Summary:

- Amazon.com, Inc. reported bad Q4 earnings, but were they thesis-busting?

- The company continues its journey to become a service-based business, although this is still not showing up in margins.

- Ads was the clear highlight, whereas AWS was the lowlight. We discuss why.

- Andy Jassy shared how Amazon views investments, and we hope this view never changes. It’s what makes the company special.

- Amazon’s guidance was bad too. “Problems” are not expected to get solved fast, so patience is required.

Daria Nipot

Introduction

Amazon.com, Inc. (NASDAQ:AMZN) reported its Q4 and FY 2022 earnings last week, and as you might have read in many articles or headlines, they were pretty bad.

Many investors are getting increasingly frustrated with Amazon’s performance and are closing their positions. We think this behavior shows a lack of long-term view, without denying that earnings were not good, of course.

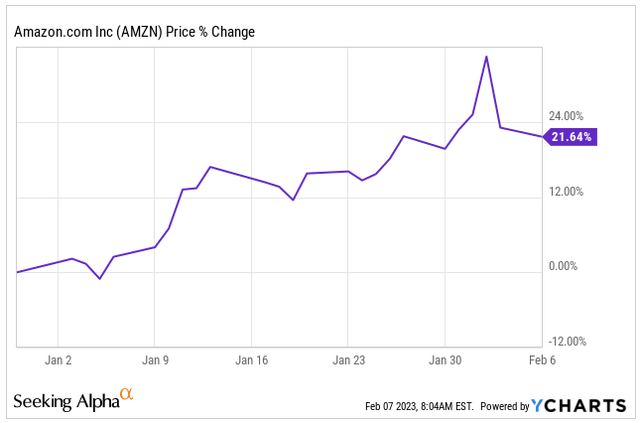

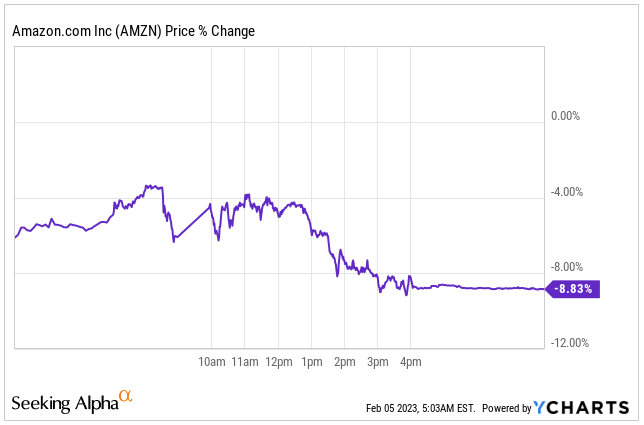

We also saw many trying to understand why the stock was not down more after such earnings. The short answer is that short-term market moves can rarely be explained by company performance, both to the upside and downside. Amazon’s stock lost almost 9% the day after earnings:

YCharts

This might sound like a significant drop, but if we zoom out a bit, we can see how the stock has performed exceptionally well year-to-date. It seems like a lot of bad news was baked into the price at the lows:

Of course, the stock could drop further in the coming weeks or months, an opportunity that we would definitely take advantage of to scale our position.

Also worth noting is that Andy Jassy joined the Q4 earnings call for the first time since becoming CEO. He gave us the impression of being a great communicator and shared some interesting titbits, which we will discuss in the article too.

Without further ado, let’s get started with the numbers.

The numbers

The headline numbers

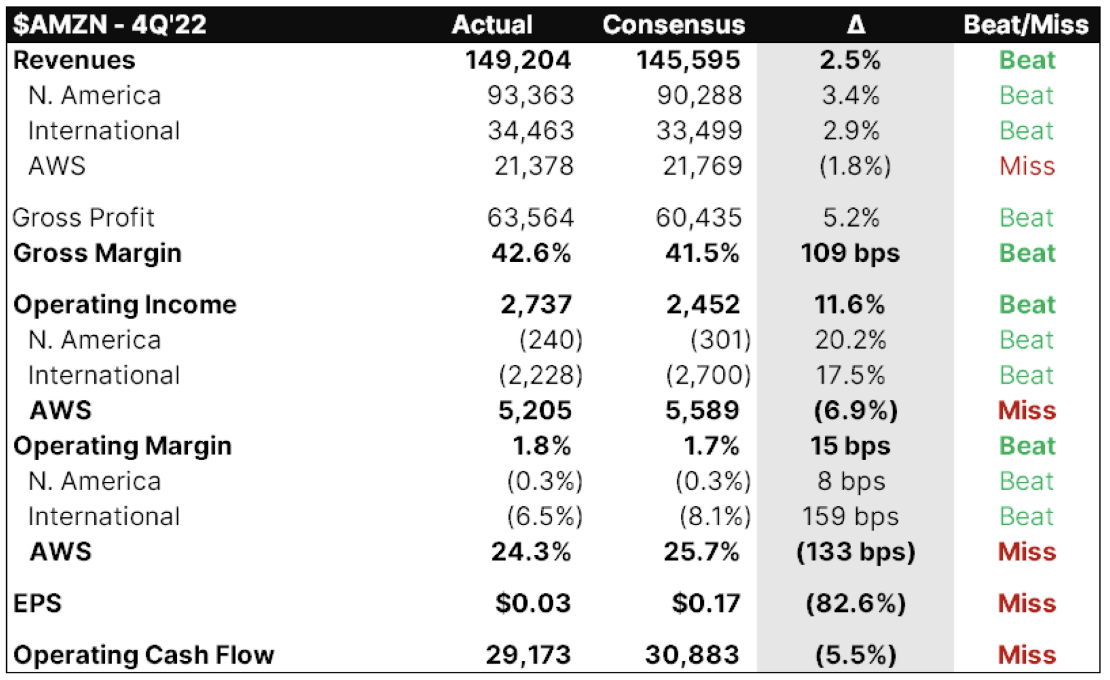

Amazon beat analysts’ top line estimates but missed on the bottom line:

Consensus Gurus

The bottom line miss was substantial, but we’ll go over why we shouldn’t focus too much on it later. There were some one-offs and non-operating expenses that negatively impacted net income this quarter.

