American Tower: Fairly Valued, Risky Floating Rate Debt, Lackluster Chart

Summary:

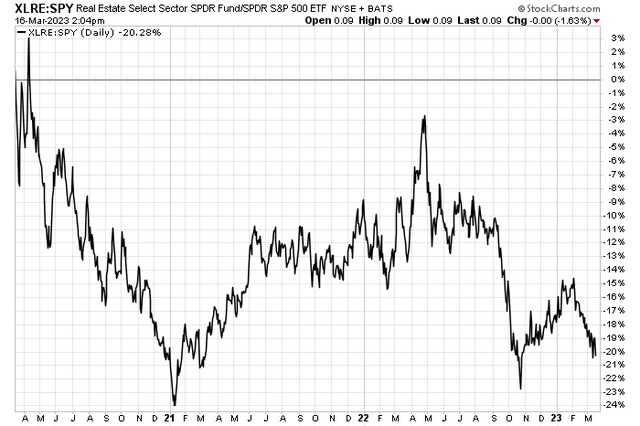

- REITs have underperformed the broad market while featuring significant drawdowns in recent years.

- One of the sector’s largest stocks, American Tower, appears fairly valued and interest rate risk along wireless sub growth trends in some foreign markets are risks.

- Technically, the trend is lower and I see a longer-term bullish to bearish reversal gradually playing out. I spot key price levels to monitor.

BackyardProduction

The Real Estate sector is one I don’t opine on much, but its relative weakness in the face of both rising and falling interest rates should be concerning to REIT bulls. The Real Estate Select Sector ETF (XLRE) is down nearly 20 percentage points from its spike high against the S&P 500 during Q2 last year. The monster jump in yields during September and the first half of October 2022 took down so many rate-sensitive plays such as Utilities and Real Estate. But even with the retreat in rates lately, XLRE has not managed to hold up.

That is key for American Tower as it is the second-largest position in XLRE and the popular Vanguard REIT ETF (VNQ). I see more risks than opportunities ahead in AMT.

Real Estate Equities Struggling Against the Broad Market YoY

According to Bank of America Global Research, American Tower (NYSE:AMT) is the largest global owner and operator of wireless and broadcast communications towers. The American Tower portfolio includes approximately 180,000 sites in the U.S., Latin America, India, Europe, and Africa. The core business for AMT is leasing space on its wireless towers primarily to wireless carriers, government agencies, and broadband data providers.

The Boston-based $94.2 billion market cap Equity Real Estate Investment Trusts (REITs) industry company within the Real Estate sector trades at a high 53.1 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.0% dividend yield, according to The Wall Street Journal.

Back in February, AMT reported an FFO miss of $2.46 while revenue grew by more than 10%, about in line with expectations. Guidance was light, though, at a range of $9.49 to $9.72 versus a $10.58 consensus estimate as total property revenue is seen as rising just 2.9% this year. Driving the soft guide was higher expected interest costs and ongoing troubles with Vodafone Idea (VIL). VIL informed AMT that it would fail to make its payments through this year (as it had done in 2022).

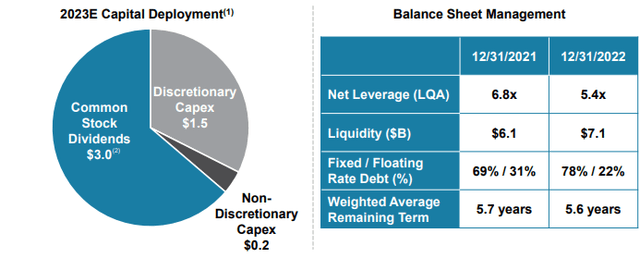

A notable risk for AMT is its exposure to floating rate debt, which accounts for about 22% of total debt, that will be hurt in this new higher-rate era, but if the recent decline in yields holds, that could lead to positive EPS and FFO revisions in the coming months.

