Summary:

- Johnson & Johnson reported strong Q4 FY23 results and reaffirmed guidance for FY24, exceeding expectations.

- The company’s pharmaceutical business has the potential for 5-7% long-term growth, driven by novel therapies and made a strong presence in the oncology market.

- The MedTech sector is expected to have stable growth, with JNJ’s robust procedure growth and product innovation contributing to expansion.

Sundry Photography

Johnson & Johnson (NYSE:JNJ) reported Q4 earnings on January 23 that exceeded expectations, reaffirming guidance for FY24. The company recently spun off its consumer health subsidiary, Kenvue (KVUE), in 2023, redirecting its focus toward pharmaceuticals and medical devices. I am initiating coverage with a ‘Buy’ rating and a fair value target of $180 per share.

5-7% Growth in their Pharma Business

JNJ stands as the second-largest pharmaceutical company globally, presenting a diverse portfolio of best-in-class medicines. Their offerings span across various therapeutic areas, including oncology, immunology, neuroscience, and selected disease domains.

Johnson & Johnson Investor Presentation

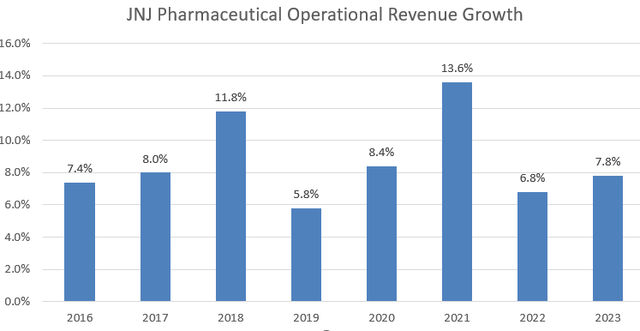

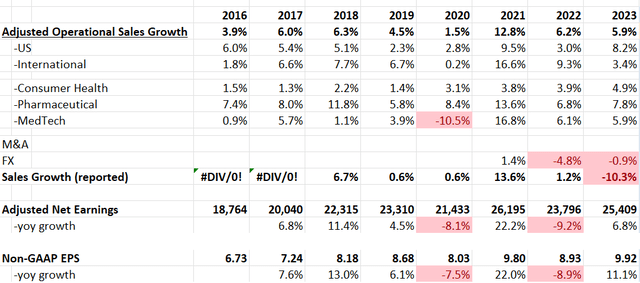

I believe their pharmaceutical business has the potential to achieve their targeted 5-7% growth over the long term. Illustrated in the chart below, their pharma business has demonstrated an average operational growth exceeding 8% over the past 8 years. This robust track record serves as evidence that they have consistently outpaced their peers, as indicated in the capital market day presentation.

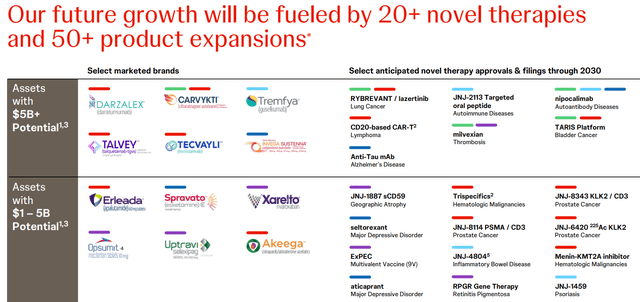

Moreover, novel therapies are poised to be a significant growth driver for JNJ’s pharmaceutical business. These novel therapies encompass a wide range, including treatments for lung cancer, autoimmune diseases, lymphoma, bladder cancer, Alzheimer’s disease, and more. For instance, their Alzheimer’s therapy is leveraging precision medicine and biomarkers to identify patients who will benefit the most. These robust pipelines position the company favorably for future growth.

Additionally, JNJ boasts a formidable presence in the oncology space, which I consider a structurally growing sector. With 14 new medicines approved since 2011 and a robust pipeline, the company is well-positioned in the oncology market. According to their capital market day presentation, the oncology market is expected to grow at an 8% compound annual growth rate from 2022 to 2030. The recent advancements in drug development have empowered pharmaceutical companies with cutting-edge technologies to combat various types of cancers, including lung cancer, bladder cancer, prostate cancer, and others.