Looking at the different business lines

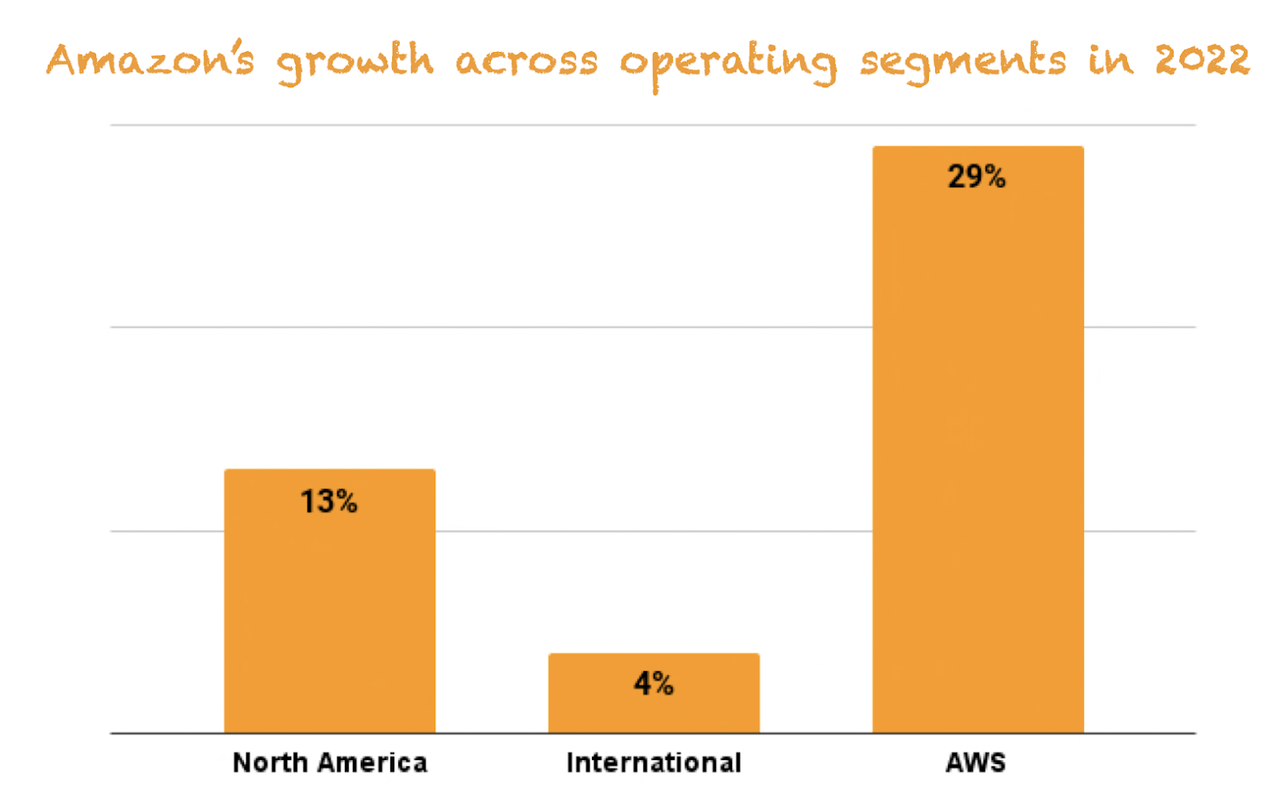

Amazon typically reports under three operating segments: North America, International, and AWS. The three segments grew in 2022 (in constant currency) despite facing tough comps from 2020 and 2021, two years when Amazon enjoyed the benefit of the pandemic:

Made by Best Anchor Stocks

Growth was meager in its international operations, but we have to take into account that the economy is also in worse condition outside of the US. Andy Jassy argued during the call that this slowdown is temporary and related to macro (emphasis added):

We’re very enthusiastic about the business we’re building there. I think just perspective, if you look at the compounded annual growth rate from 2019 to ’21, in the U.K., it was over 30%; in Germany, it was 26%; in Japan, it was 21%. And the fact that we haven’t given back that growth, and these are all net of FX, but if you look at even the last couple of quarters where we’re continuing to grow and we haven’t given back some of that growth, a meaningful amount of market segment share has shifted to our global established e-commerce territories, and we’re excited about that.

Now we’re — at this stage, we’re big enough in our developed international territories that when there’s something significant happening in the macro, we’re going to be impacted as well.

Despite these being Amazon’s “official” operating groups, the company is best viewed by looking at the different business lines. These business lines are our only way of knowing if Amazon is becoming a better company.