AMT: Capital Allocation Plans & Debt Exposure

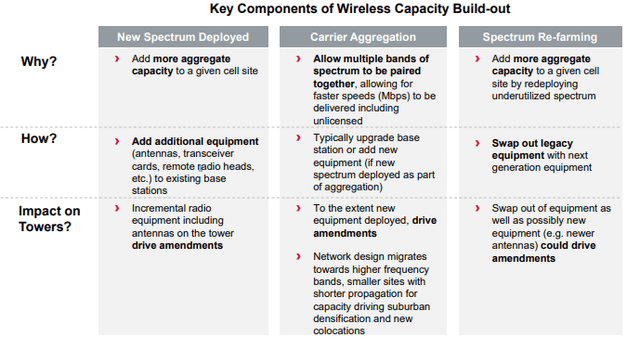

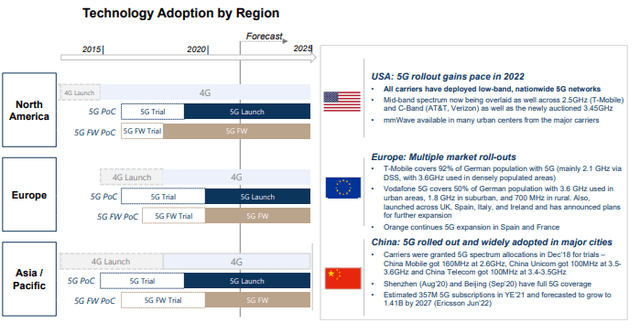

With international global tower assets, faster adoption of 5G and wireless subscriber growth are key upside catalysts, and AMT is transitioning from the 4G capacity stage to coverage stages of 5G with more aggregate capacity additions and shifting out legacy equipment. This buildout is something to watch as the year progresses.

AMT Technology Progress into 5G

5G Deployment Timeline

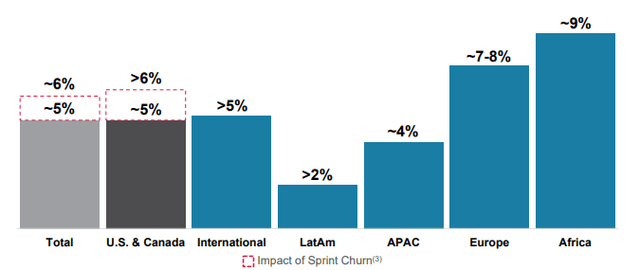

With REITs assessing the quality of business of their tenants/leaseholders becomes paramount. American Tower expects ample growth across geographies with accelerating U.S. and Canada organic tenant billings growth and record new business contributions.

2023 Organic Tenant Billings Growth Outlook

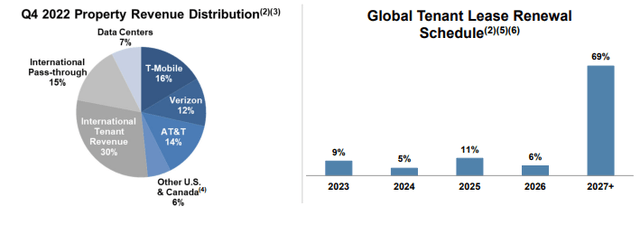

Most of AMT’s leasholders have entered into non-cancellable terms of 5-10 years with multiple 5-year renewable periods. Global tenant lease renewables are not expected to jump until 2027, earnings should be somewhat stable until then.

Tenant Base Characteristics

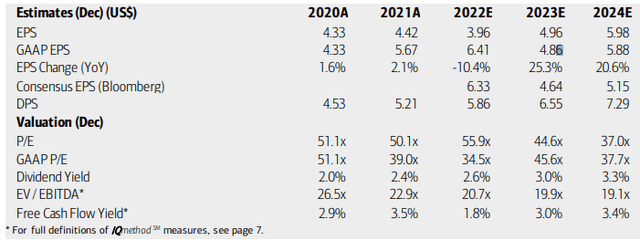

On valuation, analysts at BofA see earnings rising sharply this year and next while dividends drop following a fall in GAAP per-share profits in 2023. Dividends should rise commensurate with per-share profits while the firm’s operating and GAAP earnings multiples remain high. But for the REIT, 2023 AFFO available to common shareholders is expected to be $9.60 per share, so if we apply a premium 21.9x AFFO multiple to that (its 10-year average), then shares should trade at $210, not far from the current price.

