Johnson & Johnson: Time To Buy Before The Split

Summary:

- JNJ will be spinning off its popular consumer health segment into a separate company called Kenvue.

- Medical Devices and Pharmaceutical segments will remain together in which they are the fastest growing segments within the business.

- In a time of much uncertainty surrounding 2023, JNJ is a defensive name with essential products with a rock-solid dividend.

CatLane/iStock Unreleased via Getty Images

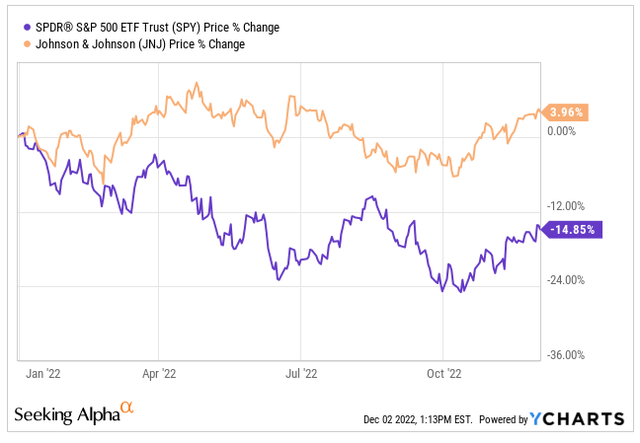

Johnson & Johnson (NYSE:JNJ) for years has been a safety net for many dividend investors, and that continues to be the case in 2022. In a year in which the S&P 500 (SPY) is down ~15%, JNJ shares have gone in the opposite direction and find themselves up roughly 4% year to date.

One reason shares of JNJ are up is due to their defensive nature. Given the uncertainty in the economy surround 2023, with expectations of at least a minor recession (assuming we are not already in one now), investors have flooded to more stable names like JNJ.

Johnson & Johnson has been known for their stability, and in fact, over the past three years, JNJ shares have actually outperformed the S&P 500, albeit slightly.

That is saying something considering the past three years JNJ has seen a lot of rough patches in terms of negative press.

JNJ’s COVID-19 vaccine was a struggle for the company and so was the talc powder lawsuit that has been going on for years. Originally, the company was hit with a $4.7 billion lawsuit that was awarded to nearly two dozen women who claimed the powder had asbestos that contributed to them contracting ovarian cancer.

After appealing the original verdict, the company was successfully able to lower the awarded amount to $2.1 billion after some women dropped their suit. However, the company was not done there as they continued to defend their position rigorously and they appealed yet again which took things to the Supreme Court, but this is where they were rejected.

CNBC

Those two instances were a rough time for JNJ and its shareholders, but since then, the company has yet again secured itself as a strong business, led by a very competent and fiscally responsible management team backed by an A rated Balance Sheet.

Consumer Health Segment To Spin Off And Become Kenvue in 2023

About a year ago, JNJ announced that they would be splitting their long-time business into two separate companies. This news sent shockwaves through the investing community as JNJ has been the same business for over a century, having started back in 1886.

As it stands now, Johnson & Johnson operates within three segments:

- Consumer Health

- Pharmaceutical

- Medical Devices (MedTech)

The consumer health segment has been a staple for the business, as it includes items such as: Band-Aid, Listerine, Aveeno, Neutrogena, and Tylenol among other products. These are essential products that are required regardless of the economic backdrop.

Although consumer health has been the backbone of the company over the years, the pharmaceutical and medical device sales segments have been the growth drivers.

All three segments continued to expand to a point where management believe the consumer health segment could stand on its own and with the growth trajectory of the other two segments, they required further attention, which is why the plan to split the business ended up being the final decision.

To give you an idea on the size of each segment, here is a look at the revenues for each segment through the first nine months of 2022:

- Consumer Health = $11.2B

- Pharmaceutical = $39.4B

- MedTech = $20.7B

Management believes that by splitting up the businesses will allow the individual businesses to think more about growth opportunities on a standalone basis given their size now, which would further unlock value for shareholders. The change is expected to take place later in 2023.

This change is really separating safety from growth. Pharmaceutical and MedTech have been growth drivers growing above or near double digit returns on average over the past few years. The higher growth opportunities would increase the multiple for a company like that whereas Kenvue would remain a lower multiple stock.

Dividend Royalty

Right now there are 48 Dividend Kings in the US, and one of those happens to be Johnson & Johnson. This is a prestigious list for dividend stocks and in order to be on this list, you must pay a growing dividend for 50+ CONSECUTIVE years.

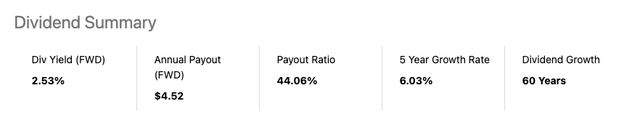

When it comes to JNJ, they have increased their dividend for 60 CONSECUTIVE years, making them dividend royalty.

As the stock currently trades, shares of JNJ pay an annual dividend of $4.52 which equates to a dividend yield of 2.53%. Over the past five years, the company has increased the dividend at an average annual rate of 6%.

The dividend is well covered with a low payout ratio of 44% and a very strong A rated balance sheet.

However, once the spin-off does take place, it will be interesting to see how the dividend plays out. The consumer health will be a stable company, but the growth won’t be as strong. I would expect a similar slow growing dividend here for Kenvue.

On the flip side, the new JNJ will now be a faster growing business, and I can see it playing out very similar to that of AbbVie (ABBV) when they spun-off from Abbott Labs (ABT) about a decade ago, and that would be very intriguing.

Investor Takeaway

Johnson & Johnson is one of the iconic companies here in the US, but they going to be going through some major changes in 2023 as they split up the business, moving consumer health into its own company called Kenvue.

Shares in the meantime have been providing stability for investors’ portfolios given the uncertainty surrounding the economy in the near-term.

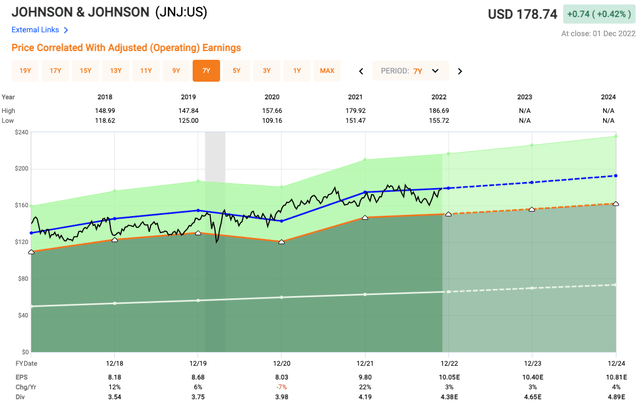

Shares of JNJ currently trade at a P/E 17.8x and a forward P/E of 17.2x. These are in-line with exactly where the company has traded on average over the past five years.

JNJ is a dividend king with strong portfolio of products and a rare AAA credit rating, making an investment in JNJ about as reliable as they come.

Disclaimer: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I/we have a beneficial long position in the shares of JNJ, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No marketing to add