Rivian: Rightfully Discounted For Opportunistic Dollar Cost Averaging

Summary:

- RIVN’s FQ4’23 production/ delivery gap has been grossly misunderstood, since it is attributed to AMZN’s delayed intake during the peak holiday season.

- Readers must focus on the double-digit growth recorded for its production and delivery capabilities, likely to improve its scale of economy.

- The peaking observed in the PPI for automotive industry may also contribute to its improved gross margins over the next few years, moderating its cash burn rate.

- Assuming that RIVN is able to sustain its high growth rate and premium Price/ Sales valuations, we may see the stock more than double from these depressed levels.

- Its top line expansion may also outperform expectations, as more TSLA drivers consider the R1S and R1T to be alternative EV models.

Leon Neal/Getty Images News

We previously covered Rivian Automotive (NASDAQ:RIVN) in November 2023, discussing the promising development surrounding its production/ delivery numbers and improving gross margins over the past few quarters.

Combined with the raised FY2023 production guidance and robust ASPs, we had rated the stock as a speculative Buy, with it likely to emerge as one of the prospective winners in the start-up EV industry.

In this article, we shall discuss why we maintain our Buy rating, attributed to the attractive risk/ reward ratio from the misunderstanding surrounding RIVN’s supposed delivery miss in FQ4’23.

With the PPI in the Automotive sector already peaking and borrowing costs likely to moderate as the Fed pivots, we believe that its top line expansion may outperform expectations, as more TSLA drivers consider the R1S and R1T to be alternative EV models.

The Near-Term EV Investment Thesis Appears To Be Mixed

While RIVN has yet to report FQ4’23 earnings, it appears that the market has decided to discount its prospects first, attributed the supposed delivery miss in the quarter.

For context, the automaker produced 17.54K vehicles (+7.6% QoQ/ +75% YoY) while delivering 13.97K vehicles (-10.2% QoQ/ +73.5% YoY), implying a widening ratio of 79.6% (-15.8 points QoQ/ -0.7 YoY).

However, readers must also note that the RIVN management has already warned of this event in the FQ3’23 earnings call, with Amazon (AMZN) expected to “limit intake of new commercial vans during its peak holiday delivery period, resulting in a significant gap between production and deliveries in Q4 relative to prior periods.”

As a result, it appears that the market has not been paying attention, since the automaker has already produced an impressive sum of 57.23K vehicles (+135.2% YoY) and delivered 50.12K vehicles in FY2023 (+146.5% YoY), with a narrowing ratio of 87.5% (+4 points YoY).

These numbers easily exceed the management’s original FQ4’22 production guidance of 50K vehicles, FQ2’23 guidance of 52K vehicles, and FQ3’23 guidance of 54K units indeed.

With RIVN still sustaining an impressive double digit production/ delivery growth rates, it appears that demand for its EV offerings remain excellent, as opposed to the issues faced by multiple legacy automakers, such as General Motors (GM) and Ford (F), prompting their subsequent moderation in EV ambitions/ capex.

Nonetheless, these developments may pose near-term uncertainties to RIVN’s prospects indeed, depending on how readers interpret them.

On the one hand, F has committed to reducing its FY2024 F-150 Lightning production from the planned capacity of 3.2K vehicles to 1.6K vehicles each week, following the completion of the EV early adopter wave and pending the introduction of mass-market (ie: cheaper) models in 2025/ 2026.

At the same time, GM has also confirmed that “the pace of EV growth has slowed,” despite the supposed “100K reservations and orders for EV pickups through 2025.” The uncertainty has already triggered the management’s lowered 2024 capex guidance to $11B, compared to the original top-end guidance of up to $13B through 2025.

To put the final nail down, we believe that Tesla (TSLA) only managed to report double digit FQ4’23 production and delivery growth because of the drastic price cuts, with the cost reductions/ efficiencies already “approaching the limits within its current platforms.”

The same has been observed in the peaking Producer Price Index for Automobile, Light Truck, and Utility Vehicle Manufacturing at 169.361x by November 2023.

While the index has moderated to 168.432x by December 2023, there remains a great distance to the 155.1x reported in 2019, implying that RIVN’s positive gross margin target by the end of 2024 may be an underwhelming figure indeed.