Stable Growth in MedTech

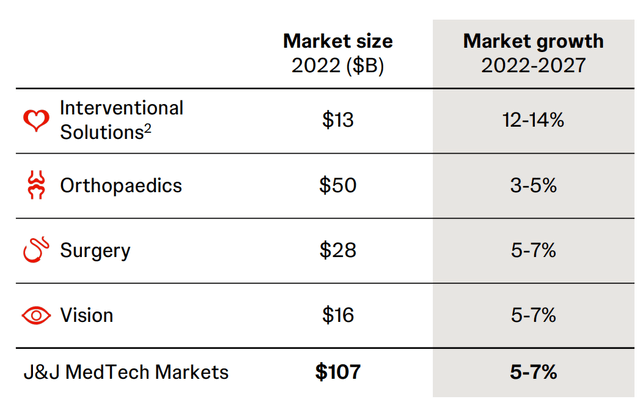

Compared to the pharmaceutical business, the MedTech sector tends to be more stable in nature, given the widespread use of medical devices by the healthcare industry on a day-to-day basis. During their capital market day, JNJ estimated that the overall market will grow by 5-7% from 2022 to 2027.

Johnson & Johnson Investor Presentation

JNJ holds a leadership position in interventional solutions, orthopaedics, and surgery, and ranks as the second-largest player in the contact lens market. In the realm of medical device companies, I consider product innovation and procedure growth as the two primary factors influencing overall expansion. Fortunately, I observe robust overall procedure growth in both the U.S. market and international markets. In their recent earnings call, JNJ expressed an expectation that procedure growth in 2024 will maintain consistency with the elevated levels observed in 2023.

Regarding product innovation, JNJ has excelled in delivering innovative MedTech products to the market. With a broad distribution channel and a commitment to spending more than 15% of group revenue on Research and Development (R&D), they have the capability to introduce new products globally. During the Q4 FY23 earnings call, they indicated that one-third of their MedTech revenue is expected to be generated by new products by 2027.

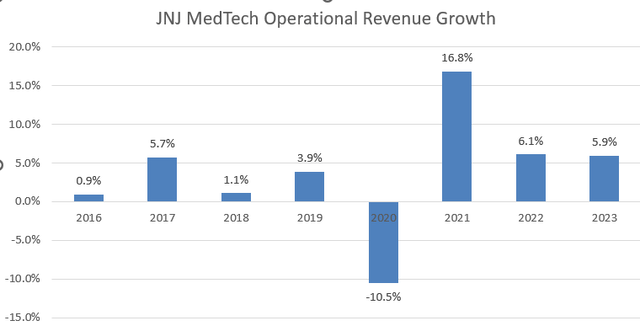

As illustrated in the chart below, JNJ’s MedTech business has experienced accelerating growth in the post-pandemic period, consistently falling within the range of 5-7% in recent years.

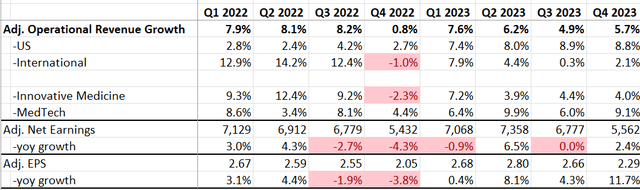

Q4 FY23 Result and FY24 Outlook

In Q4 FY23, JNJ achieved a commendable 5.7% operational revenue growth and 2.4% adjusted net earnings growth. Closing the quarter, they held $23 billion in cash and marketable securities, with approximately $29 billion in debts. Notably, their net debt leverage remained below 1x, indicating a robust balance sheet. In terms of free cash flow, they concluded FY23 with $18 billion, reflecting a solid 5% year-over-year growth.

Johnson & Johnson Quarterly Results

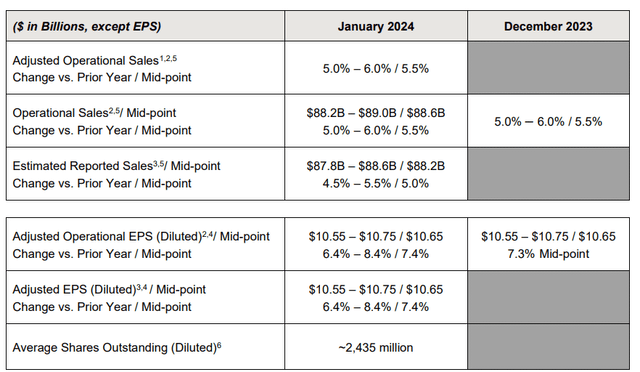

As indicated in the table below, JNJ has reaffirmed its guidance for FY24, projecting operational sales growth in the range of 5.0% to 6.0%, and adjusted operational EPS between $10.55 and $10.75. This forecast reflects a growth rate of 7.4% at the mid-point.

