Nike Is Running Well, But Its Valuation Is A Hurdle

Summary:

- Nike is a leading entity in the consumer discretionary sector, but it is currently overvalued.

- The company has seen impressive revenue and EPS growth over the past decade, driven by innovation and cost efficiencies.

- Nike has opportunities for growth through its digital platform, expansion into emerging markets, and focus on innovation and sustainability.

code6d

Introduction

The consumer discretionary sector represents a dynamic and evolving landscape, captivating investors and consumers alike with its volatility and the need for adaptability due to the fluctuating economic environment. Many companies in the sector thrive on innovation and brand loyalty, which are particularly significant nowadays. While the segment is volatile, companies that blend cutting-edge technology with sublime execution emerge as leaders and should be considered even during the down cycle, as they have the potential to deliver long-term value. These companies may be compelling investments despite the inherent volatility associated with consumer discretionary spending.

Nike (NYSE:NKE) stands out as a leading entity within this sector, epitomizing the synthesis of innovation, brand strength, and global market presence. Nike has become the leader of the sportswear industry, with both athletic performance and cultural relevance. A year ago, I analyzed Nike and found it to be a HOLD on valuation. Since then, the S&P 500 has outperformed it by 40%, and I decided to revisit the company. My analysis leads me again to a HOLD thesis, as despite its multiple strengths, Nike seems overvalued.

Seeking Alpha’s company overview shows that:

Nike designs, develops, markets, and sells athletic footwear, apparel, equipment, accessories, and services worldwide. The company provides athletic and casual footwear, apparel, and accessories under the Jumpman trademark and casual sneakers and accessories under the Converse, Chuck Taylor, All-Star, One Star, Star Chevron, and Jack Purcell trademarks. It also sells performance equipment and accessories comprising bags, sports balls, socks, eyewear, timepieces, digital devices, bats, gloves, protective equipment, and other equipment for sports activities under the NIKE brand and various plastic products to other manufacturers. In addition, the company markets apparel with licensed college and professional teams and league logos, as well as sports apparel.

Fundamentals

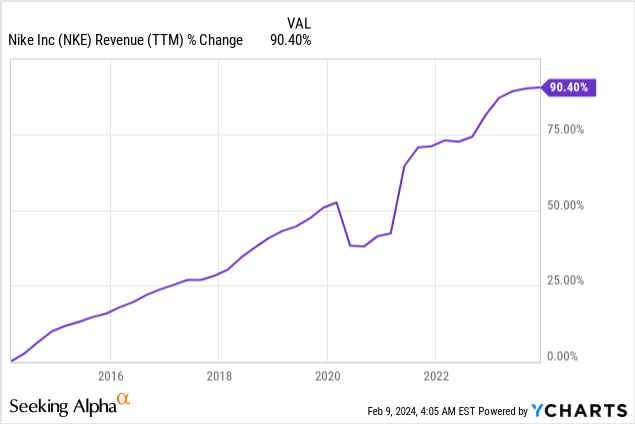

Over the past decade, Nike has seen its revenues climb by an impressive 90% due to its strong market presence and brand loyalty across the globe. This growth has been primarily organic, driven by Nike’s innovation in product design and marketing strategies. Acquisitions like RTFKT in 2021 underscored its commitment to digital transformation and expansion into the Metaverse meant to expand the value proposition. Looking ahead, analysts on Seeking Alpha project a steady growth trajectory for Nike, anticipating sales to grow at an approximate annual rate of 5% in the medium term.

