view, maybe no modern company embodies those qualities quite like Apple. In terms of operational and financial efficiency, the company is simply unmatched. While there may be some hiccups along the way (Apple stock, like every other, still has a degree of beta, after all), we believe that investors would be hard pressed to find a company that has delivered for investors the way Apple has.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.