Johnson & Johnson Q4 FY23 Earnings

I find the provided guidance reasonable for several reasons. The primary driver of growth in the MedTech business is anticipated to be the sustained elevation in procedure growth. The company expects this momentum to extend into FY24, at least for the first half of the year. They are confident in maintaining MedTech business growth at the upper end of their markets, aiming to establish themselves as a best-in-class competitor in the MedTech sector.

As depicted in the table below, their MedTech business has consistently achieved around 6% organic growth in the post-pandemic period. I anticipate that their broad and diversified portfolio will continue to fuel growth in the MedTech business in the near future. For the pharmaceutical business, the expectation is for 2024 to deliver above-market growth, attributed to market share gains from key brands and the ongoing adoption of recently launched products.

Additionally, I foresee potential margin expansion in FY24 driven by operating leverage. The company is actively pursuing cost management initiatives, particularly in the orthopedics business, which is expected to contribute to this margin expansion.

Acquisitions Review

In January 2024, JNJ announced its acquisition of Ambrx (AMAM) for $2 billion. Ambrx, a clinical-stage biopharmaceutical company, is focused on developing next-generation antibody drug conjugates. I believe this acquisition is well-aligned with JNJ’s overall pharmaceutical business, and the incorporation of Ambrx’s technology is expected to enhance and strengthen JNJ’s presence in the field of oncology.

In 2022, JNJ completed the acquisition of Abiomed with an enterprise value of approximately $16.6 billion. Abiomed, recognized as a rapidly growing MedTech company, specializes in cardiovascular medical technology. The acquisition is anticipated to contribute to the acceleration of JNJ’s MedTech growth and expand their pipeline. In recent quarters, Abiomed’s patient procedures have demonstrated high-teen growth, with strong adoption observed for their Impella 5.5 technology in surgery.

It appears that JNJ’s acquisition strategy is consistent, with the company strategically utilizing acquisitions to fortify their growth areas, particularly in oncology and MedTech. This approach allows them to enhance their capabilities, expand their portfolio, and stay competitive in these crucial segments of the healthcare industry.

Valuation

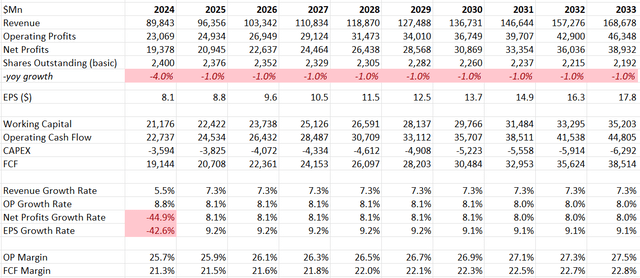

My assumptions align with their full-year guidance for FY24, representing a typical year of growth driven by both the MedTech and Medicine businesses. For normalized revenue growth, I assume a 6% organic revenue growth rate, consistent with their historical average. Additionally, I anticipate that acquisitions could contribute another 1.3% to growth, assuming they allocate 5% of revenue to acquisitions and pay a 4x EV/Sales multiple for acquired companies.

On the margin side, I expect them to benefit from operating leverage, innovative product launches, and efficient operating expense management. Based on my calculations, I estimate they can achieve a 20 bps annual margin expansion.

Johnson & Johnson DCF- Author’s Calculation

The model utilizes a 10% discount rate, consistent across all of my DCF models. The terminal growth rate is assumed to be 4%, comprising 2% pricing growth and 2% volume growth. Based on my estimate, the fair value is calculated to be $180 per share.

Key Risks

Zytiga Drug Patent Expiration: JNJ has already lost exclusivity for their cancer drug Zytiga in Europe, and they are poised to lose patent protection in the U.S. market in 2027. The impending loss of patent protection is expected to have a significant impact on Zytiga sales, as generic drugs are likely to enter the market and compete with the branded product.

Baby Powder Lawsuit: The company is currently facing numerous lawsuits related to the use of body powders containing talc, primarily their Baby Powder. They are actively pursuing appeals, and the legal process is expected to extend to the Supreme Court of the United States. The potential financial obligations arising from these lawsuits remain uncertain at this time.

Conclusion

I believe Johnson & Johnson is well-positioned in the pharmaceutical and medical device industry, and their diversified portfolios provide investors with great visibility into their business. I am initiating coverage with a ‘Buy’ rating and a fair value of $180 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.