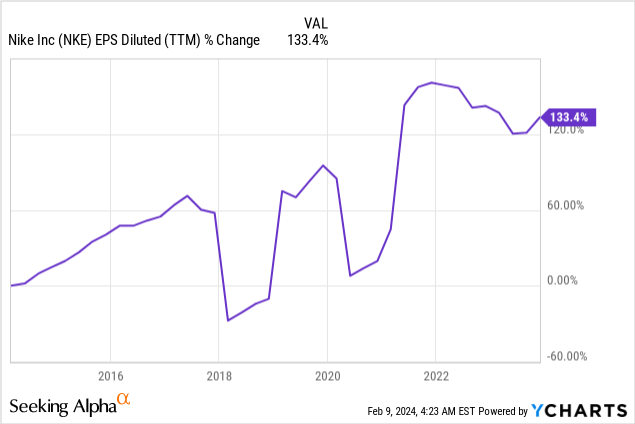

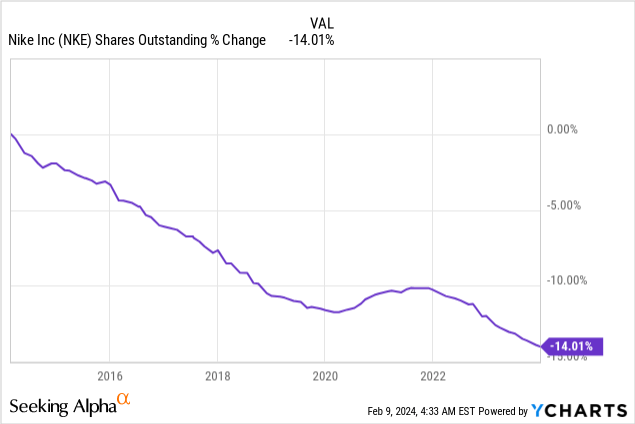

The company’s EPS (earnings per share) has seen an even more remarkable ascent, surging by 133% over the same period. This increase in EPS can be attributed to a combination of factors, including robust sales growth, strategic share buybacks, and cost efficiencies realized through an emphasis on online sales channels. The future looks even brighter for Nike, with analyst consensus on Seeking Alpha forecasting Nike to sustain an annual EPS growth rate of around 15% in the medium term as the company improves its operating margin and lowers production costs in a post-inflationary environment.

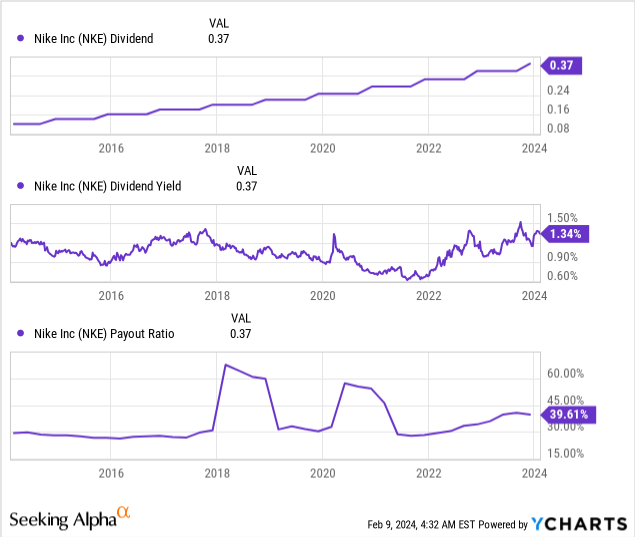

Dividend payouts are a critical aspect of Nike’s appeal to investors, with the company demonstrating a solid commitment to returning value to its shareholders. Nike has consistently paid dividends without reduction for 39 years, and for the last 21 years, it has increased its dividend annually, nearing the status of a dividend aristocrat. The recent 9% dividend hike in November 2023 is a business-as-usual increase emphasizing the commitment to grow payouts. With a payout ratio of 40%, the dividends, yielding 1.35%, are considered safe. Although the yield may appear modest, investors are poised to benefit from continuous double-digit increases, aligning closely with the company’s anticipated EPS growth of 15%.

Share buybacks have played a strategic role in Nike’s capital allocation strategy, with the company reducing its share count by 14% over the last decade. This approach supports EPS growth by reducing the number of outstanding shares, albeit its efficacy is somewhat tempered by the current high valuation of Nike’s shares. These buybacks underscore Nike’s commitment to shareholder value and reflect a balanced approach to capital management, leveraging buybacks alongside dividends to reward investors.

