JPMorgan: SVB Collapse Might Be Beneficial In The Short Term

Summary:

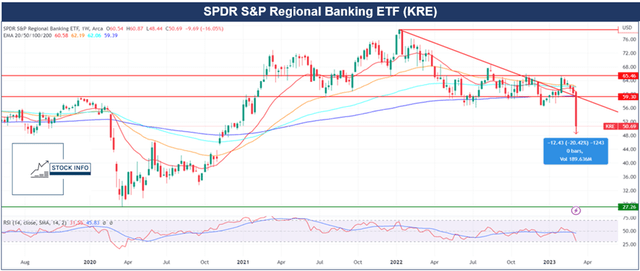

- It was a rough week for banks with KRE down 20% and XLF down 10% for the week.

- Due to the collapse of SVB, the financial sector is under significant pressure, as both savers and investors are running to the doors.

- Big banks such as JPM currently are in much better papers compared to regional banks, which are at risk of a liquidity crisis and further bank runs.

- JPM’s preferred shares are an interesting option for risk-averse investors as they may act like a bankruptcy canary.

- In the short term, JPM might benefit from this issue as savers will transfer their money from regional banks to big banks. As such, we rate JPM as a buy.

winhorse

Introduction:

Due to the SVB Financial (NASDAQ:SIVB) collapse, investors are worried about their capital with banks, this clearly puts some stress on the financial sector as a whole. The Financial Select Sector SPDR ETF (XLF) was down by almost 10% at its lowest point this week in just 4 trading sessions. In addition, the SPDR S&P Regional Banking ETF (KRE) was down over 20% at its lowest point this week. The ETF is now trading below all of its moving averages, with no signs of immediate support, as can be seen in the chart below.

While a lot of regional banks might be in rough waters right now, we believe most of the big banks aren’t at risk of contagion from this collapse of SIVB. In this article, we will talk about the possible benefits of these this collapse for big banks, with a focus on JPMorgan Chase & Co. (NYSE:JPM.PK), the risks of a credit crisis, and take a look at some of the preferred shares of JPM.

What Caused The Collapse?

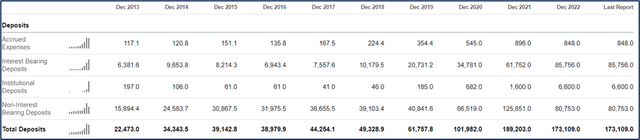

In the post-pandemic era, some banks grew aggressively, which made investors wary about their liquidity and funding situation. So what exactly caused the collapse of SVB Financial? SVB Financial is one of the prime examples of this aggressive growth, as the company positioned itself as the bank for the venture capital market. Due to the risk-on environment post-pandemic, the company witnessed a boost in deposit amounts. At its high, the company had total deposits of over $173 billion as of December of 2022, which is more than triple the amount of 2019, as can be seen in the image below.

What caused this latest collapse? The fact that SIVB used these deposits to buy low-yield notes and US treasuries. These types of investments are typically considered to be risk-free, but with the Fed announcing that they changed stance from Quantitative Easing (QE) to Quantitative Tightening (QT) these so-called risk-free securities depreciated swiftly due to the rise in interest rates. Due to rampant inflation, central banks all over the world had no other choice than quickly raise rates to tamp down inflation.

In addition, SIVB bought long-duration assets, but they didn’t hedge these with interest rate swaps like competent banks such as JPM do. Currently, there are even theories swirling around that SVB intentionally kept their capitalization under $250B to avoid stricter balance sheet regulations.

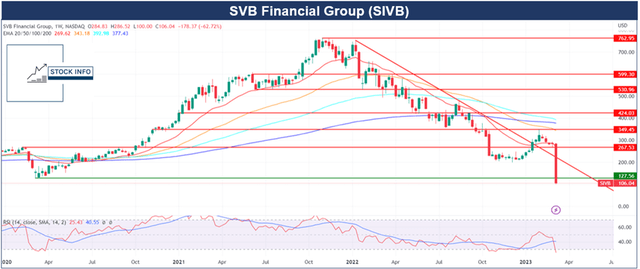

So now SIVB had to deal with a depreciation of its investments, but this wasn’t the only conundrum it had to face. As mentioned before SIVB was considered as the bank for the venture capital market. As many are aware, the venture capital market was under immense pressure in 2022 due to the rise in interest rates and people changing from risk-on investments to risk-off investments. This caused savers to lose trust, so they decided to withdraw their deposits as they were looking for higher-yielding opportunities to park their cash. When the market realized this issue, SIVB’s share price cratered quickly as can be seen in the chart below.

