Summary:

- Elon Musk introduced Master Plan 3 for Tesla, Inc. during the March 1st Investor Day presentation.

- Key items that investors wanted to know more of were largely absent, though, making the event not much more than a generic presentation of Tesla’s forward growth aspirations.

- The lack of follow-through on previously taunted catalysts was enough to stem the stock’s recent rally, as Tesla’s valuation disconnect from its fundamentals buckles.

Sundry Photography

Tesla, Inc.’s (NASDAQ:TSLA) Investor Day yesterday was underwhelming to say the least. The momentum that Elon Musk & Co. had built up over the “generation 3 platform” reporting Tesla’s second consecutive quarterly delivery miss in early January quickly fizzled, with management simply citing more details to come at a later unspecified date during the Investor Day presentation. Specifically, Master Plan 3 was impressive as expected in true Tesla form, but the lack of details makes it nothing incremental to what investors already know and wanted more of. Meanwhile, the “AI plug” that Musk had brough to the presentation – which many across corporate America had looked to capitalize on during the latest earnings season – with a swift 5-minute reintroduction of an improved Optimus did little to arrest the Tesla stock’s post-market declines throughout the session.

Admittedly, Tesla’s market valuation is a phenomenon that presents a significant disconnect from its underlying fundamentals. Echoing what one of our readers had mentioned in a recent coverage, “Tesla’s share price has long been cut out from fundamentals,” forging a different meaning to valuation that is primarily driven instead by Musk’s actions and other external qualitative considerations over the company’s actual business performance (hence the stock’s lofty valuation that totals more than the market cap of some of the largest automakers combined). And Tesla’s most recent Investor Day presentation – an opportunity for Musk to reinforce the stock’s uptrend with his magic – had seemingly failed to convince investors that the early-year rally would remain sustainable in the near-term.

With momentum built up over the stock’s approximate 100% rally in recent months now losing air again, Tesla’s share price could very well be in a directional downtrend moving forward. And any sporadic spikes dependent on Musk’s typically non-pragmatic next steps are unlikely to prove sustainable in the near-term, unless a structural “transformational catalyst” comes along for the electric vehicle (“EV”) pioneer. The following analysis will look into some of the potential transformational catalysts that investors have set their eyes on for Tesla and how Investor Day had failed to impress on said items, and gauge their implications on the stock’s near-term performance. The Investor Day disappointment – a presentation that failed to deliver on the hype that had overshadowed Tesla’s latest earnings disappointment in recent months – will likely push the stock’s momentum back to the modest sentiment leading up to the company’s fourth quarter delivery miss. This will likely unleash deflation in the spread between Tesla’s lofty valuation and its underlying business fundamentals over the coming months as markets digest the latest company-specific, industry, and broader macroeconomic developments.

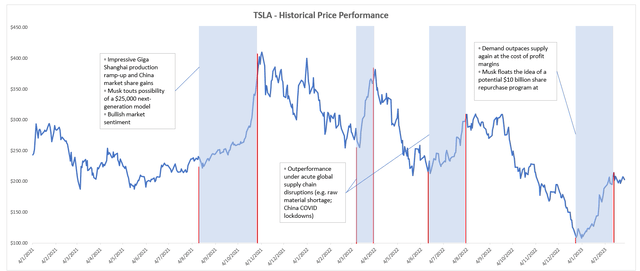

Notable Tesla rallies in recent years (Tesla Stock)

Some of Tesla’s most notable rallies in recent years shed light on the transformational catalysts that investors had been hoping would materialize within the foreseeable future. These include the bull market rally in the months leading up to November 2021, which was bolstered by Tesla’s announcement of a potential $25,000 next-generation model critical to capturing incremental share in the mass market; post-earning rallies in 2022 on investors’ optimism over Tesla’s outperformance under acute global supply chain disruptions; and more recently, the business’ return to a supply-constrained state following price cuts to alleviate demand risks, and Musk dangling the potential for a $10 billion share buyback program at Tesla.

The common theme among the Tesla stock’s notable rallies is that the driving transformational catalysts all point back to investors’ desire for fundamental strength, despite its lofty valuation’s stark disconnect with the underlying business’ financial performance. The transformational catalysts – counting the introduction of a competitively priced mass market product to overcome mounting competition, resilience amid industry-upending supply chain disruptions, and a potential share buyback – together indicate fundamental-driven factors including a sustained longer-term growth and market share gains at Tesla, the company’s cost advantage as the world’s most efficient auto manufacturer, and a robust balance sheet to support longer-term shareholder returns.

And the fizzling rally following Tesla’s most recent Investor Day presentation highlights its failure to deliver on said catalysts investors had been hopeful would materialize in the near-term, shedding uncertainty to the sustainability of the stock’s lofty valuation at current levels, and ultimately narrowing the valuation-fundamental disconnect once again.

For one, details regarding the generation 3 platform were rather lacking during the Investor Day presentation, which did not live up to the hype that management had built up regarding the strategic priority that would be critical to keeping Tesla’s margins “healthy and industry leading over the course of the year.” While CFO Zach Kirkhorn had promised a reduction to production costs by 50% upon ramped up production of vehicles built on the next-generation platform, no specific timeline was provided on the endevour. Further details over the development have instead been pushed back to a “proper product event” in the unspecified future. Meanwhile, management remained keen on reiterating the continuance of cost pressures in the near-term due to the lingering aftermath of “COVID-related instability” and ongoing growth investments in an attempt to temper investors’ expectations, which they had also simultaneously had a hand in building over the recent months by taunting a more cost-efficient next-generation platform that might come sooner rather than later. The anticipation for further cost pressures in the near-term comes despite steep improvements to Tesla’s already market leading manufacturing efficiency, underscoring the significant burden of ongoing capital investments and R&D – which little detail has been provided over – on the company’s near-term profitability:

Tesla has now made 4 million cars. It took 12 years to build the first million Teslas, then 18 months to get to 2 million, 11 months to get to 3 million and then seven months to get to the 4 million mark.