Valuation

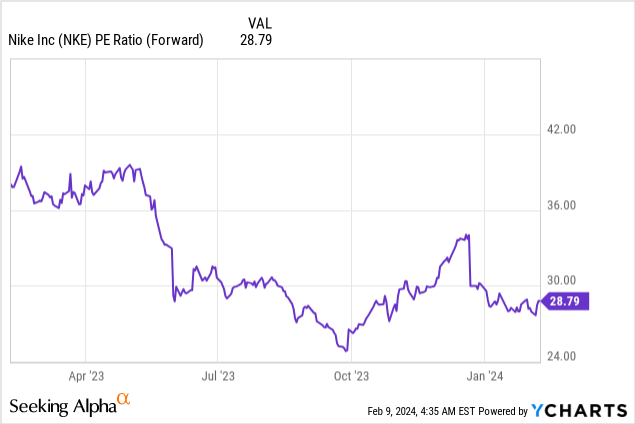

Nike trades 29 times its 2024 EPS estimates, marking a lower P/E ratio than the last twelve months. This valuation adjustment is significant, considering that Nike’s P/E ratio stood at 40 times earnings just a year ago. While the reduction to 29 times earnings signals a more attractive valuation, it still poses a challenge to justify such a premium. This valuation is challenging for a company forecasted to grow at an annual rate of 15%. The high valuation has made Nike underperform over the last year, which is also a significant risk.

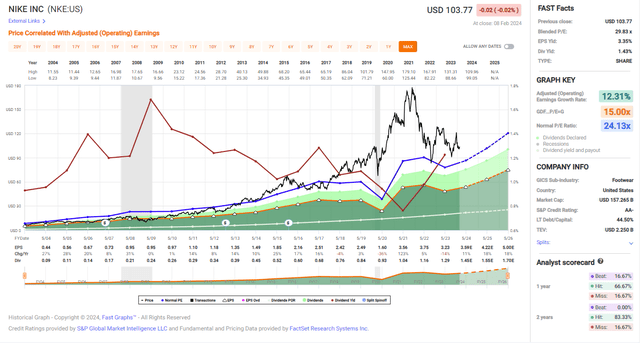

The graph below from Fast Graphs emphasizes that Nike is overvalued. Over the past two decades, Nike’s average P/E ratio has been 24, notably lower than its current P/E of 29. This discrepancy suggests that Nike is trading at a slight premium compared to its historical averages. However, this premium is somewhat mitigated by the company’s current growth rate, which, at 15%, exceeds its average growth rate of 12%. This higher growth projection might justify a higher valuation to some extent, yet the current interest rate environment and global economic uncertainty add complexity to this justification. While Nike exhibits more robust growth prospects, the elevated P/E ratio is in a challenging economic landscape.

Opportunities

The company’s digital platform and DTC (direct-to-consumer) channels have shown remarkable growth, highlighting a significant opportunity for expansion. The company can deepen customer engagement and increase sales by leveraging advanced analytics, personalized marketing, and enhancing the digital user experience. With a strategic focus on digital innovation, the company can capture a larger market share, adapt quickly to consumer trends, and improve profitability through direct sales with higher margins. This led to an increase of 10% yearly, creating an opportunity for additional growth as e-commerce becomes more prevalent and straightforward.

“NIKE Digital had its strongest Black Friday week ever, and a record number of consumers shopped in our stores over the long Thanksgiving weekend.”

(John Donahoe, President and Chief Executive Officer, Q2 2024 Conference call)

Emerging markets represent a substantial growth opportunity for the company, with increasing demand for branded sportswear and athletic products. By tailoring products to meet local preferences, investing in market-specific marketing strategies, and expanding its retail and distribution networks, the company can capitalize on the growing middle-class population and increase health and fitness awareness in these regions. This strategic expansion can drive long-term revenue growth and diversify the company’s market presence as more markets adopt healthier lifestyles. China is the most prominent market with double-digit growth.

