Tesla’s Real Test Approaching: Recessionary Demand

Summary:

- Automakers usually decline markedly during U.S. economic recessions in GDP output.

- Tesla’s valuation remains stretched and may be priced for perfection.

- The bubble chart pattern may have further downside to go in 2023 before another meaningful rise can emerge.

- Purchasing shares on a retest of January’s low may be the most opportune way to play this name. I rate Tesla, Inc. stock a Hold.

Sjoerd van der Wal

We may be reaching for the point of maximum stress in the auto demand cycle during a looming recession this year. My question for Tesla, Inc. (NASDAQ:TSLA) shareholders who have never experienced a severe drop in sales (as an industrywide phenomena), what will happen to the stock quote if significant earnings and sales misses appear during a deep or prolonged recession? The only “stress test” in the general economy experienced by this electric-vehicle leader was the 2020 pandemic shutdown, when it was basically a monopoly player selling 80% of all EVs in America and Europe.

The good news is Tesla is now profitable manufacturing and selling cars, and its other business adventures/inventions could help overall results survive better than traditional old-school automakers.

Plus, the trend of accumulation in TSLA shares during 2023 has been quite extraordinary. Whether rational or not (I have mixed feelings), interest in buying the stock of late will likely not reverse markedly.

While I was quite bearish on Tesla last autumn at $300 per share, worried about an explosion in competition, a quote closer to my $100 valuation target of 2022 caused me to upgrade my rating to Hold in late December here. I suggested a bounce higher was in the cards (with a $175 target later in 2023), although I did not exactly foresee the sharp rebound all the way back to $200+ over a few months. At this juncture, with the overall stock market and economy on the ropes from a developing liquidity crunch, I thought I would write a quick review of my current take on the stock’s prospects for readers.

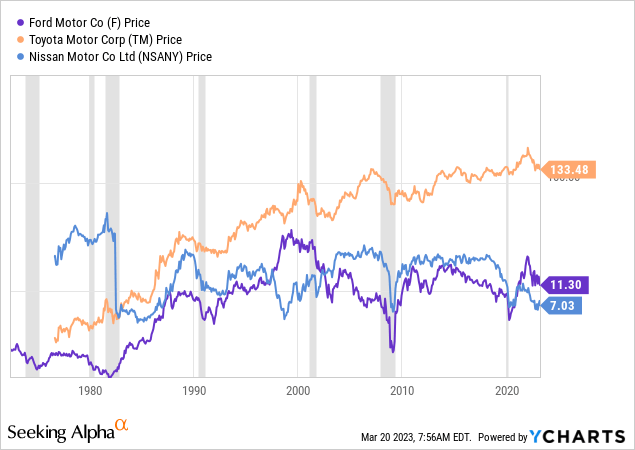

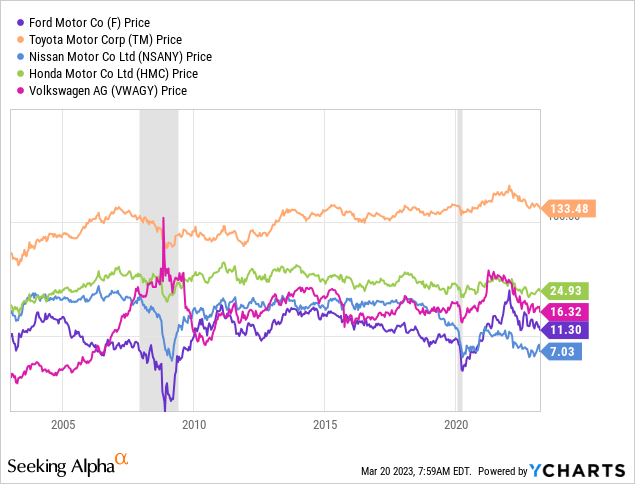

Recessions Are Not Kind to Automakers

Running a quick history review of car makers during recessions, equities in the industry of varying trading lengths have declined better than 90% of the time, measured from the official beginning of a U.S. GDP contraction to the end. Below are the longest continually-traded charts I can find on YCharts in the auto manufacturing industry as samples, with recessions shaded. Ford Motor Company (F), Toyota Motor (TM), Nissan Motor (OTCPK:NSANY), Honda Motor (HMC), and Volkswagen AG (OTCPK:VWAGY) share price change graphs are drawn.

