Summary:

- JNJ’s acquisition of Abiomed increases the prospects of the company advancing innovation in both Medtech and the pharmaceutical business.

- Sales of JNJ’s pharmaceuticals were highest in the nine months leading to October 2, 2022, at $39.4 billion while consumer health was least at $11.1 billion, a decline of 1.1%.

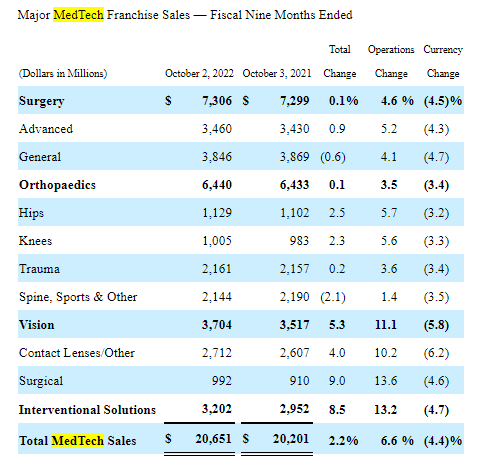

- In the 9 months leading to October 2, 2022, sales in JNJ’s Medtech segment stood at $20.7 billion an increase of 2.2% (YoY).

yuelan

Johnson & Johnson (NYSE:JNJ) closed its acquisition of Abiomed (ABMD) on December 22, 2022. Abiomed, a leading manufacturer of heart pump solutions now forms part of JNJ’s Medtech. JNJ’s share price has risen 5.49% (YoY) with the global health giant set to pull the plug on its body powder. The year 2023 will also see JNJ split its consumer products brand from its pharmaceutical and Medtech business, a move seen to be bolstered by Abiomed’s acquisition.

Thesis

JNJ is incorporating a smart data approach in its development of new medicine as well as infusing technology in its medical device business. The company plans to strengthen its cardiovascular sales with the addition of Impella from Abiomed. After the split, JNJ intends to be a $60 billion pharmaceutical entity by 2025 driven by growth of its major brands and key product launches. I think the company will also spur innovation in the Medtech segment and augment sales in the long run, detached from the fast-paced and often litigious consumer health segment.

JNJ’s Q3 2022 revenue rose 1.94% (YoY) to $23.79 billion beating Wall Street estimates by $357.93 million. However, this number represented a 0.9% (QoQ) drop from the $24.02 billion recorded in Q2 2022. The company’s investment in research & development (R&D) also rose 5% (YoY) to $3.6 billion. It had spent 15.1% of its sales in Q3 2022 on R&D due to its progression in the pharmaceutical business portfolio and added investment in various Medtech businesses.

The Abiomed Equation

JNJ’s acquisition of Abiomed increases the prospects of the company advancing innovation in both Medtech and the pharmaceutical business. To achieve the intended $60 billion annual revenue by 2025, JNJ should attain a CAGR of at least 5% per year beginning in 2023 in these two segments.

In Q2 2022, Abiomed indicated that it expected an income of $1.01 billion to $1.03 billion (recording a growth of 19% to 22% YoY). This annual guidance represented a non-GAAP operating margin of 24-25% (YoY). ABMD has gone from investing $41 million in patient-centered R&D and achieving 23% operating margins to a revenue consensus of almost $1.3 billion in 2023.

JNJ intends to reap from the global cardiovascular devices market which is expected to rise at a CAGR of 6.9%. It is projected to grow from a market size of $54.08 billion in 2021 to $86.27 billion in 2028. The market size of Abiomed’s lead product Impella, which forms part of the smart implantable pumps market, is expected to surpass $3.8 billion in value by 2031. According to the study, this market is forecast to advance at a CAGR of 7.5% between 2022 and 2031.

According to an international review of the cost estimates of treating cardiovascular diseases, it was established that the US had almost twice the amount charged in the EU. In the study, the cost of treating unstable angina was $6,466, acute myocardial infarction was $11,664, and heart failure stood at $11,686. Treatment cost for acute ischemic stroke was $11,635, coronary artery bypass graft (CABG) was $37,611 and percutaneous coronary intervention (PCI) stood at $13,501.

The news of Abiomed’s acquisition comes months after Abbott Laboratories (ABT) confirmed that its HeartMate 3 pump could extend a heart-failure patient’s life by up to 5 years. This left ventricular assist device (LVAD) – approved by the FDA in 2017 is implanted during an open-heart procedure to help pump blood from the left ventricle chamber.

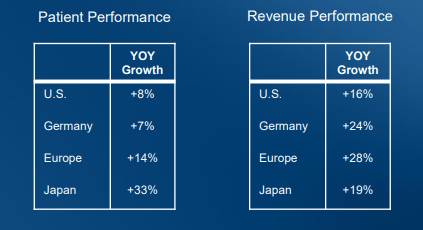

In its Q2 2022 earnings call, ABMD noted that Abiomed 2.0 (in Q2 2022) had met the growing needs of heart diseases in multiple emergency patient situations in both the catheter labs and surgical suites. It had the highest patient utilization rates in Europe and Japan. Germany had the least patient performance (treatment) at 7% (YoY) with Japan registering the highest rate at 33% (YoY). In terms of revenue performance, Europe recorded a growth of 28% (YoY) with Germany coming second at 24%.