As such, we believe SIVB is currently a sell, as there seems to be no way out apart from government intervention or a buy-out.

JPMorgan Chase: Currently Not Affected

Now seemingly everyone is panicking about the possibility of a bank run on SVB Financial, as there are concerns that the company has not been able to raise enough capital. We believe this is not representative of a broader issue in the banking system, as other banks such as JPMorgan, Bank Of America (BAC), and Wells Fargo (WFC) are in better positions regarding capital, funding, and liquidity.

Nonetheless, government intervention might be necessary to stop the contagion into regional banks, which could eventually be of concern for the whole financial industry if this issue becomes wider spread. A lot of well-known public figures like Bill Ackman, David Sacks, and Jason Calacanis are asking for the government to step-in to at least make sure the deposits are safe. However, trust in a bank’s capital is fundamental, and if depositors question a bank’s ability to remain solvent, it can lead to a self-fulfilling prophecy. As such, we believe the current sell-off might present interesting buying opportunities in high-quality banks such as JPM.

As savers are afraid of a possible contagion in regional banks, this could actually be beneficial for the high-quality banks. Why you may ask? Well, if people start withdrawing their money from regional banks they need a place to store it. The first place most people think about is storing it is at another bank. The people that are aware of this issue are unlikely to store their money at another regional bank, so it is highly likely that a good amount of this money ends up at one of the big banks, such as JPM.

Why JPMorgan Over Other Big Banks?

While SIVB’s collapse was caused by a foolish balance sheet composition, this is no issue for big banks as they are better diversified across multiple investments. In addition, JPM’s deposits grew at a significantly lower pace over the last years, which is in big contrast to the 200%+ increase of SVB Financial’s deposits over the same time frame.

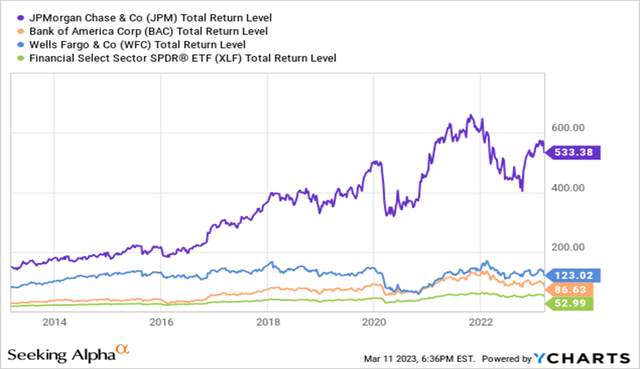

JPM is best in class in the US banking industry. JPMorgan has the status of being a conservative, quality-oriented investment, supported by robust capitalization, top-notch risk management, and a history of outperformance during recessions. This can be seen in the graph below, which compares JPM to the 2 other big banks and to the Financial Select Sector SPDR ETF (XLF). Over a period of 10 years, JPM was able to outperform massively.

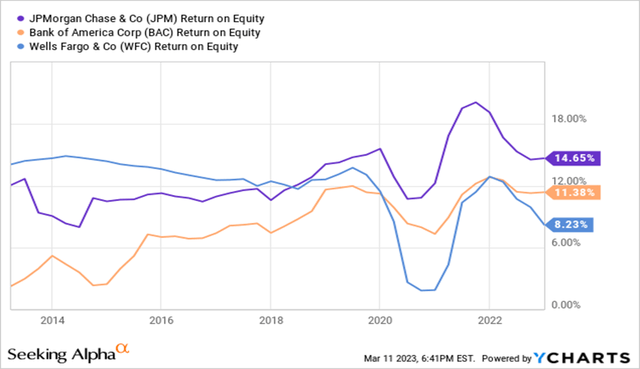

Furthermore, JPM has been able to steadily grow its Return on Equity (ROE) over the last years, with a ROE higher than that of its competitors. JPM currently has a ROE of 14.65% compared to 11.38% for BAC and 8.23% for WFC, as shown in the chart below.