YChart – Major Automakers, Price Change, Recessions Shaded, Since 1971 YChart – Major Automakers, Price Change, Recessions Shaded, Since 2003

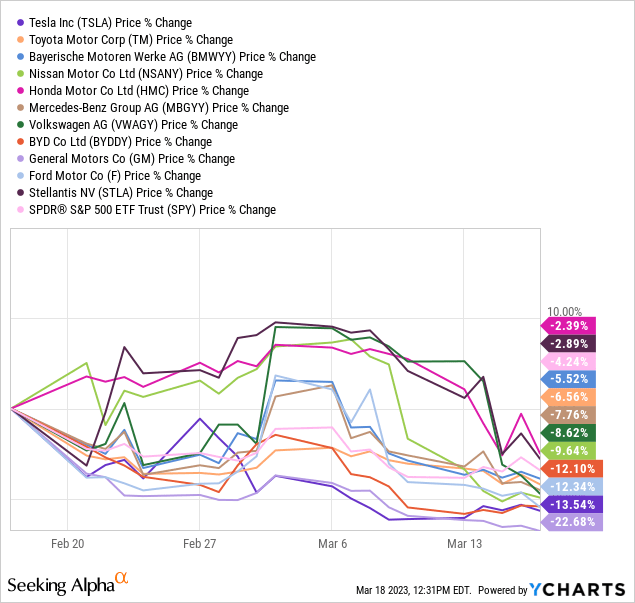

When consumer/business demand for vehicles implodes, sales, earnings and cash flow crater at the deep-cyclical automakers. I would expect the same in a 2023 version of economic contraction. Already, the globe’s largest automakers are reeling in March for performance vs. the popular U.S. market-indexed SPDR S&P 500 ETF (SPY). And, Tesla is suffering the same as others.

I have expanded my peer list to include Bayerische Motoren Werke AG (OTCPK:BMWYY), Mercedes-Benz (OTCPK:MBGYY), Chinese EV firm BYD Co. (OTCPK:BYDDY), General Motors (GM), and Stellantis N.V. (STLA).

YCharts – Auto Industry, Share Price Changes, 1 Month

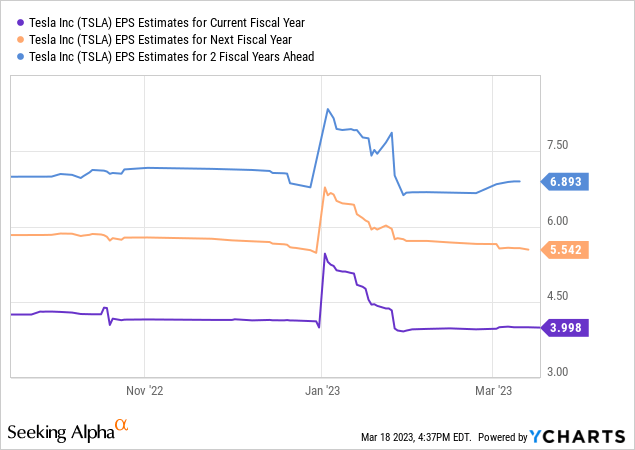

For Tesla specifically, earnings estimates from Wall Street analysts have made a slight downturn over six months, which hasn’t taken place since 2019. EV competition heating up is one reason.

If we experience a serious recession, earnings will almost surely slide dramatically. I can argue inflated demand for Teslas since 2019 has been supported by stock market, real estate, and cryptocurrency winnings, which are now disappearing. A deep economic contraction means the capital to buy high-priced autos will be slashed. That’s the math of a steep downturn in auto demand.

Plus, CEO Elon Musk‘s outside adventure acquiring Twitter (turning off much of its radical-idea moderation) has upset some of the demand interest from liberals and progressives in the U.S. and Europe, previously large buying groups. The last $50 of Tesla’s decline in late 2022 was widely blamed by the mainstream media on fears the Twitter fiasco would hurt sales going forward.

YCharts – Tesla, Forward 2023-25 EPS Estimates by Analyst Consensus, Last 6 Months

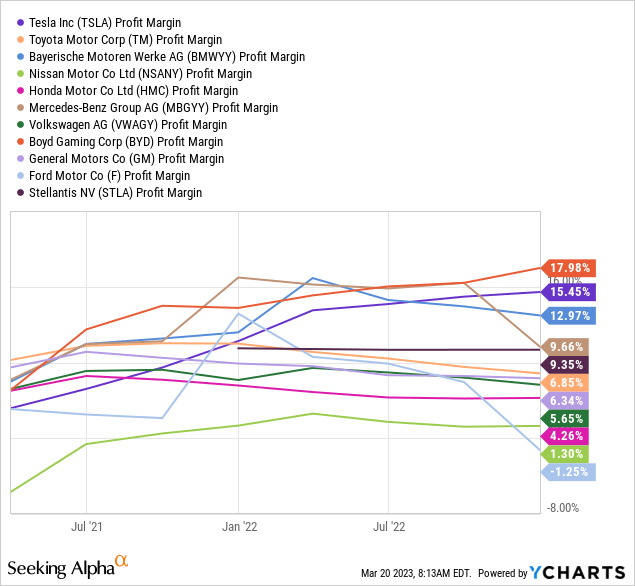

The wildcard in a recession is Tesla didn’t start trading until the summer of 2010, as more of a startup company. We don’t have any experience with how its shares, sales, and earnings will react in a “severe” recession scenario. Profit margins are near industry-leading levels in early 2023. So, even a minor contraction in margins alongside worse-than-expected sales could really dent cash flow and earnings. If EPS for this year come in around $2 or $3, the share quote will almost surely suffer. Already in January and again several weeks ago, the company has slashed prices to stay competitive with new entrants. With little doubt, margins on sales and per vehicle will be headed lower in coming years, as inflationary pressures on parts and wages continue to rise on the other side of the margin spread equation.

