Summary:

- We touch upon some attractive facets of the AT&T story.

- T’s relatively superior operating dynamics (versus most of its large peers) have not been appropriately captured by the forward EV/EBITDA valuations.

- From a technical perspective, the risk-reward looks favorable for a long position.

imaginima

AT&T- What’s To Like

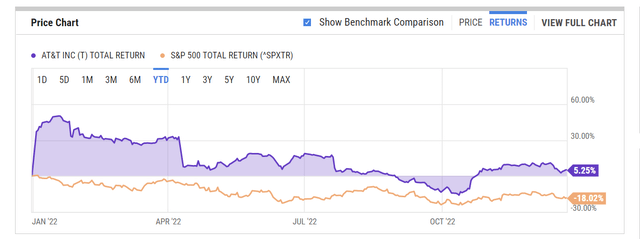

AT&T (NYSE:T) may not have set the world alight in 2022, but all things considered, one can’t have too many complaints with mid-single-digit-returns, at a time when the broader markets have slumped by 18%! There are a few encouraging factors working in favor of T, and I suspect this could well continue into next year.

YCharts

AT&T’s mobility business unit which accounts for over two-thirds of the group’s 9M-22 revenue has been faring quite well. Incidentally, this unit’s EBITDA came in at a record high in Q3, primarily driven by wireless momentum. In the current environment, something like postpaid ARPUs are benefitting from customers’ predilection for higher-price unlimited plans. This, alongside better-targeted pricing, has seen ARPUs grow by 1.5% QoQ and 2.45% YoY. Looking ahead, the mobility EBITDA annual growth differential could continue to look attractive, as the base period was hampered by heightened 3G transition costs.

I also like the company’s impetus in the fiber-optic space where it has seen net additions of over 200K customers per quarter for close to three years now. Crucially, as the sales mix shifts from traditional copper-based infrastructure sales to fiber sales, ARPUs will only get stronger (In Q3, Fiber ARPU grew by 1.5% on a quarterly basis). This shift will also see customers casting aside the erstwhile promotional legacy pricing. Whilst fiber penetration across US homes is likely growing at 12% or thereabouts, AT&T’s fiber initiatives will likely be a lot stronger (as of 9M-22, fiber net additions are up by 23% YoY), as it is poised to penetrate 30m + homes by 2025, which would imply a much superior CAGR of over 17% (as of 9M-22 they had captured 18.5m homes).

In addition to that, investors should also remember that there’s still a good chunk of AT&T’s long-term transformational cost savings plan that needs to play out. This year, T will likely complete around $4bn worth of cost savings, leaving approximately $2bn of benefits that could come through next year.

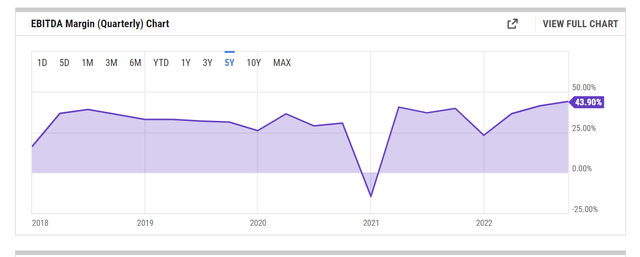

All these developments have reflected well on the company’s EBITDA position with the margin recently hitting its highest point in five years! Just for some context, quarterly EBITDA margins have typically averaged a little over 31% over the last five years, but currently, it stands at nearly 44%.

YCharts

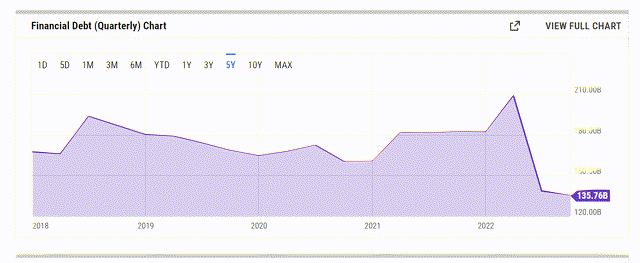

Investors can also feel heartened by AT&T’s fast-improving balance sheet, particularly in light of a deteriorating macro environment. Over the last 9 months, the company has been very aggressive in paying back close to $25bn of debt (whereas this time last year, cash used to pay down debt was in the low single-digit range). The company’s total debt which hovered around the $200bn levels earlier this year, has now dropped to around $135bn.

YCharts

Lower debt balances (and to some extent, higher capitalized interest costs associated with M&A) have played a key role in bringing down the interest bill by 11% YoY on a 9M basis. You combine healthy operational improvement and lower interest costs, and you get an interest coverage ratio that is not far from its highest point in five years.

YCharts

What Do Analysts Believe About AT&T’s Future?

Despite some promising developments, as things stand, Wall Street appears to be fairly lukewarm about AT&T’s prospects; out of the 30 sell-side analysts who cover the stock, the majority (~54% of all analysts) have HOLD ratings. Besides, the average price target of $20 implies only around a 10% upside, which may come across as unremarkable to a fair few.

