Summary:

- Microsoft has a low dividend yield.

- Microsoft has increased its dividend by over 11% per year for the last 10 years.

- Over every time period, Microsoft has raised its dividend at a faster rate than other stocks in the Information Technology sector.

Khaosai Wongnatthakan/iStock via Getty Images

Overview

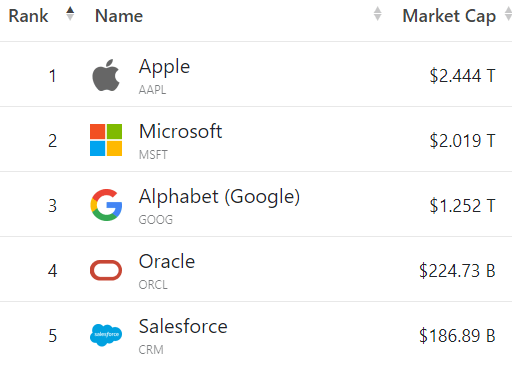

Microsoft Corporation (NASDAQ:MSFT) is the 2nd largest software company in the world by market cap and gaining on number 1, Apple (AAPL). Some would argue Apple is not really a software company, but that is a quibble we will ignore for the purpose of today’s article.

companiesmarketcap.com

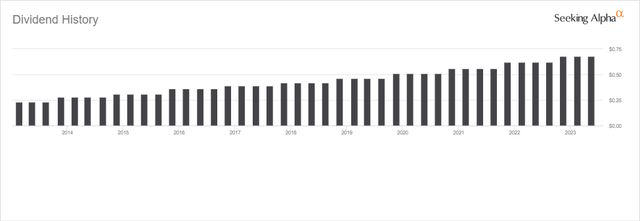

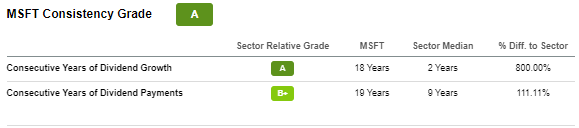

An undiscussed advantage of owning MSFT stock is its policy of consistent dividend growth. In fact, it has increased its dividend for the last 18 years, an enviable record for any company.

Seeking Alpha

At 18 years and counting, MSFT’s continued annual dividend increases will make it a Dividend Aristocrat by 2030. I recently published an article about Dividend Aristocrats.

MSFT Stock Key Metrics

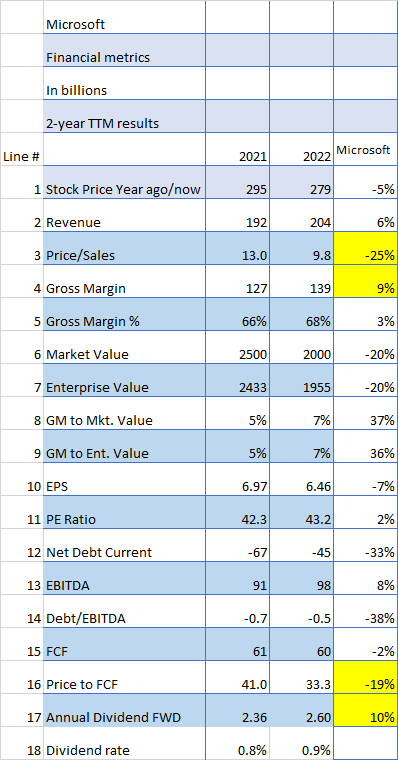

If we look at MSFT’s financial metrics comparing the latest TTM (Trailing Twelve Months) with the previous year, we can make a reasonable comparison of today’s value versus last year’s value. Once we have done that comparison, we will make an attempt to see how the coming year may play out, including the dividend.

Seeking Alpha and author

One quick look at the financial metrics table above comparing 2021 to 2022 shows that on several value metrics, MSFT is actually in better shape now than a year ago in spite of raising the dividend by 10% over the latest TTM period.

I have highlighted in yellow the items I consider the most important in terms of magnitude compared to the other items.

Note that MSFT’s price (Line 1) has fallen by 5% over the last year and that in and of itself is indicative of a potential bargain. But when we look at the Price/Sales ratio (Line 3), it may be an even better indicator of value, and it is down 25%.

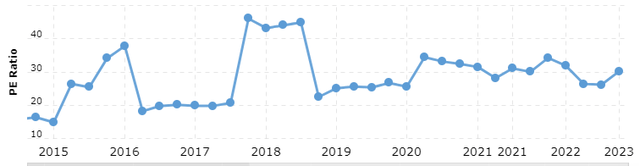

MSFT has had an elevated P/E ratio (Line 11) forever, but compared to the PE over the last 5 years, the current PE looks like a bargain.

