Summary:

- Amazon investors must wonder: when will results finally turn the corner?

- Persistent headwinds dog the company. But there are signs this could turnaround soon, and other signs that it may take longer.

- Let’s take a look at what warrants watching closely as we close out the first quarter.

Rezus/iStock via Getty Images

The pandemic was a tremendous boon to Amazon (NASDAQ:AMZN) for a time. Product sales skyrocketed 51% from $160 billion in 2019 to $242 billion in 2021, and service sales blossomed by 90%, from $120 billion to $228 billion over this time.

Low interest rates and stimulus spurred spending in all areas. Amazon Web Services (AWS) was a beneficiary of massive B2B cloud infrastructure spending.

Fortunes quickly turned as several storms struck at once, including:

- a historically tight labor market;

- logistical bottlenecks;

- stubborn inflation;

- cratering consumer sentiment; and

- rising interest rates.

But wait! There’s more. The US dollar (DXY) rose precipitously; Businesses began to pare spending; and Amazon’s extreme (but necessary) increase in CAPEX (purchases of fixed assets) pushed free cash flow deep into negative territory.

Amazon investors are patiently (or perhaps impatiently) waiting for signs of a turnaround. What is the expectation for the first quarter?

Defining the turnaround

Getting out in front of this many headaches will take time, but there will be signs of improvement.

First, we should define what exactly constitutes a turnaround. Here are a couple of items to look for.

- Return to positive free cash flow.

- Return to operating profit in the North America segment, and limited losses internationally.

- Stem the slowdown in AWS growth.

- Continue driving advertising sales.

Will free cash flow return?

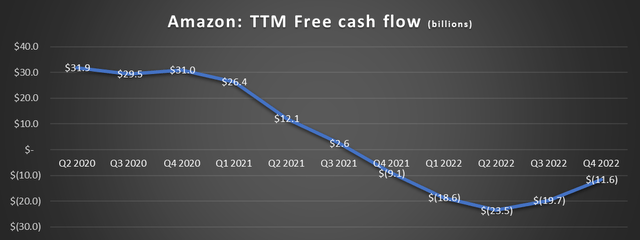

Amazon’s trailing twelve months (TTM) free cash flow peaked in 2020 at over $31 billion and looks to have troughed in Q2 2022, as shown below.

Data source: Amazon. Chart by author.

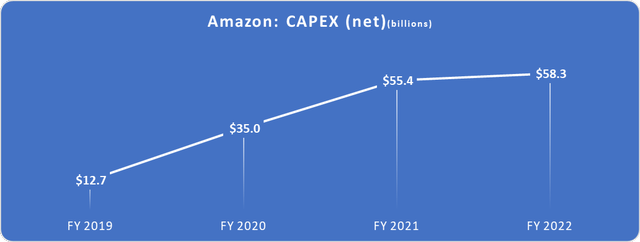

Several factors, many of which were bulleted in the opening section, caused net income to drop. Skyrocketing CAPEX was also a huge factor, as shown below.

Data source: Amazon. Chart by author.

CAPEX spending is normalizing and should begin to come down. It didn’t come up on the Q4 2022 earnings call, but CFO Brian Olsavsky offered clues in Q3.

And then CapEx is a big driver. We had…very high CapEx the last two years. You’ll see that we’ve lowered CapEx year-over-year. We probably cut about one-third of our budget from what we originally thought for 2022 while still focusing our capital dollars really on the AWS business and increasing customer demand or capacity for increasing customer demand in our stores business.

We’ve taken steps to alter our forward plan and take CapEx out… A lot of the CapEx we spend in any given year is feeding future years’ capability. And we’ve tightened that up. We feel good about the arc of demand versus supply that we have in our fulfillment and transportation area.

Watching for:

- A noticeable decline in CapEx; and

- Continued uptrend in TTM free cash flow.

