Summary:

- Northrop Grumman Corporation is a leading aerospace and defense contractor that has an impressive performance history.

- The company has improved its profit margins over the last decade, which has allowed earnings growth to run ahead of revenue increases.

- NOC has a solid dividend growth streak of 20 years, although its yield of 1.6% is lower than its industry peers.

- The payout ratio is also lower than its largest competitors.

JHVEPhoto

Dividend growth investors have different requirements when it comes to picking stocks. While most likely want to own names that provide safe dividends, investors can differ on whether the size of the yield is also at the top of the list of important characteristics.

For the investor needing a larger source of income, sub 2.0% yields may not make for an attractive investment. For those who value the health of underlying company, the lower yield may not be a dealbreaker if the business is strong.

One such name that I feel makes for an interesting discussion in the debate over the importance of yield is Northrop Grumman Corporation (NYSE:NOC).

Company Background

Northrop Grumman is one of the largest aerospace and defense contractors in the world, with revenue approaching $40 billion over the last four quarterly reports. The company is composed of four business segments, including Aeronautics Systems, Mission Systems, Defense Systems, and Space Systems.

Northrop Grumman manufactures the B-2 bomber and the B-21 bomber, which recently had its first test flight, as well as supplies content for the F-35.

Shares are down almost 5% over the last year, vastly underperforming the S&P 500 Index, which has gained more than 22% during that same period.

The company has a market capitalization of $71 billion and has a backlog of nearly $84 billion as of the most recent quarter.

Profitability Improvement Has Been Impressive

Thanks to a significant increase in defense appropriations, including a proposed deal to raise spending to $886 billion for fiscal year 2024, Northrop Grumman has seen its business improve dramatically over the years. The company’s adjusted earnings-per-share has a compound annual growth rate (CAGR) of more than 13% for the 2013 to 2022 period.

Some of this growth does come from the company’s aggressive buybacks, which have reduced the share count by almost a third during this same period. Accounting for this reduction in the share count, net income has a respectable CAGR of 8.9% over the last decade.

Revenue, on the other hand, is up just over 4% annually during this time. Bottom-line performance has been aided by Northrop Grumman’s ability to gradually expand its margins. Net margin increased from 7.9% in 2013 to 13.4% last year, an improvement of 550 basis points.

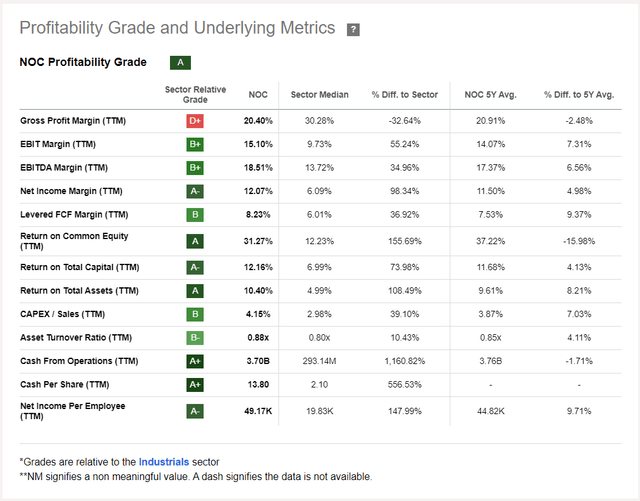

Aside from gross profit margin, Northrop Grumman has solid to very high scores on most aspects as it has outperformed its industry group on a number of metrics.

The company’s recent performance has also been encouraging. Northrop Grumman reported third quarter earnings results on October 26th, 2023, with headline numbers coming in comfortably ahead of estimates.

Adjusted earnings-per-share of $6.18 was up 5% year-over-year and was $0.38 better than analysts had expected. The company has topped earnings estimates in 16 out of the last 20 quarters, showcasing its consistent ability to outdo the market’s expectations. Revenue grew 9% to $9.78 billion, which was $235 million above estimates.

All segments improved top-line numbers compared to the prior year. Space Systems was the real standout as revenue grew 11% to $3.5 billion. This segment benefited from the modernization of the Ground Based Strategic Deterrent. Aeronautics was up 9% to $2.8 billion, due to volume gains in the segment’s manned aircraft. Mission Systems grew 7% to $2.6 billion due to increases in restricted programs. Finally, Defense was up 6% to $1.4 billion due to demand for missile systems and ammunition.

Northrop Grumman added more than $15 billion in awards during the quarter, which drove the backlog to a record $83.9 billion. Of this, $36.5 billion is already funded. The book-to-bill ratio was an impressive 1.53 for the quarter.

Furthermore, Northrop Grumman increased its revenue guidance to $39 billion and reaffirmed its prior guidance of adjusted earnings-per-share of $22.45 to $22.85 for the year. Most segments are projected to have at least low double-digit growth, led by a 15% increase for Missions Systems.

