It’s One Of The Best Times To Buy Visa

Summary:

- Visa is a high-quality company with excellent fundamentals.

- Visa is a compelling inflation play.

- Long-term growth drivers are in place that will allow Visa to grow its profits at a sizeable pace.

- Visa trades at a clear discount compared to its historic valuation.

AsiaVision

Article Thesis

Visa Inc. (NYSE:V) continues to generate very strong results, proving again that it is a great inflation hedge in this environment. On top of that, Visa has recently hiked its dividend by a compelling 20% and also upped its share repurchase program. Shares aren’t cheap in absolute terms, but the quality, growth, and its historic valuation norm suggest that Visa is an attractive investment at current prices.

Visa’s Excellent Fourth Quarter Results

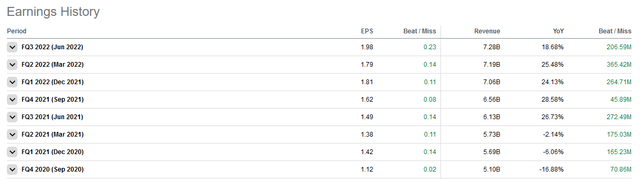

Visa Inc. reported its most recent quarterly results on in November. During its fiscal fourth quarter, the company generated revenues of $7.8 billion, which was up 19% year-over-year. Even better, the company beat estimates once again — as it has done for every quarter over the last two years:

Somehow, Wall Street analysts continue to underestimate the company, even though one might think they should have learned from past experiences. That’s great for investors, however, so I’m happy with Visa’s ongoing outperformance versus what analysts are forecasting each quarter.

Visa also beat estimates for its bottom line performance, as its earnings per share of $1.93 came in 6% ahead of estimates. The stronger-than-expected revenue performance explains some of that, as Visa beat revenue estimates by 3%, but Visa also managed to generate a higher profit margin compared to what Wall Street had forecast. Visa has been operating with excellent margins for years, but the company nevertheless manages to grow its margins further — from an already high level.

Visa Is An Inflation Beneficiary

As a payment technology company, Visa takes a cut out of every transaction that its card holders make. When inflation results in higher spending on goods such as groceries, gasoline, and so on, Visa benefits from that, as it takes a steady cut on the now-increased payment. Many other companies suffer from higher inflation, especially when their own expenses climb due to higher labor costs, higher transportation costs, higher energy bills, and so on.

But since Visa is a company where these expenses aren’t a large factor, its own costs do not climb much. Visa does not need to transport anything from A to B, so it does not incur higher expenses due to elevated diesel prices, for example. Visa’s business isn’t labor-intensive, thus higher expenses for employees aren’t a meaningful headwind for Visa. Visa does not sell any goods, thus the company does not suffer from higher purchase prices for manufactured goods.

While Target (TGT), Walmart (WMT), or Amazon (AMZN) suffer from higher energy costs at its stores and warehouses, from higher diesel prices that impact their transportation costs, from higher labor expenses, and from higher purchase prices for the goods they sell, Visa is happily taking a higher cut on all consumer spending that grows due to inflation, while its own expenses do not grow much. This explains why Visa was able to grow its margins further during the most recent quarter, despite the fact that Visa’s net profit margin already was excellent in the past.

In short, Visa is a great inflation play, as its revenue rises due to price increases (there are other revenue growth drivers at play on top of that, but more on that later), while its costs do not climb much, which differentiates Visa from many other companies that suffer due to the impact high inflation rates have on their expenses.

In the current environment, where inflation rates are at 40-year highs in many economies, including the US, this resilience versus inflation is a great advantage for Visa. It is, I believe, not a coincidence that Visa has seen its shares climb by 7% over the last year, while the S&P 500 index has dropped by around 13% over the same time frame — Visa’s strong positioning in the current environment explains its sizeable outperformance versus the broad market, where many companies suffer.

A Lot Of Growth Potential

Visa is a beneficiary of the current inflation macro theme, but Visa also has other growth tailwinds in place. Even if inflation were to revert back to 2% in the foreseeable future, which isn’t guaranteed, Visa would likely continue to deliver compelling business growth, and especially earnings per share growth.

First, Visa benefits from growth in its network. More and more consumers around the world are opting for non-cash payments. In the US, many consumers already use credit cards, but in other markets, there is more potential for expanding the user base. It is thus, I believe, very likely that Visa will be able grow the number of users on its network over time, with international expansion likely providing the majority of said growth.

New technologies such as Apple Pay, which allow users to use their credit cards in combination with their phones, will likely further shift cash spending towards non-cash spending, meaning Visa will be able to take its cut from a larger overall pie over time.

Even in a hypothetical no-inflation world, consumer spending would climb over time. That growth rate is not very large, but consumer spending still is growing in real terms in the long run, which also results in revenue growth tailwinds for Visa, all else equal.

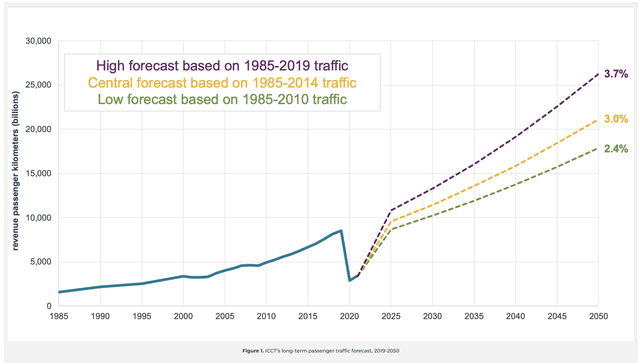

International travel also is a tailwind for Visa. With the pandemic coming to an end, travel will likely recover, especially once China has exited its lockdowns (the timing of that is not certain, of course). Growing travel is a long-term megatrend, as shown by statistics such as the following one:

One can debate which one of these projections is most likely to occur, but it is pretty clear that the trend, overall, is upwards. Growing wealth levels in emerging countries means that more and more people will be able to travel for entertainment, and the world is getting more interconnected over time, which should have a positive impact on travel as well. When people are abroad, they use their credit cards especially much, as it means they don’t have to carry cash in a foreign currency. Also, Visa’s take rate on “international” or cross-border revenue is higher, which is why growing travel is a long-term tailwind for Visa (and other credit card companies as well).

