Summary:

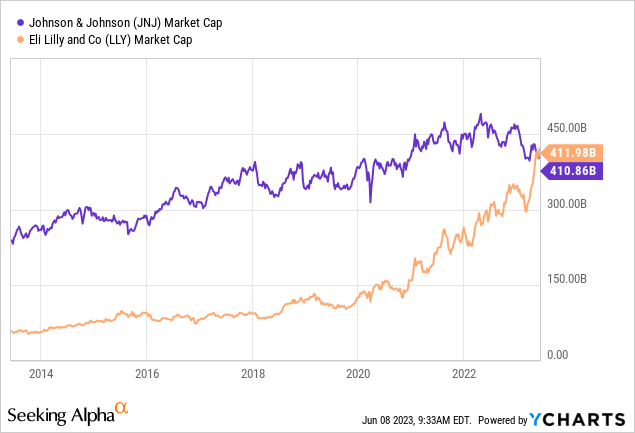

- Eli Lilly has surpassed Johnson & Johnson in market cap for the first time, driven by LLY’s breakthroughs in obesity and Alzheimer’s treatments.

- JNJ features a relatively less sanguine pipeline and earnings outlook.

- With a reasonable valuation and solid dividend yield, the chart appears mildly bearish in my view.

- The stock is a hold to me, with potential support in the mid $130s for tactical investors.

Sundry Photography

There was big news in big pharma earlier this month. Eli Lilly (LLY) leapfrogged Johnson & Johnson (NYSE:JNJ) in market cap for the first time. Just a few years ago, the latter was upwards of $250 billion more highly valued than the former. But with major breakthroughs taking place at LLY in the obesity and Alzheimer’s areas, JNJ’s less exciting pipeline and bottom-line growth have altered the sector.

I am a hold on JNJ as a decent valuation is married with a mildly bearish technical situation. I highlight a key level where long-term investors should add to the stock.

LLY Now Bigger Than JNJ

YCharts

According to Bank of America Global Research, JNJ is a leading global healthcare company that develops, manufactures, and markets a diversified portfolio of products in pharmaceuticals, medical devices, and consumer health.

The New Jersey-based $443 billion market cap Pharmaceuticals industry company within the Healthcare sector trades at a high 33.2 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.0% dividend yield, according to The Wall Street Journal.

At its recent analyst meetings, JNJ offered details regarding the results of the BCMA CAR-T Carvykti phase 3 Caritude-4 (2-4L) and phase 1b/2 Cartitude-1 (4L+) data in multiple myeloma (MM). BofA analyst noted that figures were about as expected, and benefits were seen across subgroups. Demand is forecast to be strong for CAR-T in the next two years, helping to drive solid earnings growth. But back in April, the company reported a less certain long-term growth forecast.

Despite the bottom-line beat, underscored by a robust 7.2% rise in adjusted operational sales, and a guidance increase, lowered expectations for MARIPOSA appeared to drive a negative stock price reaction. Still, strong numbers in its Consumer and Medtech segments should lead to momentum heading into the second half of 2023. Key risks for the bulls include lingering demand drop-offs from elective procedure deferral in the wake of COVID while M&A and organic growth from new products could lead to upside earnings potential.

On valuation, analysts at BofA see earnings rising at a steady clip, above the rate of inflation, through next year but per-share profit growth is seen as moderating by 2025. The Bloomberg consensus forecast is about on par with what BofA projects but is slightly less sanguine over the coming quarters. Dividends are expected to be near $5 this year.

The firm raised its quarterly payout to $1.19 per share back in April, a 5.3% jump from its previous dividend amount. JNJ sports a below-market forward operating earnings multiple. The current non-GAAP P/E is 14.9 while the outlook calls for a gradual reduction in the multiple should the stock price hover near $160. With a fair EV/EBITDA multiple, in line with the S&P 500’s average, along with solid free cash flow yield, the stock is a reasonable value.

JNJ: Earnings, Valuation, Dividend, Free Cash Flow Forecasts

BofA Global Research

Specifically, if we assume $10.70 of NTM EPS and apply a 16 multiple (just under its 5-year average), then shares should trade near $171. Thus, I have a hold rating, but it is a solid long-term dividend yielder for value and income investors.

JNJ: Mixed Valuation Metrics, Reasonable Forward Operating P/E

Seeking Alpha

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Thursday, July 20 with a conference call immediately after the numbers hit the tape. You can listen live here. Volatility could also strike today through Thursday June 15 as a pair of industry conferences take place. The European Hematology Association EHA Congress 2023 event and the Goldman Sachs 44th Annual Global Healthcare Conference 2023 both feature JNJ presentations.

Corporate Event Risk Calendar

Wall Street Horizon

The Options Angle

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus Q2 EPS forecast of $2.62 which would be a modest 1% rise from $2.59 of EPS earned in the same quarter last year. JNJ has topped analysts’ earnings estimates each time since July 2020, and shares rarely move much after the report.

This time around, the options market has once again priced in a small earnings-related stock price swing. A 2.1% change is seen when analyzing the at-the-money straddle expiring soonest after the July 20 report. With implied volatility exceptionally low — near 12% — I’m not expecting much movement in late July, so let’s focus on the shares.

JNJ: Muted Volatility Expected

ORATS

The Technical Take

While I like the valuation and dividend, the chart is a concern. Notice in the graph below that shares appear to be working on a topping process. This bullish to bearish reversal signature, called a rounded top, suggests lower prices ahead. I went with the weekly view – the 40-week moving average (comparable to a 200-day moving average) is now negatively sloped with the share price under that key trend indicator. What’s more, the 200-week moving average is being probed.

The mid-$150s had been key support from early 2021 through much of last year, and the bears were able to take JNJ to the $150 mark at the end of a 9-week losing streak. Shares recovered, but the bears regained control on a failed test to climb above the 40-week moving average. While the $165 to $167 range is resistance, I see support in the mid $130s – that is where a significant amount of volume by price comes into play. So, buying on a dip to that range would be prudent for tactical investors.

JNJ: Bearish Rounded Top, Eyeing $130s Support

Stockcharts.com

The Bottom Line

With just a 7% margin of safety between the share price and where I see fair value, the technical downside risk outweighs the bullish thesis in this case. I assert paying attention to price action is wise but acknowledge JNJ as a stable firm with a solid yield. Overall, I am a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.