Source: Bloomberg News.

The long-awaited $25,000 model – which Musk had put on the back burner since earlier last year – also remained a “no-show” in Tesla’s Master Plan 3. The development was regarded as a key catalyst for sustaining Tesla’s longer-term market share gains as competition in the EV landscape gains momentum (further discussed here), and management’s hint at the development of the generation 3 platform earlier this year had awaken hopes that the mass market offering would make it into the EV titan’s near-term business plan. Although management promised the development of lower cost next-generation vehicles with the generation 3 platform – which will be built in the newly announced assembly plant in Mexico – they remained mum on the timeline, which is likely still years out from reality since Tesla has yet to break ground on the new facility. This makes another optimism that was previously priced into the stock’s recent rally that investors have since retracted.

There was also no mention of potential for up to $10 billion in share buybacks at Tesla in the near-term, an idea that Musk had previously floated which assuaged share dilution concerns following his massive share sale last year. That is unsurprising though, given astronomical figure required to materialize all that is set out in Master Plan 3:

Chief Financial Officer Zach Kirkhorn said publicly for the first time on Wednesday that Tesla could need to spend nearly $150 billion more to achieve its long-term goals, which includes selling 20 million vehicles a year…Mr. Kirkhorn said his investment forecast of up to $175 billion, including around $28 billion already spent, was intended to illustrate the feasibility of Tesla’s goals.

Source: Wall Street Journal.

Although it is prudent of Tesla to reinvest its success into future growth rather than hastening on the provision of incremental shareholder returns in the form of buybacks, investors had previously viewed a share repurchase program a catalyst for the stock, nonetheless. Realization of a $5 billion to $10 billion share repurchase program in the near-term would alleviate some of the pressure stemming from Musk’s massive share sales over the course of 2022 that the stock has yet to regain its footing from – but that is likely to remain a no-go for now.

Taken together, Tesla’s latest Investor Day brings the stock back to status quo, drawing the stock’s lofty valuation closer once again to the underlying business’ fundamental performance under the current operating environment, given the lack of transformational catalysts to sustain an incremental uptrend.

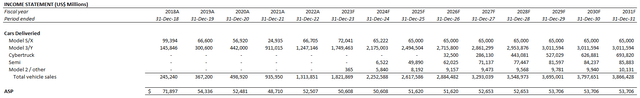

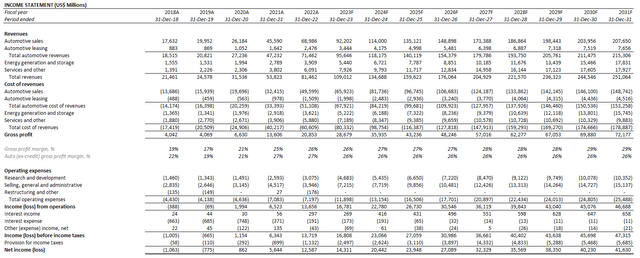

Tesla vehicle delivery forecast (Author) Tesla financial forecast (Author)

Tesla_-_Forecasted_Financial_Information.pdf

And turning back to Tesla’s underlying fundamentals – one of the core drivers of market valuation – updating our model for actual fourth quarter results and the broad-based forward aspirations introduced in Master Plan 3 during Investor Day, the company likely remains far out from plans to achieve sales of 20 million vehicles a year – at least not within the current decade under consideration of production capacity announced to date. Meanwhile, competition is growing at a rapid pace across all vehicle and pricing segments, dialing up urgency for Tesla to introduce a low-cost mass market model to penetrate new opportunities without compromising margins (a strategy it has sought after in recent months to shore up demand through price cuts). Based on the conservative consumption that development of the generation 3 platform is progressing positively and can deliver on greater manufacturing efficiency, and thus enable next-generation EVs with better profitability to restore vehicle margin expansion over the longer-term, we have modelled modest sales of the potential $25,000 vehicle (dubbed “Model 2”). However, the Model 3/Y will likely remain best-sellers given their relatively competitive price point in the best-selling premium compact electric sedan and SUV categories.

On the spending front, there will likely be little relief to the near-term cost structure. This is corroborated by diminishing vehicle margins in recent quarters that will likely linger considering persistent uncertainties in global supply chains, and massive capital investments and R&D required for the build-out of the generation 3 platform as well as Tesla’s global production capacity. Over the longer-term, we also remain conservative about Tesla’s return to near-30% auto margins (ex-auto credit sales), given uncertainty over the realization timeline for next-generation models and the extent of expanded manufacturing capacity required to achieve Kirkhorn’s vow to cut production costs by half in the unspecified future.

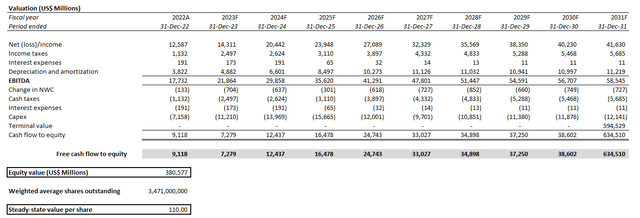

Tesla steady-state valuation analysis (Author)

Taken together with key valuation assumptions held constant from our previous discussion on Tesla’s steady-state valuation method, we remain hold rated in the stock at current levels. Without realization of transformational catalysts, Tesla, Inc.’s lofty valuation will likely fizzle towards the $110 to $120 range again as mounting market uncertainties – spanning macroeconomic deterioration, rising costs of capital, and persistent inflationary pressure – re-emerge as the forefront of sentiment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!