Summary:

- We analyze McDonald’s current valuation and operating performance over the last 20 years.

- We think the company has likely reached the end of its ability to feasibly optimize costs in a high-inflation environment.

- We would wait for a valuation contraction before initiating a position.

M. Suhail

A Popular Trade

McDonald’s (NYSE:MCD), the ubiquitous fast-food chain that operates more than 40,000 locations in 100-plus countries, is quite popularly known as being, if not recession-resistant, then recession proof.

Plenty of articles have been written on this–given that McDonald’s sells a relatively low-cost, popular product, it seems to fit the perfect mold of the ‘affordable luxury.’ That is, even in difficult times, consumers are likely to carve out a few dollars to spend on a simple pleasure like McDonalds.

But has this thinking gotten far too conventional? As a general rule in investing, we believe that the time when ideas become the most widely accepted is exactly the time to assess them for veracity.

In this article, we’ll look at McDonald’s current valuation and analyze how we think the stock would hold up if a recession were to hit.

A Historic Relationship

We’ll begin by asking–what is the nature of McDonald’s valuation today compared to its past? Is it currently undervalued or overvalued, and how has it performed in previous recessions? Since the best comparison would be the stock’s performance in 2008, we will primarily look at the 20-year chart and zoom in on time frame where warranted.

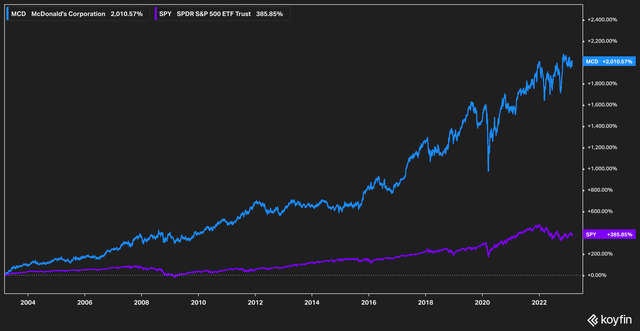

Let’s start with the stock’s performance over the last 20 years. Solid, steady McDonald’s has handily beaten the S&P 500 (SPY) by a fairly incredible margin, returning over 2,000% vs the broader market return of 386%. For reference, the company’s market capitalization has grown around 1,100% in the same time frame.

With that kind of performance, the company must have turned in stellar growth in both the top and bottom line. Let’s take a look.

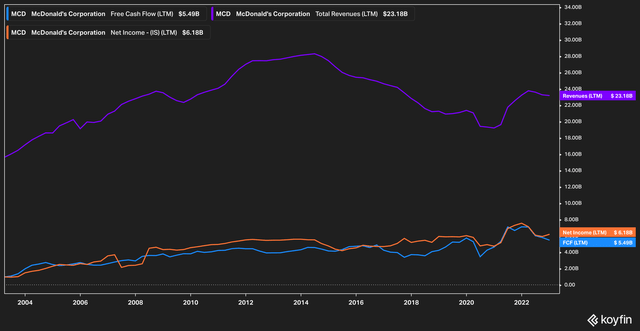

Revenue, Net Income, & FCF (Koyfin)

The above chart depicts McDonald’s top line revenue, net income, and free cash flow for the past 20 years. We’ll also take a look at the percentage change in these items to compare with the company’s price growth. Revenue topped out at close to $30 billion in 2014, hitting a bottom in 2020 and then recovering to its current LTM level of $23 billion. Free cash flow and net income, have remained impressively resilient throughout the time frame.

Changing the way we view this data, however, from raw numbers to cumulative growth reveals something interesting. Over the last 20 years, revenues have grown by only 48%, while net income and free cash flow have grown roughly 530% and 460%, respectively.

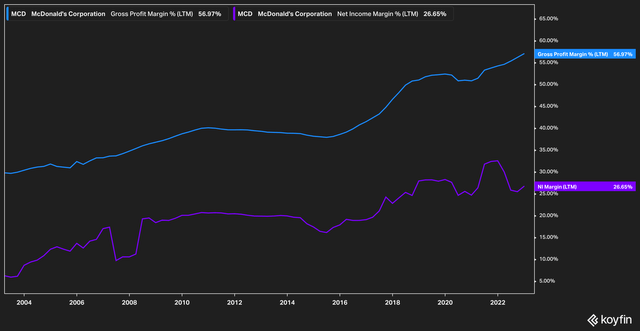

Net and gross margins have also expanded, with net margins stalling a bit recently.