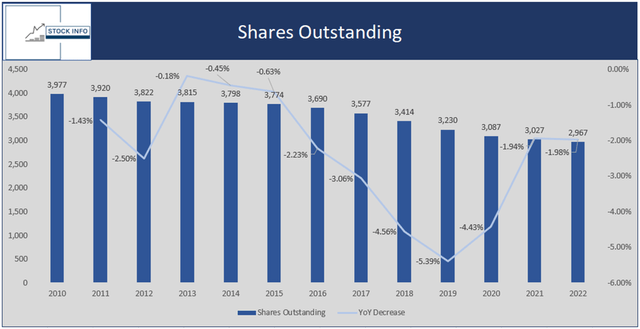

In addition, JPM has been doing share buybacks the last few years, which should boost capital returns, and could put a cushion under the share price. As shown in the chart below, the company was able to reduce its shares outstanding from 3,977 million shares to 2,967 million as of December 31st of 2022, which is a decrease of 25.40% since 2010.

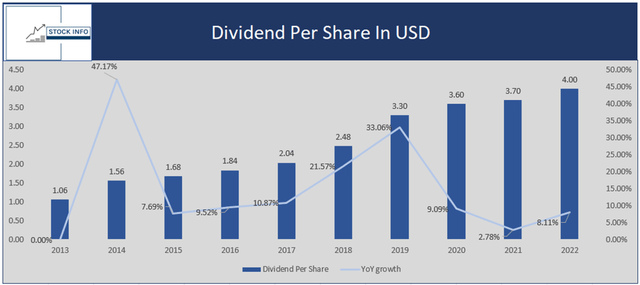

In addition, the company has been able to continue paying a steady dividend of around 3%, which has grown to $4 annually as can be seen in the chart below. With a payout ratio of 33%, investors shouldn’t be worried about the dividend declining anytime soon (as long as conditions for the sector don’t become worse) as the company currently has plenty of room to pay the dividends. JPM has been able to grow its dividend at a CAGR of 14.20% over the last decade, as can be seen in the chart below.

While JPM trades at a higher P/E ratio compared to its competitors, which we believe can be attributed to its higher quality, the company seems like a decent investment at its current price. Currently, the company sits at a relatively low Price to Book value of 1.48, which is quite low when we exclude crises and large market drawdowns. That said, taking a starter position here might be advised as the current environment surrounding financials remains highly uncertain.

It is important to remember that even the strongest banks can experience short-term setbacks, but over the long term, they are generally able to weather difficult market conditions.

Furthermore, Jamie Dimon is an excellent CEO who has turned JPM into the company that they are today. We believe that as long as Mr. Dimon remains in his executive role the company will be able to stay ahead of its competitors.

Preferred Shares

So why are we talking about preferred shares one may ask himself? Well, in times of hardship, preferred shares can be seen as a source of safer income. In addition, preferred shares are an interesting choice when one likes the company, but the valuation of the common stock isn’t at an attractive price. Furthermore, it is important to mention that preferred shares could act as bankruptcy canary along with bonds.

Preferred shares have characteristics from both common stock and bonds, which makes them interesting for the more risk-averse investor. Preferred shares most of the time don’t have any voting rights. In addition, preferred shares have a higher claim on dividend distributions compared to common stockholders, but the most important characteristic is the fact that in case of a liquidation preferred stockholders have a larger claim on assets compared to common stockholders, but a lower claim than bondholders. Because of this, if preferred shares trade at a significant relative discount to common shares, it’s a sign of low confidence among investors that they will be paid in a liquidation.