Therefore, while the worst may very well be behind us, allowing start-up automakers, such as RIVN, to improve their cost basis as they ramp up in production volume, readers must also temper their near-term expectations as the reversal will not occur over night.

On the other hand, assuming that RIVN is able to sustain the robust consumer demand, we may see its EV market share accelerate from current levels, as more TSLA drivers consider the former’s R1S and R1T to be alternative brands with 34.1% in popularity rating (double of the F-150 Lightning).

While it remains to be seen how things may progress for RIVN, we believe that its near-term prospects may be temporarily impacted by the ongoing EV uncertainties.

This is until the automaker releases mass market models starting from $40K on the R2 platform in 2026, as borrowing costs for new vehicles moderate from the 7.1% reported in December 2023, compared to the normalized 5.4% in December 2019.

Only time may tell.

So, Is RIVN Stock A Buy, Sell, or Hold?

RIVN Valuations

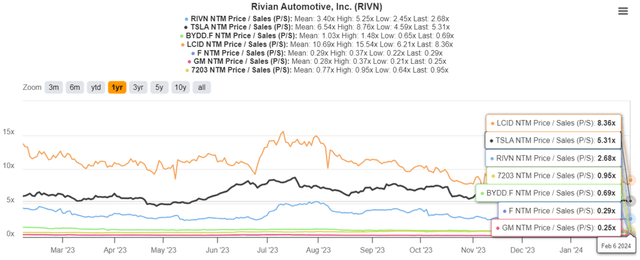

For now, RIVN continues to trade at premium FWD Price/ Sales valuations of 2.68x, while moderated from its 1Y mean of 3.40x, still elevated compared to the automotive sector median of 0.90x.

At the same time, we believe that part of the premium is warranted, with RIVN’s valuations appearing to be the cheapest amongst all start-up EV peers.

The Consensus Forward Estimates

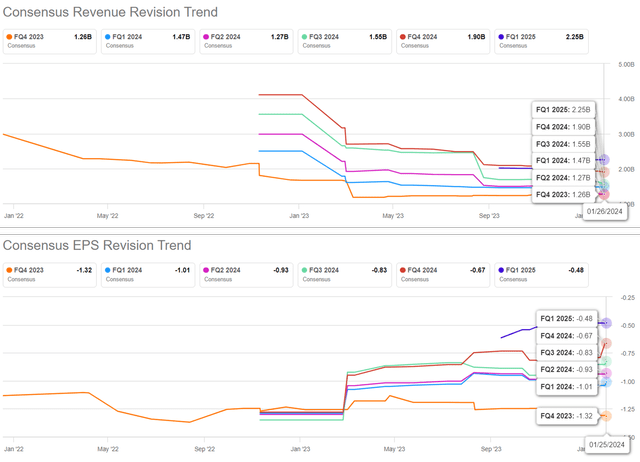

With a consistently raised EPS forward estimates despite the moderating top-line estimates, it is also apparent that the consensus believes that RIVN may be able to record improving gross margins moving forward, naturally decelerating its cash burn rate ahead.

RIVN 1Y Stock Price

While the RIVN stock may have fallen in sympathy to the uncertainties surrounding EV demand, with the two leaders, TSLA and BYD Company Limited (OTCPK:BYDDF) also charting lower highs and lower lows YTD, we are not overly concerned.

After opening up their commercial van orderbook from November 2023 onwards, RIVN has also inked new deals with AT&T (T), with more likely to come after prices becomes more attractive as lithium spot prices/ battery prices moderate and EV parity is achieved by 2026.

With the optics temporarily skewed toward pessimism, attributed to the gap between its production and deliveries in FQ4’23, we believe that these depressed levels offer interested investors with the opportunistic chance to dollar cost average accordingly.

Assuming that RIVN is able to sustain its premium FWD Price/ Sales valuation of 2.68x, we may also see an excellent upside potential of +162.5% to our long-term price target of $40.70, based on the consensus FY2026 revenue projection of $15.19B.

As a result of the attractive risk/ reward ratio, we maintain our Buy rating on the RIVN stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.