All of this indicates to us that McDonald’s has likely maximized every efficiency benefit available to It as a result of globalization and automation over the last twenty years. The question now is, with inflation rearing its heads on a sustained basis for the first time in several decades, will McDonald’s be able to sustain that level of growth?

What’s Already Baked In

The historical numbers reviewed above are, we think, important. They tell a story of a wildly successful company that has achieved five-digit growth in its stock price, all while posting less than 50% revenue gains over that period, but three-digit percentage expansion of its operating cash flow and net income.

Now, with that data in mind, we are ready to compare forward looking valuations–that is, what does the market think about McDonald’s future prospects, and how much are investors paying for that future?

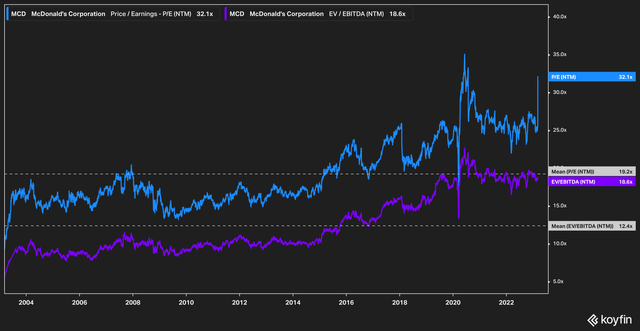

Perhaps not surprisingly, as McDonald’s has posted better results, its valuation multiples have experienced similar expansion. As it stands, the stock is not cheap. With a 20-year median forward P/E of 19x, McDonald’s today trades at 32x forward earnings. It’s 19x forward EV/EBITDA also sits significantly above its historic 12.4x average.

Let’s zoom in just a little more and review what happened to the valuation during the great financial crisis. From December 2007 to September 2009, the P/E fell from 19x to 13x. During that timeframe the stock itself was quite resilient, climbing and falling but only posting a roughly 4% loss during the period.

The stock, during that timeframe, did what it was supposed to do: it rode out a turbulent time in the market quite well.

Valuations today, however, and investor memories of holding McDonald’s as a less-risky place in a very risky time, may mean that the narrative has changed. Valuations certainly have a ways to fall before they reach more normalized levels.

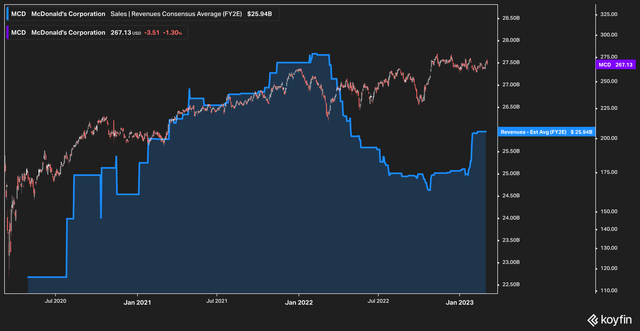

Indeed, we wonder if investors have even taken notice of the fact that analyst expectations for future revenues looking two years out have been falling (though they have recovered slightly in the last few months, which reflects expectations of a recession and recovery), while the stock has barely reacted.

Earnings Expectations vs MCD Price (Koyfin)

Would You Overpay For A Hamburger?

While McDonald’s has been a fabulous stock for a very long time, it cannot squeeze efficiencies out of its operations infinitely. At some point, we think, valuations will begin to revert closer to historical norms, and investors will have to take note of lower income projections on the horizon.

We will be watching McDonald’s closely to take advantage of price dips and valuation reversions. With inflation remaining high, and the cost of Big Mac rising to heights previously unknown, we are unsure that McDonald’s represents the value to consumers (and relative safety to investors) that it once did. Today, we’re sitting on the sidelines when it comes to McDonald’s stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.