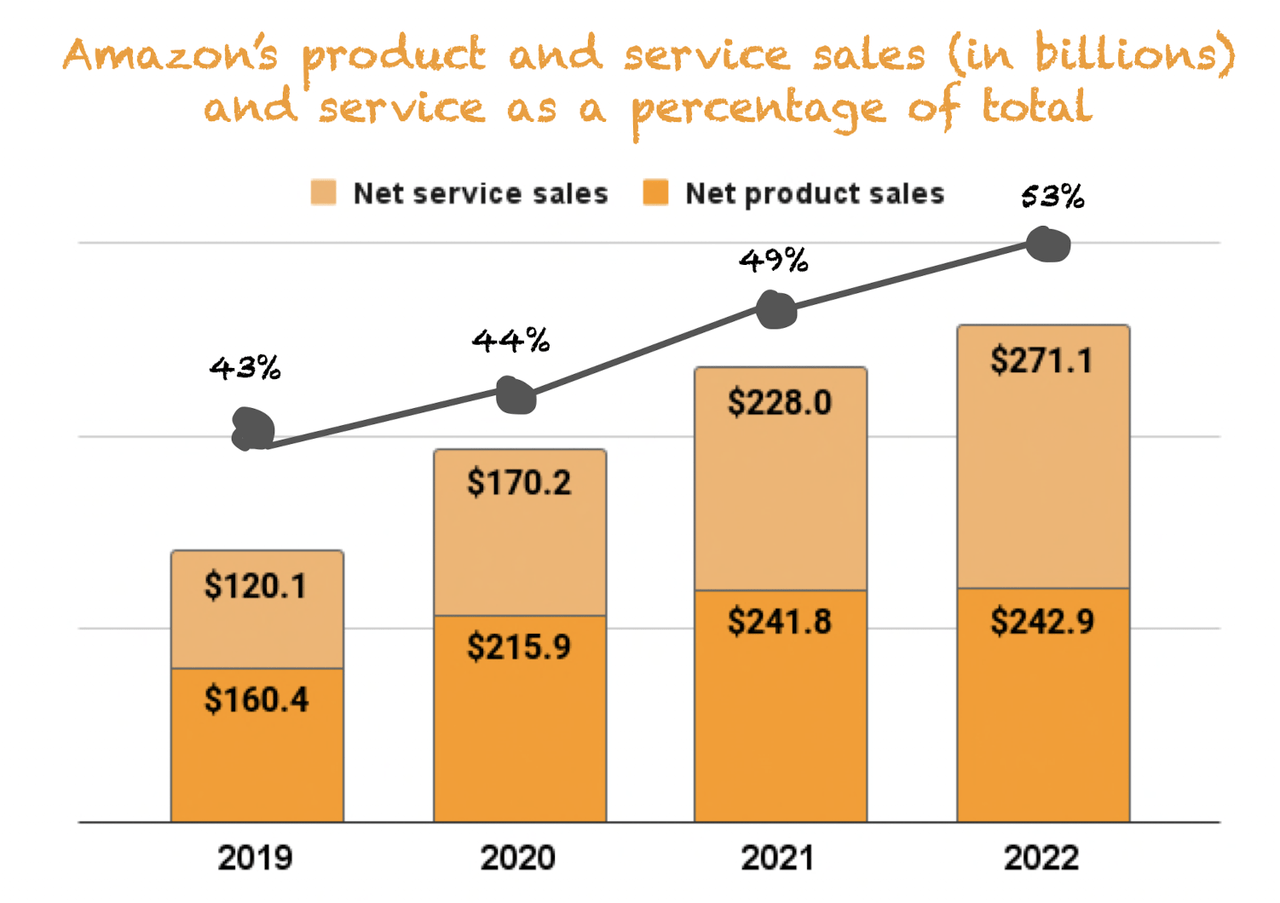

If we first look at product and service revenues, we can see how Amazon is increasingly becoming a service-based company:

Made by Best Anchor Stocks

This is good because service revenues tend to carry a higher margin than product sales and, in some cases, are more recurrent too (like subscriptions). Our interpretation here is that if Amazon manages to match costs with revenue in its retail operations (more on this later), we should see a higher margin for the company in the future than we’ve ever seen.

Note that the percentage of revenue that comes from service should enjoy tailwinds from the introduction of Buy With Prime (we wrote a comprehensive two-part article series on Buy With Prime which you can read here and here.)

Considering that Amazon has a culture of building capacity in advance of demand, the timing of when these higher margins will surface is unknown. This is most likely what is frustrating investors. Amazon’s management continues to delay the margin uplift by investing for the long term. This time, they might have gone too far with these investments but it’s something one must get used to if interested in Amazon.

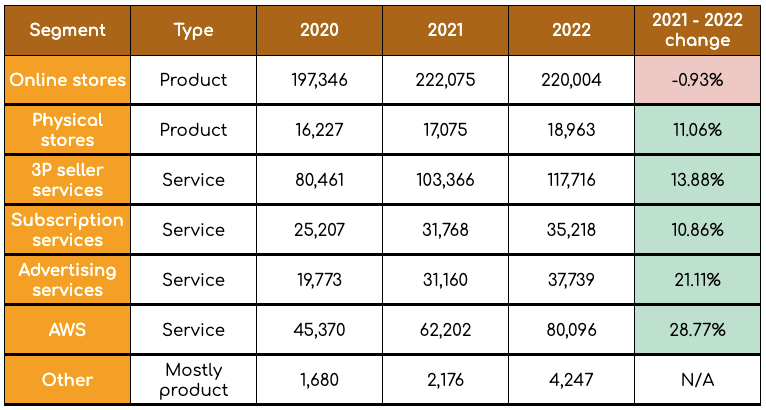

The table that summarizes how Amazon is increasingly becoming a service-based company is the following:

Made by Best Anchor Stocks

Services continued to grow at an adequate pace in 2022, with product being the only lagging business line. We’ll briefly discuss 3P seller services, subscription services, advertising services, and AWS.