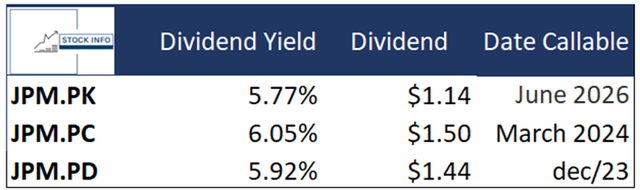

JPMorgan has a significant amount of publicly listed preferred shares. Most of these shares are currently yielding around 5.85%. They are not trading at a relative discount to common shares. Furthermore, preferred shares of banks are almost always non-cumulative, which is important to keep in mind.

Let’s take a look at the table below to discuss some of these preferred shares and in which scenario you should buy these.

JPMorgan Chase & Co. 4.55 DEP PFD JJ (NYSE: JPM.PK)

JPM.PK is a good choice if you believe in a deflationary environment, this one can give a little upside on your capital. Meanwhile, JPM.PC and JPM.PD both have limited upside if we get into a rate-cutting cycle again.

JPMorgan Chase & Co. 6 DEP NCM PFD EE (NYSE:JPM.PC)

This one currently offers a 6.05% yield, but keep in mind that these are callable in March 2024. Thus, one has to keep redemption risk in mind if it starts trading above par again. This is an ideal position to buy if you believe in higher rates for a longer amount of time.

JPMorgan Chase & Co. 5.75% SHS PFD DD (NYSE:JPM.PD)

This one is callable in December of 2023 and offers a nice amount of upside, should we enter a rate-cutting cycle and JPM decides to call it.

JPM: Technical Analysis

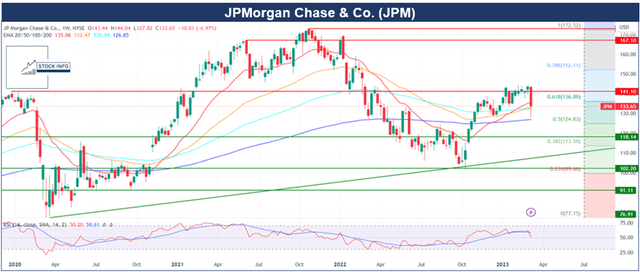

As can be seen in the chart below, JPM experienced an ugly week. At its lowest point, the company was down close to 11%. Nonetheless, the stock price bounced 2.54% in Friday’s trading session. The stock swiftly fell below its 20,50, and 100 Weekly MA and bounced shortly before reaching its 200WMA. Now, we will have to see if this 200WMA holds next week as the financial sector isn’t out of the woods yet. This 200WMA is the one we should keep an eye out for in the short term. It is fairly likely that if the stock loses this moving average it falls further down until the green trend line support is reached.

On the upside, we have to look out for that $141 to $144 zone. Afterward, the stock could go significantly higher. That said, we believe the risk lies on the downside, as the financial industry is in rough waters. We will have to see how everything evolves further and how wide-spread the issue is.

Conclusion

In conclusion, while the recent panic surrounding SVB Financial’s ability to raise enough capital may have caused concerns about the broader banking system, high-quality banks such as JPMorgan are in a better position regarding capital, funding, and liquidity. The current sell-off in regional banks may actually benefit JPMorgan as savers look for a safe place to store their money. JPMorgan’s conservative and quality-oriented approach, robust capitalization, top-notch risk management, and history of outperformance during recessions make it a good investment option.

Additionally, the company’s share buybacks, steady dividend, and strong leadership under CEO Jamie Dimon further support this investment thesis. While the financial sector remains uncertain, taking a starter position in JPMorgan may be a wise decision for long-term investors. Banks that are well-capitalized, have strong balance sheets, and a diversified portfolio of low-risk assets are likely to be better positioned to weather market volatility and emerge stronger over the long term. As such, we believe the company is currently a buy for the long term. Nonetheless, we believe it is wise to take a small starter position here. If material weakness in the sector arises, JPM’s stock could drop further and even better opportunities may arise.

Nevertheless, it is important to keep a close eye on how this situation further evolves. Risk-averse investors might be better off buying preferred shares to limit the risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.