Turning the tide in the North America and International segments

Amazon is transforming from a product-based company to a service-based company as service-based revenue outpaced product sales for the first time in 2022. This will eventually be terrific for profitability, but the North American and International segments (everything not named AWS) produced heavy losses in 2022.

North America

Net sales in North America rose a respectable 13% in 2022, but the segment swung from a 2021 operating profit of $7.3 billion to a loss of $2.8 as operating expenses jumped.

However, the Q4 loss narrowed to just $240 million despite several large one-off charges, such as asset impairments and employee severances.

Some of the severances will hit the books in Q1, and another round of layoffs has been announced. Amazon has announced 27,000 layoffs recently, representing about 1.8% of the workforce. This should improve the cost structure but comes with up-front costs.

Watching for: Amazon to eke out an operating profit in North America.

International

Amazon’s international business was crushed by the strong dollar last year. Sales were down 8% year over year (YOY) in Q4 but would have risen 5% were it not for the exchange rate.

This should normalize in Q1 as the dollar has come back to Earth, as shown below.

Seeking Alpha

Watching for: A significant reduction in operating losses and break-even unadjusted sales.

AWS

A slowdown in AWS is a given as companies look to cut costs. The question is how much. You could almost hear traders rushing to push the “sell” button when Amazon mentioned AWS growth was just in the mid-teens for the first month of 2023 (growth was 20% in Q4). This signals that companies have trimmed budgets even more and are being very cautious about their data usage.

Amazon is making a concerted effort to help customers lower costs, which will hurt in Q1, but is intelligent in the long run. Would you rather help customers lower costs during an economic slowdown or lose them outright to competitors?

AWS… we’re going to help our customers find a way to spend less money. We are not focused on trying to optimize in any one quarter or any one year, we’re trying to build a set of relationships in business that outlast all of us. And so if it’s good for our customers to find a way to be more cost-effective in an uncertain economy, our team is going to spend a lot of cycles doing that.

-CEO Andy Jassy on Q4 earnings call (author’s emphasis).

Watching for:

- Amazon to maintain margins and produce $5 billion in Q1 operating profits amidst the slowdown.

- Will some investors panic if we see just 15% growth?

Advertising sales

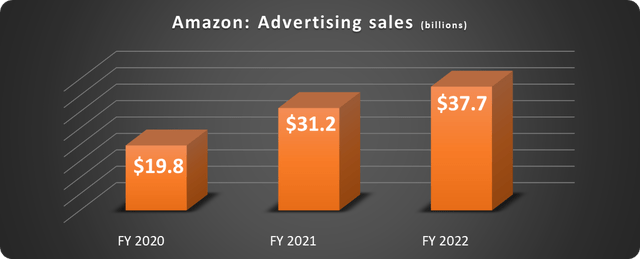

Advertising was the fastest-growing revenue stream other than AWS last year and is a force in the industry. Sales have nearly doubled in two years, as shown below.

Data source: Amazon. Chart by author.

Advertisers have limited budgets, and Amazon makes a compelling case for their dollars. Sponsored products and display ads are highly effective since they reach consumers who are ready to buy. Even so, this segment is not immune to the economy.

Watching for: Maintaining 20%+ YOY growth in digital advertising will be a huge win.

Will we see a Q1 turnaround?

It comes down to timeframe and expectations. Management gave several hints last quarter that Q1 results will be tempered. Amazon needs to be as efficient as possible, but not to the detriment of long-term goals.

We’re going to continue to invest. We’re going to be very thoughtful about how we streamline our costs, and I think you see a lot of that, but we’re also going to continue to invest for the long term. – CEO Andy Jassy on Q4 earnings call.

This is the correct strategy for long-term investors and the company. But it could shock unprepared investors.

Long-term investors can take solace that Amazon has over 200 million Prime members, a stranglehold on the US eCommerce and global cloud market, a burgeoning advertising business, and an iron in the fire with Buy with Prime.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors’ goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.