Risks to Investment Thesis

As with any investment, there are risks to be considered, even for those companies with excellent track records. Northrop Grumman is no different.

First, Northrop Grumman’s largest customer is the U.S. While national defense spending has been on the rise for years, there is no guarantee that it will continue to do so. Fortunately, defense appropriations are usually something that has bipartisan support. Still, with the U.S. being the primary customer, Northrop Grumman would see a material impact on its business if domestic spending were to slow or be reduced.

The company does have a record backlog as of the end of the third quarter, only 43.5% of it is currently funded. Most defense contractors are long-dated, as projects can often take years to complete, so the risk of cancelation is low. However, a reduction in defense spending could see some of the backlog go unfunded.

Additionally, if Northrop Grumman’s products were to have a manufacturing defect could see programs paused or canceled. For example, deliveries for Lockheed Martin’s F-35 program, for which Northrop Grumman provides content, were paused last year following a technology issue. In total, almost a year’s worth of production might not be delivered until this summer.

Lastly, shares of Northrop Grumman are not cheap. Using the midpoint of guidance for 2023, the stock has a price-to-earnings ratio of close to 21. Northrop Grumman has usually had a valuation closer to 16 to 18 times earnings over the last decade. A slowdown in the aerospace and defense sector in general or in Northrop Grumman specifically would likely see the market rerate shares at a lower valuation.

Dividend Analysis

Northrop Grumman’s long-term trend of high increases in net income and earnings-per-share has paved the way for the company to regularly raise its dividend.

Northrop Grumman typically raises its dividend for the first payment of the year, usually in the middle of March. Though this year’s raise has yet to be announced, the company did increase its distribution by 8.1% for the March 15th, 2023 payment. This extended the dividend growth streak to 20 years, one of the longest in the aerospace and defense industry.

For context, the CAGR over the last decade is 12.3%, though this slows to 9.5% when looking at just the last five years.

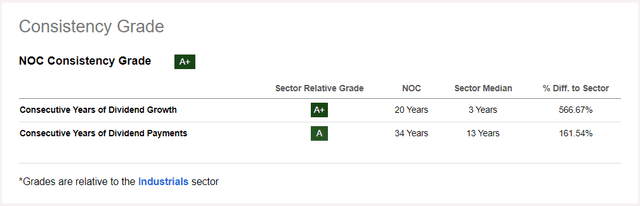

Overall, Northrop Grumman ranks very well in terms of consistency compared to its peer group.

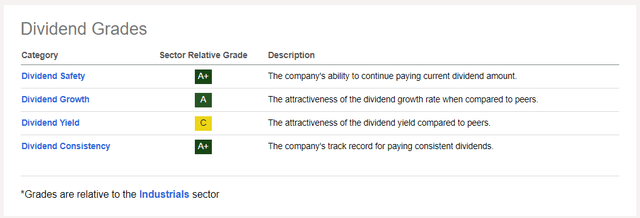

Diving deeper into the company’s dividend, we see that Northrop Grumman stacks up well in most areas compared to those companies in the industrial sector.

The most obvious hesitation an income investor might have with Northrop Grumman is that stock’s yield is on the low side. Currently, the yield is just 1.6%, which is roughly in line with the average yield of the S&P 500 index.

Furthermore, most of its peers offer a higher dividend yield. RTX (RTX) and Lockheed Martin Corporation (LMT) both yield 2.8% while General Dynamics (GD) is just above 2.1%.

For those seeking a higher income stream, Northrop Grumman is lower than most of its competitors.

That said, Northrop Grumman’s dividend should be considered very safe. The company has not reported yearend earnings results yet, but the projected payout ratio of 2023 is a very healthy 32%. The company usually has a very low payout ratio, with a 27% average over the last decade.

Lockheed Martin and General Dynamics have an average payout ratio of 47% and 35%, respectively. Similar data points cannot be discerned from Raytheon Technologies, but its former parent companies, Raytheon and United Technologies, often had a payout ratio in the mid-30% to low 40% range. Northrop Grumman does have a small edge on the payout ratio relative to its peers.

Final Thoughts

Northrop Grumman’s long-term performance has been impressive. Even controlling for the reduced share count, net income has improved at a high single-digit rate for the last decade. This has occurred even as revenue gains have been lower as the company has very effectively improved its margins.

The company also has a solid dividend growth streak of two decades. The stock’s yield is on the low side, especially when compared to its industry peers, but the dividend does appear to be safe as the projected payout ratio is close to its historical levels. Northrop Grumman grades out well in most areas related to its dividend, showing that the company is one of the best dividend-paying stocks in its industry.

Shares are trading with an elevated multiple, but the business is performing well, which can likely be sustained by a tremendous backlog and a very high book-to-bill ratio. If investors do not mind the lower yield that the stock offers, Northrop Grumman could make an enticing addition to their portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LMT, GD, RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.