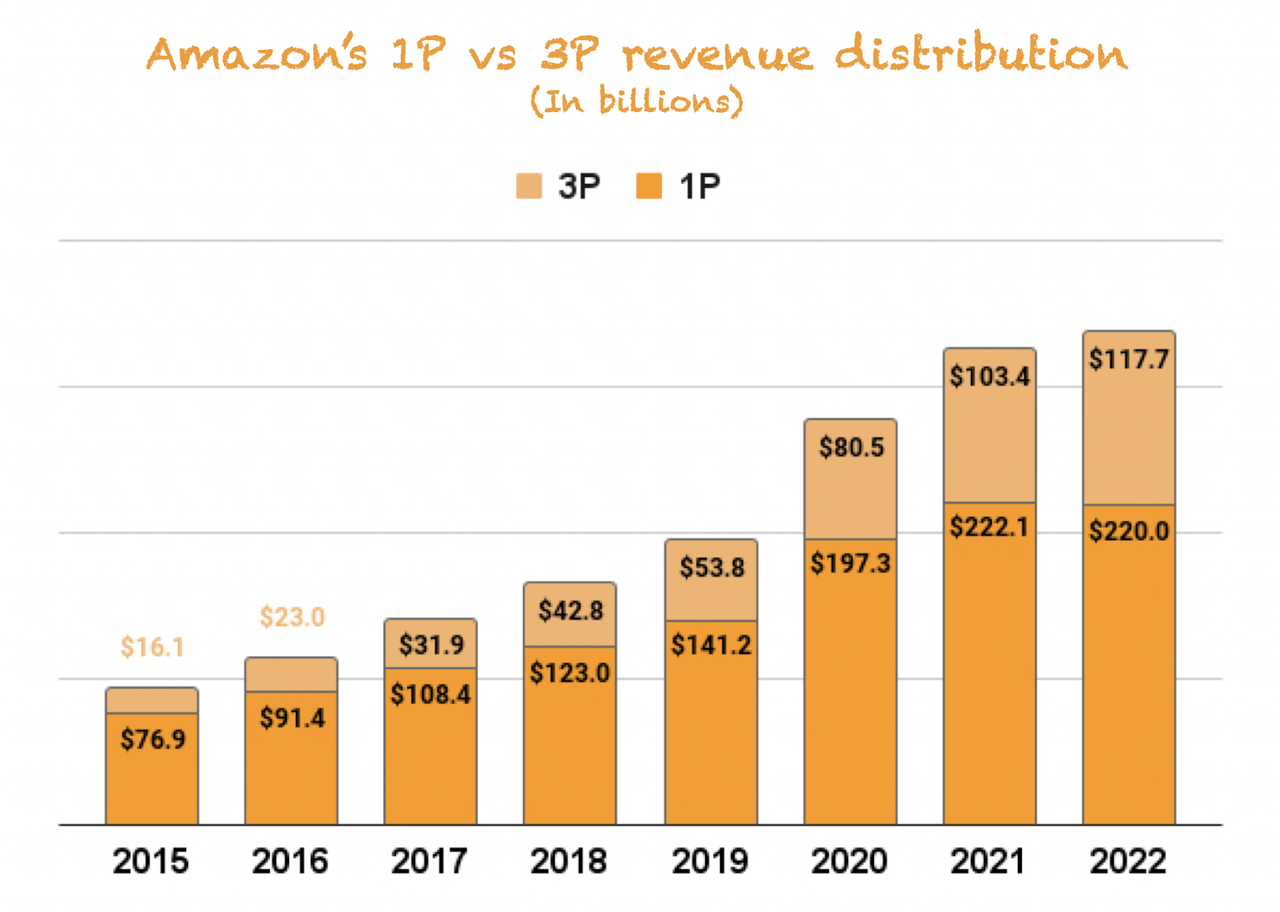

3P seller services continue to grow at a good pace as Amazon continues its journey to becoming a 3P marketplace. This should not only help with margins but also with regulatory scrutiny. The latter is especially true with Buy With Prime, through which Amazon will open its marketplace for the first time:

Made by Best Anchor Stocks

Note that the graph above shows revenue, not Gross Merchandise Value. GMV for 3P is significantly higher than 1P GMV, but Amazon doesn’t disclose it. However, Brian Olsavsky, Amazon’s CFO, did give the following stat:

In Q4, sellers comprised a record 59% of overall unit sales.

The new Buy With Prime offering should give 3P seller services yet another boost.

Subscription services continue to grow at a good pace too, but it seems to be growing below its potential. Andy Jassy explained during the call how the value equation is tilting toward the consumer as Amazon continues to add services while being priced below the market:

If you step back and think about a lot of subscription programs, there are a number of them that are $14, $15 a month really for entertainment content, which is more than what Prime is today.

If you think about the value of Prime, which is less than what I just mentioned, where you get the entertainment content on the Prime Video side and you get the shipping benefit, the fast shipping benefit you can’t find elsewhere and you get the music benefit, you get the Prime Gaming benefit and you get the photos benefit and you get the Buy with Prime capability, use your Prime subscription on websites beyond just Amazon and some of the grocery benefits that we provide, and RxPass like we just launched to get a number of medications people take regularly for $5 a month unlimited, that is remarkable value that you just don’t find elsewhere.

This screams pricing power to us, but it’s difficult to tell when the company will realize it. Prices will undoubtedly go up, but the value-price relationship for the customer will stay constant or increase, something that’s in Amazon’s DNA. It still amazes me knowing that I pay around €36 a year for my Prime subscription. That’s what I spend dining out in Madrid on any given night!

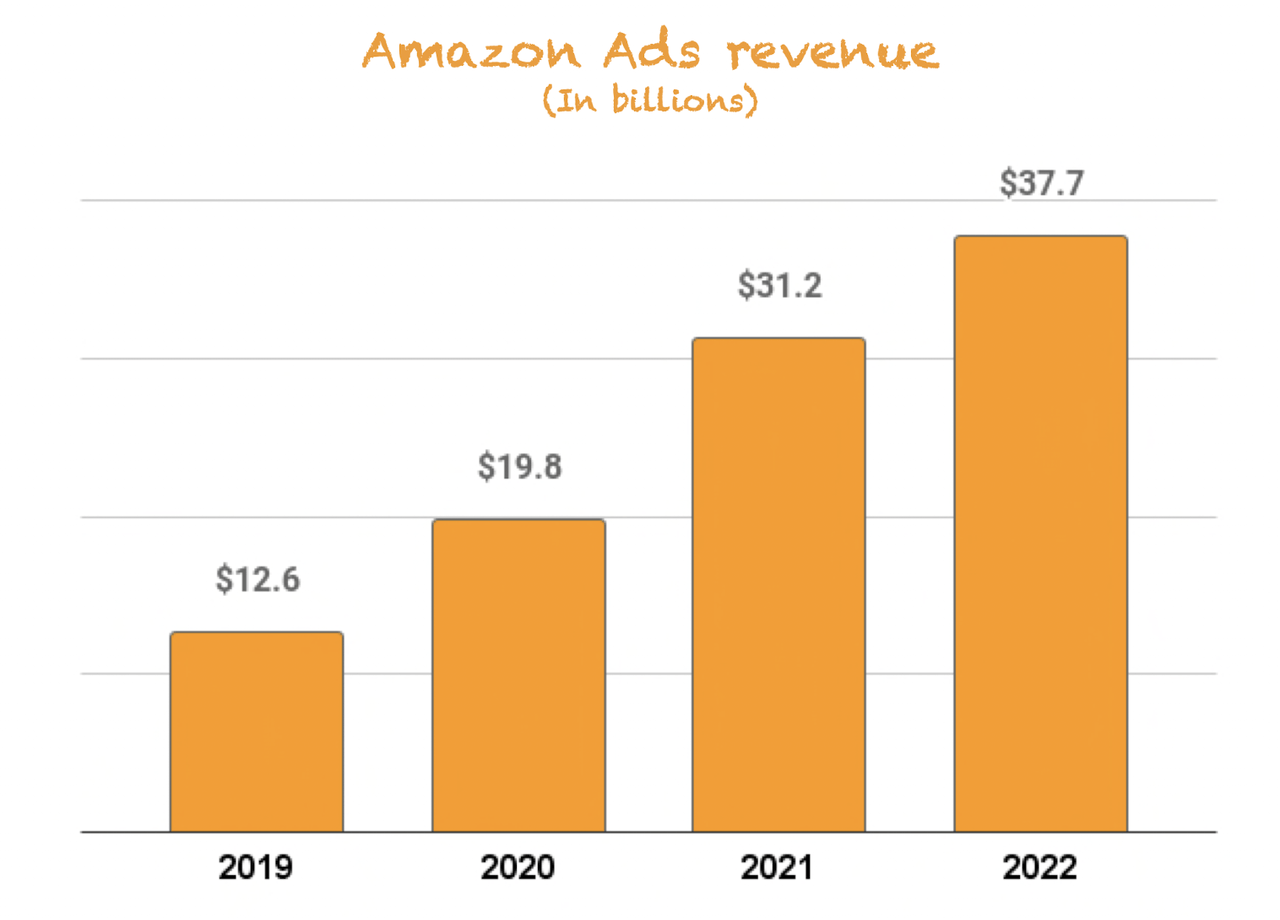

Advertising was undoubtedly the highlight. Ads grew 21% in 2022 and an impressive 23% (excluding FX) in Q4. Amazon’s ads business is already generating $37 billion in sales:

Made by Best Anchor Stocks

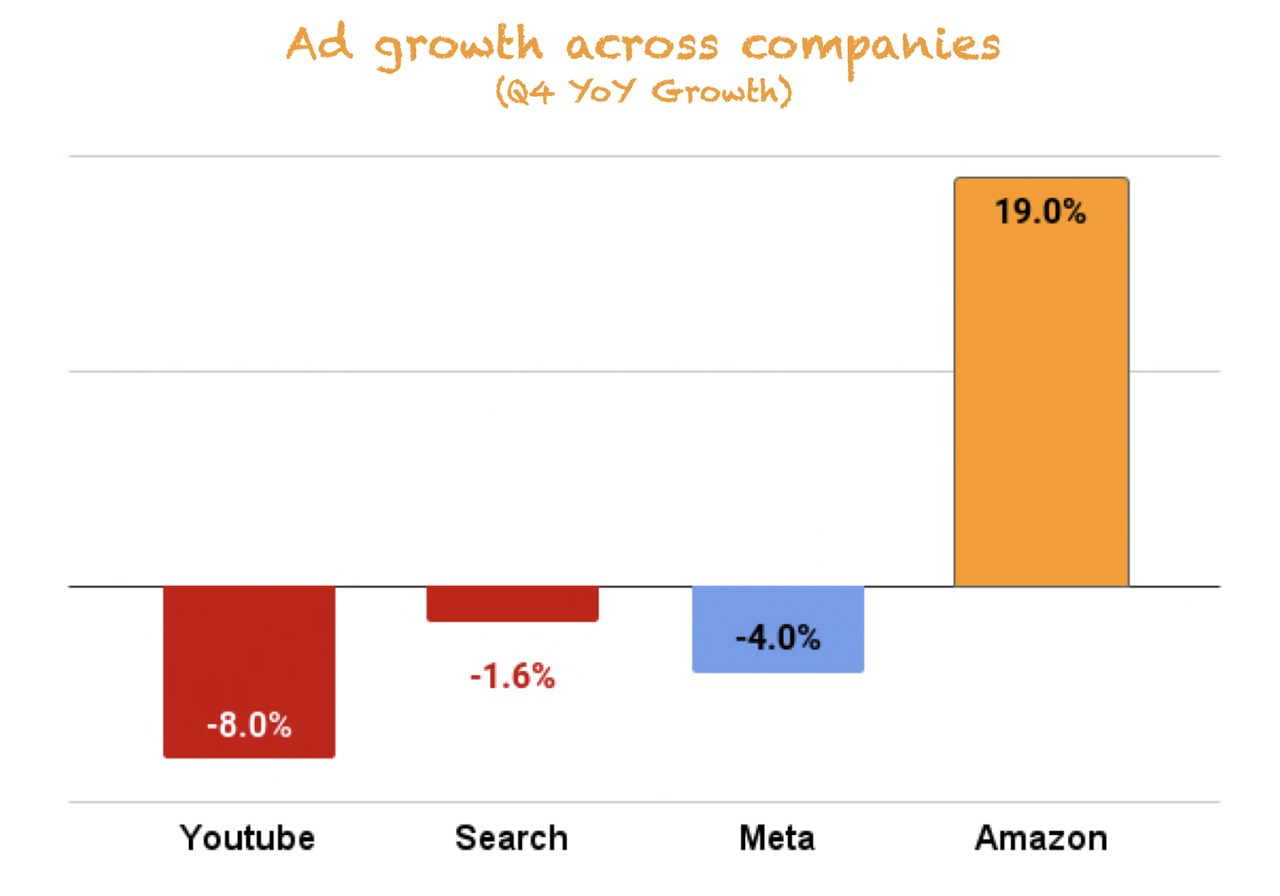

The Q4 result was even more impressive than it looked at first sight; we just need to compare it to Alphabet’s and Meta’s results. Alphabet’s search and YouTube revenue decreased by 1.6% and 8% year-over-year, respectively, in Q4. Meta’s revenue decreased by 4% year-over-year. This compares against Amazon ads’ 19% year-over-year growth (including FX):

Made by Best Anchor Stocks

Meta’s and Alphabet’s search revenue undoubtedly come from a much higher base, but the divergence in performance is too wide to ignore. As we’ve said several times, these Ad businesses are not too comparable due to Amazon’s traffic being of much higher quality than search, YouTube, and Meta’s Family of Apps (due to higher customer intent). Still, it portrays the great ads business that Amazon has built, which should also see significant tailwinds from Buy With Prime. Always good to remember that this business line is only possible thanks to retail.

AWS was probably the lowlight of the release and what spooked the market (besides margins). AWS grew at a good pace in 2022 (+29%), but it’s starting to decelerate significantly. AWS grew 20% in Q4, but growth had decelerated further in January:

So far in the first month of the year, AWS year-over-year revenue growth is in the mid-teens.

Source: Brian Olsavsky, Amazon’s CFO, during the Q4 earnings call.

Management attributed the slowdown to the uncertain macroeconomic environment, which led customers to control their spending. Amazon is helping its customers with these cost cuts, which is not something you typically see:

Our customers are looking for ways to save money, and we spend a lot of our time trying to help them do so. This customer focus is in our DNA and informs how we think about our customer relationships and how we will partner with them for the long term.

Source: Brian Olsavsky, Amazon’s CFO, during the Q4 earnings call.

The shift to the cloud is still in its early days, so Amazon prefers to gain and retain customers today than give them a reason to switch to another provider early in this shift. Upselling and price raises will probably come sometime in the future, but Amazon’s management doesn’t feel the time is now. In fact, these “optimization efforts” will continue for some time:

We expect these optimization efforts will continue to be a headwind for AWS growth in at least the next couple of quarters.

