Summary:

- Johnson & Johnson focuses on pharmaceuticals and medical devices after spinning off its consumer-health segment.

- The company’s solid pipeline of cancer, immunology, and neurology drugs, along with its leading medical device portfolio, offer growth prospects.

- Johnson & Johnson reported strong Q4 earnings, beating revenue forecasts, and expects continued growth in pharmaceutical sales and revenue in FY24.

domin_domin

This article was coproduced with Chuck Walston.

With the spinoff of its consumer-health segment, now known as Kenvue (KVUE), Johnson & Johnson (NYSE:JNJ) is now focused on its pharmaceuticals and medical devices businesses. Pharmaceuticals now generate just under two-thirds of the company’s revenue, with the latter segment hauling in the remainder.

With a solid pipeline of cancer, immunology, and neurology drugs, along with a market leading medical device portfolio, management believes JNJ offers far greater growth prospects now that Kenvue is in the rearview mirror.

Add to that an AAA credit rating, a status JNJ shares with only one other company (Microsoft), and its status as a Dividend Aristocrat, and you have the makings for a solid investment.

Unfortunately, the company has potentially enormous litigation expenses that weigh on the stock, as well as the upcoming patent loss for blockbuster drug Stelara. Despite a solid Q4 earnings report, most pundits view those two factors as weighing heavily on the stock.

Q4 Results

Non-GAAP EPS of $2.29 narrowly beat the consensus $2.28.

Revenue of $21.40 billion, up 7.3% over the comparable quarter, beat analysts’ $21.01 billion forecast.

Full year sales of $85.2 billion were up 6.5% over 2022. Non-GAAP EPS for the year of $9.92 increased 11.1%.

The company reported free cash flow of $18 billion.

Breaking results out by the segments, MedTech revenues of $7.67 billion increased 13.3% over the comparable quarter and beat analysts’ $7.50 billion estimate. Management attributed the solid growth to the recent acquisition of Abiomed and a surge in procedures that were delayed during the COVID crisis.

Pharmaceutical sales of $13.72 billion were up 4.2% year-over-year, and above the consensus $13.44 billion. Management credited increased sales of Darzalex, Stelara and Erleada for the growth in pharma.

For the full year, pharma sales increased by 6.5% to $54.8 billion, and MedTech sales were up 10.8% to $30.4 billion.

Management guides for FY24 revenue in a range of $87.8 billion to $88.6 billion and adjusted EPS in a range of $10.55 to $10.75 per share.

The company also forecasts pharmaceutical sales to grow at a compounded annual rate of 5% to 7% through 2030.

During the earnings call, the CEO, Joaquin Duato, offered the following:

At our Enterprise Business Review, we shared that we expect our Innovative Medicine business to grow 5% to 7% from 2025 to 2030 with our industry-leading pipeline and portfolio delivering more than 10 assets that have the potential to generate over $5 billion in peak year sales by 2030. We also expect a further 15 assets to have the potential for $1 billion to $5 billion in peak year sales.

Recent Acquisitions

At the end of 2022, in a deal valued at $16.6 billion, JNJ completed the acquisition of Abiomed.

Abiomed is a manufacturer of heart pumps used to treat a variety of medical conditions, including heart attacks and clogged arteries. In 2021, Abiomed’s sales increased by 22% to just over $1 billion.

Abiomed is now a standalone business within Johnson & Johnson’s MedTech segment. In the last quarter, JNJ’s worldwide MedTech sales of $7.7 billion increased 13.4% with Abiomed contributing 4.5% to growth.

Late last year, J&J acquired Laminar for an upfront payment of $400 million. Laminar is a medical device company with products focused on reducing the risk of stroke associated with atrial fibrillation. Additional payments for reaching clinical and regulatory milestones may be made in 2024 and beyond.

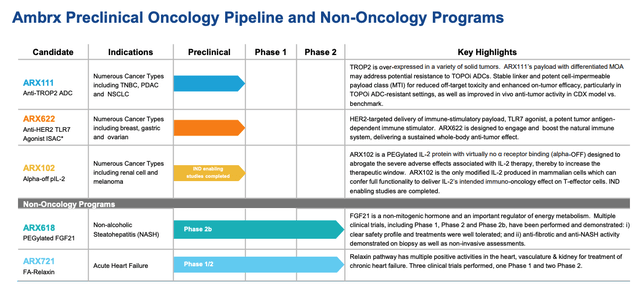

Early last month, in a deal valued at $10 billion, J&J agreed to acquire Ambrx Biopharma (AMAM). Ambrx specializes in the development of antibody-drug conjugates (ADC). ADC’s work with chemotherapy to target and kill cancer cells with relatively minimal damage to healthy tissues.

ADCs are not a new therapy; however, the efficacy and safety of ADCs has improved, bringing them to the forefront of the war on cancer.

The following chart provides an overview of Ambrx’s pipeline.

Ambrx also has a promising candidate in ARX517, which targets prostate cancer. ARX517 is in a phase 1 trial.

Potential Headwind: Drug Pricing Negotiations

The 2022 passage of the Inflation Reduction Act gives Medicare the power to negotiate drug prices.