Also, the Price/FCF (free cash flow) (Line 16) has dropped by 19% another indicator that MSFT might be undervalued at this point in time.

And lastly, the dividend was increased by a healthy 10% year over year.

How Much Is Microsoft’s Dividend Yield?

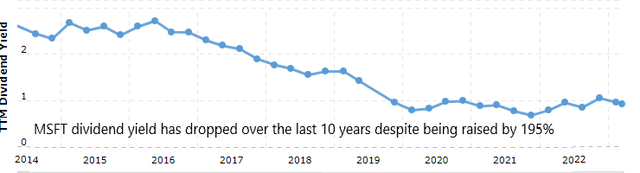

MSFT’s current yield is low at about 1%.

But keep in mind that’s a reflection of the value of the business itself.

Over the last 10 years, MSFT has increased the dividend by 195% going from .23 per quarter to .68 per quarter.

The problem with using the yield is the fact that MSFT’s business has grown by almost 900% over that same time period, much faster than the dividend. Therefore, it follows that the yield will drop.

The result is a lower yield, but who is going to complain when the value of your shares is up 900% and the value of your dividend is up 195%? That’s good news, not bad news.

That positive result makes the yield curve look like this:

Is The Dividend Likely To Grow?

We have seen how the dividend has grown by an average of over 10% over the last 10 years. This would make it likely that something in the same range would continue into the future.

If the rate continues in the next 10 years as it has in the last 10 years, the future dividend would be about $2.00 per quarter or $8 per year.

Based upon the current share price of about $200 that would be a 4% yield on cost.

Of course, it is also likely that Microsoft will continue to grow and prosper, especially with its chatbot product being added to Microsoft Office and other products existing and new. I recently published an article comparing MSFT’s chatbot with Google’s and Baidu’s.

How Does Microsoft’s Dividend Compare To Competitors Now?

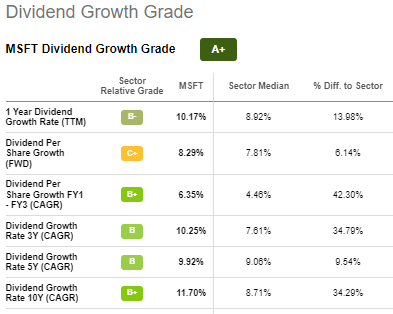

Comparing MSFT’s dividend stats to other companies in the Information Technology sector, we see that it is above the Sector Median in every single category. The 10-year dividend growth rate is 34% higher than the sector average.

Seeking Alpha

That’s about as good as you can do.

What Should Dividend Investors Consider?

Dividend investors typically look for higher yields than MSFT offers. One high-yielding sector that is very popular on Seeking Alpha is REITs (Real Estate Investment Trusts) because of their higher yields.

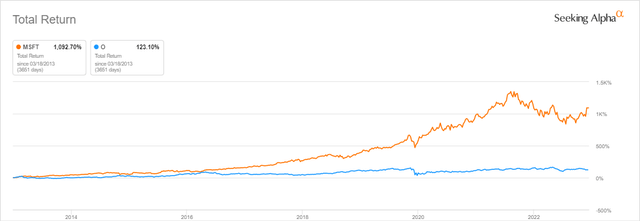

One example would be Realty Income Corporation (O) a well-known, conservatively managed REIT that currently pays a 5% dividend. Realty Income Corporation is a Dividend Aristocrat, having raised its dividend for 26 consecutive years. But looking at Total Return (including dividends) over the last 10 years shows MSFT outperforming O by a massive amount, 1,092% to 123%.

Obviously, if you had a long-term outlook 10 years ago, MSFT would have been the easy choice even with a lousy dividend yield.

So always remember, the dividend yield is just one part of the investment decision process.

Is MSFT Stock A Buy, Sell, Or Hold?

In looking at Microsoft as a dividend stock, I have re-learned a lesson I have often forgotten: there are two parts to a successful investment strategy: dividends and capital gains.

As I have shown above, MSFT has been a very successful dividend grower and, of course, a share price grower too. Anyone who turned MSFT down 10 years ago because it was low yielding would have made a big mistake.

After examining MSFT’s historical record and comparing it to other technology companies, I would highly recommend Microsoft as a dividend growth stock.

Microsoft is a Buy mainly for capital gains but also for a rapidly increasing dividend payout.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you found this article to be of value, please scroll up and click the "Follow" button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.