Source: Brian Olsavsky, Amazon’s CFO, during the Q4 earnings call.

AWS is an $80 billion business in customer-acquisition mode in a rapidly growing market, so we are not worried about what seems to be a temporary slowdown. Amazon has always focused on the long-term, and we highly doubt management will sacrifice the future for faster growth in the short term. Azure and GCP (with an inorganic benefit from the purchase of Mandiant) did grow faster than AWS, but AWS added more absolute dollars than both. Size matters and we can’t expect AWS to outpace two smaller players forever.

All in all, there were mostly positive things in Amazon’s top line. The company is increasingly shifting into a service-based business. The Ads business was a highlight, whereas the AWS slowdown was a lowlight, but growth rarely comes in a straight line, so it’s better to wait for how it evolves before rushing to conclusions.

Profitability

Profitability was the lowlight of the release, missing analyst estimates significantly. However, the numbers need some context. We’ll focus on operating income here, as Amazon’s Rivian (RIVN) stake distorts net income quite a bit.

Amazon reported operating income of $2.7 billion in Q4, a meager 1.8% margin. However, operating income was negatively impacted by certain one-offs (emphasis added):

The operating income was negatively impacted by 3 large items, which added approximately $2.7 billion of costs in the quarter. This was related to employee severance, impairments of property and equipment and operating leases and changes in estimates related to self-insurance liabilities. This cost primarily impacted our North America segment. If we had not incurred these charges in Q4, our operating income would have been approximately $5.4 billion.

Source: Brian Olsavsky, Amazon’s CFO, during the Q4 earnings call.

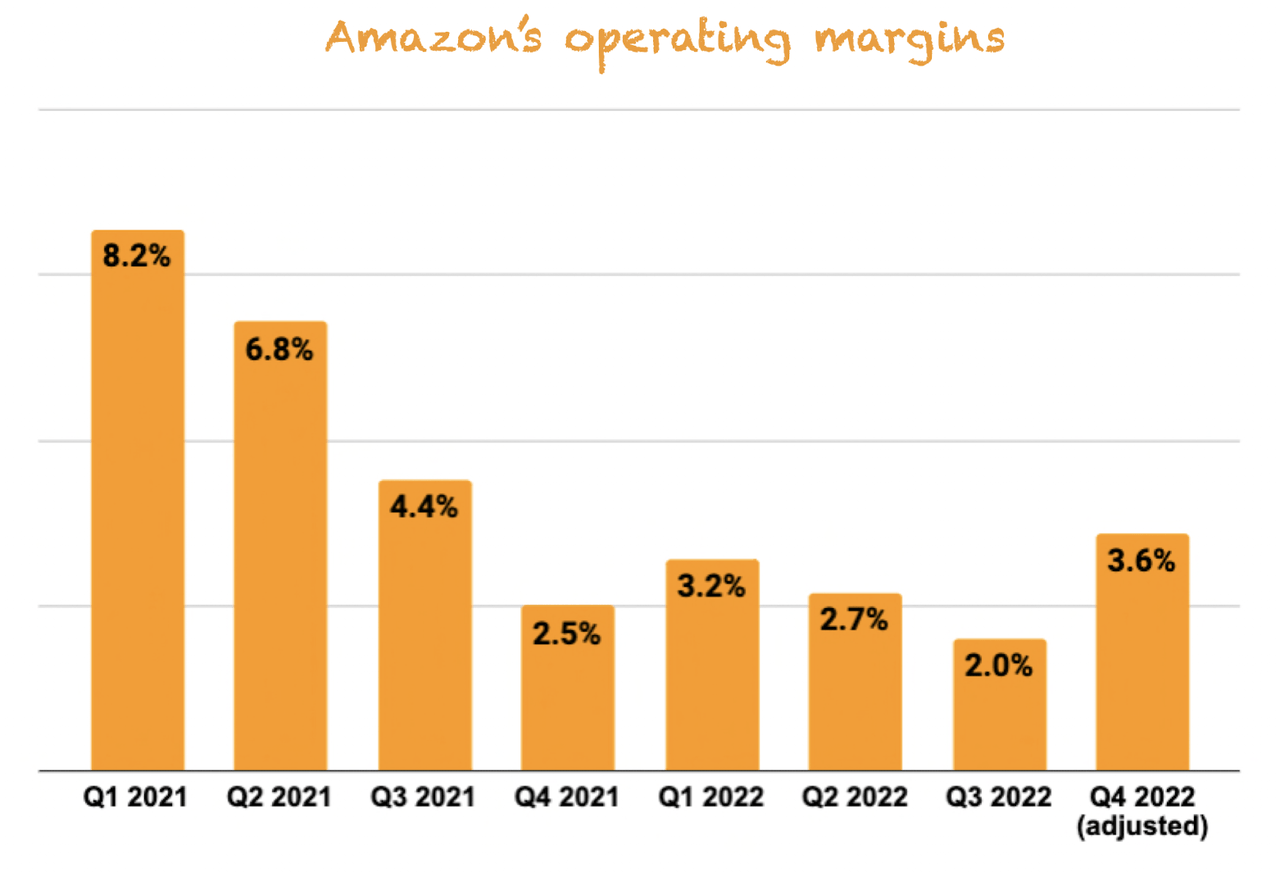

Even if we adjust operating income for these items, we can see that Amazon’s margins have gone south after peaking in Q1 2021. The good news is that the adjusted operating margin showed a sequential and yearly improvement, which might indicate that Amazon is starting to streamline its operating costs:

Made by Best Anchor Stocks

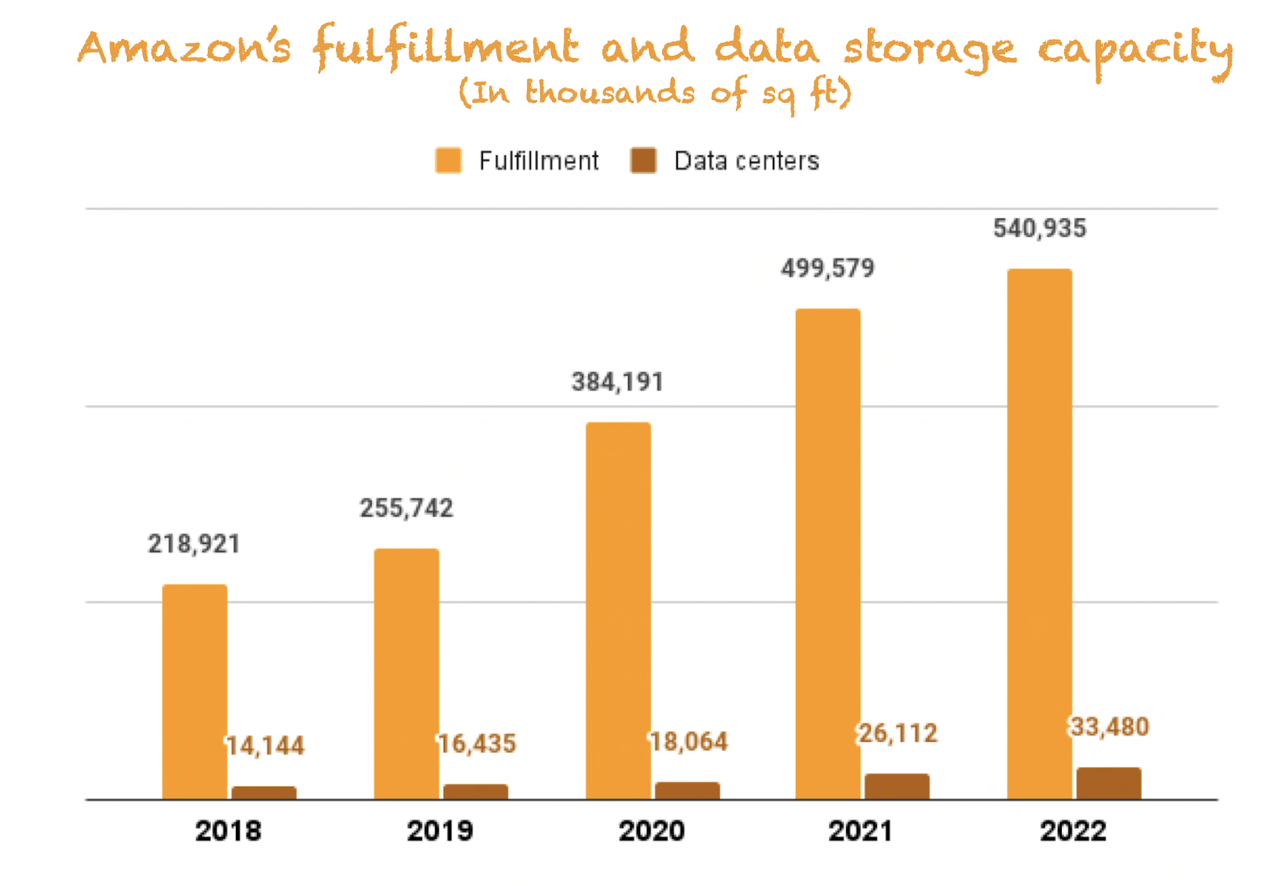

So, what happened? The short answer is that demand outpaced supply during the pandemic, leading management to overbuild capacity. To grasp the size of Amazon’s capacity expansion during the pandemic period, you just have to look at the following chart. Amazon has more than doubled its fulfillment and data center capacity since 2019:

Made by Best Anchor Stocks

It’s important to remember that over the last few years, we took a fulfillment center footprint that we’ve built over 25 years and doubled it in just a couple of years. And then we, at the same time, built out a transportation network for last mile roughly the size of UPS in a couple of years.

Source: Andy Jassy, Amazon’s CEO, during the Q4 earnings call.

The company made these investments in capacity to support future growth, but management was probably too optimistic about the timing of this demand, which will take more years to materialize.

Note that even though this seems obvious in hindsight, it was hard to know how permanent societal changes would be once we came out of the pandemic. We are not excusing management here, it was definitely a misjudgment, but the risk of underbuilding (potentially losing market share) was significantly higher than the risk of overbuilding (low margins for a couple of years).

The thing is that a good portion of this capacity generates fixed costs, so if it’s not coupled with demand, it weighs negatively on margins.

Amazon’s management has acknowledged they have overbuilt and are working to fix it. It will take time until the company sees the fruits of these efficiencies and cost cuts, as one can’t simply make a company that has doubled in size in the past 3 years efficient in 6 months. However, we do believe management will eventually get there. Will investors require patience? For sure.

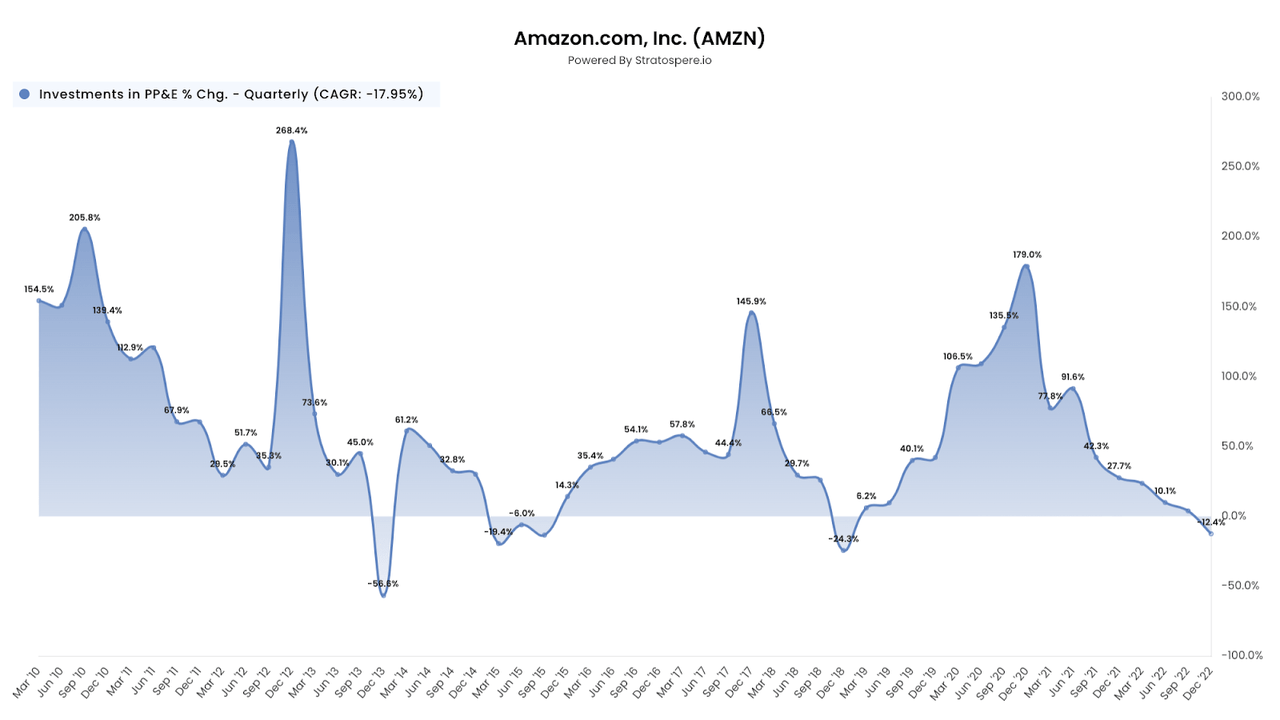

The first steps to streamline costs and match demand with capacity can already be seen, though. Amazon’s capital expenditures were up for the full year again, albeit slightly (+4.2%). However, in Q4, they saw a 12% year-over-year decline:

Stratosphere

In the past two years, everything was about investing in capacity to meet future demand. Now that supply has overrun demand; it’s all about making the network efficient.

Margins have suffered and might continue to do so in the coming quarters or even years, but we don’t think Amazon reached peak margins in Q1 2021. The rationale is that the company’s sales continue to shift to service (which is higher margin), and this shift is still not showing up in margins due to the outsized costs from the capacity oversupply. In our opinion, it’s a question of “when,” not “if” the true margin potential shows up.

We don’t think we should expect management to cut investments completely because it’s not in Amazon’s DNA. Still, we do believe management will now be more stringent in choosing where they invest and how much, at least as demand catches up with supply.

Qualitative highlights

Using media to drive Prime subscriptions

Management said that Prime continues to show good engagement data and signups driven by investments in media (emphasis added):

But in general, if you step back, we had some very large video properties that we had launched last year, Thursday Night Football and Lord of the Rings: Rings of Power. Both of them had record sign-ups for Prime membership. And we know that, again, investments like that will help with not only a new member or new Prime member acquisition, but also retention. And we see a direct link between that type of engagement and higher purchases of everyday products on our Amazon website.

Source: Brian Olsavsky, Amazon’s CFO, during the Q4 earnings call.

Many people consider media streaming a bad business, and while we agree, we think it’s different for Amazon. The company uses Prime video in the Prime bundle to drive new signups, which later “spill over” to other parts of the organization. More Prime members make the retail business more appealing for 3P and Buy With Prime sellers, and Amazon also collects money there through fees and Ads. Of course, measuring the return of these investments is tough, as we’ll never know how much revenue in other parts of the business comes “thanks to” investments in media.

Advances in grocery but being more measured in investments

Andy Jassy was asked about the company’s developments in grocery. He said the following:

We think grocery is a really important and strategic area for us. It’s a very large market segment, and there’s a lot of frequency in how consumers shop for grocery. And we also believe that over time, grocery is going to be omnichannel. There are going to be a lot of people that order their grocery items online and have it delivered to them, and there are going to be a lot of people who continue to buy in physical stores.

He also said that the company would be more efficient with its grocery investments:

And we’ve been — we’ve decided over the last year or so that we’re not going to expand the physical Fresh doors until we have that equation with differentiation and economic value that we like, but we’re optimistic that we’re going to find that in 2023.

We think grocery is a significant opportunity not for the business itself but because it can help increase Prime’s retention substantially. Someone who uses their Prime membership to purchase staples (such as groceries) is unlikely to cancel it, allowing Amazon to upsell other offerings or exert pricing power in the future.

The “Other bets” and how they might shape Amazon in the future

One of the most interesting parts of the call was Andy Jassy’s answer to how Amazon views its investments. Amazon’s CEO argued that they go through a 4-question filter to decide what to invest in:

-

If we were successful, could it really be big and move the needle at Amazon?

-

Do we think it’s being well served today?

-

Do we have a differentiated approach?

-

Do we have some competence in those areas? If we don’t, can we acquire them quickly?

He mentioned that the answers to these questions sometimes lead to straightforward investments (like Buy With Prime) while other times leads to less straightforward ones (like AWS). He ended the answer with the following quote (emphasis added):

And I think that do I think every one of our new investments will be successful? History would say that, that would be a long shot. However, it only takes one or two of them becoming the fourth pillar for Amazon for us to be a very different company over time.

So I think it’s very worthwhile.

This culture of reinvestment and continuous reinvention is what makes Amazon special, so we hope it always remains in the company despite many wanting Amazon to pull the breaks on such investments.

Guidance

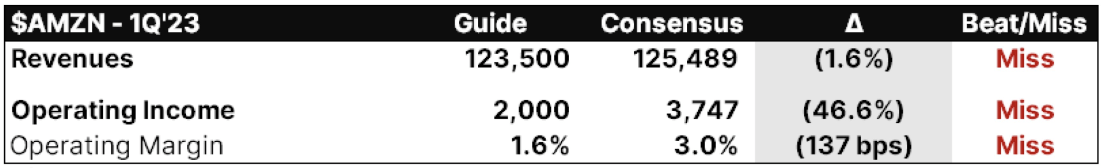

Guidance wasn’t great either and missed analyst expectations:

Consensus Gurus

Management expects sales between $121 and $126 billion, which would be a growth of 6% at the midpoint with a 210 basis points foreign exchange impact. Margins are expected to contract as management expects operating income between $0 and $4 billion, compared to operating income of $3.7 billion in Q1 2021. The same comments that we made for margins this quarter apply to margins in Q1; there’s still work to do by Amazon to match supply and demand.

Conclusion

Amazon.com, Inc. had a bad quarter, put mildly. However, the real question for an investor should be if this quarter changed something about the long-term thesis, and our answer to that question is “no.” Note that other people might think differently due to diverging investment horizons or different viewpoints on Amazon.com, Inc.’s performance. This divergence in opinions makes a market, so it’s welcome.

In the meantime, keep growing!

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Best Anchor Stocks helps you find the best growth stocks to outperform the market with the lowest volatility. They can anchor your portfolio on the stormy market sea, still allowing you to outperform.

Best Anchor Stocks have a long track record of revenue growth combined with below-average volatility. The first pick is up 16,000% from its IPO but has never been down 30%, not even during in 2008-2009.

Best Anchor Stocks can serve several purposes: stabilize your high-growth portfolio, or add low-volatility growth to your index, dividend or value investing.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!