AMT: Long-Term P/AFFO Multiple: Average Near 22x

A risk is that higher rates and a 15-year high in rate volatility could lead to weaker profits with its high floating-rate debt exposure, so an extra margin of safety is prudent. So, I see shares as near fair value here.

American Tower: Earnings, Valuation, Dividend Forecasts

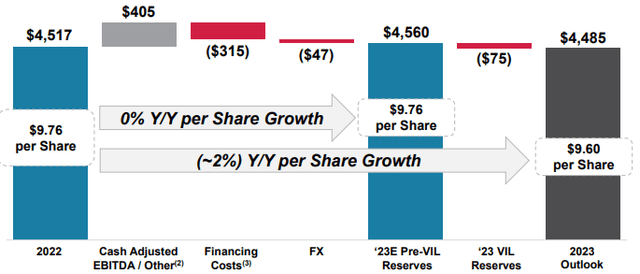

For context, AMT expects $9.60 of attributable AFFO this year. With elevated interest rate volatility, earnings could be particularly uncertain.

2023 Attributable AFFO Outlook

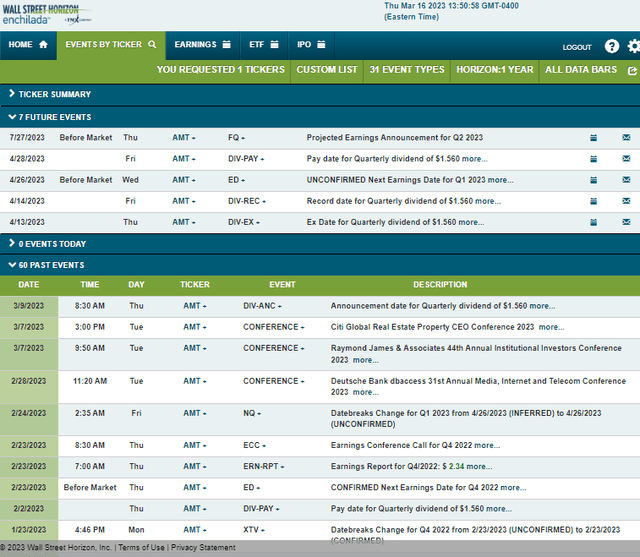

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Wednesday, April 26 BMO. The next dividend ex-date is Thursday, April 13. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Risk Calendar

The Technical Take

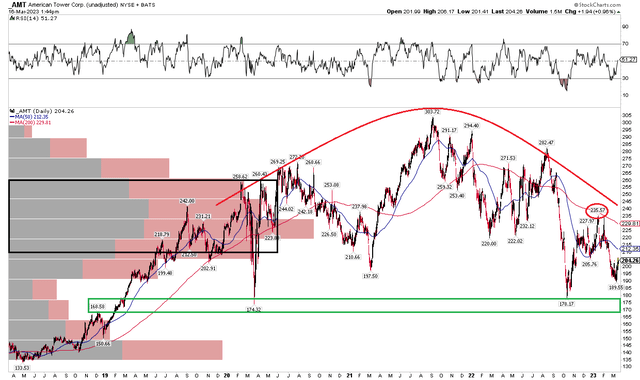

Making the buy case more difficult is that AMT is putting in a long-term rounded top pattern. This bullish to bearish reversal feature has key support in the $170s – that’s where the REIT bottomed out in March 2020 and at the October 2022 low. A break below that would likely lead to an acceleration to the downside. I see resistance in the $230s where the falling 200-day moving average comes into play.

I acknowledge that a tradeable low is in, so a swing long here with a stop under $189, targeting $235 could work. But with shares underperforming for several years now and making fractional new relative lows against the S&P 500 earlier this month, I would stay away from this fairly valued stock for now.

AMT: Bearish Rounded Top Pattern, $170s Support

The Bottom Line

I see shares of AMT as fairly valued while the yield is not all that high. With a bearish rounded top pattern unfolding and a declining long-term moving average trend indicator, I would stay away from the REIT at this time.

Disclosure: I/we have a beneficial long position in the shares of VNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.