Visa’s business model comes with low proportional costs — its gross margin is at an extremely attractive level of more than 80%. Operating expenses do not grow meaningfully when an additional dollar in revenue is added, which is why Visa generally benefits from operating leverage, meaning its profits will grow more than its revenue over time.

When it comes to earnings per share, the higher growth rate, relative to the revenue or business growth rate, is further pronounced due to the impact of share repurchases. Visa has been buying back shares for years, and continues to do so. In fact, the company has recently announced a new $12 billion buyback authorization. Those buybacks reduce Visa’s share count over time, which leads to an increasing portion of the company’s overall earnings being distributed to each remaining share. Visa is buying back around 2% of its shares per year (actual reduction rate, i.e. accounting for shares being issued to employees and management), which is why we can estimate EPS growth to be around 2% higher than net income growth in the future.

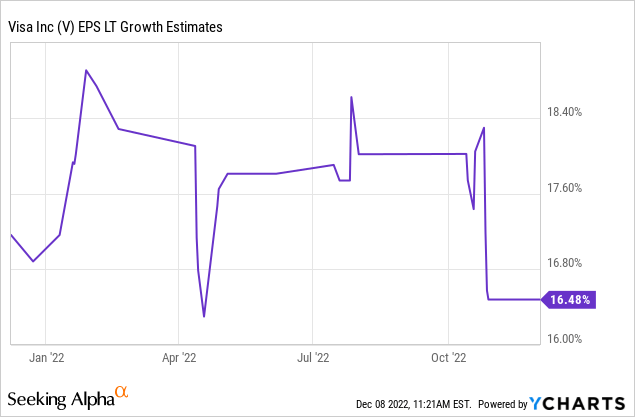

With all these factors in place, I believe that there is a high chance that Visa will grow its earnings per share by at least 10% a year in the foreseeable future, likely significantly more in 2023 due to the ongoing recovery from the pandemic (e.g. when it comes to international travel). Analysts are estimating that the longer-term EPS growth rate will be in the 16% range:

I do not believe that this is guaranteed, but the fact that Visa has oftentimes outperformed analyst expectations is a positive sign for sure. No matter what, the 10%+ EPS growth rate I believe will be achieved in the long run is not aggressive, and it would be far from surprising if Visa’s average growth rate is well above 10% going forward — but even 10% would be solid.

The Valuation Is Very Attractive

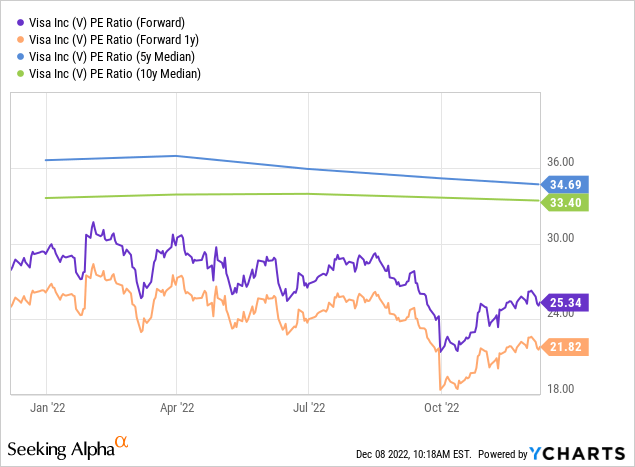

A company’s quality and growth outlook matter, but investors also should always consider the valuation a stock trades at. Looking at that, Visa looks very attractively priced today:

At 25x this year’s earnings, and at just 22x next year’s earnings, Visa trades at a hefty discount compared to how the company used to be valued in the past. The 33x median earnings multiple over the last decade represents a 32% premium relative to how Visa is valued today, using earnings per share estimates for the current fiscal year.

When we take a look at the next fiscal year, Visa does have upside potential of 53% towards its 10-year median earnings multiple [33.4/21.8]. When we look at the 5-year median earnings multiple, the valuation discount is even more pronounced.

One can argue about the likelihood of Visa trading at the historic valuation norm in the foreseeable future, but it is pretty clear that Visa is inexpensively priced today — it looks like one of the best times to buy Visa’s shares. With the earnings growth outlook remaining strong, buybacks continuing, and with Visa being an inflation beneficiary, the current valuation does seem pretty inexpensive, especially when we consider Visa’s great fundamentals such as its ultra-high margins and strong balance sheet.

Takeaway

Visa is a high-quality company with a strong growth outlook that also is an inflation beneficiary. Add growing shareholder returns and a historically low valuation, and Visa looks like a pretty compelling investment right here, I believe.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

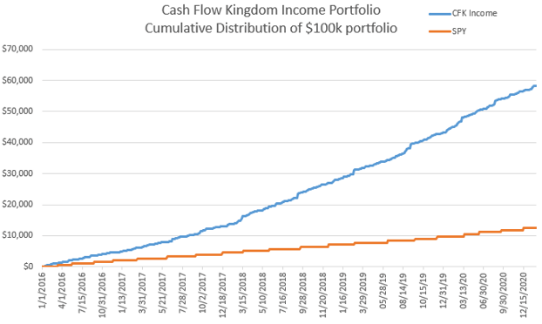

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!