YCharts, Auto Industry, Final Income Margins, Since 2021

2023 Technical Strength

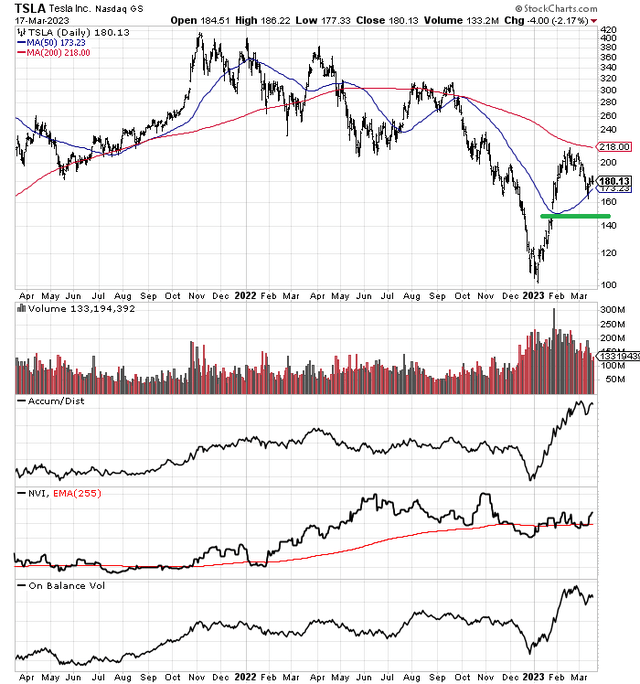

Although TSLA’s price is down a whopping -40% since September, the standout chart read is all the buying taking place from the $100 level in January. A better-than-expected earnings release, with positive guidance for 2023 caused a large price gap higher at the open on January 26th. I have drawn a green line on the daily graph below, as possible support on a gap refill move.

Clearly in the bullish column when evaluating this investment security, uptrends in the Accumulation/Distribution Line and On Balance Volume movements (pictured below) have been absolutely fantastic since the price reversal in January. The open question is whether aggressive buying remains during a recession and the likelihood of worse-than-forecast results in the second half of 2023?

StockCharts.com – Tesla, Daily Price & Volume Changes, Author Reference Point, 2 Years

Overvaluation Stats

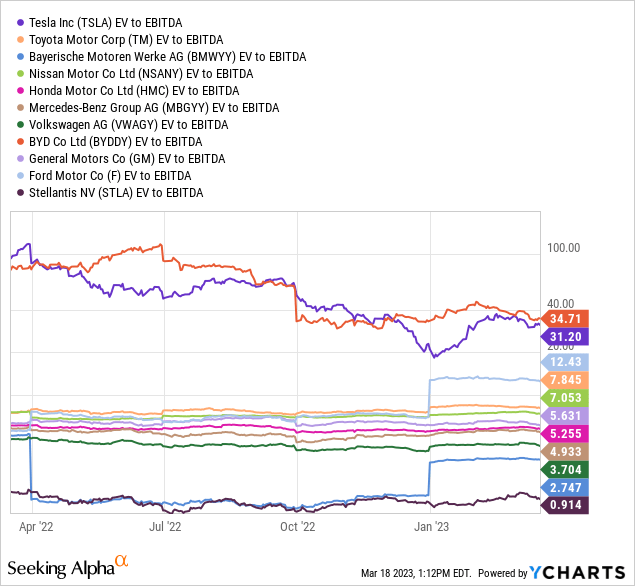

Overvaluations for Tesla remain the biggest weight on the share quote. I won’t rehash how expensive the stock is today, but a broad summary is worth contemplating. EV to trailing EBITDA of 34x is honestly outrageous (especially if growth stalls) when measured against 6% CPI inflation or a median industry average of 6x. If there’s any bullish news, TSLA earnings have improved markedly as the share price has declined rapidly, pulling down this important ratio from around 100x at the beginning of 2022.