Abiomed

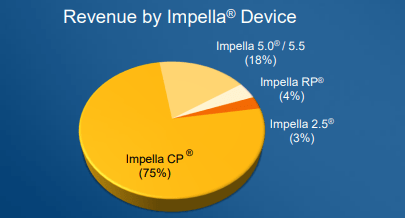

Impella CP- a temporary mechanical cardiac assist device inserted percutaneously at the left ventricle of the heart registered the highest revenue growth rate at 75% (YoY) followed by Impella 5.0/ 5.5 at 18% (YoY).

Abiomed

As seen above, Impella heart pumps will strengthen JNJ’s medical technology portfolio. Abiomed indicated that post-closure it intends to operate as a stand-alone business within JNJ with the capability to deliver up to $1 billion in revenue annually.

Back in Q2 2018, JNJ planned to focus its resources and increase investments in critical technologies to not only augment its future product portfolio but also enhance agility and steer growth. It is in this light that the company began expanding its scope in consumer health, pharmaceutical, and Medtech business. In the 9 months leading to October 2, 2022, sales in JNJ’s Medtech segment stood at $20.7 billion an increase of 2.2% (YoY). Medtech sales in the U.S. rose 4.9% (YoY) while it reduced by 0.1% (YoY) in the international space. However, JNJ did not have the heart pump device to boost sales of medical devices.

Johnson & Johnson

In the Fiscal Q3 2022, Medtech franchise sales for JNJ stood at $6.782 billion an increase of 2.1% (YoY). Sales in the Medtech division represented 28.5% of revenue recorded in the quarter. JNJ needed to increase sales in this sector since it is the second-best performing as compared to consumer health and pharmaceuticals.

JNJ Split is good for business progression

Sales of JNJ’s pharmaceuticals were highest in the nine months leading to October 2, 2022, at $39.4 billion while consumer health was least at $11.1 billion, a decline of 1.1% (YoY). Innovative therapeutics in the pharmaceutical segment such as CAR-T meds and gene therapies as well as established medicines and investigational drugs were the key highlights of JNJ’s quarter. Total pharmaceutical sales in Q3 2022 stood at $13.214 billion indicating a 2.6% (YoY) increase from $12.882 realized over the same period in 2021.

Some of JNJ’s pharmaceutical drugs poised for growth into 2023 include Darzalex (oncology), Opsumit (Pulmonary Hypertension), Xarelto (Cardiovascular/ metabolism), and Remicade (immunology) among others. Sales in immunology drugs were the highest at $12.817 billion in the nine months leading to October 2, 2022. There has been remarkable development in the pharmaceutical space into 2023. The Janssen Pharmaceutical Companies of JNJ on December 9, 2022, announced that it had submitted its Biologics License Application (BLA) to the U.S. FDA for Talquetamab to be used for the treatment of patients with relapsed/ refractory multiple myeloma.

The news of JNJ’s split later in 2023 to me comes as a sigh of relief, with the pharmaceutical segment turning out as the best performer. In my view, tying consumer health and Medtech to pharmaceuticals will only drag sales downwards, seeing the company needs to evolve while integrating technology. Through its pharmaceutical side, JNJ is set to unveil at least 14 new medicines with a sales potential of more than $1 billion. The company also believes that close to half of these drugs can rake in up to $5 billion or more.

In my view, FY 2023/2024 is the best to effect this split since JNJ’s quarterly cash balance is standing higher than it did during the Covid era. JNJ’s cash balance as of October 2, 2022, stood at $34.08 billion, an increase of 89% (from $18.024 billion recorded in March 2020). The company also announced that it has generated free cash flow above $13 billion (YTD) against $32 billion in debt.

Risks to Consider

The $35/ share CVR offer accompanying JNJ’s offer of ABMD will take effect between 2028 and 2029. It means investors will have to wait for almost 7 years to realize these benefits. Again, the $3.7 billion net sales milestone revenues will come from specific products and not the entire revenue stream of Abiomed. Still, the management appears confident of attaining these milestones considering it is updating its medical device business structure.

Despite having a stronger cash reserve, JNJ’s cash level has also dropped 21.62% (in the nine months to October 2022) to $11.355 billion from $14.487 billion recorded in January 2022. Further, the company likely used up most of its free cash flow in the ABMD deal which stood above $13 billion. The company’s net cash also sits at $2 billion since its cash balance as of October 2, 2022, was $34 billion against $32 billion in total debt.

Also as seen above, JNJ’s consumer health segment has not been as profitable as Medtech and pharmaceuticals. It is likely that the new company, Kenvue will be formed to act as JNJ’s fast-moving consumer goods segment and help maintain costs and the company’s agility. The other segment will entail innovation. It is also unclear what will happen to the dividend after the split as it stands at a forward yield of 2.55% and a dividend rate of $4.52.

Bottom Line

JNJ’s share price will likely drop after the split and I intend to invest in the Medtech/pharmaceutical space. I think the company may face liquidity challenges since its net cash is only $2 billion after subtracting the total debt of $32 billion. I still believe innovation will form the main investment basis for JNJ and a progression factor into the future. Further, JNJ needs to focus on Medtech and Pharmaceutics that have higher annual growth sales as opposed to consumer health. For these reasons, we recommend a buy rating after the split.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.