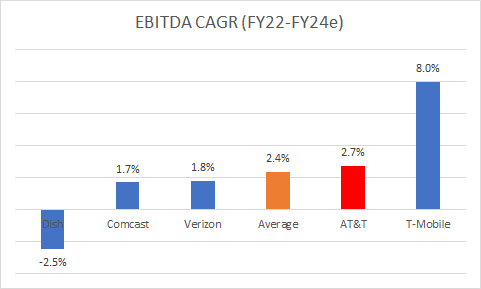

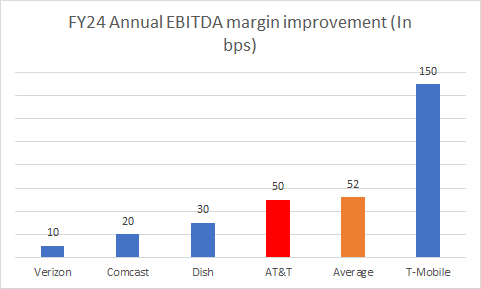

Admittedly the headlines around sell-side positioning are nothing to shout about, but there’s something to be said for what they think about AT&T’s operational improvements through FY24, particularly when juxtaposed against other large alternatives in this space.

Over the next two years, AT&T’s EBTIDA growth prospects are better than the majority of its peers with only T-Mobile (TMUS) offering a better operational growth runway.

YCharts

Similarly, AT&T will also likely experience solid EBITDA flow-through relative to its FY24 sales figure, as exemplified by 50bps worth of annual EBITDA improvement. The likes of Verizon (VZ), Comcast (CMCSA), and DISH Network (DISH) will likely only see annual EBITDA margin improvement to the tune of 10-30bps.

YCharts

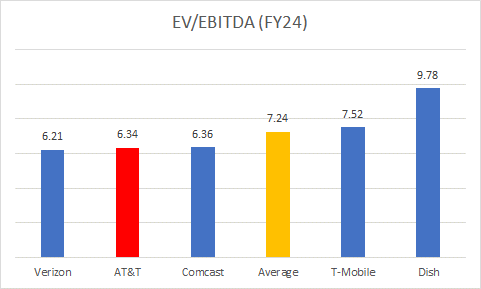

Ideally, forward EV/EBITDA valuations should have adequately captured these operational differentials, but that does not appear to be the case. Despite a better EBITDA roadmap than most of its peers, AT&T trades at a 12% discount (6.34x) to its peer set average (7.24x), with only Verizon trading at a lower multiple of 6.21 (AT&T’s current multiple is also lower than its 5-year average of 6.85x).

YCharts

All in all, I believe this discrepancy in the forward valuations is something that enhances the allure of AT&T as a prospective bet for 2023.

Closing Thoughts- Is T Stock A Buy, Sell, or Hold?

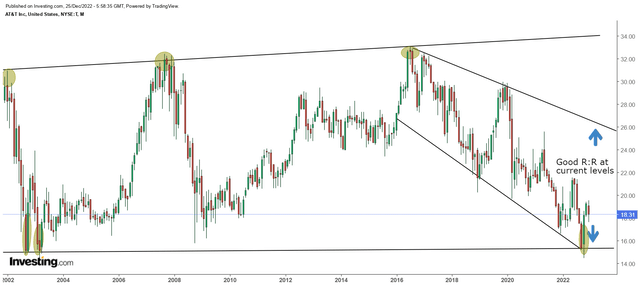

From a technical perspective as well, AT&T’s stock prospects look promising. There are two key takeaways from the price imprints on T’s long-term chart. Firstly, over the last two decades (since late 2001) the stock has chopped around within an approximate range of $15-$33/$34. Not including the recent pivot in October 2022, there have been five separate instances where the stock has bounced off the upper and lower boundaries of this range.

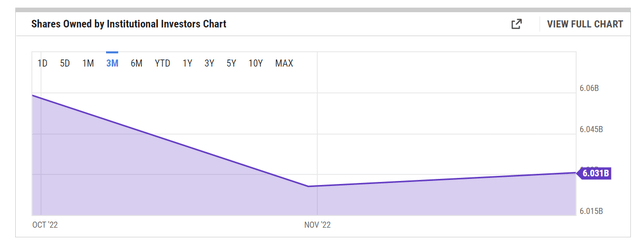

Separately also note that after months of reducing their stakes in AT&T, the influential institutional investment community has shown a slight inclination to get involved with the stock again. T shares owned by these big guns increased marginally from 6.026bn to 6.031bn.

YCharts

Within this broad range, you currently have an intermediate descending broadening wedge pattern. Currently, the price is a lot closer to the lower boundary of the wedge, implying good risk-reward of roughly 3.6x for those considering a long position.

Investing

The long case is further augmented by how attractively positioned AT&T looks, relative to other communication services peers of the S&P500. As you can see from the image below, the current relative strength ratio is around 2.4x lower than the lifelong range of this ratio implying good prospects for a potential mean-reversion trade.

Stockcharts

To conclude, the conditions are there for T to be a rewarding play in 2023. Longer-term, this is also a decent price point to get on board with a business that is building ample clout in the fiber sector where penetration in the US is still likely lower than 50% (last year it was 43%). T’s stock is a BUY.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.