“And in Greater China, brick-and-mortar grew double-digits during National Day holiday and NIKE once again outperformed the industry during Double Eleven is the number one sport brand on Tmall.”

(John Donahoe, President and Chief Executive Officer, Q2 2024 Conference call)

Innovation remains at the core of the company’s growth strategy. The company can strengthen its market leadership by investing in research and development to create cutting-edge, sustainable products that cater to evolving consumer preferences. Acquisitions such as RTFKT in 2021 even innovate to the Metaverse. Sustainable initiatives resonate with the growing consumer preference for eco-friendly products, offering a competitive edge while addressing environmental concerns. This approach also helps Nike deal with regulations.

“100% waste diverted from landfill in our extended supply chain with at least 80% of waste recycled back into Nike products and other goods.”

(Nike Website, 2025 Sustainability targets)

Risks

The company faces intense competition from both established and emerging brands in the global sportswear market. This competition could lead to price pressures, higher marketing costs, and the need for continuous product innovation to maintain market share. To mitigate this risk, the company must stay ahead of market trends, invest in brand differentiation, and enhance customer loyalty through exceptional product quality and customer service. Competitors include European giants like Adidas, as well as newcomers in the U.S such as Under Armour.

“In this competitive environment, we need to accelerate our pace of innovation, elevate our marketplace experiences, maximize the impact of our storytelling and increase our speed and responsiveness, all in service of the consumer.”

(Matthew Friend, Chief Financial Officer, Q2 2024 Conference Call)

Global supply chain disruptions pose a significant risk to the company’s operations, potentially leading to inventory shortages, increased costs, and delayed product deliveries. To address this risk, diversifying the supply chain, investing in logistics technology, and enhancing supplier relationships can improve resilience and flexibility, ensuring steady product availability and cost efficiency. Higher inventory is more expensive to hold, and liquidating it took time for the company and slowed the growth. If the need for more inventory will return, it may hurt the growth again.

“We moved proactively in the prior year to liquidate excess inventory and reduce wholesale sell-in for the first half of fiscal ’24. And while this dampened our reported revenue growth through Q2”

(Matthew Friend, Chief Financial Officer, Q2 2024 Conference Call)

The company operates in a global market that is susceptible to economic fluctuations, consumer spending trends, and currency exchange rate volatility. These factors can significantly impact the company’s revenue and profitability. Developing a more flexible business model, focusing on cost management, and geographic diversification can help mitigate the impact of macroeconomic uncertainties. Right now, the company is dealing with cautious consumers making it harder to increase sales.

“We are seeing indications of more cautious consumer behavior around the world in an uneven macroenvironment.”

(Matthew Friend, Chief Financial Officer, Q2 2024 Conference Call)

Conclusions

To conclude, Nike stands as a leader in the global sportswear market, with strong fundamentals, including a robust digital presence and direct-to-consumer channels, strategic expansion in emerging markets, and a commitment to product innovation and sustainability. These core strengths not only drive its current market leadership but also present significant growth opportunities. The company’s ability to adapt to consumer trends, coupled with its pursuit of innovation positions it well to capitalize on the expanding demand for athletic wear and eco-friendly products. This strategy, alongside its successful navigation of the digital and global landscape, underscores

However, Nike does face challenges, as the company navigates through the waters of increasing global competition, supply chain disruptions, and macroeconomic volatility. These risks, while manageable, necessitate strategic planning and operational flexibility to mitigate potential impacts on revenue and profitability. Given the current market valuation, the shares are overvalued. Taking into account NIKE’s solid foundation, growth prospects, and the outlined risks, the verdict leans towards a HOLD. I will consider Nike when the forward P/E ratio is around 22.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.