YCharts – Auto Industry, EV to Trailing EBITDA, 1 Year

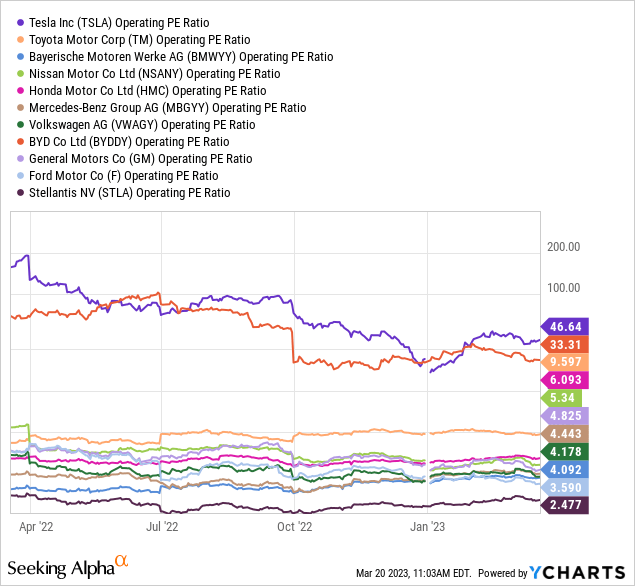

Tesla’s operating P/E is far and away the highest of the major peer group, and consequently shares offer the greatest risk of decline if a recession trips up results and expectations.

YCharts – Auto Industry, Operating P/E, 1 Year

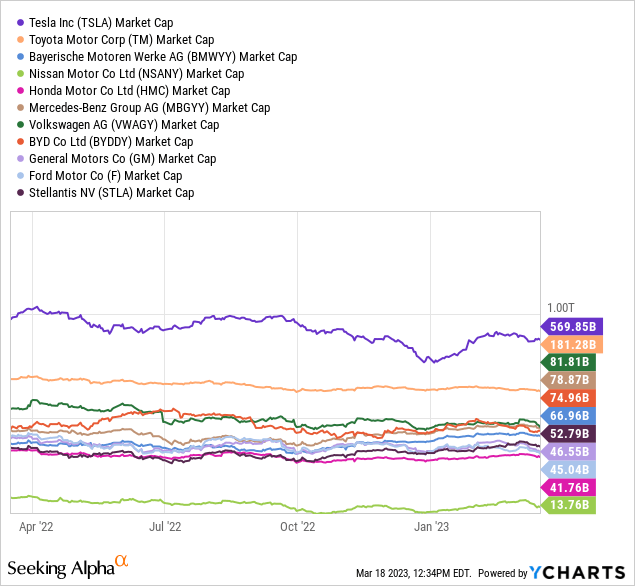

In addition, we are all debating if Tesla’s equity market capitalization is really worth the same as the rest of the world’s auto manufacturing industry combined. With legacy car makers quickly entering the EV market as honest competition in future years, will the valuation spread close? Textbook economics suggests Tesla profit margins will erode dramatically as basic price and product value competition heats up.

YCharts – Auto Industry, Market Capitalizations, 1 Year

Final Thoughts

The incredible March 2023 weakness in small caps, banks/financials, deep cyclicals, airlines, steel makers, and even major autos is exactly what past recession performance has looked like. What if Tesla experiences a big drop in car sales soon vs. current forecasts? I doubt the share price will rise materially in the face of such bearish news flow.

Yes, the wicked 40-year high spread in the Treasury bond yield curve starting in November was an obvious signal of an approaching recession. It can take 6-12 months before the meat of the economic downturn appears historically, meaning summer and autumn growth in America could be quite negative.

So, here’s my TSLA price forecast for a zigzag the rest of 2023. From my vantage point, the massive percentage technical chart rise from a little over $100 in early January sorely needs a retest, at a minimum. I am projecting the $140 price gap will be refilled as a recession in auto demand becomes the prominent industry story over the summertime.

Then, a rebound back toward $175-$200 could materialize on another massive round of Federal Reserve easing (including trillions in new QE) to prevent a depression and mass debt/loan defaults in the U.S. economy. I estimate a year-end quote around $180 when all is said and done, approximately where we stand today. Basically, 3% for YoY inflation and short-term interest rates, a 35x forward P/E multiple, and a 20% long-term growth rate (lower than present Wall Street forecasts) are my inputs for December 2023. Hence, my Hold rating for a 12-month outlook remains.

Of course, if a deep recession pushes Tesla earnings into a flat to negative outcome (I mean operating losses for the business), a share price under $100 is still possible. That’s the worst-case scenario at this stage. The best-case scenario would be a mild recession, with steady, well above-average growth in Tesla sales. A price closer to $220 by the end of December is the most bullish forecast I can make, under a best-of-all-worlds variable setup, considering the rich valuation already in place.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. When investing in securities, investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but the author’s opinion written at a point in time. Opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.