Last August, a list of the first ten drugs to be targeted for price negotiations was issued by the U.S. Department of Health and Human Services. With Xarelto, Imbruvica, and Stelara, JNJ has the distinction of having the most drugs on the list. From June of 2022 through May of 2023, Medicare Part D spending on Xarelto, Imbruvica, and Stelara totaled $11.3 billion.

The Centers for Medicare & Medicaid Services will make a price offer to pharmaceutical firms this month, giving companies a month to accept the initial offer or provide a counteroffer.

Negotiations will end in August, and the prices will be made public in September of this year. However, the new pricing will not go into effect until January 2026. Pharmaceutical companies that reject the government pricing will be required to pay an excise tax of up to 95% of U.S. sales or remove all products from the Medicare and Medicaid markets.

At this juncture, it is impossible to estimate the potential effect this will pose for JNJ; however, investors should consider this development when weighing an investment in the company.

The Kenvue Spinoff

In August, J&J completed the divestiture of its consumer-health business. Named Kenvue, the spinoff resulted in J&J reducing its outstanding shares by 7%, or 191 million shares. The company did so without using cash and in a tax-free manner.

J&J has a 9.5% stake in Kenvue’s common stock, which the company may sell.

Legal Issues

About two weeks ago, J&J announced the resolution of an opioid-related claim in Washington State. The $149.5 million settlement will resolve all pending opioid litigation by the state as well as all litigation brought by the U.S. state Attorneys General; Washington had opted out of the global 2021 settlement.

Late last month, JNJ reached a tentative agreement to resolve lawsuits brought by over 40 states. Centered around the marketing of the company’s talcum-based baby powder, JNJ agreed to pay $700 million.

Last year, JNJ proposed to pay $8.9 billion to resolve lawsuits related to the use of J&J’s talcum powders. It initially appeared as if this move would resolve the bulk of the lawsuits, but a New Jersey bankruptcy judge rejected the plan.

J&J plans to appeal the New Jersey decision to the U.S. Supreme Court. However, as the court proceedings continue, additional plaintiffs are coming forward. Analysts estimate JNJ will eventually be forced to pay $10 billion to $15 billion to resolve the plethora of talcum powder related lawsuits.

The potential costs required to resolve other litigation is also enormous. For example, last July, a court in California awarded a single plaintiff $18.8 million in damages following a claim that he developed mesothelioma by using J&J’s talc powder.

Debt, Dividend, And Valuation

JNJ has an AAA credit rating. At the end of FY 2023, the company had $23 billion in cash and equivalents and $29 billion in debt.

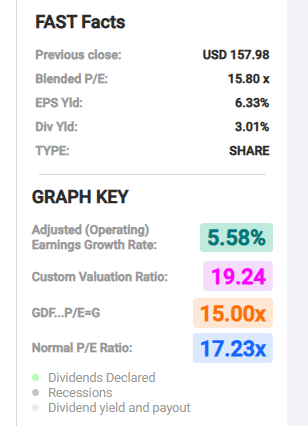

The stock yields 3.01%. The payout ratio is a bit over 45%, and the 5-year dividend growth rate is 5.83%. JNJ has increased the payout for over 60 consecutive years.

JNJ has a forward P/E of 17.77x, somewhat above the average P/E over the last five years of 17.14x. The 5-year PEG ratio of 5.82x is well above the 5-year average PEG for the stock of 3.32x.

JNJ currently trades for $158.03. The 23 analysts that follow the stock have an average price target of $174.55.

FAST Graphs

Is JNJ A Buy, Sell, Or Hold?

JNJ’s research budget for the drug segment is just over 20% of sales. That’s a bit higher than the industry average. R&D for the device segment stands at about 9% of sales, which is at the upper end for the industry.

JNJ expects to launch 20 new therapies by 2030. Management projects more than 10 of the products will generate over $5 billion in peak annual sales. The company includes cancer treatments Talvey and Tecvayli on that list.

However, JNJ faces some fierce headwinds. Lawsuits against the company number in the thousands, and the cost to eventually resolve litigation totals in the billions.

Another headwind lies in the upcoming competition from biosimilars for Stelara. An analyst for Wells Fargo projects a 40% drop in Stelara sales in 2025 and an additional 40% fall in sales each year thereafter.

The surge in medical device sales from the delay in medical procedures during the COVID crisis contributed to MedTech growth in 2023. That may wane, reducing growth for that segment.

I consider the current PEG ratio of 5.28 a significant negative.

I recognize that JNJ is a very high-quality business, and I’ll confess I struggled to make a decision as to whether I should rate JNJ as a Reasonable Buy or a Hold. However, I view discretion as the better part of valor when rating a prospective investment.

Therefore, I feel compelled to rate JNJ as a HOLD.

I do not hold a position in JNJ, but I will keep it near the top of my watch list.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT® on Alpha today… for more in-depth research on REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. You’ll get more articles throughout the week, and access to our Ratings Tracker with buy/sell recommendations on all the stocks we cover. Plus unlimited access to our multi-year Archive of articles.

Here are more of the features available to you. And there’s nothing to lose with our FREE 2-week trial. Just click this link.

And this offer includes a FREE copy of my new book, REITs for Dummies!